Free Trade Zones in the Philippines

Philippines Free Trade Zones are also known as Special Economic Zones (SEZ) and are considered to be an optimal choice for business owners and foreign investors looking to set up business in the jurisdiction. These Philippines Free Trade Zones are governed by the Philippines’ Economic Zone Authority (PEZA) which is a part of The Department of Trade and Industry.

The primary objective of the Philippines Free Trade Zones is to promote foreign direct investment and the setting up of businesses in these specific areas subsequently stimulating the Philippines’ economy. Businesses operating in these free trade zones are provided with various customs tax exemptions and incentives along with other regulatory benefits. Currently, there are approximately 400 SEZs in the Philippines which can be further subdivided into Agro-industrial economic zones, Manufacturing economic zones, tourism economic zones, Information Technology economic zones, and more.

Tetra Consultants will advise you on the most suitable Philippines Free Trade Zones for you after understanding your business activity, free trade zone requirements, and long-term business goals.

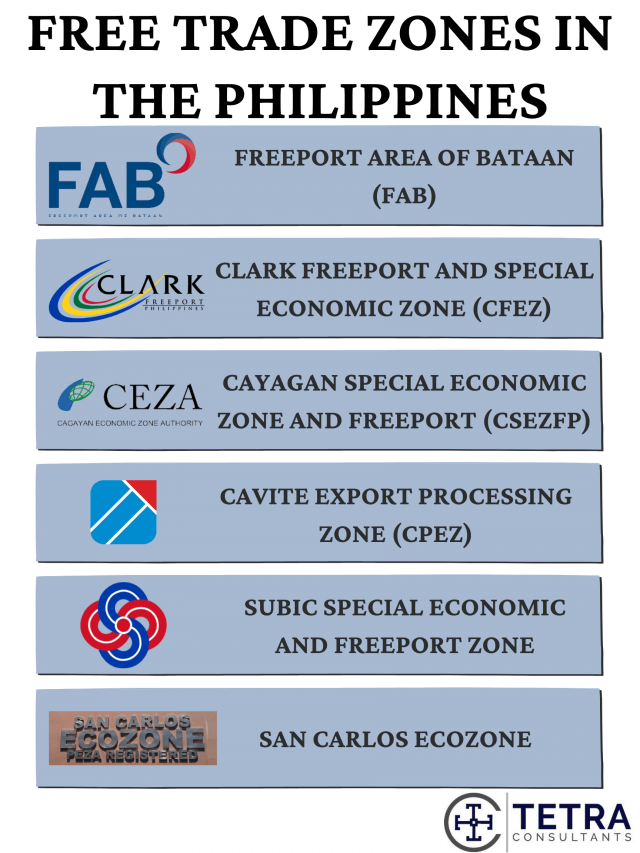

Some popular Special Economic Zones found in the Philippines

- SEZs are also known as Free Trade Zones (FTZs) or Ecozones in the Philippines. The following are some of the most popular SEZs in the Philippines catering to different business activities:

Freeport Area of Bataan (FAB)

- Previously known as the Bataan Export Processing Zone, the Freeport Area of Bataan was the first EPZ to be set up in the Philippines in 1972.

- It is governed by the Authority of the Freeport Area of Bataan (AFAB), a division under the Office of the President of the Philippines.

- Located in the Philippines’ centre of trade – the Manila Bay region, FAB is a transshipment hub as it allows domestic, regional, and global shipping.

- It is a growing investor’s hub in the Asian region that is trying to further attract foreign investors through its Philippines Investment Promotion Plan (PIPP) undertaken along with the National Government.

- Businesses set up in this Philippines Free Trade Zone can fall under the following regions:

-

- Manufacturing

-

- Infrastructure

-

- BPO

-

- Tourism

-

- Shipbuilding

-

- Electronics

-

- Energy

-

- Logistics

- The Freeport Area of Bataan has a well-developed infrastructure with various facilities including the provision of inexpensive electricity, water, and more.

- Businesses in this free trade area are also provided with a skilled labour force, owing to the support of the Technical Education and Skills Development Authority (TESDA).

Clark Freeport and Special Economic Zone (CFEZ)

- This free trade zone can be subdivided into the Clark Freeport Zone (CFZ) and the Clark Special Economic Zone (CSEZ).

- It was set up by the Clark Development Corporation, a subdivision of the Bases Conversion and Development Authority (BCDA), and is currently governed by the Philippines Economic Zone Authority (PEZA).

- Located in the central Luzon area in the Philippines, the CFZ and CSEZ is an inland economic zone that can be reached by land and air transport.

- Some of the industries in this region include:

-

- Commercial

-

- Industrial

-

- Recreational

-

- Tourism

-

- Aviation

Cagayan Special Economic Zone and Freeport (CSEZFP)

- Established in 1997, the CSEZFP is governed by the Cagayan Economic Zone Authority which is owned and managed by the government.

- Located in the Cagayan Province in the Luzon area, the CSEZFP is well connected to various countries worldwide through its Port Irene and Cagayan North International Airport (CNIA).

- CSEZFP has been featured in the news as it is gradually establishing itself as the Crypto Valley of Asia by providing the required infrastructure support. In fact, it was the first SEZ that allowed for the establishment of a financial technology company by creating a competitive FinTech ecosystem in the country.

- Some industries in this region include:

-

- Commercial

-

- Financial

-

- Industrial

-

- Recreational

-

- Logistics

Cavite Export Processing Zone (CPEZ)

- The Cavite Export Processing Zone is also known as the Cavite Economic Zone.

- Established in 1990, the Cavite Economic Zone is spread across 275 hectares and is home to various companies.

- The Cavite Export Processing Zone (CPEZ) is a public zone that is governed by the Philippines’ Economic Zone Authority (PEZA).

- This zone has a well-developed infrastructure with power substations, transportation systems, telecommunication facilities, and other amenities.

- Some industries in this free trade area include:

-

- Commercial

-

- Industrial

-

- Biofuel

-

- Information Technology

Subic Special Economic and Freeport Zone

- Also known as the Subic Bay, the Subic Special Economic and Freeport Zone was established in 1992.

- As per the Republic Act No. 7227, the Subic Bay is governed by the Subic Bay Metropolitan Authority (SBMA), a division of the Bases Conversion and Development Authority.

- Covering the region of Olongapo, Zambales, Morong, and Hermos, the Subic Bay Zone covers approximately 68,000 hectares.

- The primary objective of this Zone is to establish an environmentally-friendly and sustainable community.

- Some industries in this region include:

-

- Commercial

-

- Industrial

-

- Tourism

-

- Transportation

-

- Environmental

San Carlos Ecozone

- The San Carlos Ecozone is governed by the PEZA.

- Located in the Negros Oriental region, this Ecozone is spread across approximately 400 hectares.

- In this zone, there is well-developed infrastructure available including transportations, telecommunication facilities, power, and more.

- Some industries in this region include:

-

- Commercial

-

- Industrial

-

- Recreational

-

- Environmental

How many economic zones are there in the Philippines

- The Philippines is home to 101 economic zones, which are managed by the Philippine Economic Zone Authority (PEZA) and offer incentives and benefits to both local and foreign investors. These zones, also known as special economic zones (SEZs), aim to promote economic development, create job opportunities, and attract foreign investment to the country.

- To make it easier and more attractive for businesses to invest in the Philippines, SEZs offer various incentives and benefits, such as tax holidays, simplified customs procedures, streamlined business registration, and access to government services. These benefits can help stimulate economic growth and development in the country.

- The PEZA is responsible for ensuring that the SEZs comply with local laws and regulations, as well as providing assistance and support to investors interested in setting up operations in the zones. Overall, SEZs in the Philippines play an important role in promoting economic growth and development, creating job opportunities, and attracting foreign investment to the country.

Why should you set up a company in the Philippines Free Trade Zones?

- A FTZ company in the Philippines is not subjected to any corporate income tax for up to six years. This tax benefit can be extended to eight years provided the following terms are met:

-

- Average net foreign exchange earnings in the first three years of operation are above US$500,000

-

- At least 50% of the cost of raw materials used in manufacturing is from local raw materials

-

- Capital equipment to labour ratio is not greater than US$10,000 to 1

- Businesses in this area are then subjected to a corporate income tax rate of 5% on Gross Income once the Income Tax Holiday of six to eight years is completed. They are also exempted from paying withholding tax.

- The import of raw materials, capital equipment, machinery, intermediate products, and related products are exempted from tax and duties.

- Businesses can recruit non-resident foreigners in supervisory, technical, or advisory roles in these Economic Zones. The government offers a Non-Immigrant Visa for these foreigners and their families.

- The facilitation of import and export in this zone is simplified.

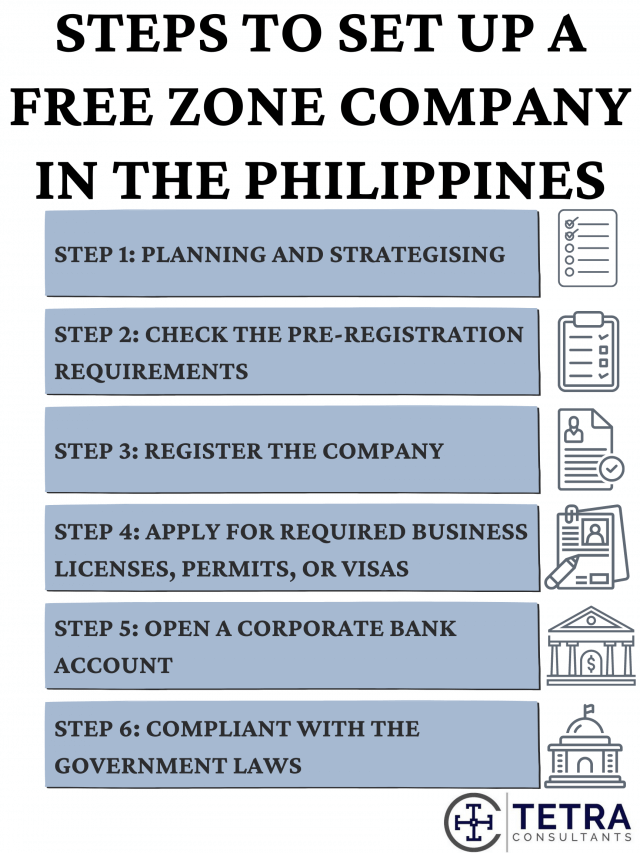

How to set up a Free Trade Zones Company in the Philippines?

Step 1: To plan and strategize when incorporating a company in Philippines Free Trade Zones

- Tetra Consultants will first need to understand your business activities, requirements, and long-term goals before deciding on a suitable FTZ for your business.

- We will then recommend a suitable legal entity for your business and advise you on the optimum share capital you need to invest.

Step 2: To check whether all pre-registration requirements for Philippines Free Trade Zones are met

- Once you have decided on a suitable SEZ for your new business, you need to meet certain requirements.

- The business must allocate a local resident director to act on behalf of the company.

- There is no minimum paid-up capital that must be invested.

- You must then prepare the following documents:

-

- Letter of Intent

-

- Business registration documents for the existing business (if applicable)

-

- Documents containing the personal information of the directors and shareholders

-

- Bank certificate showing the minimum deposit

- Investment projects must be read and approved by the relevant authorities on the basis of the following content:

-

- Nature of the business

-

- Business activities

-

- Infrastructure needs of the business

-

- The scale of the new business

- You may be required to meet additional requirements, depending on your chosen Economic Zone.

Step 3: To register your company in Philippines Free Trade Zones

- The business must submit an application along with a detailed business plan to the Philippines’ Economic Zone Authority (PEZA). Tetra Consultants will assist you in this process.

- Our team will then proceed to make the relevant fee payment when registering the Philippines company in the chosen Economic Zone.

- You will not be required to travel to the Philippines throughout this entire incorporation process.

- Once the registration is completed, we will receive the documents on your behalf and courier them to your preferred business address. Rest assured that your company’s sensitive information will be kept with the strictest confidentiality as per our privacy policy.

Step 4: To apply for business licenses, permits, or visas (if applicable)

- Depending on your business activities, you are required to apply for a business license or permit.

- You may also need to apply for a visa for foreign owners or employees in your business.

Step 5: To open a corporate bank account

- Our banking team will assist you in opening a corporate bank account by leveraging our extensive banking network.

Step 6: To stay compliant with the laws of the government

- Even after the registration process is complete, Tetra Consultants will ensure that you remain compliant with the Philippines government regulations and that of PEZA.

- The new business must attempt to create a market for its goods and services abroad, leading to an increase in exports. The products must be in accordance with the policy of the Bureau of Standards or PEZA.

How to proceed with registering a company in Philippines Free Trade Zones?

With Tetra Consultants by your side, the registration process of your company in the Philippines will be smooth and easy. Our service package includes planning and strategizing with our international clients to choose a suitable FTZ in the Philippines and a suitable business entity; completing the set up process so that you can devote your time and energy to your company; opening a corporate bank account by leveraging our banking network; ensuring that your business is compliant to the government regulations.

Contact us to find more information about how to register company in Philippines Free Trade Zones. Our dedicated and experienced team will revert within the next 24 hours.

FAQ

How many free trade zones are there in the Philippines?

- According to the Philippines’ Economic Zone Authority (PEZA), there are over 400 Special Economic Zones (also called the Free Trade Zones) currently operational throughout the country.

- The primary objective of these are to attract foreign direct investment to facilitate export-oriented business operations.

Where are the free trade zones located?

- The 400 SEZs are located all around the Philippines. You can find the location of these zones on this PEZA website.

- Contact us to find more information about FTZs in the Philippines and our team will revert within the next 24 hours.

Can foreigners own a company in the Philippines?

- Yes, foreigners can set up their company in the Philippines in selected industries which can be found in the Foreign Investment Negative List.

Why should I incorporate my company in the Philippines?

- A company set up in the Philippines will have the following advantages and incentives:

-

- Companies are not subjected to any corporate income tax for six to eight years, after which a 5% tax is levied on the Gross Income.

-

- Raw materials, capital equipment, machinery, and intermediate products are exempted from tax and duties.

-

- Businesses are also exempted from paying withholding tax.

-

- It is relatively easier to obtain a non-resident visa in the Free Trade Zones.

-

- You will also be able to leverage on benefits from the Philippines’ competitive trade agreements with major economies such as Japan and ASEAN.

Who is governing the foreign trade zone?

- Different trade zones are governed by different authorities. Most trade zones are under the charge of the Philippines’ Economic Zone Authority (PEZA).

- For example, the Freeport Area of Bataan is governed by the Authority of the Freeport Area of Bataan.

Will I need to appoint a local resident director for incorporating my business in the Philippines free trade zone?

- Yes, you will need to appoint a resident director before incorporating your business.

- You can take advantage of the nominee director services we provide to our clients at Tetra Consultants.

What are the activities that my business can perform in the Philippines free trade zone?

- Some of the activities that you can conduct with your business are as follows:

-

- Manufacturing

-

- Information Technology Services Export

-

- Tourism

-

- Export

-

- Logistics

-

- Utilities