Secure EU residency with Portugal Golden Visa

- It is time to invest in your future and gain access to the European Union through the Portugal Golden Visa. This residency-by-investment program enables non-European nationals and their families to get Portuguese residence while also enjoying visa-free travel within the Schengen Zone. It also offers a favorable tax regime and a pathway to full European citizenship. At Tetra Consultants, our team of Golden Visa legal consultants have expertise in guiding individuals and families through the Portugal Golden Visa 2025 process, while also offering end-to-end support, from legal drafting services to collecting all the necessary documents for your visa applications. Tetra Consultants is here for you. Whether you want to start a new life or open a business in Europe, our expert team will ensure a seamless, compliant, and effective application process.

What is the Portugal Golden Visa?

- The Portugal Golden Visa is a residency-by-investment program that was launched in 2012 by the Portuguese government in order to attract foreign investment and increase economic growth. This visa enables non-EU individuals and even Swiss nationals to get a Portuguese residence permit in exchange for a qualifying investment in Portugal. In the present scenario, the Portuguese Golden Visa program remains as one of the most accessible and attractive options available to global investors, as well as high net worth individuals wanting to relocate for expansion into Europe.

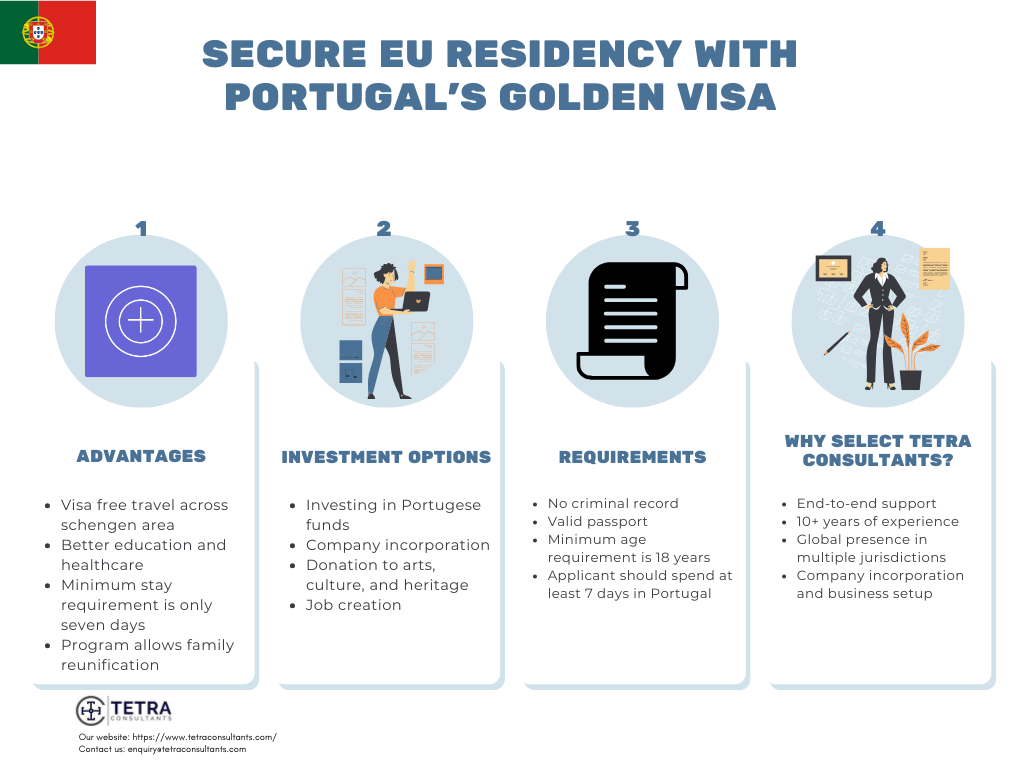

Advantages of the Portugal Golden Visa 2025:

- Investors and their families attain the right to live, work, and study in Portugal.

- The program also provides the opportunity to apply for Portuguese citizenship after five years of maintaining the investment and also fulfilling the minimum stay requirements. Applicants can then apply for permanent residency or Portuguese citizenship, subject to language and integration requirements.

- In this program, the applicant has the option to benefit from Portugal’s Non-Habitual Resident (NHR) tax regime.

- It is one of the most stable EU residency-by-investment programs.

- The visa also grants visa-free travel within the 27-member Schengen Area, improving the global mobility for business or leisure.

- The program allows family reunification and covers the main applicant’s spouse, parents, and dependent children.

- The minimal stay requirement for this program is only seven days in the first year, and 14 days in each subsequent two-year period, which makes it best for those not wishing to relocate full-time.

Eligibility criteria

- The applicants should be a non-EU, non-EEA, as well as a non-Swiss national and should be at least 18 years old.

- A clean criminal record is a must from the country of origin and Portugal.

- The applicant should have a valid passport and legal entry into Portugal.

- The applicant should spend at least 7 days in Portugal every year.

- Offer proof of the legal source of funds and maintain the investment for at least five years.

Updated rules for 2025

- The recent focus has shifted to the interior regions, qualified investment funds, and business development.

- The minimum investment thresholds from the government of Portugal have been adjusted in order to ensure compliance with new legislative updates.

- Real estate investments in Lisbon, coastal regions, and Porto are no longer eligible.

Investment options

- The Portugal Golden investment options for 2025 are mainly focused on fostering economic growth, innovation, and cultural development, with real estate investments no longer being considered. Here are some of the current investment routes that you can take:

Investing in Portuguese funds

- The minimum investment amount is €500,000 or venture capital funds that are regulated by the Portuguese Securities Market Commission (CMVM). It should be noted that the fund should not have direct or indirect ties to the real estate. At least 60% of the capital should be invested in Portuguese commercial companies with a minimum maturity of at least five years.

Donation to arts, heritage, and culture

- The applicants can also support artistic production, cultural projects, or the preservation or restoration of the national heritage of Portugal. The minimum investment amount is €250,000. Furthermore, the projects should get pre-approval from the Portuguese government, usually through the Ministry of Culture or relevant public institutions.

Company incorporation

- The applicant can also start a new company or increase the share capital of an already existing Portuguese business, combined with the creation of at least 5 permanent jobs for the period of three years.

Job creation

- The applicant can also create 10 new full-time jobs in any new Portuguese business owned by it. However, the minimum number is reduced to 8 if the business is located in a low-density region, which are the regions that have less than 100 inhabitants per km square or GDP per capita is under 75% of the national average. Lastly, an alternative option for the applicant is to invest €500,000 in an existing company.

Scientific research

- Funding research activities conducted by public or private scientific research institutions, integrated into the national scientific or technological system. The minimum investment amount is €500,000.

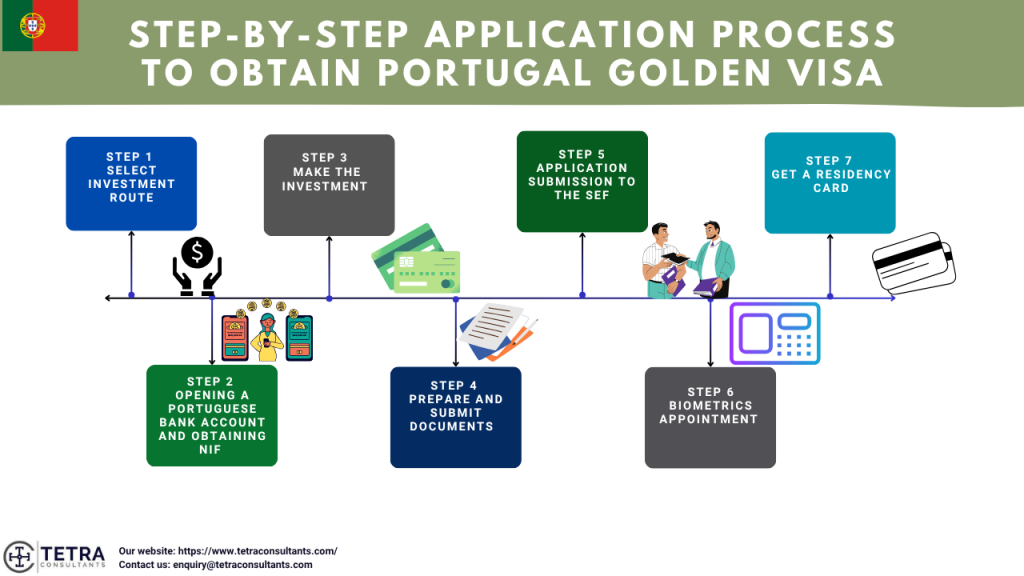

Step-by-step application process

- Applying for the Portugal Golden Visa program consists of a structured process, which is usually complex if you do not have any expert assistance. Tetra Consultants will help you to simplify this journey by managing every stage on your behalf, while also ensuring full compliance along with timely application execution.

Step 1- Select investment route

- Our team of experts will help you select a qualifying investment option, whether it is in terms of funds, capital transfer, or business creation. We will help you select an option based on your objectives and eligibility. If you opt for business incorporation, Tetra Consultants will help you with the offshore company incorporation.

Step 2- Opening a Portuguese bank account and obtaining NIF

- Tetra Consultants will then help you in getting a Portuguese Tax Identification Number (NIF) and help in personal bank account opening, which is significant for completing the investment. If needed, our team will also help you with corporate bank account opening if you opt for business creation as an investment choice.

Step 3- Make the investment

- We will help you to facilitate and verify the investment transaction while also making sure that all the compliance requirements are fulfilled in accordance with the Portugal Golden Visa program regulations.

Step 4- Prepare and submit documents

- Our team of experts will then compile and review all the necessary documents, which include:

- Investment proof

- Proof of all the legal funds and sources

- Passport and identification documents

- Portuguese bank account statements

- Certificate of criminal record

- Health insurance

Step 5- Application submission to the SEF

- After gathering and submitting the documents, our team will then file your complete application with Serviço de Estrangeiros e Fronteiras (SEF) which is the immigration authority of Portugal. We will also ensure timely updates as well as responses.

Step 6- Biometrics appointment

- Our team of Golden visa legal consultants will then schedule and coordinate your biometric appointment in Portugal, only upon receiving the initial approval.

Step 7- Get a residency card

- After your application is approved, you will get your initial 2-year residence permit. Apart from this, our team will also provide you with ongoing assistance with the renewals, family applications, along with relocation support.

Rights, obligations, and benefits

Rights and benefits

- The Portuguese Golden Visa also covers your spouse or legal partner, dependent children, and parents.

- In the Portuguese Golden Visa Program, you are only required to stay for seven days in the first year and fourteen days in each subsequent two-year period, which makes the country a suitable place for those individuals not wishing to relocate for full-time.

Obligations

- You should make and sustain a qualifying investment in Portugal for at least a period of five years.

- In order to apply for citizenship, you should be able to pass an A2-level Portuguese language test, which will be conducted at the end of the five-year period.

Living in Portugal

- You and your family can legally live, work, and study in Portugal and also gain access to the country’s public healthcare and education systems with European standards.

- Portugal has a higher quality of life and provides a safe atmosphere, with affordable living costs, strong healthcare, and pleasant weather. It has one of the most stable EU residency-by-investment programs.

- The tuition fees of Portugal schools and top-tier academic institutions are affordable.

Financial considerations

Taxation and non-habitual resident status

- NHR status provides major tax benefits for new residents, even Golden visa holders who can easily decide to move to Portugal and become tax residents. The benefits of NHR last for the period of ten years.

- Portuguese-sourced income is subject to a flat 20% tax rate for high-value-added activities such as employment or self-employment.

- Dividends from foreign sources are usually exempted. Secondly, personal gains from crypto are not taxed in Portugal.

- Golden visa holders who do not move to the country are not subjected to the Portuguese tax on worldwide income, and they do not need NHR.

Investment analysis

- Investment funds should allocate at least 60% of their capital to Portuguese ventures and have a minimum maturity of five years.

- Direct business investment and job creation routes provide returns through the business profits; however, they need active management and also carry operational risk.

- Venture capital and innovation funds are popular options, as they provide potential for higher returns, but they also come with higher risk.

Post-residency and citizenship

- Permanent residency after five years.

- After maintaining the legal residence and your investment in Portugal for the period of five years under the Portugal Golden Visa, you can easily apply for permanent residency.

- With permanent residency, you can easily have the right to live, work, and study in Portugal, and to travel visa-free within the Schengen area.

Portuguese citizenship

- After a period of five years, you are eligible to apply for Portuguese citizenship.

- You get the right to vote and participate fully in Portuguese civic life.

- You also have the ability to easily retain your original citizenship, as Portugal allows for dual citizenship.

Our services- why select Tetra Consultants

- At Tetra Consultants, we have a decade of global consulting experience. We are a reliable service partner for easily navigating the complexities of the Portugal Golden Visa procedure. We also offer end-to-end support customized to individual investors, entrepreneurs, and families. Tetra Consultants also has a global presence with 12+ jurisdictions, and we have transparent pricing with no hidden costs.

Company incorporation and business setup

- If you are opting for the option of the business creation route under the Portugal Golden Visa program, we will help with the complete setup of a Portuguese company, which consists of:

- Drafting incorporation documents

- Securing tax numbers and business licenses

- Opening corporate bank accounts

- We also have global expertise in offshore company incorporation, which ensures that your business is easily structured for compliance and efficiency.

Nominee director and shareholder services

- When we are structuring investments or businesses for the Golden Visa, local representation plays a significant role. Through our nominee director and shareholder services, we can easily help you:

- Maintain discretion in ownership

- Fulfil local residency and governance requirements

- Fulfil administrative duties without any day-to-day involvement

- Financial licensing and compliance

Offshore financial licenses application

- For those investors who are interested in fund management or regulated financial investments, we also offer advice on getting offshore financial licenses application and guide you through the complex regulatory framework. Our team of experts also ensures that your chosen fund is compliant with the Portuguese and European requirements.

- We also provide ongoing compliance solutions like:

- Tax compliance with the Portuguese authorities

- KYC/AML documentation

- Regulatory filings

Looking to obtain Portugal Golden Visa

- If you are looking for a long-term residency in the European Union, then Portugal Golden Visa is the right step for you and your family. The visa provides visa-free travel to the Schengen area, and has no minimum stay requirement providing a golden opportunity to you and your family to get Malta citizenship. Tetra Consultants will help you to simplify this entire procedure, from managing and submitting your documents to providing regulatory compliance from start to finish.

- Contact us to know more about Portugal Golden Visa and our team will get back to you in 24 hours.

FAQs

Can we still get a Portugal Golden Visa in 2025?

Can I include my children and spouse in this Golden Visa application program?

Do I have to live in Portugal in order to maintain my Golden Visa status?

Can I apply for Portuguese citizenship through the Golden Visa Program?

What are the minimum investment requirements for the Portugal Golden Visa?

How long does it take to get residency through the Portugal Golden Visa?

Are there any restrictions on property locations for Golden Visa eligibility?

What are the tax advantages of the Portugal Golden Visa?

What documents are needed for the Portugal Golden Visa application?

What type of real estate investments qualify for the Golden Visa?