If you intend to set up your business in Dubai, there are multiple factors you need to keep in mind. Firstly, you need to decide whether you wish to set up your business in the mainland or one of the Free Zones in Dubai. Secondly, you need to understand the industry of your business. Lastly, you need to understand how you can complete the Dubai FreeZone company setup. In this article, you will learn more about Free Zones and how you can register company in Dubai.

Free Zones are locations where foreign investors can set up their businesses and maintain full control over them. This means that there is no need for a UAE national to be present to register business in Dubai. There are presently around 30 Free Zones in Dubai created to attract foreign investment to the country and promote business activities. In order to encourage new business set up in Dubai, the government and Free Zone authorities provide multiple benefits such as tax exemptions. Moreover, the stable political environment, efficient legal system, and favorable government policies further incentivize investors to choose Dubai Free Zones.

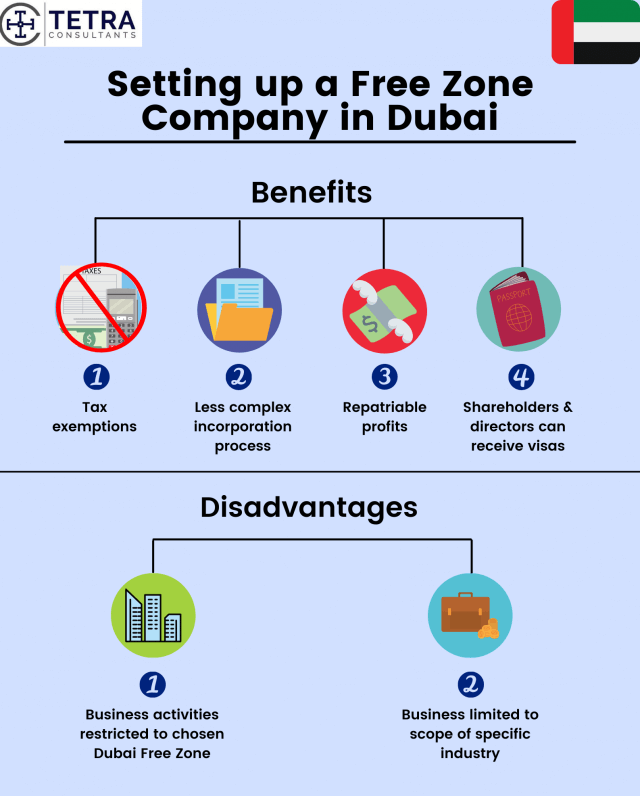

Benefits of setting up business in Dubai:

- The company receives various tax exemptions, including exemptions from corporate tax and personal income tax.

- The process to register business in Dubai and receive the required license is less complex in Free Zones.

- In a Free Zone, companies are permitted to repatriate the full profits earned to their home country.

- Shareholders and directors of the company can also receive visas in Dubai.

However, despite the benefits, there are some disadvantages as well.

Disadvantages of setting up business in Dubai:

- The company is not allowed to expand to other UAE markets after setting up business in the chosen Dubai Free Zone. Hence, the activities of the company will be restricted to that zone.

- Each Free Zone caters to specific industries. For example, the Dubai Multi Commodities Centre (DMCC) is a Free Zone for businesses in the commodity market and the Dubai International Finance Centre is a Free Zone for businesses in the Finance sector. Therefore, the company in a Free Zone cannot go beyond the scope of their industry, further restricting them.

To complete the process to register business in Dubai, the following steps must be taken.

Steps to Dubai FreeZone company setup:

Step 1: Understand your business activity and select your business name

Step 2: Apply for initial approval

Step 3: Complete the registration process

Step 4: Complete the licensing process

Step 5: Find an office place

Step 6: Open your corporate bank account

Step 1: Understand your business activity and select your business name

- Since different Free Zones cater to different industries, you need to first understand which industry your company falls under, and then decide which zone would be the most suitable.

- You must select a business name and check its availability.

Step 2: Apply for initial approval

- You must submit your application through the online portal of your chosen Free Zone.

- You also need to provide various documents which differ depending on the Free Zone you are applying to. Some of these documents include the passport copies of all shareholders and directors of the company, past financial reports, a Letter of intent, and more.

Step 3: Complete the registration process

- After the initial approval is received, payment for registration has to be made. The payment amount depends on each specific Free Zone.

- You must also sign the necessary legal documents.

Step 4: Complete the licensing process

- Sign the lease agreement given to you by the authorities.

- After approval is granted, the license and permits will be issued.

- The visa approval process can also begin once the above steps are completed.

Step 5: Find an office place

- After you have received approval, you must look for office spaces to rent or purchase.

- You will then be required to register this address with the relevant authorities.

Step 6: Open your corporate bank account

- After receiving your license, you must open your bank account. Since you have registered your business in the Dubai Free Zone, it is considered a resident company. Therefore, Dubai Banks will give preference to your company for opening a Dubai offshore bank account.

There may be some additional steps that you need to take, depending on the specific Free Zone selected. However, the entire process should be completed within two weeks.

Looking to start a business in a Dubai FreeZone?

We at Tetra Consultants recognize that the process of identifying the Free Zone most appropriate for your business is difficult and so is the process of registering your business in the Zones. We offer you our full Dubai FreeZone company setup services, where we will recommend to you the most suitable Free Zone for your business and guide you through the relevant application processes. We will also ensure that you are aware of the requirements of the government and relevant authorities and that you comply with the laws in each zone.

Contact us if you wish to find out more about the Free Zones in Dubai and our team will revert to you within the next 24 hours.