A gateway to the Asian market, Japan is a country that has a well-developed infrastructure and human resources. Through its various ports and airports, Japan is well connected to the world. Besides, Japan has various business-friendly policies including tax incentives and exemptions, simpler regulations, and Intellectual Property-related treaties. In this article, we explore the various types of companies in Japan. On deciding the business structure, you wish to set up, you can register company in Japan.

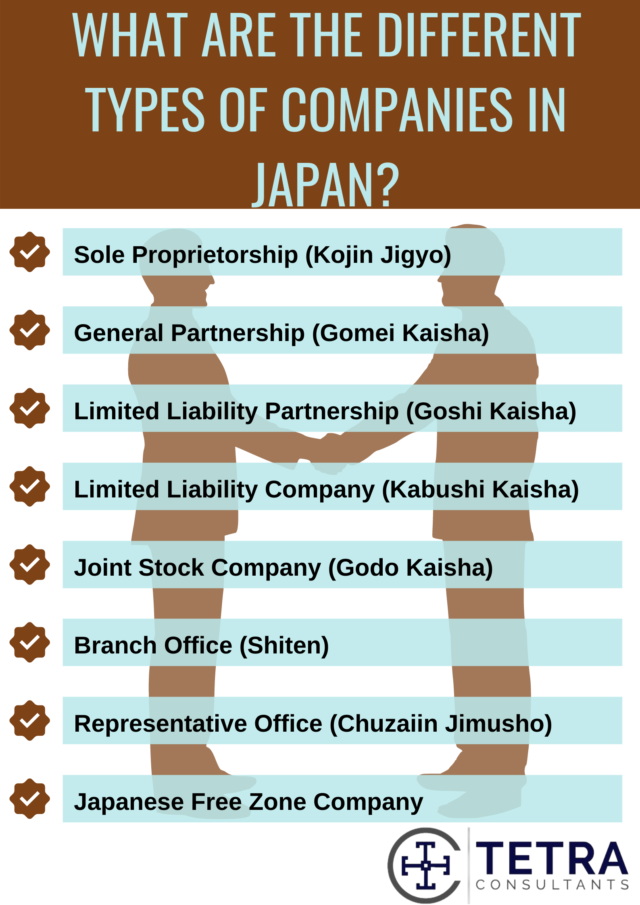

What are the different types of companies in Japan?

Before you start the Japan company registration process, you need to first decide on a legal entity suitable for your business.

Sole Proprietorship (Kojin Jigyo)

- A Kojin Jigyo is owned and managed by one individual and is one of the simplest forms of business.

- It is not considered to be a separate legal entity. This means that the owner will not only reap all the profits of the business but also be completely liable for any of its debts and obligations.

- Some of the requirements to set up such a business is:

- If you are a foreigner, you should have a suitable visa- Work, Long term resident, Permanent resident, or more.

General Partnership (Gomei Kaisha)

- A Gomei Kaisha is a business entity where its partners represent the company and therefore, are completely liable for all the debts and obligations of the company.

- It is established when two or more individuals come together to start a business.

- The registration process is simple without many requirements

Limited Liability Partnership (Goshi Kaisha)

- A Goshi Kaisha is a form of business structure that has been available to set up since 2005.

- It is established when two or more individuals come together to start a business.

- In such a business, limited partners are only liable for the debts and obligations of the business, up to the value of their contributions. However, general partners are completely liable for the same.

- Some of the requirements include:

- All individuals involved in the partnership must make a capital contribution

- At least one local partner

Limited Liability Company (Kabushi Kaisha)

- A Kabushi Kaisha (KK) is a form of business entity that is similar to a limited liability company such that it is considered to be a separate legal entity whose shareholders are liable up to the value of their share capital.

- Some of the requirements to set up such a business are:

- At least one local representative director

- At least one shareholder (any nationality)

- Local registered address

- This form of business seems to be more credible than a Godo Kaisha (GK) but is relatively costlier as well.

- A KK company can scale its business by having a Board of Directors, listing itself on the stock exchange, and raising funds by selling its shares.

- In this form of business, the ownership and the management are separated.

- Additionally, KKs have more compliance requirements than GK. This is because KKs must hold an annual shareholders meeting, publish financial reports, holder quarterly Board of Directors meetings, appoint an auditor, and more.

Joint Stock Company (Godo Kaisha)

- A Godo Kaisha (GK) is a form of business entity that is common among small and medium enterprises.

- Under this form of business structure, the business registered is treated as a separate legal entity whose shareholders are liable for the business debt and obligations up to their share capital.

- Some of the requirements to set up such a business are:

- At least one partner

- At least one representative director

- No minimum paid-up capital

- Local registered address

-

- With fewer requirements, the incorporation process of a Godo Kaisha is simpler with low registration costs.

- Such a business is owned and managed by the partners and hence, there is no clear separation of ownership from the management.

Branch Office (Shiten)

- Foreign businesses are permitted to setup a Branch Office in Japan. These offices can only perform the same activities as the parent company.

- Branch offices are not considered to be a separate legal entity from the parent company. Hence, the parent company is accountable for all the debts and obligations of the Branch Office.

- Some of the requirements include:

- A local resident representative

- Company name must be same as the parent company

- The setting up cost of this business is lower than that of a KK or a GK.

Representative Office (Chuzaiin Jimusho)

- Foreign businesses are also permitted to setup a Representative Office in Japan.

- However, these offices are not allowed to conduct any business activity for the parent company. They can only engage in market research and advertising. Therefore, such an office is best suited to test the market in Japan.

- The parent company is completely liable for all the debts and obligations of a representative office.

- However, such a business cannot open a corporate bank account in Japan.

Japanese Free Zone Company

- There are multiple Free Trade Zones and Special Economic Zones available in Japan. These zones offer companies with various tax incentives, subsidies, and additional benefits, thus attracting foreign investment.

- Some trade zones in Japan include the Okinawa Free Trade Zone and the Naha Free Trade Zone.

- Some of the requirements for setting up a company in the FTZ are:

- Local registered office address

- Local sponsor to act on behalf of the company

- No minimum paid-up capital

- At least one director

- At least one shareholder

How to complete the incorporation process in Japan?

In order to start a business in Japan, you must follow these steps:

Step 1: Choose a business structure

Once you decide on the business you wish to set up and have your business plan ready, you need to decide on a business structure best suited for your business. You can refer to our previous section which describes all the business structures and their requirements in detail.

Tetra Consultants will understand your requirements and long-term goals before recommending a suitable business entity for you. We will advise you on the requirements of each of these business entities as well.

Step 2: Reserve your preferred business name

Our team at Tetra Consultants will then check for the availability of your preferred business name and reserve the same with the Registry Office.

Step 3: Check to see if you meet all the requirements

Depending on your chosen business entity, there will be different requirements you need to meet. Tetra Consultants will ensure that you meet all these requirements by providing you with our nominee director service, assisting you in getting a local registered office address, and more.

For a foreign company looking to establish itself in Japan, the certificate of incorporation of the parent company, acceptance letter of the parent company’s representative, and more are also required. Our team will inform you of the same.

Step 4: Prepare the required documents

On receipt of all the due diligence documents of the directors and shareholders, Tetra Consultants will prepare all the required documents including the Articles of incorporation. We will get it notarised for you.

Step 5: Register your company

Tetra Consultants will then register the company, on your behalf, with the Japanese Legal Affairs Bureau (Homukyoku). Once approval is granted, we will courier all the documents, including the Certificate of Incorporation, the Memorandum and Articles of Association, and more to your preferred address.

Step 6: Register for tax and additional business licenses

Tetra Consultants will then notify the Tax Office and register you for tax. Depending on your business structure and activity, you may need to obtain additional business licenses.

Step 7: Open a bank account

Tetra Consultants will leverage our extensive banking network and assist you in opening a corporate bank account for your business.

Step 8: Staying compliant with the local laws

Even after the registration, Tetra Consultants will continue to support you by ensuring your compliance with the local laws. Our team will remind you of the accounting and taxation obligations.

Conclusion:

Tetra Consultants is experienced in assisting our clients with the incorporation process in Japan. Contact us to find out more about setting up a business in Japan and our comprehensive service package. Our dedicated and hardworking team will revert within the next 24 hours.