Labuan fund management license

Tetra Consultants assists our international clients in setting up a fund management company. Our service package includes registering Labuan company, opening a corporate bank account, meeting economic substance requirements, and securing the Labuan fund management license.

In Labuan, there are two main types of fund management companies: private fund management companies and public fund management companies. Tetra Consultants will advise our international clients on the differences including the minimum paid-up capital, license requirements, and the allowed business activities. Tetra Consultants will ensure that you meet the fund manager requirement in Malaysia and are compliant with the local regulations in Labuan.

Introduction

- Labuan fund management license is governed by Labuan Financial Services and Securities Act 2010 (LFSSA), Labuan Companies Act 1990, and Labuan Business Activity Tax Act 1990. The Labuan fund manager license holder can provide management services to clients. This may include investment advice or administrative services in respect of securities for investment, including dealing in securities. If your company is planning to undertake Islamic fund management activities, your operations are also required to comply with Shariah principles.

Advantages of having a Labuan fund management license

Services you can provide:

- Management Services:

-

- You can serve as a portfolio manager for your client.

-

- You do not require any other licenses such as the money manager license or portfolio management license, unlike that in other countries.

- Investment Advisory Services

-

- You can provide advice on investment and securities.

-

- You can provide consulting services related to financial planning for clients.

- Administrative Services

-

- You can make necessary submissions with respect to securities, on behalf of your client to the Labuan FSA.

-

- Issue any required documents.

- Dealing in Securities

-

- You can purchase or sell securities on behalf of your clients.

-

- You can underwrite the securities as well.

Tax system:

- You are required to pay a 3% corporate tax on net profit, which is relatively lower than that in other countries.

- There are multiple tax exemptions offered as well, which may be beneficial to the company.

- In Malaysia, there is an extensive network of tax treaties with over 70 countries which prevents double taxation problems.

Pre-application requirements for Fund Management License

Eligibility

According to Labuan International Business and Financial Centre (IBFC), you are required to meet the following fund management requirements in Malaysia to apply for the license:

- An individual who holds a relevant degree or professional qualification to carry on fund management activities. As per the Labuan financial services authority (FSA), the applicant must be at least a diploma holder with three years of relevant experience in the capital market or direct experience in fund management activities.

- An approved fund manager or any provider of such services from a country or jurisdiction who is a member of the International Organisation of Securities Commission (IOSCO); or

- A person who does not fulfil the above requirements may also be considered, provided that the activities are run and managed by suitably qualified and experienced individuals.

Labuan Financial Services Authority (LSFA) requirements

To secure a Labuan money-broking license, the initial step involves obtaining approval from the Labuan Financial Services Authority (LFSA), based on the business plan, company profile, and other required documents. Subsequently, the official incorporation of the company follows this regulatory clearance. The entity must then submit a comprehensive license application to the LSFA, comprising a three-year business plan with financial projections and marketing strategies. Additionally, the application must include details of all directors and shareholders, the latest two years’ audited accounts for the current corporate entity (if applicable), as well as documents related to Know Your Customer (KYC), Anti-Money Laundering Act (AMLA) compliance, and operational manuals/procedures.

Requirements

Labuan IBFC has stated that they will consider the below criteria while assessing the issuance of the Labuan fund manager license.

- You must have a paid-up capital that is unaffected by losses of at least RM300,000 or its equivalent in any foreign currency throughout its operations.

- If your assets under management (AUM) of more than RM150 million, you are required to maintain an additional capital which is equivalent to 0.2% of the AUM over RM150 million.

- You are required to subscribe to a professional indemnity insurance policy with coverage of not less than RM1 million or its equivalent in any foreign currency throughout your operations.

- You must have a Labuan registered office where business activities are carried out.

- There must be at least one shareholder, two directors, and three local employees; all relevant personnel is required to meet the requirements of the Labuan FSA Guidelines on Fit and Proper Person Requirements.

- You are required to establish adequate internal policies and procedures for your operations, compliances, internal controls, corporate governance, and risk management, including its business continuity plan. These must be regularly reviewed to ensure that they remain appropriate, relevant, and prudent.

- You should appoint an approved auditor to carry out an annual audit of your accounts according to Section 174 of the LFSSA and Section 135 of the LIFSSA.

- You can conduct your business in any foreign currency other than Malaysian Ringgit unless permitted under Section 7(4) of the Labuan Companies Act 1990.

- You must maintain adequate and proper records and books of accounts in Labuan in line with the Directive on Accounts and Record-keeping Requirement for Labuan licensed Entities issued by LFSA Labuan.

- You should indicate your name and license or registration number on your letterhead, stationery, and other documents.

- If your company is planning to undertake Islamic fund management services, you are required to appoint a qualified person onto your internal Shariah Advisory Board. The company is required to follow the Directive on Islamic Financial Businesses.

Type of fund management company and additional requirements

Private fund management company

- If you are managing your own company funds, you can set up a private fund management company. For this Labuan private limited company, you are not required to apply for any fund management license in Labuan. Tetra Consultants will assist you to prepare an information memorandum to the Financial Services Authority of Labuan (FSA) stating the nature of your business activity.

- Registration of the company and submission of the information memorandum will be completed within 3 weeks. Labuan Financial Services Authority usually approves the information memorandum within 10 working days.

- Thereafter, Tetra Consultants will assist our international clients to open a Malaysian corporate bank account. On average, we will secure a banking solution within 4 weeks. See our corporate bank account opening webpage for more information on how to open such accounts.

- In order to meet the new economic substance requirements, Tetra Consultants will assist you to look for a local office and hiring 2 local employees. Every month, you will be required to pay the landlord and employees directly. This is to ensure your private fund management company stays compliant with local regulations.

- All in all, you can expect to start operations within 9 weeks after engaging Tetra Consultants.

Public fund management company

- If you are managing customer funds, you are required to apply for a Labuan fund management license from the Financial Services Authority of Labuan. Tetra Consultants will assist you to secure the fund management license after registering the company and opening a local corporate bank account.

- Our team of experts will prepare a comprehensive business plan including shareholding structure, intended business activities, customers, and suppliers as well as financial projections over the next few years. In addition, we will prepare AML/CFT documents such as AML/CFT policies and procedures, risk management, and privacy policy.

- Tetra Consultants will ensure that you meet the new economic substance requirements in Labuan, which requires the company to have a local Labuan office, 2 Labuan employees, and a paid-up capital of RM300,000. The license application will take approximately around 2 to 3 months.

- All in all, our international clients can expect to start operations within 5 months after engaging Tetra Consultants.

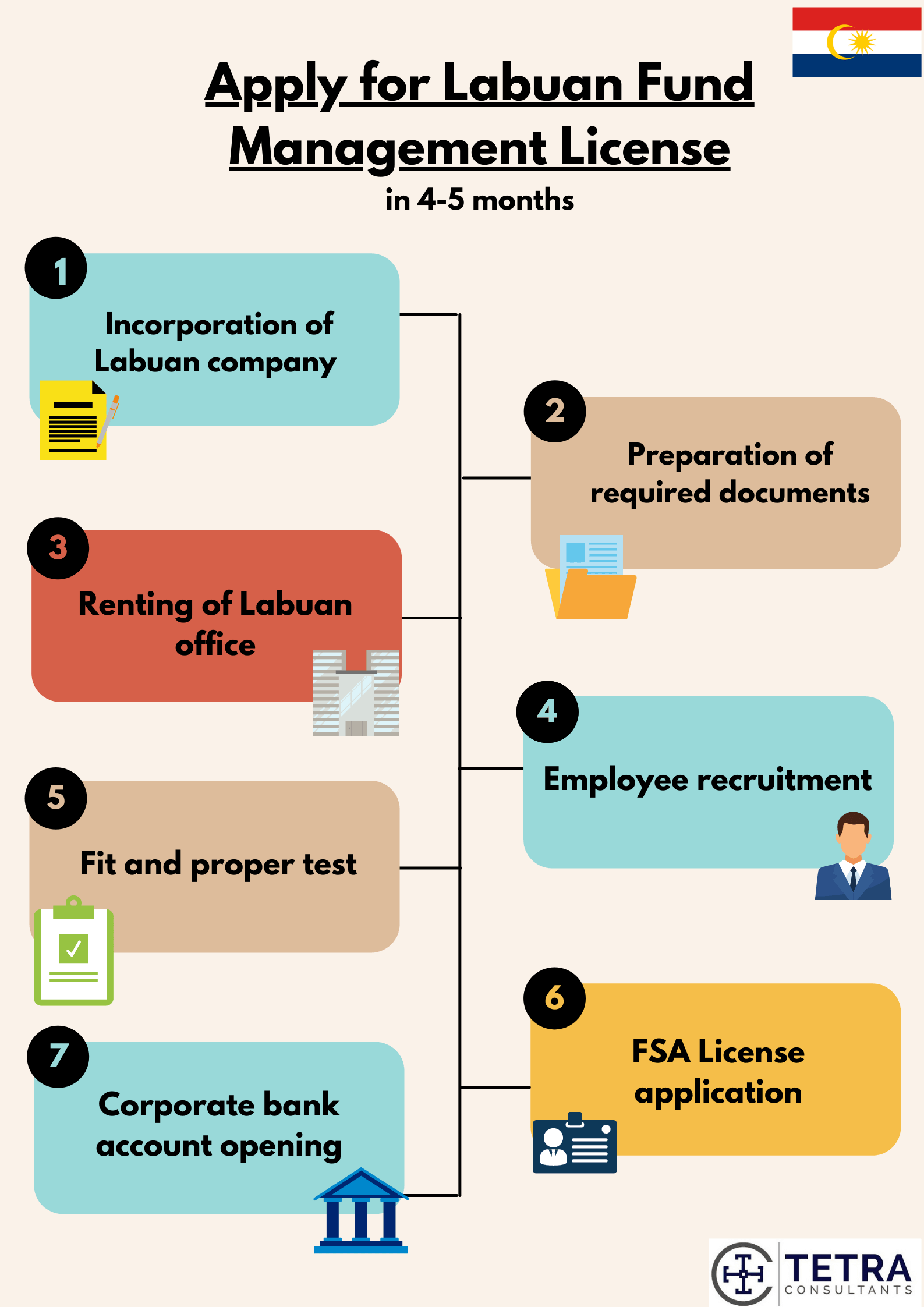

Application process

- Tetra Consultants will assist you to incorporate a Labuan company within 2 weeks. Once the company is registered, Tetra Consultants will send you the Certificate of Incorporation, Memorandum & Articles of Association, and other corporate documents.

- Once the company is successfully registered, Tetra Consultants will proceed to prepare the documents required for the Labuan fund management license application. This includes a business plan for three years, which describes the business intentions, business activities, target audience, revenue projections, and manpower, including the equity structure of the company with regard to the percentage of shareholding.

- Other documents include AML/CFT procedures and internal policies such as technology risk management, corporate governance, regulatory reporting, and others.

- Simultaneously, Tetra Consultants will liaise with you to provide a source of wealth declaration and work on securing insurance coverage. This is to ensure we meet paragraphs 8.1 and 8.2 of the Guidelines on the Establishment of Labuan Fund Manager.

- To meet the additional economic substance requirements, Tetra Consultants will assist you to rent a local Labuan office located in the Central Business District. Our legal team will prepare a lease agreement as per local Labuan real estate regulations, to be signed by all parties. Thereafter, our international clients are required to pay monthly rent directly to the landlord.

- In addition, Tetra Consultants will recruit 2 quality employees for your established company. Our services include conducting initial screening and interviews as well as preparing employment contracts as per Labuan employment regulations. You are only required to attend the final interview to pick the preferred candidate. Thereafter, monthly salaries are to be paid directly to your employees.

- Once the organizational chart is confirmed, Tetra Consultants will request the directors, shareholders, principal officer, and employees to undergo a fit and proper test as per the Labuan FSA Guidelines on Fit and Proper Person Requirements.

- With everything in place, Tetra Consultants will submit a license application to Labuan FSA. Within one week, Labuan FSA will assign a Case Manager to your company. In the event the Case Manager requires additional documents or a video conference call, Tetra Consultants will immediately prepare the same. Otherwise, Labuan FSA will issue an in-principal approval to your company. within 3 months.

- With this in-principle approval, Tetra Consultants will proceed to open a local corporate bank account with a reputable Labuan bank.

- Some of the banks we work with include RHB, Maybank, Standard Chartered, and OCBC. On average, this process takes around 4 weeks, and you may be required to travel to Labuan for a face-to-face meeting. Once the account is opened, you will be required to deposit the initial paid-up capital into the corporate bank account.

- Once the paid-up capital is injected, Tetra Consultants will inform Labuan IBFC of the same and they will release the full Labuan fund management license.

- In total, Tetra Consultants expects to register your Labuan company, open Labuan corporate bank account, and secure a Labuan fund management license within 4 to 5 months.

Post-application requirements for a fund management license

- Tetra Consultants will assist you in ensuring you are compliant with the local laws after you have received the necessary approval to conduct your fund management business.

- You will then be required to pay an annual license fee of RM5,000 (approximately USD $1,200 and a marketing office annual fee of RM7,500 (approximately USD $1,800).

- You are required to submit your audited financial statements to the Supervision and Enforcement Department within six months of the end of the financial year, every year.

- In case of any alteration to the business plan, you must inform the Labuan FSA within thirty days.

Contact us to find out more about how to set up a Labuan fund management company and acquire your license. Our team of experts will revert within the next 24 hours.

FAQ:

Do Asset managers need a license?

- Yes, asset managers require a license to set up a public company in Labuan. If they wish to provide advice to their customers, then they need to get the Fund Manager License as per the Labuan FSA guidelines.

- Moreover, if the assets under management (AUM) is more than RM150 million (approximately USD $36 million), then the asset managers have an additional capital requirement of 0.2% of the AUM above RM 150 million.

How do I become a licensed fund manager in Malaysia?

- In order to become a licensed fund manager in Malaysia, you must meet the eligibility criteria and the requirements of the government, as mentioned on our website. After this, you must apply for the Labuan fund management license to the Financial Services Authority. After you have received the license, you must ensure that you are compliant with the law. If you wish to find more information, you can refer to our website or contact us and we will revert to you within 24 hours.

How do you get a fund manager license?

- To get a Labuan fund manager license, you can follow the steps on our website. Firstly, you must meet the eligibility criteria and any additional requirements of the government. Secondly, you must complete the incorporation process of your company and make all the required submissions and payments. Thirdly, once you get the approval you must open a bank account. Lastly, you must apply for the fund manager license as per the Labuan FSA guidelines. You must then ensure that you are compliant with the government regulations.

- To find more in-depth information, you can check our website or contact us, and our team of experts will revert within 24 hours.

How long will getting a Labuan fund management license to take?

- The process to get a Labuan fund management license takes approximately 45 to 60 days, depending on LFSA Labuan. Prior to this, you must also complete the company registration process and open a bank account. With Tetra Consultants, this entire time-consuming process should be completed within four to five months. While we focus on helping you be operational in Labuan, you can focus on running your business.