Poland as a jurisdiction has managed to prove itself to be stable during times of financial crisis and is a land that offers promising opportunities to investors, both local and international. The business climate has been and its economy has been improving throughout the years, with many reasons that inadvertently attracts foreign investors. Some of the reasons why foreign investors are keen to invest in the jurisdiction is because of its close proximity to the European Union (EU) market and track record of stable growth. The country also offers highly qualified employees and is home to high quality infrastructures. The company registration cost in Poland is also considerably cheap, costing approximately EUR 140 to register a company in the conducive and attractive investment market of Poland. Before you register company in Poland, Tetra Consultants has helped to prepare 5 things to know before you register a limited company in Poland.

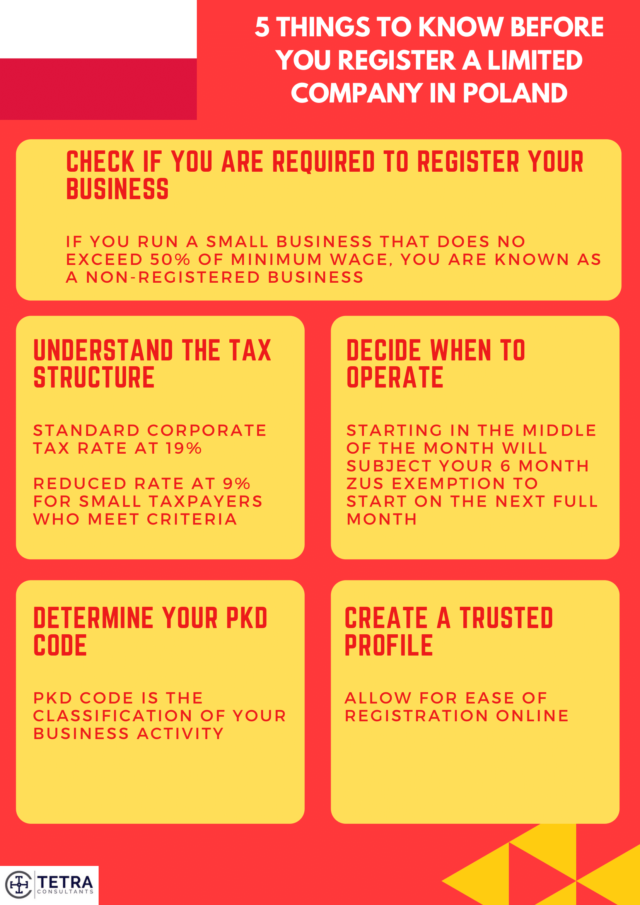

1) Check if You Are Required to Register Your Business

When conducting a business, it is not always compulsory to register a limited company in Poland. In general, if you run a small business and your revenues do not exceed 50% of the minimum wage throughout the year, you are allowed to run what is known as a “non-registered business” and there is no obligation to register the activity with the Central Register and Information on Economic Activity (CEIDG). In principle, non-registered businesses are exempt from the obligation to issue an invoice unless otherwise requested by clients and must be done so within three months in which the goods or services were supplied and or all payment was made. Otherwise if you are not a non-registered business, you will be required to register your company or business with the CEIDG.

2) Understand the Tax Structure :

The second thing to know when you register a limited company in Poland is to understand the corporate tax structure as a limited company operating in the country. Taxation by corporate income tax is regulated by the Corporate Income Tax Act of Poland. The standard corporate income tax rate is at 19%, similar to ideal jurisdictions like Singapore and Hong Kong. However, a reduced rate of 9% is applicable to small taxpayers whose total earning revenue (inclusive of Value-Added Tax) does not exceed EUR 1.2 million for their first year of operation. It is also important to note that under the Corporate Income Tax Act, taxpayers that have registered office in the jurisdiction of Poland are subjected to taxation, irrespective of the place where the income was generated. If taxpayers are not resident in Poland, they are obligated to pay taxes only when the income source was generated from Poland.

3) Decide When to Operate:

The third thing to know when you register a limited company in Poland is to decide your company’s date of commencement. During your application process, users will be prompted to enter a specific date of commencement for their company (of which can be later than the date your application was filed). It is fine to register your company and choose to commence on the same day of application but do note that when you officially commenced operating, the company has to take over duties concerning entrepreneurship and among others, are also responsible for payment of social security contributions (ZUS payments). The Social Insurance Institution (ZUS) is a state organisation that is responsible for social insurance matters in Poland and firms incorporated in the jurisdiction are obligated to pay their contribution to it but are usually given exemption on the first 6 months of incorporation. If you decide to set up company at the beginning of the month, you will start the count on the 6 month exemption. However, if you register your company in the middle of the month, the 6 month exemption will not start to count until the next full month.

4) Determining Your PKD Code:

The fourth thing to know when you register a limited company in Poland is to determine your company’s area of activities under the Polish Classification of Activities (PKD). This is an important factor to know because the PKD code will affect your obligations depending on the type of activity you are classified under (For e.g. using specific legal forms, type of taxation, mandated to use cash registers or Value-Added Tax registration). To determine a PKD code, you may enter the online portal of BIZNES to check the areas of business activity you fall under. Your PKD code is mandatory during the stage of submitting your application for company formation and it must also be entered in your articles of association.

5) Create a Trusted Profile for Ease:

The fifth thing to know when you register a limited company in Poland is that you can opt to create a Trusted Profile. A Trusted Profile is a free tool to confirm your identity and its allows the user to register a company and deal with other official matters online, providing convenience.

Conclusion:

Engage Tetra Consultants as we guide you on how to register a company in Poland through a smooth and hassle-free process. The team provides a comprehensive service package that includes planning and strategizing with our clients to select a suitable business entity, completing the registration and documentation processes, obtaining required licenses, opening a corporate bank account, and ensuring your compliance with the government regulations.

Contact us to find out more about company registration in Poland and our dedicated and experienced team will revert within the next 24 hours.