How to register a company in Cyprus?

Tetra Consultants advises you to read through this guide to fully understand the steps required on how to register a business in Cyprus.

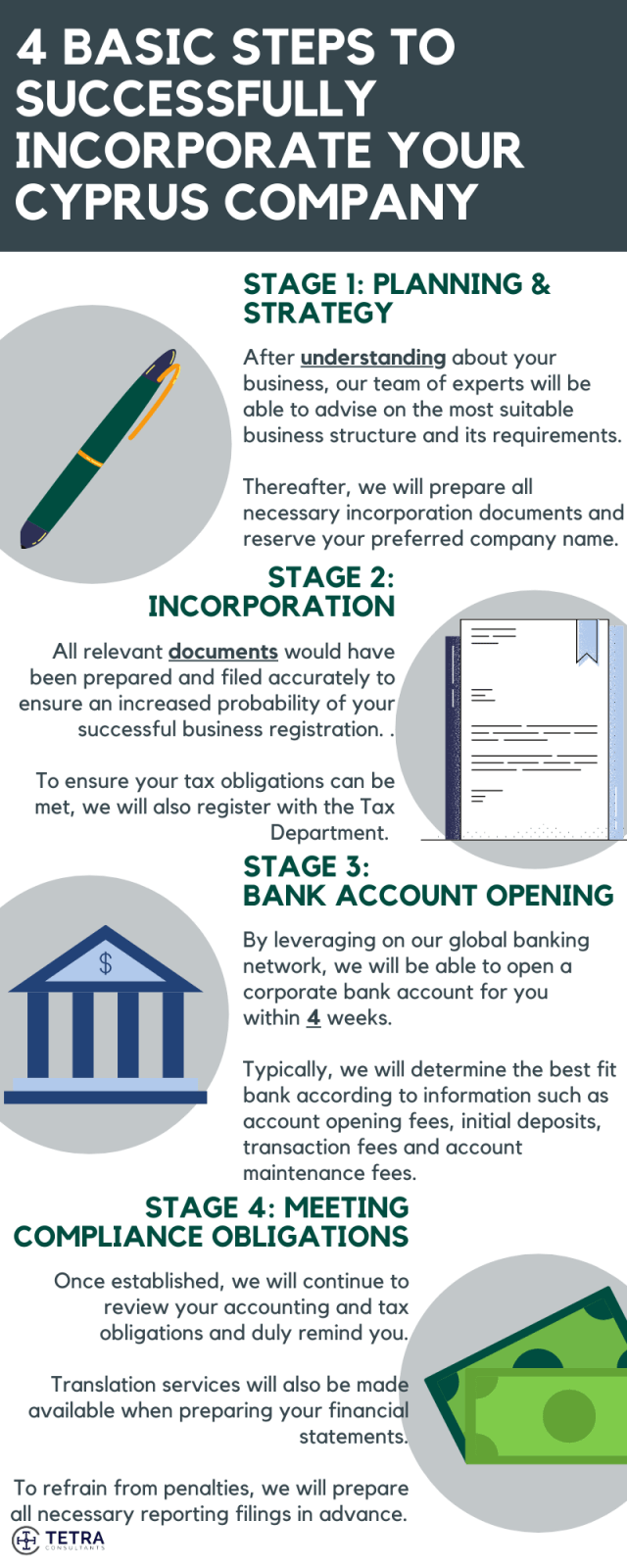

In essence, your engagement will be broken down into 4 phases:

- Planning and strategy

- Incorporate

- Opening an account with a bank

- Staying compliant

By systematically following the above 4 phases, you can expect to start conducting business with your company in Cyprus within 6 weeks. Contact us to find more information about how to register a business in Cyprus. Our team of experts will revert within the next 24 hours.

Step 1: Planning and Strategy

- The most essential step is for you to understand the requirements of how to register a business in Cyprus. After understanding your business goals and activities, our team of dedicated consultants will recommend the most suitable corporate entity for you to carry out your business.

- Prior to incorporating a Cyprus company, you will be advised on the optimum paid-up share capital, corporate structure, legislations, and whether there is a need to apply for any licenses to operate your business.

- For clients who are looking to incorporate in Cyprus, our team will advise and assist with renting local offices and appointing a nominee director. The registered office will be used to maintain all corporate records and official Cyprus company documents. While a nominee director will primarily assist in liaising with external parties.

- In most cases, the directors and shareholders are required to provide basic KYC documents. Some of these documents include the names of directors, certified true passport copies, proof of address, bank reference letter, and CV for our internal due diligence checks.

- Tetra Consultants will reserve your preferred company name with the Registrar of Companies Cyprus.

- According to the business activity and corporate structure, Tetra Consultants will also draft Articles of Association, business plan, and other incorporation documents.

Step 2: Incorporation

- Once you are clear on how to register a business in Cyprus, we will then proceed to file for Cyprus company incorporation with the Department of Registrar of Companies and Official Receiver through the Cyprus company register online portal.

- After receiving approval, Tetra Consultants will courier the Certificate of Incorporation, Memorandum and Articles of Association, and other corporate documents to your preferred address.

- These documents contain the business registration number and other Cyprus company details required for running the business.

- Once the Certificate of Incorporation has been acquired, our team will follow up in obtaining a Value Added Tax Number with the Tax Department.

- Additionally, further compliance matters such as Social Contribution registration with the Ministry of Labour, Welfare, and Social Insurance will be managed by our team to ensure that you continually fit all regulations issued by Cyprus.

Step 3: Opening an Account with the Bank

- After the incorporation of your company in Cyprus, Tetra Consultants will assist you in opening a corporate bank account. Our team has established partnerships with multiple reputable banks in Cyprus. We will present your business to each relationship manager and compliance team.

- Typically, setting up an offshore account takes roughly 4 weeks. In most cases, the directors and shareholders are not required to travel. However, if travel is required, we will have a representative accompany you to the bank meeting so that you can establish your current account. Alternatively, our team will negotiate with the banks to conduct a conference call instead or to request a waiver.

- While nominee directors are not necessary for Cyprus business setup, you may still require one to set up your Cyprus bank account. If necessary, we will provide you with a suitable, fit, and proper nominee director.

- Once your account has been successfully opened, Tetra Consultants will courier the internet banking token and access codes to your preferred address.

- Some of the international reputable banks we work with include the Bank of Cyprus, The Cyprus Development Bank, and Hellenic Bank. By engaging our services, you can leverage our full portfolio of banking partners.

Step 4: Staying Compliant

- After incorporating the Cyprus company and opening a current account in the bank, Tetra Consultants will continue to provide you with the necessary accounting and tax services to ensure that you can continue to legally conduct business while staying compliant with regulatory obligations.

- Our team of dedicated consultants will timely prepare your firm’s financial statements, corporate tax returns and manage bookkeeping on your behalf.

- Generally, the corporate income tax is charged at 12.5%.

- Businesses are required to maintain proper books of account and upkeep the associated accounting documents for minimally 6 years.

- Our team of dedicated consultants will continue to clarify any doubts you may have concerning your company’s obligations.

Contact us to find out more about how to register a business in Cyprus. Our team of experts will revert within the next 24 hours.

FAQs

Can a foreigner register a company in Cyprus?

- Yes, a foreigner can register a company in Cyprus. The setting up process is the same for any organisation looking to register their company. Moreover, opening a bank account in Cyprus for foreigners is also possible.

- For example: if you have a business in Hong Kong and wish to expand to Cyprus, you can easily do so.

- Tetra Consultants can assist you in this entire endeavour. Do contact us if you wish to receive more information.

How do I open a limited company in Cyprus?

- For a company limited by shares, the steps to set up a company are the same as for all the businesses. However, your company must meet the following requirements:

-

- You must have at least one and seven shareholders for a private and public company, respectively.

-

- There can be a maximum of 50 shareholders for a private limited company.

-

- A public company can issue shares to the public easily whereas it is difficult to transfer shares of a private company.

- There may be some additional requirements depending on the form of business entity you wish to set up. For example: if you wish to set up a Cyprus holding company, you must pay a small tax of 0.6% levied on the capital when registering.

- Tetra Consultants can assist you in understanding the requirements and help you in setting up your business.

How do I set up a business in Cyprus?

In order to set up a business in Cyprus, you must follow these steps:

- Check to see if you meet all the requirements:

-

- You must have an agent who is a Cypriot.

-

- You must also register your main office address.

-

- You must have the required documents like Articles of Association prepared.

- Reserve company name:

-

- You may be wondering how to register a business name in Cyprus.

-

- You must ensure that your proposed business name is unique and available for use.

-

- You must then apply to the online portal of the Registrar of Companies Cyprus and pay the required fee.

- Apply to the Trade registrar:

-

- You must file the documents you had prepared with the Trade Registrar and pay the Cyprus company formation fees.

-

- You will receive the Registration certificate after approval.

- Complete Tax registration Cyprus:

-

- You may wonder how to register tax in Cyprus.

-

- You must complete two applications to obtain a tax number for your business and to find VAT number Cyprus.

- Open a Cyprus bank account:

-

- You must also open an account with a bank in Cyprus.

How much does it cost to register a company in Cyprus?

- The total engagement fee depends on the services you require from Tetra Consultants. We provide multiple services including planning and strategizing with your firm, assisting you through the incorporation process, and ensuring that your firm is compliant with the laws of the country. To be clearer, you can choose our Cyprus company formation with bank account service which would not include post-registration assistance and would have a relatively lower fee.

- This total fee includes the Cyprus company formation fees which vary depending on the form of entity you wish to set up, your activity, and more.

- We will discuss the total engagement fee in detail before we begin with the registration process.

Why do companies set up in Cyprus?

Companies set up in Cyprus for the following reasons:

- Low Corporate Tax rates:

-

- The corporate tax rate levied by the government is 12.5% which is relatively lower than that of most countries in the European Union and worldwide.

-

- The government also provides additional tax exemptions on capital gains, dividends, and more and incentives for the companies.

- Government Policies:

-

- The government policies are business-friendly and the government is trying to reform the business framework.

-

- Cyprus has an extensive tax treaty network with over 65 countries to prevent double taxation issues.

- Connectivity:

-

- Cyprus is well connected to the world through its well-established shipping hub and airports connecting to major cities in not only Europe but worldwide.

How long does it take to open a company in Cyprus?

- Usually, it takes approximately ten days to complete the company registration process. After the registration process is completed, setting up an account with the bank will take approximately four weeks.

What is Cyprus Ltd?

- Cyprus Ltd is a limited liability company in Cyprus. It is the most popular form of business for foreign investors. This form of business is taken to be a separate legal entity such that the directors and shareholders have unlimited liability (they are not liable to cover the firm’s debts and liabilities).

Is Cyprus a tax haven?

- No, Cyprus is not a tax haven. Tax havens are those countries that provide individuals and companies with little to 0 tax liability. Since the government raised the Cyprus business tax to 12.5% in 2019, it is not considered to be a tax haven.

How many companies are registered in Cyprus?

- There are approximately 223,000 registered companies as of 31st December 2019. This number continues to grow further.

What is the best business to do in Cyprus?

- One of the best businesses for you to do in Cyprus is in the Shipping industry. Cyprus is strategically located allowing it has strong connectivity between Europe, Middle East, and Asia with its well-established shipping port. Therefore, having an export-import business in Cyprus could serve to be profitable for you. However, there are already approximately 130 Cyprus trading companies, including some Cypriot companies and multinational companies in Cyprus. Hence, this industry may be slightly competitive.

- You may wish to start small and then eventually grow your business and therefore may wonder how to register a small business in Cyprus. The process is the same as the registration of any other business in Cyprus but the cost may differ.