Many small business owners face a difficult decision when starting a business. They often deliberate whether to choose a sole proprietorship or partnership for their business. Alternatively, after proceeding to register company in Malaysia, your business goals may have changed along the way and the business structure may no longer be a good fit for your company. You will then have to make an official change of business type. In this article, we will explore the most important things to consider if you wish to change a partnership to sole proprietorship in Malaysia, as well as how to complete the registration process.

Types of business entities in Malaysia:

- Sole Proprietorship

- Partnership

- Limited Liability Partnership (LLP)

- Sendirian Berhad (Sdn Bhd) / Private Limited Company

- Berhad (Bhd) / Public Limited Company

- Branch Office

What is Sole Proprietorship?

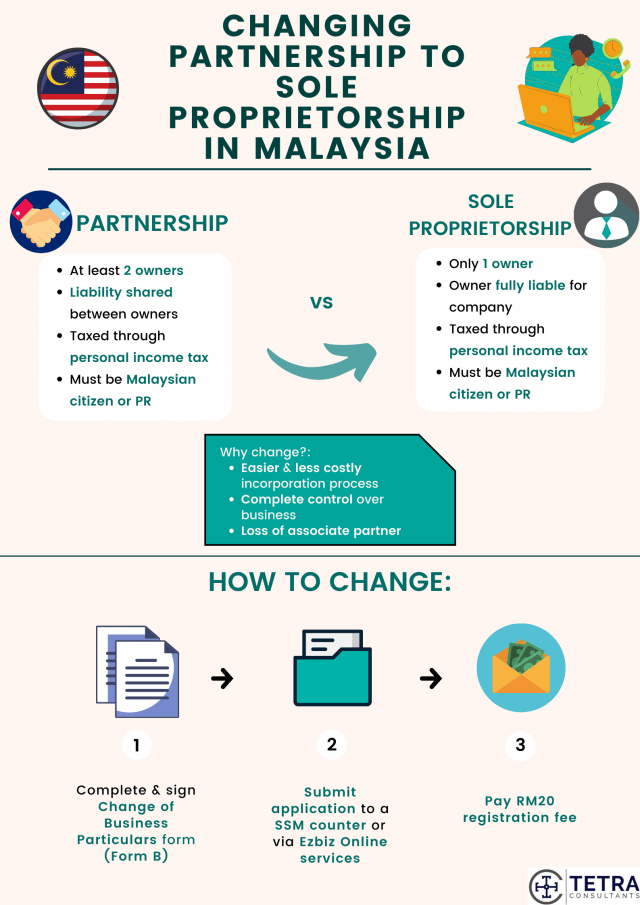

- A sole proprietorship business entity in Malaysia, being one of the simplest business entities to get started with, involves only one owner. As there is only one owner, that individual will be fully liable for all the debt repayments and liabilities of the company and pay taxes through personal income tax.

- For new company registration in Malaysia, a sole proprietor must register his business with the Registrar of Businesses at any Suruhanjaya Syarikat Malaysia (SSM) counter or online via Ezbiz Online services. Your Malaysia company registration should be completed within 30 days of its commencement.

- However, in order to apply for sole proprietorship in Malaysia, you must be either a Malaysian citizen or a permanent citizen. Foreigners are not allowed to set up a sole proprietorship unless they have permanent resident status in Malaysia.

What is Partnership?

- Partnership, or General Partnership, is similar to a sole proprietorship except that it involves at least two owners. Partners of the partnership are also bound by unlimited liability. They share the liabilities towards the business and pay taxes through personal income taxes. This type of business setup is most suitable for professional firms such as auditors and lawyers. Like a sole proprietorship, you must be either a Malaysian citizen or a permanent citizen. Foreigners are not allowed to register partnerships unless they have permanent resident status in Malaysia.

Why might you want to choose sole proprietorship over partnership company?

As both partnerships and sole proprietorships have their own pros and cons, it is crucial to weigh them before deciding on one for your company formation in Malaysia.

What distinguishes partnerships from sole proprietorships is the number of partners. A sole proprietorship only has one partner, whereas, in a partnership, there are at least two partners. Although there are high risks associated with sole proprietorship as you are fully liable for the company’s debts, there are several advantages of choosing a sole proprietorship over a partnership.

Advantages of sole proprietorship

- As you are the sole owner, you have complete control over your business and you do not have to worry about finding reliable partners. All profits earned by the business belong to you and you do not have to share with partners.

- A possible reason you may have to switch to a sole proprietorship may be that the partner(s) in your partnership company has decided to leave or is unable to continue being partners in the company.

- A sole proprietorship requires lesser paperwork and features lower costs of incorporation compared to a partnership. This makes offshore company registration in Malaysia easier for those who wish to start a small business.

How to change partnership to sole proprietorship in Malaysia?

Changing from a partnership to sole proprietorship company is a simple and fuss-free process. To change partnership to sole proprietorship company, it is mandatory to notify the Suruhanjaya Syarikat Malaysia (SSM) within 30 days from the date of change. The change of business type can either be completed by the owner or one of the partners of the business.

Registration Procedure

- Change of business particulars can be registered by filling in the form Change of Business Particulars (Form B).

- After filling in the form, it must be signed by all business owners and/or partners.

- The application can either be submitted in-person to a SSM counter, or online via the SSM Ezbiz Online services website. It must be submitted by the business owner or partner.

- Documents required are:

-

- The identity card of the business owner and/or partner.

- The Original Business Registration Certificate, showing the type of business, branch and change of business.

- A photocopy of the death certificate (if the change is due to a death of the business owner or associate partner).

- The approval letter or other supporting document from relevant agencies (if required by the Registrar of Businesses).

The registration fee for a Change of Business Particulars is RM20.00 and only registered businesses that have not expired can notify the changes. It is important to note that changes in the nature of business must be registered in accordance with the business name. Businesses that use either “sole proprietorship” or “partnership” in the trade name may change their status from a sole proprietorship to partnership or vice versa.

Changing your company from sole proprietorship to partnership?

Changing your company’s structure may seem to be a complicated process. However, rest assured that Tetra Consultants’ team of experienced professionals will guide you through the full process hassle-free, from confirming the best business structure to match the unique needs of your company, to applying and registering your new company.

Contact us and we will revert within 24 hours.