Norway has managed to ascertain itself as the world leader in the oil and gas, energy, maritime and seafood sectors across the world. With one of the world’s strongest economies developed across the board, it should come as no surprise as Norway receives a huge amount of Foreign Direct Investments (FDIs) with many international companies incorporated in the jurisdiction. The FDIs in 2018 received by Norway stood at USD 140 billion, registering a figure that more than doubled over the last decade. Its major industries are also supported by strong and competitive professional services like finance, Information & Communication Technology (ICT) and legal services, allowing for strong collaboration and developments into new emerging opportunities such as Fintech, Cleantech, Medtech and Biotechnology. With Norway being at the forefront of technology and professional services, many wonder how to register a company in Norway as they hope to enter the well developed economy. Before you proceed to register company in Norway, Tetra Consultants has prepared an ultimate guide on starting a business in Norway as a foreigner for your consideration.

1) Business Entity

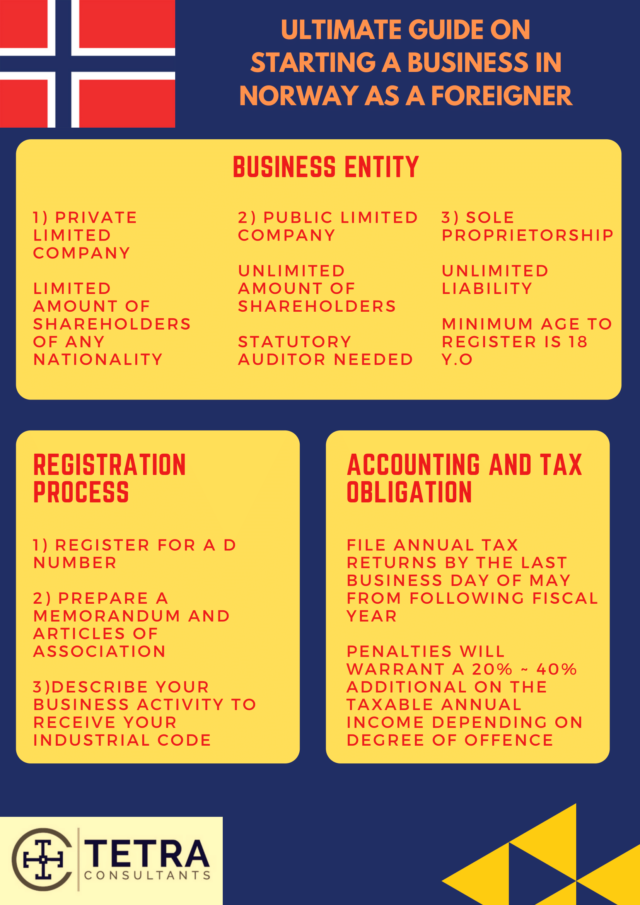

The first step of the ultimate guide on starting a business in Norway as a foreigner is to understand and decide which business entity or vehicle you wish to choose to incorporate as. Under Norway’s jurisdiction, they offer varying organisation or business entities that you can register as but here are the main business types:

1) Limited Company:

The limited company is considered a separate legal entity from the shareholders or members of the company and they are not responsible for obligations of the company. Their liabilities are limited, only to their own respective amount of unpaid shares that they are entitled to. A Norwegian resident manager has to be identified and a local registered office address is required to be furnished. There is a requirement of minimum 2 directors, of which one must be either a Norwegian or European citizen. Shareholders can be of any nationality and a minimum of NOK 30,000 capital has to be paid-up.

2) Public Limited Company:

Similar to the limited company, a public limited company is also considered a separate legal entity from the shareholders or members of the company. None of the shareholders are personally liable to the obligations or debts of the company and are only limited to their own personal share of unpaid shares they are entitled to. Public limited companies are allowed to issue and sell shares to the public whereas standard limited companies are not allowed to. In order to set up a public limited company, there must be at least one shareholder of any nationality, minimum of 3 directors of which two must be Norway residents and a minimum paid-up capital of NOK 1,000,000 is required. There must also be a statutory auditor appointed in this case.

3) Sole Proprietorship:

A sole proprietorship holds the owner responsible and is subjected to unlimited liability to his business. In the eyes of law, he is seen as one with the business he founded. The minimum age to register as a sole proprietorship is 18 years old.

2) Registration process :

The second step of the ultimate guide on starting a business in Norway as a foreigner is to know the registration process of registering a new business in Norway. If you are starting a business in Norway as a foreigner, you are required to register and apply for a Norwegian identification number (D-number) and also a Norwegian business address. The D-number acts as a temporary national ID number for foreigners and is used during the registration process of businesses. All limited companies operating in Norway are required to be registered in The Register of Business Enterprises and several documents are required. Documents that have to be enclosed during the registration process include memorandum and articles of association, declaration and proof that confirms your payment of share capital contribution, and in some cases supplementary forms showing approval for licenses for specific trades such as a bank or finance company. Sole Proprietorships are also obliged to register in The Register of Business Enterprises and describe your core income generating activity. The description of your main business operation will assign your company to an industrial code.

3) Accounting and Tax Obligations:

The third step of the ultimate guide on starting a business in Norway as a foreigner is to understand the accounting and tax obligations of enterprises registered in Norway. In accordance with the Norwegian Tax administration, it is compulsory for entities receiving income sourced from the jurisdiction to file their annual tax returns by the last business day of May from the following fiscal year. Alternatively, businesses can request for extension until the end of June but it is subject to approval by the authorities. Failure to meet the deadline will subject the business to a late filing penalty amounting to 20% ~ 40% of taxable annual income depending on the degree of offence.

Norway corporate tax rates lie at 22% from most businesses except those under the financial business sector. For companies operating within the financial business sector, they stand to pay a corporate tax rate amounting 25% instead.

Annual accounts must be prepared according to the provisions of the Accounting Act in Norway. However, companies that fall under the definition of “small enterprise” need not prepare an annual report. One of the main criteria for being considered a small enterprise is when your sales revenue is less than NOK 70 million.

Conclusion:

Engage Tetra Consultants as we guide you on how to register a company in Norway through a smooth and hassle-free process. The team provides a comprehensive service package that includes planning and strategizing with our clients to select a suitable business entity, completing the registration and documentation processes, obtaining required licenses, opening a corporate bank account, and ensuring your compliance with the government regulations.

Contact us to find out more about company registration in Norway and our dedicated and experienced team will revert within the next 24 hours.