Malta VFA license

Tetra Consultants assists our international clients with the application for the Malta VFA license. Under the Malta Digital Innovation Authority (MDIA) Act, a company in Malta can be registered as a virtual financial assets (VFA) provider. This means that the company is effectively authorised by the Malta Digital Innovation Authority (MDIA) to conduct businesses relating to virtual financial assets such as cryptocurrency. Contact us for a free consultation to find out more about the Malta VFA license and our team of experts will revert within the next 24 hours.

What is the meaning of VFA?

- Understanding Bitcoin and its position in the news alongside other contemporary virtual finance technologies begins with understanding blockchain. Blockchain is a technology that stores information in “blocks”, duplicating and decentralizing these blocks across multiple systems using Distributed Ledger Technology (DLT). VFA thus refers to virtual financial assets such as cryptocurrencies that are stored using this same technology or any other digital medium recordation that is used as a digital medium of exchange, giving them the alternative name of DLT asset. Although these are also sometimes accessed using token instruments, it does not refer to any electronic money, financial instrument or virtual token.

- This holds huge potential. Beyond lofty claims that it is the “currency of the future”, it represents a more secure way of transacting since it uses strong cryptographies, and the information is decentralized over many systems. Hence, it prevents anyone from having the ability to manipulate money supply or conduct any other fraudulent activities.

- It is ironic then, that such a secure technology has given rise to both paranoia and uncertainty within prospective crypto exchange owners and users alike.

Cryptocurrency in Malta

- Recognising that such fears stem from a lack of regulation, Malta has taken active steps through the MDIA Act, creating the Malta Digital Innovation Authority (MDIA) to work alongside the Malta Financial Services Authority (MFSA) to issue a Malta VFA license to actively regulate and monitor cryptocurrency exchange in Malta. Being the first to do so in the world in 2018, they have earned themselves the moniker of “Blockchain Island”. This legal certainty that they have given Malta financial services comes from the creation of the Virtual Financial Assets Act and Framework, which aims to ensure effective investor protection, financial market integrity and financial stability without stifling innovation and development of new financial technologies. They also offer a beneficial tax rate, making the Malta crypto license one of the most desirable globally.

- There is now a wide spectrum of cryptocurrency firms operating across all four Malta license categories, which regulate the operation of platforms to exchange cryptocurrencies, manage portfolios and provide investing advice. Malta provides the ideal starting point for you to register your crypto business as it carries a renowned reputation as a leader in VFA asset management regulations and will help your business to command credibility internationally.

- Tetra Consultants helps our international clients to apply for all MFSA license categories, based on whatever their business requires. If you are looking to register your crypto business, you have come to the right place.

Types of VFA license in Malta

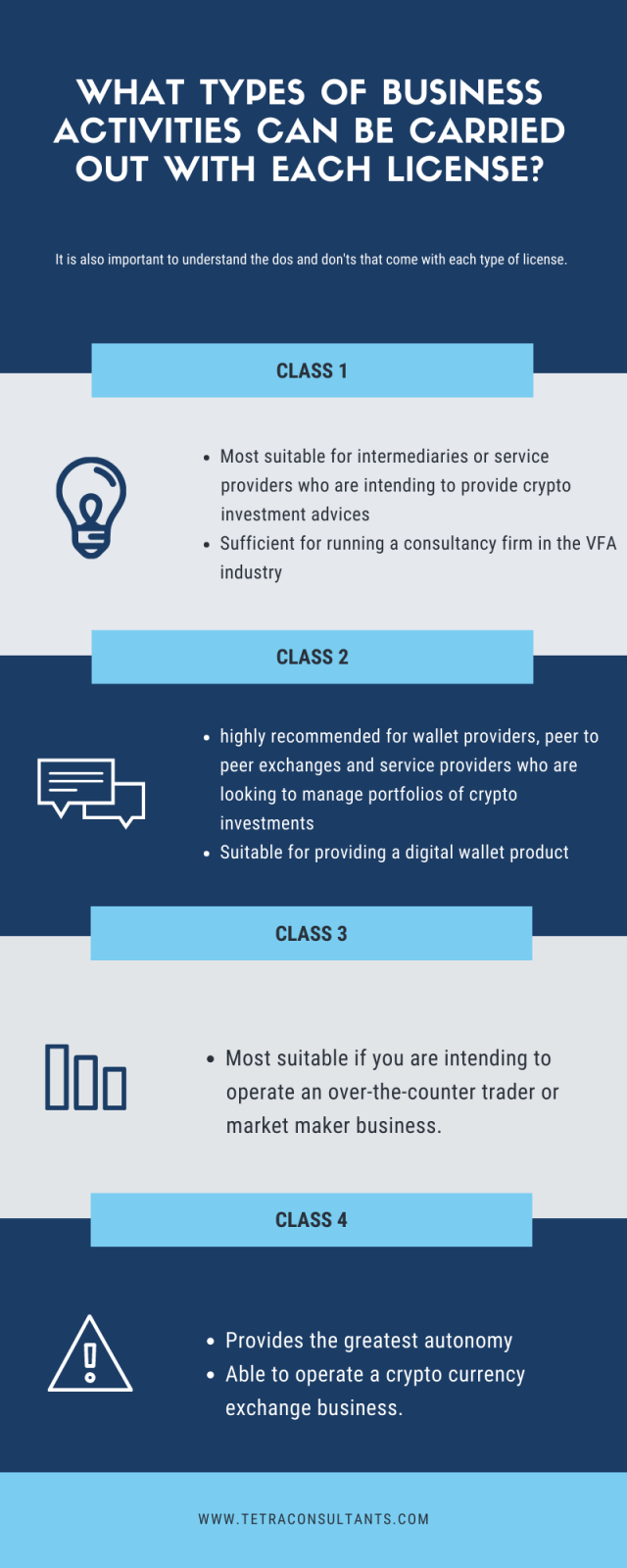

Each type comes with its set of dos and don’ts. To ensure that your business is fully compliant, it is also important to understand the business activities that you can operate with your class license. Tetra Consultants will assist you in gaining a comprehensive understanding of everything you need to know before helping you in the submission of your VFA application form.

VFA Class 1 license

- This is most suitable for intermediaries who are intending to provide cryptocurrency investment advice. For example, if you are running a consultancy firm in the VFA industry or being the middleman in helping to receive and transmit orders.

VFA Class 2 license

- This is highly recommended for wallet providers, peer to peer exchanges and those are looking to manage portfolios of cryptocurrency investments. As such, if you are operating a digital wallet product, this will be the best fit.

VFA Class 3 license

- This grants you greater rights since it allows you to trade on your account. As such, it will be most suitable for you if you are intending to operate an over-the-counter trader or market maker business.

VFA Class 4 license

- The most extensive and all-rounder license, this provides the greatest autonomy to all its holders. With a Class 4 license, you can operate a cryptocurrency exchange.

- However, additional requirements are imposed when it comes to applying for a Class 4 license and several other factors will also be taken into consideration by the Authority.

- These requirements include the protection of investors and the general public, the protection of the reputation of Malta, the promotion of innovation, competition and choice as well as the reputation and suitability of the applicant and all other parties connected with him or her.

Mandatory Requirements for Malta VFA License

General Requirements

- The first step would be to determine if the nature of your business falls under the jurisdiction of the VFA Act using the Financial Instrument Test. Only certain DLTs and VFAs fall under this, but in general, any entity that offers a VFA or is classified as a VFA service provider will be required to apply for a license. If you are operating a business in cryptocurrency or a service provider (brokerage, portfolio manager, custodian, eWallet provider and cryptocurrency exchanges), this is likely to apply to you. Tetra Consultants will advise you as to the relevant licensing you will require to operate in compliance with the new laws in Malta.

- When applying for a VFA license, the Malta Financial Services Authority will practice its sole discretion to classify the applicant into one of its four categories.

- Secondly, even though both an individual person and a company may apply, we would recommend applying with a company since this will not require your physical presence. This company has to be either incorporated in Malta or in other recognised jurisdictions. If this is the case, it must establish a branch in Malta. Its purposes will also be limited to acting as a license holder and its actual activities have to be compatible and connected with the VFA services expected of a license holder. The company should also have a valid corporate bank account.

- The company must also have at least two directors, a local secretary, and a locally registered office address. They must then appoint a compliance officer, a money laundering reporting officer and a risk manager. There are no nationality requirements.

- Lastly, the application process can only be done through an authorised VFA agent, who will help to submit the online VFA Service Provider Application Form along with the completed annexes detailing the unitholding structure, business plan synopsis and declaration sheet. The form also requires additional supporting documents, namely the completed entity questionnaire, personal questionnaire and declaration; evidence of the company being set up (Memorandum or Articles of Association and Board Resolution); organisational chart; any outsourcing contracts and the fitness and properness assessments for both the individuals as well as entity. Specific emphasis should be taken to ensure the safeguarding of client assets, and the internal monitoring controls put in place.

Specific Requirements for each Class

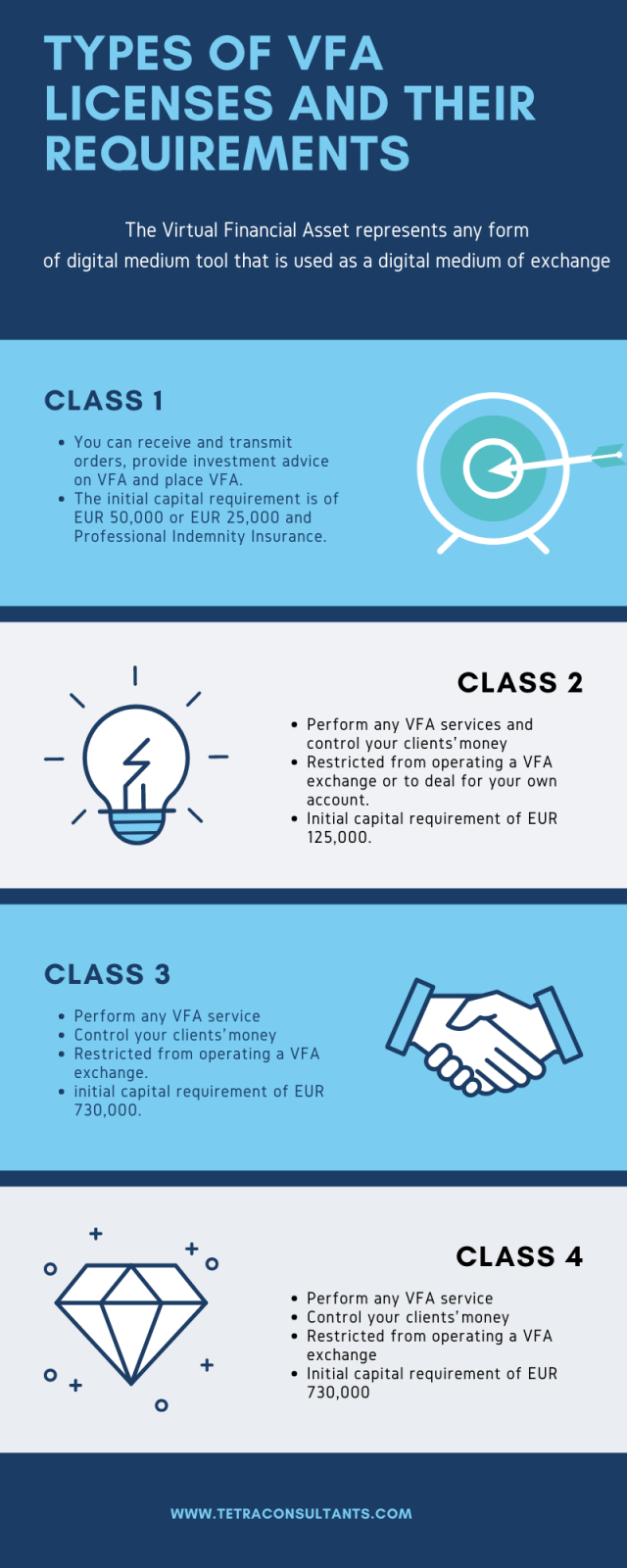

VFA Class 1 license

- Class 1 service providers can receive and transmit orders, provide investment advice on VFA and place VFA. The initial capital requirement is of EUR 50,000 or EUR 25,000 with Professional Indemnity Insurance, or VFA Insurance. This has an application fee of EUR 6,000 and an annual supervisory fee of EUR 5,500 for the first EUR 50,000 of revenue, with each additional part thereof being charged at EUR 700, up to a maximum of EUR 1,000,000 in revenue.

VFA Class 2 license

- Class 2 service providers can perform any VFA services and hold or control clients’ money. However, you will be restricted from operating a VFA exchange or to deal for your own account. The initial capital requirement for this is EUR 125,000. This has an application fee of EUR 10,000 and an annual supervisory fee of EUR 9,000 for the first EUR 250,000 of revenue, with each additional part thereof being charged at EUR 800, up to a maximum of EUR 5,000,000 in revenue.

VFA Class 3 license

- Class 3 service providers can perform any VFA service and hold or control clients’ money. However, you are restricted from operating a VFA exchange. The initial capital requirement for Class 3 applicants is EUR 730,000. This has an application fee of EUR 14,000 and an annual supervisory fee of EUR 12,000 for the first EUR 250,000 of revenue, with each additional part thereof being charged at EUR 800, up to a maximum of EUR 50,000,000 in revenue.

VFA Class 4 license

- Class 4 service providers can operate a VFA exchange, hold or control clients’ money, VFA and private cryptographic keys, and perform nominee services for activities solely relating to such VFA exchange. In essence, this provides you with the greatest autonomy. The initial capital requirement for Class 4 applicants is EUR 730,000. This has an application fee of EUR 24,000 and an annual supervisory fee of EUR 50,000 for the first EUR 1,000,000 of revenue, with each additional part thereof being charged at EUR 5,000, up to a maximum of EUR 100,000,000 in revenue.

Timeline to secure Malta VFA license

With the many steps involved, this might be a confusing process. While Tetra Consultants will assist you with the application, we advise that you continue to read through the following guide so that you can be equipped with the necessary knowledge before applying for a license.

Within three months of receiving the required due diligence documents, Tetra Consultants will be able to secure your Malta VFA license. Malta mandates that for every application, a registered VFA agent is to be commissioned. The application also has to be endorsed by the VFA agent. Tetra Consultants will provide you with a registered agent to ensure that you continue to comply with the registration requirements as per imposed by Malta.

How to apply for Malta cryptocurrency license?

Assuming your Malta business has already been registered and corporate bank account has already been approved preliminarily, you will go through the below phases in order to legally conduct cryptocurrency business using your Malta entity.

Preparatory Phase

- To apply, you will need to submit a comprehensive written description of the proposed structure, the Virtual Financial Asset services for which licensing is sought and a legal opinion that the proposed activity does not fall within the scope of traditional financial services legislation. Upon receiving the necessary details, a preliminary meeting is to be scheduled between the applicant and the Authority.

- In most cases, the directors and shareholders are not required to travel to Malta. However, if travel is required, Tetra Consultants will have a representative to accompany you to the meeting. Alternatively, our team will negotiate with the Authority to conduct a conference call instead or to request for a waiver.

Pre-Licensing Phase

- Upon submitting the completed application, the Authority will first proceed to issue you an “In Principle Approval”. Following which, a three months phase will begin whereby our team will take this time to work with you on finalising any outstanding issues or any pre-licensing conditions raised previously in the meeting. Once we have fully finalized all details to the satisfaction of the Authority, a VFA Service license will be issued.

Post-Licensing Phase

- Once the license has been issued, it is important that you continue to adhere to all regulations imposed by the Malta Financial Services Authority. Generally, upon receiving your license, you will be able to operate your VFA business within 12 months from the date of license issued.

- For all license holders, it is mandatory to pay the minimum annual supervisory fee for the first year in operation. The payment of the fees will be accounted for by proportionating the time period between the date of license issuance and submission of the annual audited financial statements.

Compliance

- Once you have received your Malta VFA license, our team of dedicated consultants will continue to ensure that all regulations imposed are met. Based on the MFSA, all companies are to carry out internal audits. If required, Tetra Consultants will assist you in engaging a professional auditor.

- Imposing many stringent requirements, the MFSA will continue to monitor holders’ compliance through their business transactions and records. As such, it is required by the law that companies continue to retain all records of services and transactions undertaken by their business for at least five years.

- These records include but are not limited to recordings of telephone conversations, electronic communications or transmission and execution of client orders. In some instances, you may be required to have a Systems Auditor if deemed fit. License holders may also appoint a Custodian to safe keep its assets and any VFA held for its clients.

- If a Custodian is required, you are to also inform the MFSA. All license holders will be held accountable to maintain a minimum, own funds that are equivalent to their capital requirement.

- All in all, Tetra Consultants will continue to advise and clarify any doubts that you may have with regards to your annual reporting obligations and ensure that you continue to stay compliant.

Contact us now for a free consultation. Our team of experts will revert within the next 24 hours.

FAQ

What is a virtual financial asset license?

- This refers to the group of licenses which governs virtual financial assets in Malta and allows businesses to operate crypto wallet or exchange services.

What are virtual financial assets?

- Virtual financial assets are legally defined as “any form of digital medium recordation that is used as a digital medium of exchange, unit of account, or store of value and that is not electronic money, a financial instrument or a virtual token.”

How do I get my crypto license in Malta?

- Applications for crypto licenses can only be done through registered VFA Agents. Tetra Consultants is able to liaise with an agent on your behalf for you to get a crypto license.

Is cryptocurrency legal in Malta?

- Yes! Malta was the first country to legalize cryptocurrency in 2018.

Why is Malta a tax haven?

- Malta is not a tax haven as it still possesses strict tax regulations in compliance with that of the EU and as a result, not been mentioned in the most recent black lists from the EU or the Organisation for Economic Co-operation and Development.

How much tax do I pay in Malta?

- Tax payable in Malta is heavily dependent on where it was derived, and there are many tax incentives available to foreign companies. In order to ensure compliance, it is best to approach us for a free consultation.

How do I become a resident of Malta?

- There are multiple methods available. Residing in, owning businesses, paying taxes and owning or renting property are several ways you can qualify yourself for Malta residency through the Ordinary Residence Scheme, Malta Residence Program, Malta Global residence program or the Malta Permanent Residency Program.

What is the currency in Malta?

- Being part of the EU, Malta uses the Euro as well.

Is Bitcoin a financial asset?

- Bitcoin does not fit the definition of a traditional financial asset as it is classified as a cryptocurrency, and thus is more appropriately classed as virtual financial assets.

Is the crypto license passportable to other EU territories?

- It is not automatically passportable, but if firms comply to the regulations of other jurisdictions and inform the Malta Financial Services Authority beforehand, they are able to offer cross-border services.

Can my business deal in both VFAs and traditional financial assets?

- Based on the Markets in Financial Instruments Directive from the European Union, two separate licenses and entities are required.

Does the VFA Act’s jurisdiction only cover crypto to crypto exchanges?

- The act governs the transactions of VFAs in general, which includes fiat to crypto transactions as well and vice versa.