Introduction to South Korea Free Trade Zones

South Korea Free Trade Zones are commonly known as Special Economic Zones. Special Economic Zones have been long established in the international scene, with over 5,400 established globally. Over 1,000 of these 5,400 were established in the past 5 years, signifying their increasing importance in today’s inter-connected global market.

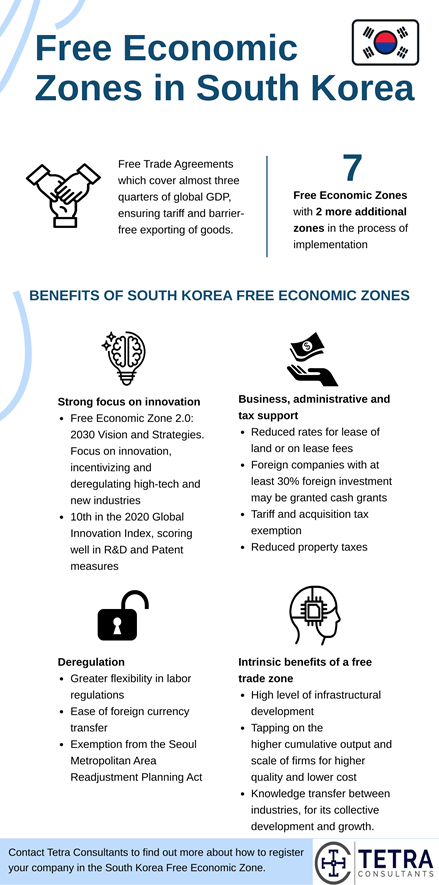

Free economic zones (FEZs) in South Korea are a specific type of special economic zone that aims to facilitate the movement of goods with preferential custom regulations and fees, allowing firms within to conduct import and export activities, or even manufacturing activities since component materials can be imported duty-free. This might be combined with preferential taxation policies as well, making it an effective tool in attracting and retain foreign investment. In South Korea, firms in FEZs are also granted additional exemptions from regulations and additional business and administrative support, making it even easier for firms to do business.

Intrinsic benefits of Special Economic Zones

- The Economic Times news once described SEZs as a “well-trodden path”. Judging from this metaphor and the rise in their popularity around the world, it is clear that they hold some major intrinsic economic benefits.

- On a tangible level, consolidating similar industries together will bring about greater collective benefits since it attracts the necessary supporting industries such as transportation, logistics, and research and development. These supporting industries would constantly compete with each other, ensuring maximal efficiency and productivity in terms of the services rendered to your business. Often, this allows them to execute these services at a much higher quality than would be possible if you were to keep such services in house. Their cumulative output would also be a lot higher, allowing them to be a lot further forward on the learning curve, allowing them to pass on their experience to your company through cost savings.

- They would also offer your business additional cost savings since they operate at a much higher scale given that they would provide these services for multiple firms. Along with the high level of infrastructural development, a free economic zone would definitely be well-equipped to support the growth and development of your business.

- On a more intangible level, locating related industries close by would also encourage and facilitate knowledge transfer. Having a high degree of synergy between industries in a zone would thus be beneficial in the collective development and growth of the zone.

- More importantly, these effects become mutually reinforcing with the reputation of the zone. As the quality of services and firms within the zone increases, the zone will start to build positive connotations and associations for itself, ultimately enabling it to attract and retain further talented individuals and quality firms. This will then further increase the quality of services and firms within the zone, allowing it to further improve its reputation.

“Free Economic Zone 1.0”

- As governed under the Special Act on Designation and Management of Free Economic Zones, the FEZs in South Korea initially focused on the more traditional aims of typical FTZs, of attracting foreign investment and reducing the regulatory barriers these investors faced in the market. These initiatives were definitely successful, as seen from the overall development rate of 89.4%.

- More specifically, total investments had an average annual growth rate of 8.7% and the number of jobs created had an average annual growth rate of 12.2% However, this success was rightly deemed by the South Korean Ministry of Trade, Industry and Energy (MOTIE) to be unsustainable since the incentives in these areas did not benefit domestic firms. For foreign firms, regulatory reforms were only being lifted in terms of traditional industries, and not enough was being done to encourage innovation in new industries.

Free Economic Zone 2.0

- Hence, the MOTIE has set out to redefine FEZs in South Korea to not only be more inclusive and supportive of domestic industries, but also to encourage greater innovation in new industries as part of its latest “Free Economic Zone 2.0: 2030 Vision and Strategies” initiative. Alongside this plan, the Foreign Investment Promotion Act aims to help the government hit its targets of attracting KRW 60 trillion worth of domestic and foreign investment, 4,000 more companies to incorporate, and creation of 200,000 more jobs for the nation’s people.

- In order to achieve these aims, they have three key strategic thrusts to transform FEZs into “global bases of new industries that lead innovative growth”. These are to refocus the scope of FEZs to revolve around innovation, offering high-tech and key strategic industries incentives, and revising regulations governing investment in new industries.

- With all this in mind, it is quite clear how a South Korean free economic zone can benefit your business and offer you some of the most favourable taxation and regulatory environments for you to conduct business on the site. This ease of conducting business is further enhanced by the complementary factors in Korea listed below.

Complementary factors to the South Korea Free Trade Zones

Macro-business environment

- South Korea ranks 5th in the 2020 World Bank Ease of Doing Business Index, making it the 3rd best jurisdiction to do business in the Asian region. Given that FEZs also come with additional incentives and exemptions to facilitate the ease of doing business, it would be even easier for you to set up and manage your business.

- Apart from being a good place to do business, South Korea is also extremely innovative, ranking 10th on the 2020 Global Innovation Index. It scores particularly well in research and development (R&D) rankings in the news, being 2nd to 4th in key indicators such as R&D performed by businesses, research talent and R&D expenditure. This has led to it being the world’s top economy in terms of Patents and Industrial designs by origin. Crucially, this demonstrates that the amount being spent on R&D as well as the research talent present, is being put to good use and is yielding results in terms of innovative efforts and patents.

Comprehensive Free Trade Agreements coverage

- From an outward-looking perspective, the products of these innovative efforts are also able to be easily exported to many global markets. South Korea is the first Asian country to sign trade agreements with the European Union, United States and China. This is a testament to its position as a global business hub in the East Asian region.

- In fact, the coverage of trade agreements negotiated by South Korea is so comprehensive that it covers almost three-quarters of the global gross domestic product. This ensures that your exports will face minimal tariffs and trade barriers, making South Korea an ideal location and springboard for your international business.

Where are the South Korea Free Trade Zones located?

- South Korea currently has 7 FEZs in Incheon, Busan-Jinhae, Gwangyang bay, Gyeonggi, Daegu-Gyeongbuk, East Coast and Chung Buk. There are also 2 additional free economic zones that were announced in 2020 and are still in the process of implementation, which are the Gwangju and Ulsan free economic zones.

- Apart from the general aim of the FEZs as mentioned above, each free trade zone also has its own area of specialty. For example, Incheon mainly focuses on aviation logistics given that it is located near to Incheon International Airport, the largest airport in South Korea. Gyeonggi instead focuses on the semiconductor and petrochemistry industries. Given that most of these specialties are in high-tech areas, Seoul has also been ranked the 3rd best technology cluster according to the 2020 Global Innovation Index.

- In terms of geography, these FEZs are also distributed all over the country. Thus, Tetra Consultants would recommend that you choose one that has a specialty that offers the greatest synergy with your business activities or the most convenient location for you to operate from.

Investing in South Korea Free Trade Zones

- Investors that choose to invest in a company will face additional free trade zone requirements as stated below.

- Acquisition of shares or equity holding in a local company:

-

- Foreigners can make an upfront investment of KRW 100 million (US$88,000).

-

- Alternatively, they can have at least 10% ownership of the company.

-

- If they have less than 10% ownership, they must enter into a contract for seconding or electing officers, producing or supplying product or raw materials for minimally a year, provide or introduce technology, or conduct joint research.

- For those who prefer not to invest through a company, there are also other avenues for investment, which include the provision of long-term loans (5 or more years) or making contributions to a non-profit or research organization.

- The process to invest your funds only has 6 steps, allowing it to be completed quickly.

-

- Report foreign investment.

-

- Remit investment fund.

-

- Register the incorporation of the company.

-

- Report incorporation and apply for business registration.

-

- Transfer equity fund to the company account.

-

- Register the company as a foreign-invested firm.

Additionally, foreign investors must also make pre-investment and post-investment declarations with the relevant authorities which include a foreign or domestic bank and KOTRA, the South Korean trade and investment promotion organization.

Benefits of incorporating your company in South Korea Free Trade Zones

Tax benefits

- Under the Special Act on Designation and Management of FEZs and the Restriction of Special Taxation Act, foreign companies will be granted 100% tariff exemptions for 5 years on imported capital goods, 100% acquisition tax exemption for 15 years, and reduced property taxes. They will also be assigned a dedicated project manager that will offer support in terms of tax management and compliancy.

Business and administrative support

- Foreign companies also enjoy other forms of monetary support beyond tax incentives. Government or public-owned land can be leased for up to 50 years at a reduced rate, and companies may also enjoy a 50-100% exemption on lease fees. Foreign companies with at least 30% foreign investment ratio may also be granted cash grants based on negotiations that can be used to cover construction costs, building purchase and employment grants.

- Lastly, firms that are constructing infrastructure or education and research facilities may also be granted financial support.

Deregulation

- Deregulation in three key areas also aims to support the business activities of such firms. They are offered greater flexibility in managing their workforce, with unpaid leave being permitted, and they are not subject to the same requirement as other companies are of filling vacancies with persons of national merit, the disabled, or the elderly. Foreign payments are also made easier since they are allowed to directly engage in foreign currency transfer, up to a sum of US$10,000. This is especially crucial in facilitating international transfers for firms that have global customers and suppliers.

- Specifically for firms that are incorporated within Seoul, they would be exempted from the Seoul Metropolitan Area Readjustment Planning Act, allowing them greater flexibility in locating and developing their company.

- These benefits help to make it cheaper for you to do business, allowing your company to capitalize on the many trade agreements that South Korea is part of. Bearing in mind the intrinsic benefits that a zone has in attracting and developing productive capabilities and human capital alongside its own reputation, incorporating a company in the South Korea free economic zone will definitely help your business to expand globally.

Considerations before incorporating your company in South Korea Free Trade Zones

Given that FEZs are geared so heavily towards supporting high-tech manufacturing and export industries, it is important to consider if this offers a good synergy with the business activities conducted by your company. Other locations within South Korea are also equally promising given that the country in general is highly welcoming to foreign investors and easy to do business in. Investors who are interested to do so should refer to our South Korea company registration guide for more information instead.

Contact us to find out more about how to do business in South Korea Free Trade Zones. Our team of experts will revert within the next 24 hours.

FAQ

Has international trade in South Korea been affected by the COVID-19 pandemic?

- Yes, the South Korean export economy has seen a decrease from previous years, although this is expected to rebound with the country’s good management of the pandemic.

How is South Korea managing the pandemic?

- Bloomberg’s COVID resilience ranking has ranked South Korea as the 5th best place to be during COVID, testifying to the efficiency of the South Korean government and healthcare system in managing the cases.

What is South Korea’s trade policy?

- South Korea is a highly trade-oriented country and has always been a strong proponent of multilateral trade liberalization.

Who are South Korea’s main trading partners?

- They are China, the United States, Vietnam, Hong Kong and Japan.

What is South Korea’s biggest export?

- They export electrical machinery, equipment and parts, vehicles and plastics.

What is South Korea’s biggest import?

- South Korea does not have its own fossil fuel sources hence its main imports are crude and refined petroleum, petroleum gas and coal briquettes.

Is South Korea a free trade country?

- Yes, South Korea is a country with established FTZs, called Free Economic Zones, where goods can be transported in and out the country without typical barriers such as tariffs.

What countries have free trade zones?

- There are many countries around the world that have them. Some of these countries include Germany, Malta, China, Lithuania, Brunei and Malaysia.

Who does South Korea have free trade agreements with?

- It has FTAs with regional economies such as ASEAN, the EU and the European Free Trade Association. It also has FTAs with individual economies such as the United States, India, Australia, China, New Zealand, Turkey and Canada.

What is the poorest city in South Korea?

- It is Daegu, which is found in the southeast portion of the country. Its GDP per capita was US$20,379, as of 2018.