Registering a new business may be a headache for many given its complexity and difficulty, especially for a country like the Bahamas; and you may be wondering how to register a business in the Bahamas. In this article, Tetra Consultants will alleviate your struggles by providing a simple guide on how to register company in Bahamas in just 3 simple steps!

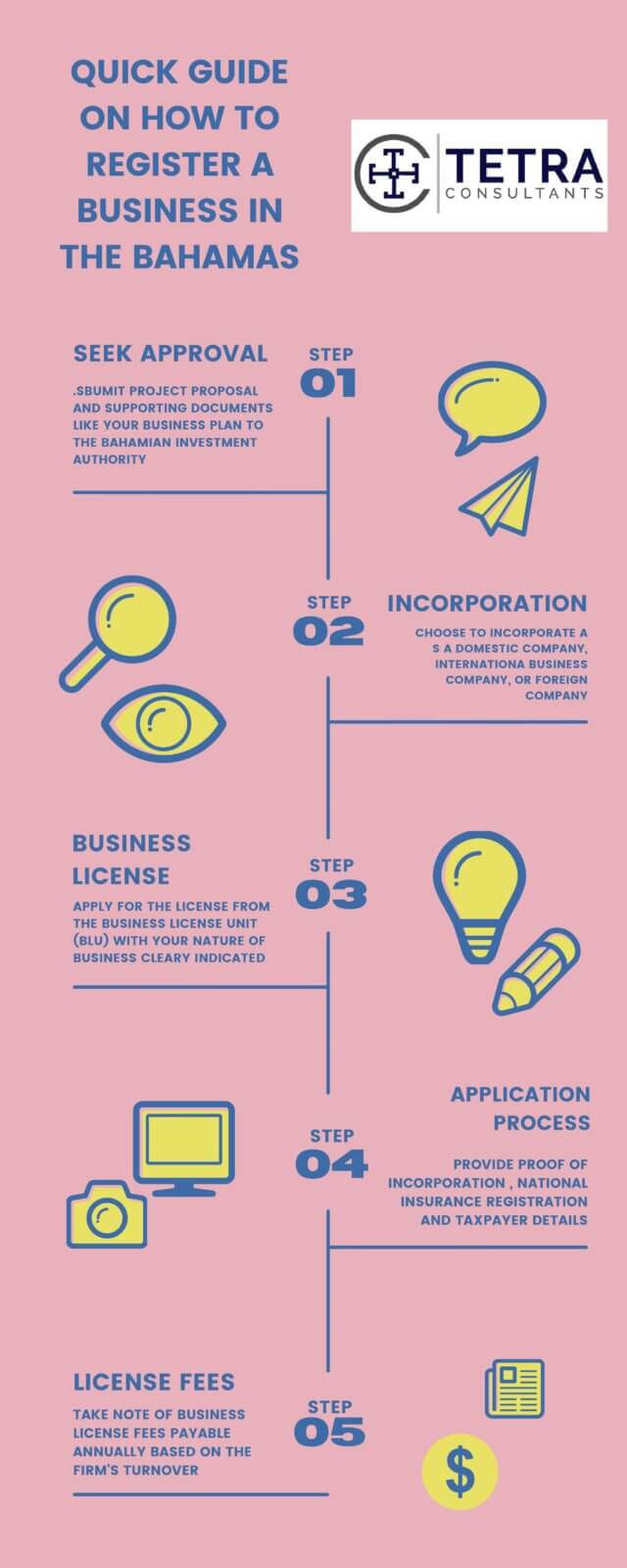

Step 1: Seek prior approval from the Bahamas Investment Authority

Before making plans to set up your business, it is critical to obtain permission from the Bahamas Investment Authority. BIA is part of the National Economics Council and Investments Board, a division under the Ministry of Finance, and aids this wing in administrative matters. The BIA is also primarily in charge of foreign direct investments in the Bahamas. Hence, promptly seeking approval from the BIA should be the very first step to starting a business in the Bahamas.

Furthermore, for one’s application to be formally recognised by the BIA, it must be in the form of a Project Proposal and in accordance with all Project Proposal guidelines established by the BIA. Some of the aforementioned requirements you must prepare include:

- Names

- Address

- Principals

- Proposed Location

- Land Requirements

- Proposed Start-up Date

- Management and Personnel Requirements

- Capital Investment

- Employee Projection

- Financial Arrangements

- Environmental Impact

- Economic Impact and Business Plan

Additionally, do note that a minimum capital investment of BS$500,000 is required and the proposed investment must not be in an area reserved for 100% Bahamian participation.

Once the Project Proposal is completed, it can be submitted to the BIA along with relevant support documents. After which, the BIA will process the proposal sent and consult with the respective government ministry or agency, depending on your business’ area of interest and specialisation. Once a verdict has been made, the BIA will update you about the success of your application, issuing a “project approval in principle”.

Step 2: Incorporating your business

After obtaining approval from the BIA, your business needs to first be incorporated before it can begin its operations. Under Bahamian law, there are two main types of businesses: businesses incorporated under the Companies Act of 1992, or businesses incorporated under the International Business Companies Act of 2000. The former is termed as Domestic Company, while the latter is termed as an IBC. You may be wondering, what exactly is the difference?

Let us first explain what domestic companies are. Domestic companies can be considered private companies limited by shares, or public companies. This means that there has to be a minimum of two shareholders and two directors, with a registered office in the Bahamas. These companies are required by law to hold annual general meetings and have to file annual statements stating the names of their main, registered shareholders and directors.

In the specific instance where a Domestic Company is to be a subsidiary completely owned by another entity, one share in this Domestic Company must be registered in the name of a nominee who makes a declaration of trust towards the Parent Company, whilst the remainder of shares are issued directly to this Parent Company.

On the other hand, International Business Companies (IBCs) are most commonly used for offshore entities conducting business internationally with no ties to the Bahamas. IBCs are a commonly chosen incorporation structure given its relatively minimal requirements.

Instead of two, an IBC can have just one shareholder and director. The aforementioned annual meetings are not mandated, and IBCs have completely no obligation to file Annual Statements as well. However, IBCs must at all times, maintain a current filing of incumbent officers and directors. Moreover, if the IBC opts to conduct business domestically in the Bahamas, it must be a designated resident by the Central Bank.

Last but not least, it is possible to register as a foreign company too. A foreign company can operate its branch in the Bahamas with no registration requirements. However, once this company begins to be operating an undertaking, it must register as an official foreign company. An “undertaking” is defined by the Companies Act as the following:

- the keeping of a place of business;

- the holding of a licence (or the requirement to hold one) for specified business;

- the holding of a licence (or the requirement to hold one) for selling securities; or

- having a local telephone listing.

To register as a foreign company, it must file a copy of the company’s Memorandum, Articles of Association and details of the directors and officers to the IBC registry. Once a certificate of registration is issued, the company effectively has the same position as a Bahamian incorporated company.

Step 3: Applying for a Business License

After obtaining BIA approval and incorporating as one of the aforementioned entities, you may be wondering about how to register a business in the Bahamas and begin your planned operations. To do so, one must register and obtain an annual business license. This can be done by applying for the requisite business license from the Business License Unit (BLU), another division within the Ministry of Finance which works in conjunction with the BIA. One critical requirement expected by the BLU is a statement of your nature of business. If your company’s nature of business is complex and multifaceted, i.e. conducting business in different industries/areas, you must provide an additional application for each area of business separately.

This process requires an application fee of $100, and your company must provide proof of incorporation (as explained in step 2), national insurance registration, and other relevant documents depending on the nature of your business. Additionally, when registering your business license, you must declare your respective taxpayer details. However, this is not a major concern given that the Bahamas operates on a tax neutral platform, where non-Bahamians receive the same tax benefits as Bahamians. Such tax benefits include the following:

- No income, capital gains and inheritance taxes for all who conduct business or reside in The Bahamas.

- Value Added Tax (VAT) of 7.5% on certain goods and services.

- A modest business licence tax for companies carrying on business in The Bahamas.

- A 10% Government tax (Stamp Duty plus VAT) on the purchase of a new home.

- Real property taxes between ⅝ % and 1.5 % of the property value.

- National insurance contributions

Once all requirements are met and approved, the application will be processed within 7 working days. The BLU will contact your business about the success of your application, with an electronic business licence certificate in the form of a PDF sent to the online user account used for the initial license registration.

However, one point of concern your business should take note of is that after your business license has been successfully registered, you must pay annual business license fees based on your firm’s turnover. This turnover is defined by the Bahamian government as “total revenues in money and money’s worth accruing to a person from his business activities in The Bahamas during the preceding year or in such other accounting period as the Financial Secretary may allow, including all cash and credit sales and commissions without any deductions whatsoever…”. Furthermore, business licenses must be renewed annually alongside your respective license fees, with the deadline for renewal and payment being 31st January and 31st March respectively.

Conclusion

Once these 3 steps have been completed, you have succeeded in Bahamas company formation! Tetra Consultants hopes this quick guide on how to register a business in the Bahamas has been useful, and if you have any other queries and concerns, Contact us and our dedicated and experienced team will respond within the next 24 hours.