Labuan economic substance

Tetra Consultants advises our international clients on the new Labuan economic substance requirements. The new Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2018 was introduced on 1st Jan 2019. Malaysia government continues to commit as a member of the Inclusive Framework on Base Erosion and Profit Shifting (BEPS). As such, this new regulation is introduced to curb tax evasion and other harmful tax practices.

Additional Labuan economic substance requirements

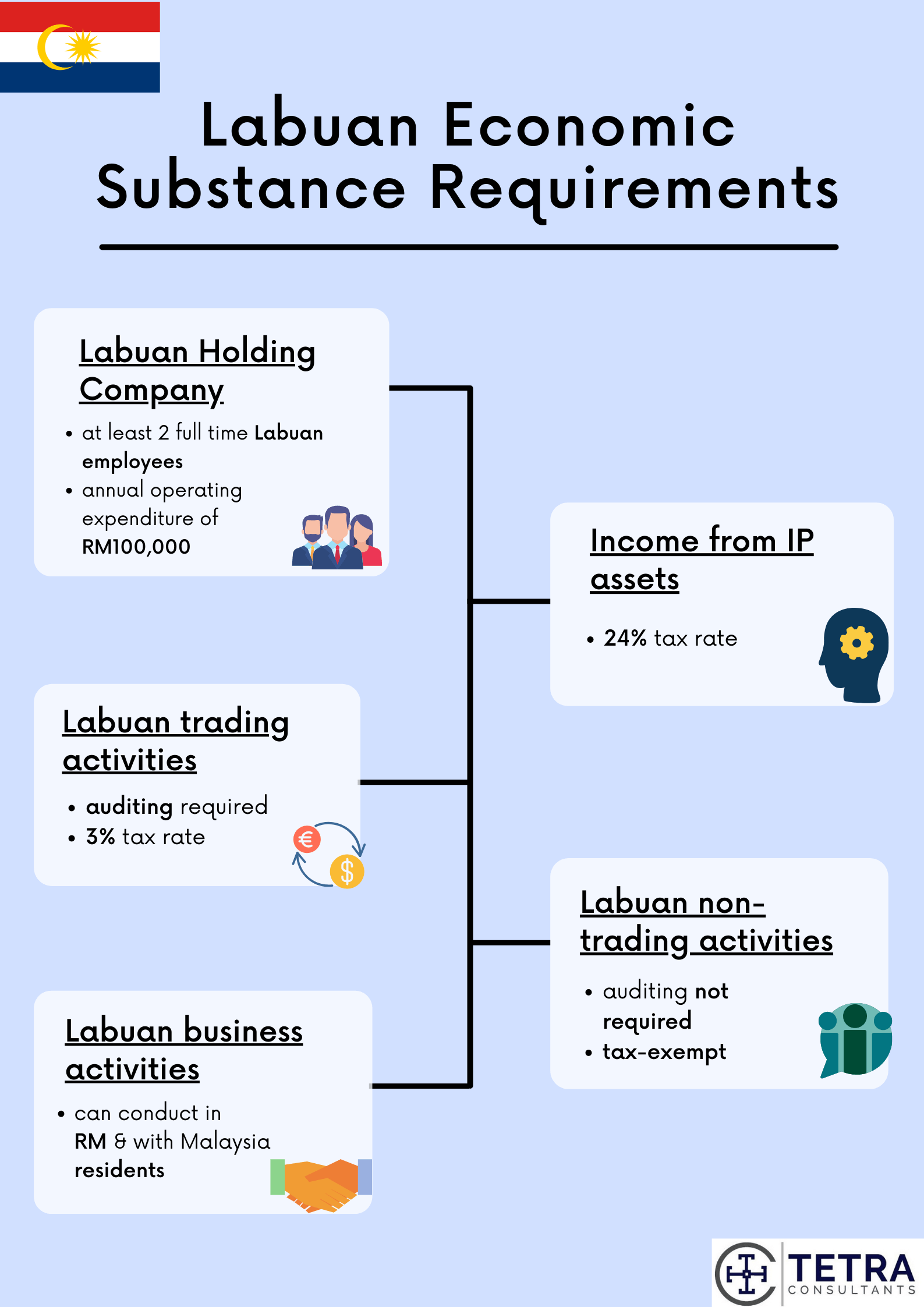

All Labuan entities conducting “Labuan business activities” are now required to meet additional economic substance requirements. These businesses are now required to have an adequate number of full time Labuan employees as well as an adequate amount of annual operating expenditures in Labuan. The number of employees and the amount of operating expenditures vary for different business activities.

According to the Economic Substance Regulations, it is now mandatory for a Labuan Holding Company to hire at least 2 full time Labuan employees and have an annual operating expenditure of RM100,000. Full time employees are defined as an employee who is employed by the Labuan entity to serve the entity in Labuan. The employee must sign an employment contract or appear in the organizational chart of the Labuan office. The operating expenditure can be pro-rated from the date of commencement of the business.

To be clear with the definition of “Labuan business activities”, the business activities included are:

- Labuan insurer, Labuan reinsurer, Labuan takaful operator, Labuan retakaful operator

- Labuan underwriting manager or Labuan underwriting takaful manager

- Labuan insurance manager or Labuan takaful manager

Labuan insurance broker or Labuan takaful broker - Labuan captive insurer or Labuan captive takaful

- Labuan International Commodity Trading Company

- Labuan bank, Labuan investment bank, Labuan Islamic bank or Labuan Islamic investment bank

- Labuan trust company

- Labuan leasing company of Labuan Islamic leasing company

- Labuan development finance company or Labuan Islamic development finance company

- Labuan building credit company or Labuan Islamic building credit company

- Labuan factoring company or Labuan Islamic factoring company

- Labuan money broker or Labuan Islamic money broker

- Labuan fund manager

- Labuan securities licensee or Labuan Islamic securities licensee

- Labuan fund administrator

- Labuan company management

- Labuan International Financial Exchange

- Self-regulatory organisation or Islamic self-regulatory organisation

- Holding Company

Intellectual Property (IP) Assets

Income derived from intellectual property right or royalty can no longer enjoy preferential tax treatment under Labuan Business Activity Tax Act 1990. The income now falls under Income Tax Act 1967 and will be subject to prevailing corporate income tax rate of 24%.

Corporate tax rate for trading businesses

In the past, companies carrying out “Labuan trading activities” can either pay a flat tax of RM20,000 or 3% of its audited net profits. Following the amendment, the option of paying a flat tax rate has been abolished. Instead, these Labuan entities are now required to have their accounts audited for the purpose of taxed filing and they will be subject to 3% tax on its audited net profits.

On the other hand, if your business is conducting “Labuan non-trading activities”, our international clients will continue to enjoy legally tax exempt status and be subject to 0% corporate income tax. These companies are also not required to have their accounts audited.

Dealing with Malaysian residents

Labuan companies are now allowed to conduct “Labuan business activities” in Malaysian ringgit and with Malaysia residents.

Consequences

Failure to comply with the new regulations will result in the company not being able to enjoy preferential tax treatment until Labuan Business Activity Tax Act 1990. Instead, the company will be subject to prevailing income tax rate under the Malaysian Income Tax Act 1967, which is 24%.

Contact us to find out more about how to set up business in Labuan and complete the Labuan company registration process hassle-free. Our team of experts will revert within the next 24 hours.