New Zealand Financial Service Provider License (FSP)

Tetra Consultants assists our international clients to secure the New Zealand FSP (Financial Service Provider License) License. Under the Financial Service Providers (Registration and Dissolution Act 2008 (‘the Act’), a New Zealand company can be registered as a financial services provider. This means that the company is effectively registered by the Ministry of Economic Development to offer financial services or in the words of the legislation becomes a financial services provider.

Once your business secures registration as a FSP, you can be allowed to conduct the following business activities:

- Broking service

- Financial adviser service

- Acting as a deposit taker

- Keep, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons

- Provide credit under a credit contract

- Operating a money or value transfer service

- Issue and managing means of payment

- Giving financial guarantees

- Changing foreign currency

- Entering into derivative transactions, or trading in money market instruments, foreign exchange, interest rate and index instruments, transferable securities and futures contracts on behalf of another person.

Types of Financial Service Provider License

- Auditors

- Crowdfunding platforms

- Derivatives issuers

- Independent trustees

- Managed investment scheme (MIS) manager

- Market operators

- Peer-to-peer lending

- Supervisors

- Financial Advice Providers

Stricter requirements for FSP license application

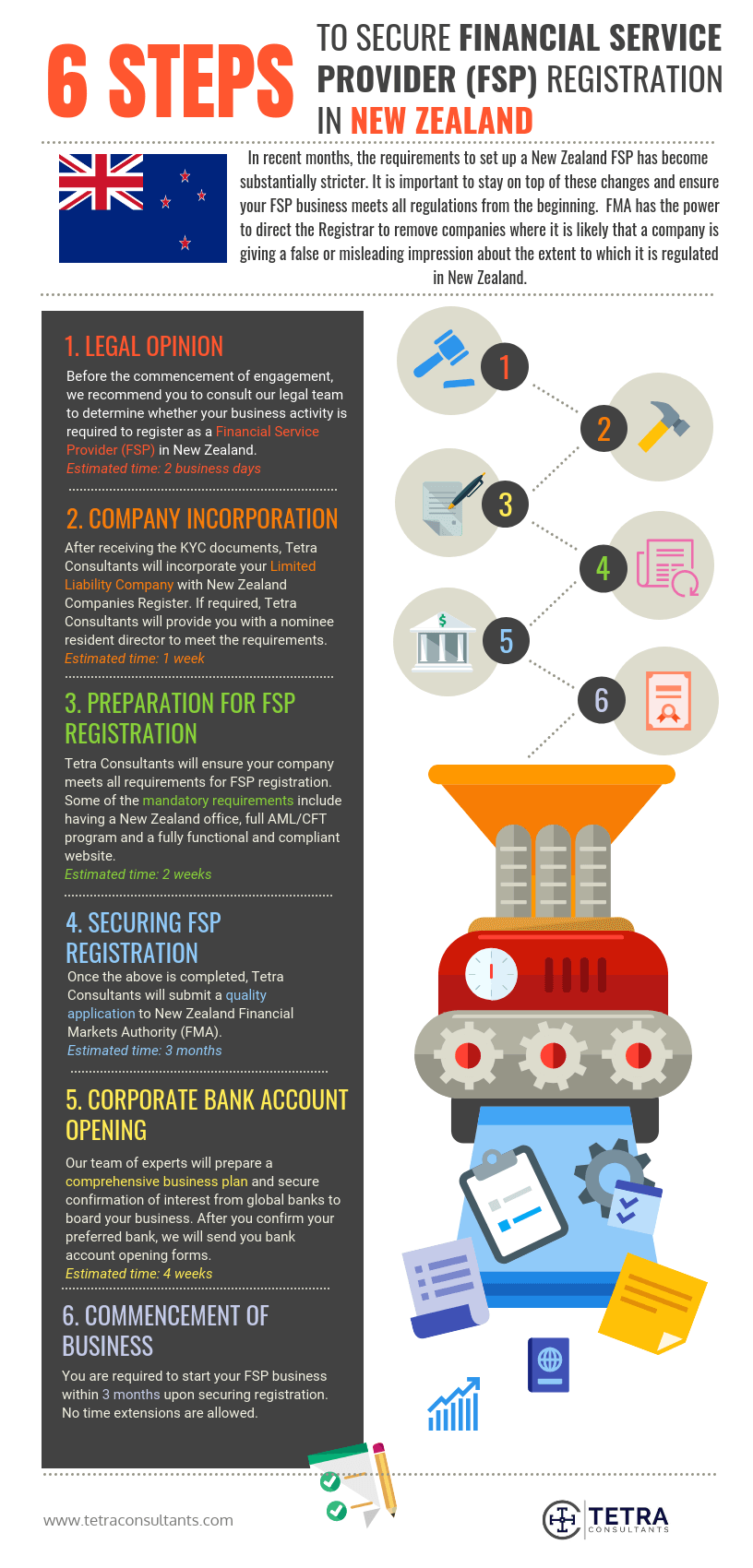

In recent months, the requirements to set up a New Zealand FSP has become substantially stricter. It is important to stay on top of these changes and ensure your FSP business meets all regulations from the beginning. Financial Markets Authority has the power to direct the Registrar to remove companies where it is likely that a company is giving a false or misleading impression about the extent to which it is regulated in New Zealand.

Does your business need a New Zealand Financial Service Provider License?

You will be required to register your business as a Financial Service Provider (FSP) if you:

- Have a place of business in New Zealand

- Are providing financial services both locally and globally

You are not eligible to register your business as a Financial Service Provider (FSP) if you:

- Do not intend to provide financial services from New Zealand

- Do not intend to have New Zealand as a targeted market

- Do not intend to establish a working office in New Zealand

How long to secure New Zealand Financial Service Provider License?

This license is approved by New Zealand Financial Markets Authority (FMA) and they take up to 12 weeks for approval.

Mandatory requirements to secure FSP license in New Zealand?

- Clear business plan showing your company is conducting business from New Zealand for both local and overseas customers

- You are required to start your FSP business within 3 months upon securing registration. No time extensions are allowed.

- You are required to set up an office in New Zealand and hire local employees.

- You are required to appoint at least one director who is resident in New Zealand.

- You are required to have a full AML/CFT program in place and file annual AML/CFT Act 2009 Report.

- Your fully functional website is required to show:

-

- Compliance with regulations of the financial activities you have applied

-

- Your FSP is clearly conducted from New Zealand

-

- Your FSP serves local New Zealand as well as international customers

Documents required

- Organizational chart

- Quality business plan with 3-year financial projections

- Internal procedures Manual

- AML/CFT Procedures Manual

Advantages

- There is no minimum capital requirement.

- Your company can enjoy the advantages of all traditional financial centres while being recognized as a legitimate onshore financial centre.

- New Zealand is not blacklisted by OECD and World Trade Organization. The country is regarded as a safe jurisdiction with long term security.

Key amendments to the Financial Service Providers Act (‘FSP Act’)

The past few years have seen growing concerns that a number of overseas entities are registering on the FSPR to mislead investors into thinking they are regulated or supervised in New Zealand. The key concern is that some may be involved in fraudulent activities offshore or cannot obtain registration in their home jurisdiction, with their registration in New Zealand negatively impacting our international reputation. In response to these concerns, amendments were made to the FSP Act in 2014 to give the FMA broader powers to deregister entities from the FSPR.

The key changes to the FSP Act include:

- Tightening of the territorial scope so that it may be clearly noticed that New Zealand is also one of your target markets;

- New regulation-making powers that can prescribe circumstances and thresholds for when an entity must register on the FSPR, and required warning statements for certain advertisements

- Provision for registration (and de-registration) of financial advisers (but not nominated representatives)

- Increased obligations for dispute resolution scheme providers to report regulatory breaches.

Impact of the changes

The amendment introduced by the New Zealand government in the regulation aims to address the continued misuse of the FSPR by tightening the rules around who can register and arming the FMA with broader powers to direct de-registration.

Old regulation

The FSP Act previously required financial service providers to register on the FSPR (regardless of where the financial service is provided) if they:

- Are ordinarily resident or have a place of business in New Zealand, or

- Are required to be licensed or registered under New Zealand legislation.

- It has previously been agreed that entities registering on the FSPR should be required to have a stronger connection with New Zealand.

New regulation

As a result, the amendment proposed replacing the current territorial scope provision with a much stricter requirement. The new provision only allows entities to register on the FSPR if they are in the business of providing a financial service, and:

- Either that financial service is provided to persons in New Zealand by or on behalf of the entity, or

- The entity is required to be licensed or registered under New Zealand legislation.

- The new provision also makes it clear that merely allowing services to be accessible by persons in New Zealand is insufficient to result in the services being caught.

In addition to the tightening of FSP Act registration provisions, the amendment also creates new regulation-making powers, which prescribe:

- Minimum thresholds for providing financial services in New Zealand before any entity can be registered, accordingly:

Entities who have been in the business of providing a financial service in New Zealand for at least 12 months, will not meet the prescribed threshold if:

- During the relevant period, the financial service is provided to fewer than 10 New Zealand residents, or

- The amount determined for the relevant period in accordance with a prescribed formula is less than NZ$10,000.

- Specific circumstances where registration is required if the government thinks it fit

- Warnings that must be included when advertising financial services

How to secure FSP registration in New Zealand?

Tetra Consultants has more than 10 years’ experience of advising our global clients on securing FSP registration. Tetra Consultants will manage your FSP registration from the start to the end, including incorporation of a new New Zealand company, opening of corporate bank account, drafting the legal documents required, sourcing for qualified local employees and physical office and securing the registration.

Step 1: Reservation of company name

- Tetra Consultants will check your company name through the ONECheck tool. Once Tetra Consultants has verified the availability of your company’s name, we will proceed to create a RealMe® login account and an online services account with the Companies Register on behalf of your company. Through the online services account, Tetra Consultants will reserve your company name for 20 working days.

Step 2: Preparation and submission of relevant documents for company incorporation

- After Tetra Consultants has reserved your company’s name, we will complete the registration of your company through the online services account. You are required to prepare the documents required for a foreign director for incorporation of the company. This includes the application form, notarized passport copies and proof of address of individual directors and shareholders.

- Tetra Consultants will also draft your company’s constitution and other relevant corporate documents, based on your business activity and corporate structure.

Step 3: Tax registration

- The tax registration process can be completed during the company incorporation. Tetra Consultants’ accounting and tax team will submit the relevant application for your company. Once your company has been incorporated, you will receive your company’s certificate of incorporation and your Inland Revenue and GST numbers.

Step 4: Corporate bank account opening

- Upon successful company incorporation, Tetra Consultants will open a corporate bank account with a reputable bank in New Zealand.

Step 5: Financial Service Provider registration

- Tetra Consultants will then proceed to register your company as a Financial Service Provider through the online services account. Tetra Consultants will help you to submit your business and contact addresses, confirmation that your company meets the business requirements, information about services provided, and provide verification whether your company is a reporting entity under the Anti-Money Laundering and Countering Financing of Terrorism Act 2009.

- Upon successful submission, the New Zealand Companies Office will carry out criminal history checks on all individuals named in the application. These checks will take approximately 2-5 working days.

Step 6: Financial Service Provider license application

- Based on the financial services provided by your company, Tetra Consultants will apply for the appropriate New Zealand FSP license(s) through the Financial Markets Authority. We will require you to send us the CV and signed declarations of all relevant personnel. The signed declaration will confirm that the company has meet the minimum standards required for a Financial Service Provider.

Step 7: Dispute resolution scheme (DRS) application

- If your company offers financial services to retail clients, you will be required to join an approved consumer dispute resolution scheme (DRS). Tetra Consultants will aid you in choosing the appropriate DRS and submit the details of your DRS membership to the relevant personnel.

- Contact us to find out more about how to set up business in New Zealand. Our team of experts will revert within the next 24 hours.

Tax and Accounting obligations

All New Zealand companies have to pay a flat corporate income tax rate of 28%. Non-resident companies will only be taxed on income derived from business activities within New Zealand. Companies are also required to file annual financial statements that adhere to the New Zealand GAAP standards and are audited by a licensed auditor.

In addition, New Zealand financial service providers will be required to file an annual confirmation with the FSP register and pay an annual renewal fee.

Alternative jurisdictions for financial license

Cyprus

- All financial companies in Cyprus are governed by the Cyprus Securities and Exchange Commission (CySEC) which have implemented strict measures to regulate licensed financial activities in order to minimise the risk of fraudulent activities. The main appeal of a financial license in Cyprus is that the financial license encompasses many of the main financial services. Unlike other jurisdictions where you may need to apply for a few financial licenses depending on the type of services your company provides, you will only need to apply for one financial license in Cyprus. This helps to save time and money. Since Cyprus is a member of the EU, a financial license from Cyprus also gives you access to the huge EU market.

Mauritius

- Financial services in Mauritius are regulated by the Mauritius Financial Services Commission (FSC) under the Financial Services Act 2007. Boasting a relatively low corporate tax rate of 15%, Mauritius is an attractive jurisdiction for financial companies seeking to operate at a low cost. Obtaining a Mauritius Forex Brokerage license is also less expensive and requires less minimum capital compared to most other jurisdictions. In a bid to boost its financial sector, the Mauritius government has also introduced corporate tax incentives for international financial companies in Mauritius.

Hong Kong

- Due to the numerous tax incentives for foreign investors, many financial companies have chosen to set up in Hong Kong. There are nine types of Financial Service Licenses regulated and issued by the Securities and Futures Ordinance (SFO) of Hong Kong. Applying for a financial license in Hong Kong is a relatively straightforward process. The strict regulations and checks undertaken by the SFO ensure that financial firms which hold a SFO license are credible and reliable.

Vanuatu

- Known as a tax haven, there is no corporate income tax in Vanuatu. This makes it an attractive jurisdiction for financial companies seeking to obtain a financial license. The financial industry in Vanuatu is regulated and licensed by the Vanuatu Financial Services Commission (VFSC). Obtaining a Vanuatu Forex and Securities Dealer License allows financial firms to transact financial instruments such as shares and options and manage investment portfolios. The business-friendly environment and low capital requirements for financial firms have attracted many investment and fund management institutions to the country.

Our services

- If you are thinking of applying for the payment license it is always advisable for you to hire a consultant to help you with the application process. In practice, applications that have sought professional help are frequently more detailed and of far higher quality.

- Tetra Consultant is proficient in providing consulting services for obtaining a payment license and provides a comprehensive set of services with regards to payment licenses which include creating a comprehensive timeline for the full setup and operation of your entity and drafting the needed documents and taking all the necessary steps needed when applying for the license application.

- In addition, Tetra Consultants can also assist with attaining other types of offshore financial license depending on your long-term business goals.

FAQ

How do I become a registered financial advisor in NZ?

- To become a registered financial advisor in New Zealand, you will have to apply for a Financial Advice Provider (FAP) licence from the Financial Markets Authority. Before you apply for the FAP license, you will have to register as an individual with the Financial Service Providers Register to be a Financial Service Provider (FSP).

How do I start a finance company NZ?

- Tetra Consultants will assist you in the reservation of company name, drafting of the company constitution and registration of company with the Companies Register.

- Once the company has been incorporated, Tetra Consultants will proceed to open a corporate bank account and register your company as a Financial Service Provider. Depending on the type of financial services provided by your company, Tetra Consultants will apply for the appropriate financial license(s) through the Financial Markets Authority.

- Since all financial providers in New Zealand must be registered under a consumer dispute resolution scheme (DRS), Tetra Consultants will advise you on the appropriate DRS based on your business model.

How do you become an FSP?

- You can become a FSP by registering as a FSP with the Financial Service Providers Register. Afterwards, you will have to apply for the appropriate financial service license from the Financial Markets Authority based on the type of financial service you provide.

What is a financial service provider NZ?

- A financial service provider is an individual or business entity that provides financial services. There are nine types of financial service providers: auditor, crowdfunding platform, derivatives issuers, independent trustees, managed investment scheme (MIS) manager, market operators, peer-to-peer lending, supervisors, and financial advice providers. If financial service providers wish to legally provide financial services, they must be registered on the Financial Service Providers Register (FSPR) in New Zealand.

What is a FSP license?

- A FSP license allows financial service providers to provide financial services legally in New Zealand. There are nine types of financial service licenses which a financial advisor can apply for, namely the auditor license, crowdfunding platform license, derivatives issuer license, independent trustee license, managed investment scheme (MIS) manager license, market operator license, peer-to-peer lending license, supervisor license, and financial advice provider license.

Who needs to register as an FSP?

- An individual or business will need to register as an FSP if it offers legal financial services or is an Anti-Money Laundering (AML) reporting entity providing financial services.

- Individuals or businesses that act as a financial advice provider/consumer credit provider or provide financial services above a certain limit in New Zealand, will also need to register as an FSP.