Introduction to UK Free Trade Zones

UK Free Trade Zones are commonly known as Freeports. Free Trade Zones have been long established in the international scene, with over 5,400 zones established in the world. Of these 5,400, over 1000 were established in the past 5 years, signifying their growing importance in today’s interconnected world economy. A freeport is a specific type of special economic zone that aims to facilitate the movement of goods with preferential custom regulations and fees, allowing firms within to conduct import and export activities, or even manufacturing activities since component materials can be imported duty-free. This might be combined with a preferential taxation policy as well, making it an effective tool in attracting and retaining foreign investment.

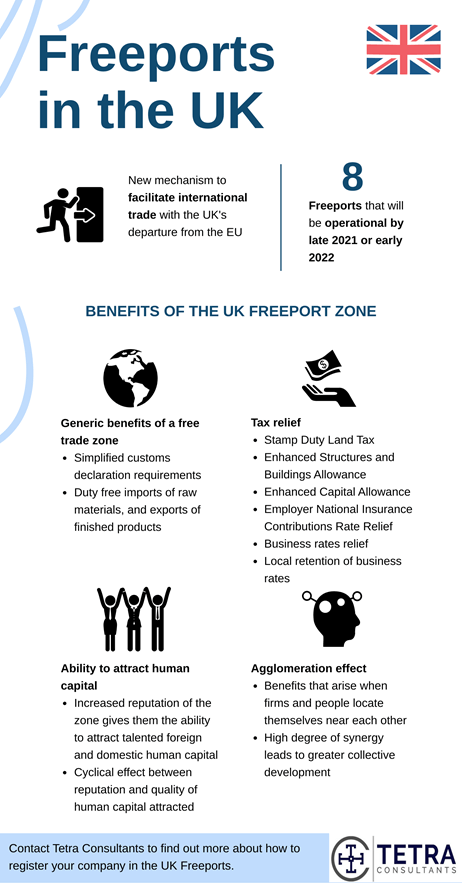

Within the UK, a customized freeport model has been adopted to ease its departure from the EU and ensure that it still remains connected to the world’s networks even as they become an independent country. Freeports have been designated as centers of international trade zone and investment, with additional emphasis on promoting innovation, regeneration and creation of employment opportunities across multiple sectors. As mentioned earlier, these ports are also aimed at boosting the economic prospects of the specific regions as well as the country in general, by facilitating international trade through customs and tariff benefits. These free trade zone benefits businesses since they would be able to import and store goods to subsequently export without incurring charges on tariffs. Manufacturers would also be able to import raw materials and subsequently export all the finished products without incurring duty charges as well. This would provide a much-needed boost to the export sector and allow them to better capitalize on the new international trade opportunities unlocked through the UK’s new trade agreements.

Implications of UK Free Trade Zones Initiatives

- An American non-profit research organization, the National Bureau of Economic Research has reported extensively on the “agglomeration effect” or agglomeration economies, which refer to the benefits that arise when “firms and people locate near one another together in cities and industrial clusters”. When there is a high degree of synergy in the types of firms and people that are concentrated together in one location, it is likely for knowledge spillovers to occur, facilitating the greater collective development of all parties involved. This then becomes cyclical as the reputation of the location develops, allowing them to continue attracting talented firms and individuals that further enhance the capabilities and thus the reputation of the location.

- On a more tangible level, the consolidation of the supporting services and facilities that enable these free trade zones and industries to operate will also increase their quality whilst decreasing their cost. Many countries have followed the seminal example of the Silicon Valley in the United States, with the Silicon Docks in Dublin being another promising location for high-tech companies to establish themselves. Thus, it is likely that the UK is trying to do the same with their freeports initiative.

International trade in a Post-Brexit world

- After the events of the departure of the United Kingdom (UK) from the European Union (EU) in February 2020, it has signalled an end to the cooperation that has characterized the relationship between the UK and the European continent since the end of the Second World War. Even though some elements of this cooperation still exist in the form of the political, economic and social integration of the two entities as laid out in the terms of the EU-UK Trade and Cooperation Agreement, one gets the sense that it would definitely have remained at a higher level if the UK were to have remained as a member state.

- This loss is most likely to affect exporters that will face non-tariff barriers in their operations, such as increased customs and immigration clearance times and additional regulations. The United Nations Conference on Trade and Development has projected the magnitude of the loss in the UK’s exports to the EU to be 9%, even with a free trade agreement. In addition, this agreement has made no mention of financial services, leaving them in much uncertainty.

Greater regulatory flexibility

- Given all these downsides, it is hard to imagine why the UK would pursue Brexit. However, it seems that in forgoing the European single market, they might have been able to grant themselves the regulatory flexibility they needed to pursue other global markets that might be more lucrative globally.

- This would come in two forms as covered below.

Free Trade Agreements (FTAs)

- Negotiating FTAs as an independent nation has proven to be significantly easier and quicker as compared to when they were part of the European Union. This has not come at the cost of the previous trade deals it was a member of under the EU since the UK has successfully negotiated rollover trade deals with 66 of the 70 countries covered by these deals.

- In addition, the UK managed to sign their first trade deal in the form of the UK–Japan Comprehensive Economic Partnership Agreement (CEPA) on 23rd October 2020, bringing the country closer to its aim of becoming a Global Britain. Crucially, this agreement represents more than just closer relations with just Japan, but also with all the Pacific countries through the Comprehensive Trans-pacific Partnership free trade area.

- The speed and ease of negotiations is further exemplified by the UK’s signing of its first trade deal negotiated from scratch with Australia, a country currently still locked in its eleventh round of negotiations with the EU as of June 2021.

Free Trade Zones (FTZs)

- Whilst the EU has permitted the creation of FTZs under the Union Customs Code, they are subject to much greater scrutiny, and the incentives of such FTZs must also meet the EU State Aid Rules. These incentives will be considered as state aid if they involve the usage of state resources, has anti-competitive effects on the EU market, or offers an advantage to the recipients. The EU would only allow the creation of a FTZ if the state aid measures involved did not create any undue economic impact.

Much like in the negotiation of FTAs, the UK has been granted a lot more flexibility in deciding the criteria for FTZs, offering them more freedom in doing so.

- Collectively, these two measures seek to facilitate the UK’s new Global Britain strategy by enabling continued tariff-free trade with its previous trading partners whilst enabling them to embark in search of new trade deals as well. With the creation of FTZs, this leaves the UK in a good position to overtake their previous trade levels.

Where are UK Free Trade Zones located?

- From 1984 to 2012, the UK had only seven freeports, further exemplifying the difficulty of opening a freeport whilst the UK was part of the EU. This number is expected to be exceeded by the opening of the eight new freeports announced in the March 2021 budget news. These ports are to be located at the East Midlands Airport, Felixstowe and Harwich, Humber, Liverpool City, Plymouth, Solent, Thames and Teesside areas. The country is aiming to have at least ten freeports, so expect to see more locations becoming available, or a renewal of the legislation governing the original freeports.

- Given that these freeports are distributed all over the nation, Tetra Consultants would recommend that you choose one that offers the greatest synergy or most convenient site for your business activities.

How to register your company in UK Free Trade Zones

- Given their recent introduction, there is not yet enough information available for us to determine how exactly the process to register your freeport company will work in these UK Free Trade Zones. However, since the news has reported that the UK government is expecting to have these freeports operational by late 2021 or early 2022, it is likely that they would share the content of these new requirements soon, allowing you some lead time to prepare to incorporate your company.

- Based on our experience with incorporating companies in the free trade zones of other countries, it is likely that incorporating a company in the Freeports Zone would have a simplified and shortened company registration process since it is governed by more favorable business laws and regulations. However, this does come at the cost of economic substance and minimum capital requirements. These free trade zone requirements could include a minimum number of employees or jobs created, as well as a minimum expenditure within the country.

Benefits of incorporating your company in UK Free Trade Zones

- On top of the standard free trade zone benefits of simplified declaration requirements and duty-free imports of raw materials, there a few additional benefits:

-

- Stamp Duty Land Tax Relief. Exemption on tax on land purchases within such zones, when property is used as part of a relevant commercial activity.

-

- Enhanced Structures and Building Allowance. Tax relief for construction or renovation of structures and buildings within the zone for commercial or industrial uses.

-

- Enhanced Capital Allowance. Relief for tax levied on money invested into assets in the areas of plant and machinery. This enables firms to offset their taxable income by the full cost of the investment in the same period when the cost was incurred.

- Enhanced Capital Allowance. Relief for tax levied on money invested into assets in the areas of plant and machinery. This enables firms to offset their taxable income by the full cost of the investment in the same period when the cost was incurred.

-

- Employer National Insurance Contributions Rate Relief. This allows employers to pay reduced rates of national insurance contributions when certain thresholds are met. The rate will be 0% for up to three years, with an earnings threshold of £25,000 per annum. Employers must also spend at least 60% of their working hours in the zone.

-

- Business rates relief. Both newly incorporated and relocated firms will be able to enjoy a 100% relief from business rates on certain business premises within the tax free zone.

-

- Local retention of business rates. Business rates growth in the area will be kept above a certain baseline, granting the certainty needed to make long term investments that further support growth.

- These free trade zone benefits help to make it cheaper for you to do business, allowing your company to take advantage of the many free trade agreements that the UK is now a part of. Costs would also be reduced since specialized providers of supporting services such as transportation and logistics firms would also choose to locate themselves in the port, making them more accessible for your company. These providers are usually a lot more experienced and operate at larger scales, allowing them to pass on cost savings to your company when you utilise them instead of attempting to carrying out such activities yourself.

- Beyond just infrastructure, the reputational and branding effects of locating your company in the prestigious UK free trade zones would allow you to tap on the abundant human capital and spillover knowledge of the area, especially if your business activities have strong synergies with the foreign trade zone in question.

Considerations before incorporating your company in UK Free Trade Zones

- However, given that not all information about incorporating your company or the full scope of benefits have been released to the public, much about the freeport zone remains tentative or unknown. This should definitely form one of your key considerations in choosing the UK to incorporate your freeport company, and would also mean that the UK would not be an immediate option available to prospective companies. Since most of the free trade agreements have just come into effect, trade channels and protocols might also not have been fully developed, making the UK an option with high potential as opposed to one with guaranteed results.

- Apart from that, it remains to be seen how the UK manages the tax breaks and incentives given to firms in the free trade zone with the need to remain compliant to their agreement with the EU. The EU still retains the option to suspend the existing trade deal and tariff advantages if the UK goes overboard with these incentives, so it is important for them to balance both needs.

- Contact us to find out more about how to do business in UK Free Trade Zones. Our team of experts will revert within the next 24 hours

FAQ

Are there plans for Freeports in Scotland, Wales and North Ireland as well?

- Yes, the UK government is proactively working with these countries to expand the benefit of freeports to the entirety of the UK.

Why are freeports being launched almost immediately after the EU transition period?

- Freeports seek to ease the transition from the departure of the EU by continuing to boost trade and attract investment. This will also help in the UK’s post-COVID recovery efforts.

Are freeports only restricted to maritime ports?

- Freeport zones can be either airports or maritime ports.

When are the freeports expected to open?

- They are expected to open by Spring 2021.

Are there going to be more freeports?

- Currently, the limit is 10. However, the Government might designate additional freeports if enough suitable proposals were presented.

What happened to the previous freeports in the UK?

- After the licenses for the first batch of freeports lapsed in 2012, they were not renewed.

Does the UK have free trade zones?

- Yes, it does. More commonly known as freeports, there are currently 8 of them which are expected to open to the public by 2021.

What is a free zone UK?

- It is a special region where goods can be transported in and out of the jurisdiction without usual international barriers such as tariffs and import duties. It is more commonly known as freeports in the UK.

Where are the freeports in the UK?

- They have been announced to ports are to be established in the areas of the East Midlands Airport, Felixstowe and Harwich, Humber, Liverpool City, Plymouth, Solent, Thames and Teesside. The nation intends to have at least ten freeports, so more are expected to become available.