Ireland is known as the strategic European base given its pro-business environment, low corporate tax rates as well as its skilled talent pool of workforce. As of date, there are more than 1,200 multinational companies that have chosen to incorporate their business in Ireland as their investment platform. To name, some of the world’s leading companies incorporated in Ireland include Intel, Twitter, Pfizer, Citi, Huawei and more. Apart from its reputation for growing major companies, the country also provides an enticing tax regime which attracts more Foreign Direct Investments (FDIs). As the country is a member state of the European Union (EU) and part of the Eurozone, this makes it all the more favorable for business within Ireland to expand its market reach beyond the local scene. The ideal conditions make foreign investors inclined to register a company in Ireland as a non-resident. Before you register company in Ireland, join Tetra Consultants as we share 4 things to know before you register a company in Ireland as a non-resident.

Types of Company Entity in Ireland:

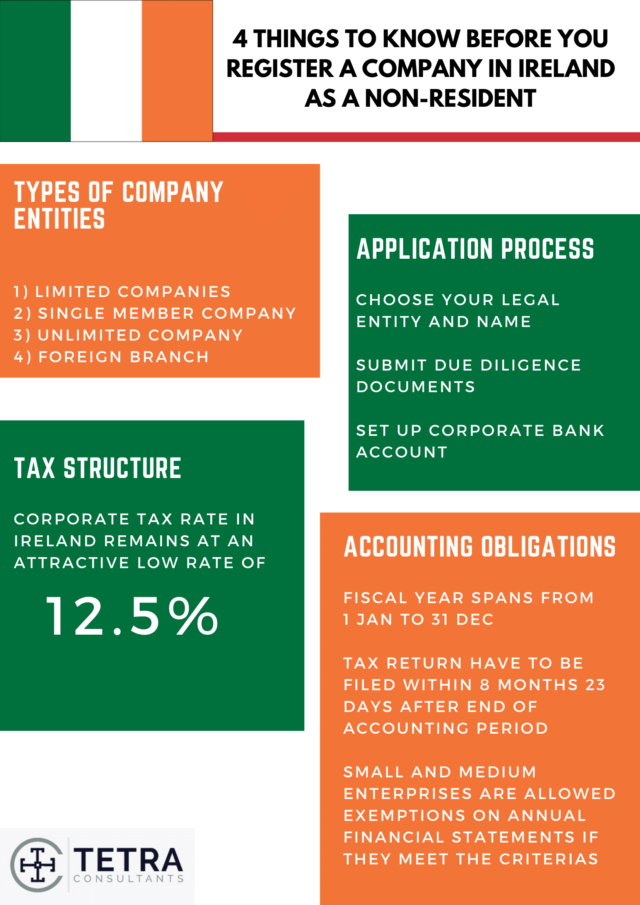

The first thing you should know before you register a company in Ireland as a non-resident is the available types of company entity that one can set up in the country. There are a number of company types available:

1) Limited Companies:

Shares in the company are owned by shareholders and their liability is limited to any amount of remaining unpaid outstanding shares held by them should the company fail. A company formation is considered a separate legal entity and therefore is distinct from those who run it. Only the company in name can be sued for failing any obligations and sue others to enforce its rights. There are several types of limited companies: private company limited by shares (LTD company), designated activity company (DAC), designated activity company limited by guarantee (DAC – limited by guarantee), company limited by guarantee (CLG) and public limited company (PLC). Do refer to the Companies Registration Office (CRO) of Ireland for their in depth descriptions before you set up company in Ireland.

2) Single Member Company:

A company which is incorporated with only a single member. However, the company has to appoint a director and secretary.

3) Unlimited Company:

The unlimited company structure subjects limitless liability to its members. Shareholders personal assets will be liable for any outstanding liabilities owed by the company in which it has failed to discharge.

4) Foreign Company Branch

2) Application Process :

The second thing you should know before you register a company in Ireland as a non-resident is the application process. The application process starts with choosing a suitable corporate entity to register. Afterwards, you are required to propose and reserve your preferred company name with the CRO of Ireland. To register for your business name, you have to head over to the CORE website and complete the registration process by filling up the RBN1 form. You should note that names should not be duplicated against existing company names. The next step is to prepare your due diligence documents that are necessary for the registration process of your company. This includes developing your constitution, memorandum and articles of association and submitting Form A1. Form A1 requires the issuer to provide details regarding the company name, registered office address, details of secretary and directors, their consent to acting in their respective positions, membership details and their shares allocation. Documents have to be notarised but there is no need for translation of documentations to Irish as English is the country’s official language. Once your registration of your company in Ireland has been completed, the next important step is to set up your corporate bank account with the various reputable banks in Ireland.

3) Tax Structure in Ireland:

The third thing you should know before you register a company in Ireland as a non-resident is the tax structure in Ireland. The corporate tax rate in Ireland remains at an attractive low rate of 12.5%. Apart from solely corporate income tax, Ireland adopts withholding tax and value added tax systems of which both are charged at a 25% and 23% tax rate respectively.

4) Accounting Obligations:

The fourth thing you should know before you register a company in Ireland as a non-resident is the annual reporting requirements in order to meet accounting standards and obligations in Ireland. Ireland’s general financial fiscal year spans from 1 January to 31 December and firms are expected to file tax returns 8 months and 23 days after the end of the accounting period. During the submission of the annual financial statements, a minimum of 2 directors will have to provide their signature accordingly as well. For small and medium firms with employees less than 50 pax, you will be able to receive exemption from submitting annual financial statements if your turnover is less than EUR12 million and EUR40 million respectively, or if your balance sheet totals to less than EUR 6 million and EUR20 million respectively.

Conclusion:

Engage Tetra Consultants as we guide you on how to register a company in Ireland as a non-resident in a smooth and hassle-free process. The team provides a comprehensive service package that includes planning and strategizing with our clients to select a suitable business entity, completing the registration and documentation processes, obtaining required licenses, opening a corporate bank account, and ensuring your compliance with the government regulations.

Contact us to find out more about company registration in Ireland and our dedicated and experienced team will revert within the next 24 hours.

2 comments

Zigor

September 15, 2022 at 3:31 am

I am looking forward to open a non resident company in different places. I believe Ireland could be a good choice. It would be mainly for my soon launch app and import and export business

Tetra Consultants

September 16, 2022 at 5:42 pm

Thank you for reaching out. One of our consultants has contacted you to discuss the above.