Costa Rica Company set up

- Costa Rica company registration is currently on the rise. Over the years, Costa Rica has emerged as one of the most business-friendly destinations in Latin America, attracting business owners, investors, and multinational companies. The country has a stable political environment, a strategic geographic location, and is committed to economic growth. Costa Rica has become an excellent choice for global investors due to its conventional Costa Rica gaming license and Costa Rica crypto license, which makes the jurisdiction more appealing to business owners wanting to expand into the region.

- Tetra Consultants provides end-to-end assistance with Costa Rica company registration, including specialized services for Costa Rica gaming company set up and Costa Rica crypto-authorized company set up. Our team will navigate you through every stage of the registration process, from selecting the right legal entity to ensuring compliance with local rules and regulations. Our experts will make the process of incorporation in Costa Rica easy and stress-free.

Why should you opt for Costa Rica company registration

- Here is why business owners and investors choose Costa Rica company formation:

Tax benefits

- In Costa Rica, the income earned outside of the jurisdiction is not taxed. Interest and dividends from foreign subsidiaries are generally exempt from local taxation. This makes Costa Rica a favorable destination for offshore and holding companies.

Access to a talented workforce

- Costa Rica is home to a talented, well-educated, multilingual workforce, which makes it a suitable destination for international business operations.

Quality infrastructure and innovation

- The country has modern infrastructure that is used for transportation, telecommunication, and banking, along with rapidly developing technological and innovation sectors.

Business continuity and legal protection

- Registered companies in Costa Rica benefit from the separation of personal and business assets, which limits the liability of shareholders and enables ownership transfer, which further promotes business continuity.

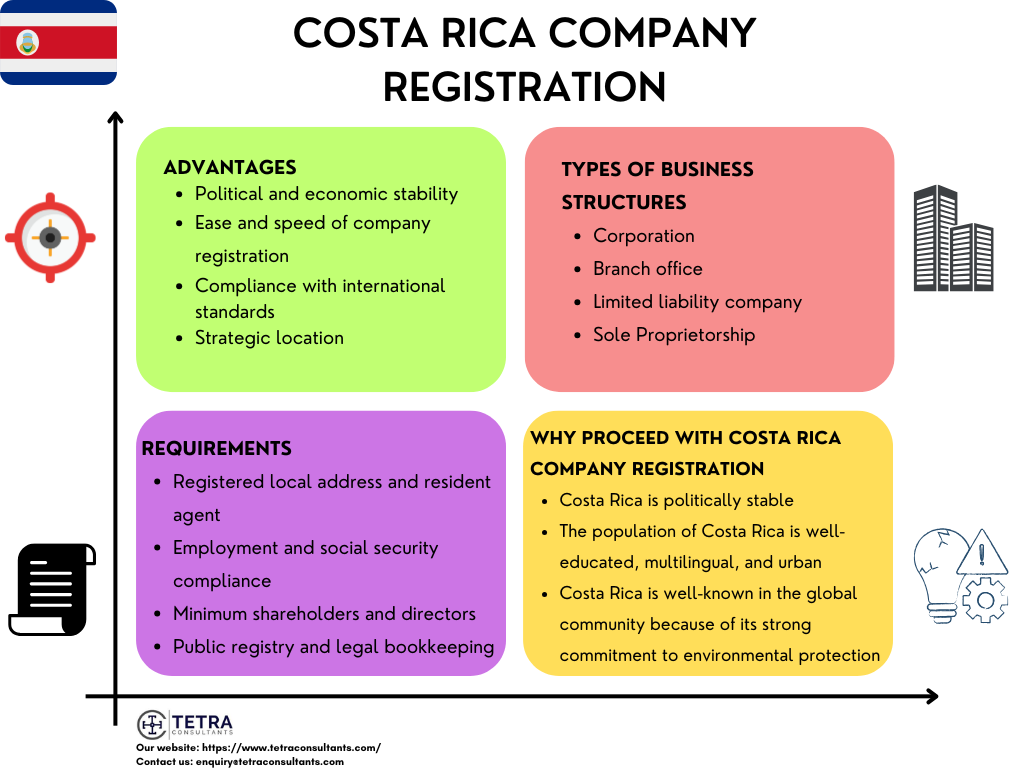

Advantages of Costa Rica company registration

Political and economic stability

- Costa Rica is famous for its stable political system and strong economy, it creates a reliable environment for business operations and investment, due to low political risk.

Ease and speed of company registration

- The process to register a company in Costa Rica is fast and straightforward. The formalities are simplified with no mandatory minimum capital requirement for incorporation. Remote company formation in Costa Rica is allowed, which makes it accessible for foreign investors as they do not have to be physically present in Costa Rica. This effective process reduces waiting time, helping business owners start operations quickly.

Compliance with international standards

- Costa Rica adheres to international laws and treaties, including the Hague-Convention. The country also maintains political and economic stability. This further provides investors with legal certainty and a safe environment for running their business.

Strategic location

- Costa Rica is positioned between North and South America, with access to both the Pacific Ocean and the Caribbean Sea, which provides Costa Rica with excellent access to major markets and trade routes.

Are foreigners allowed to proceed with Costa Rica company registration?

- In Costa Rica, foreigners are fully allowed to own and register a company. As per the Costa Rican Law, 100% foreign ownership is allowed in entities such as the Limited Liability Companies and Corporations, and there are also no requirements for shareholders or directors to be the residents of Costa Rica. Furthermore, foreign investors can also create and control a Costa Rican company without any local partner, except in specially regulated industries such as public investment management, insurance, mutual funds, banking, and specific areas that may require additional local ownership or participation rules.

Costs and timelines

- For Costa Rica company registration, the incorporation process is usually completed within 4 weeks after all the required documents are submitted. Opening a corporate bank account in Costa Rica typically takes an additional 3 to 4 weeks, based on the international due diligence processes of the bank. At Tetra Consultants, we offer our clients a transparent breakdown of all the expenses during our initial consultation. Our fees cover professional services, government charges, and post-incorporation support, in order to ensure there are no hidden costs. This will further help you to plan your Costa Rica business setup with confidence and clarity.

Types of legal structures available in Costa Rica company registration

- There are multiple legal structures in Costa Rica available for company registration. These are:

Corporation (Sociedad Anónima – S.A.)

- SA has become one of the most popular structures for larger businesses and those looking for external investment or planning to issue shares. This structure requires a minimum of two shareholders and does not have a minimum capital requirement. However, it is compulsory for the management to include a board with three directors: the president, treasurer, secretary, and a controller. In a corporation, shares can be easily transferred, and governance is controlled by the Shareholders’ Assembly. Lastly, it is mandatory for companies to include corporate minutes and share register books.

Branch office (Sucursal)

- Foreign companies in Costa Rica can register a branch in the jurisdiction, while maintaining control from abroad. The parent company will remain legally liable for the obligations of the branch. Lastly, branches are less common for SMEs because of the complex incorporation process and costs, local registration as well as formal deeds are needed.

Limited liability company (Sociedad de Responsabilidad Limitada – S.R.L.)

- SRL is suitable for small and medium-sized enterprises and partnerships. This structure requires at least 2 to 30 members, with no minimum capital, and quotas should be divisible by 100. Management in a limited liability company is simpler with a general manager as the legal representative, and member approval is required for quota transfer.

- Only two corporate records are needed in a limited liability company setup, such as the minutes of the members’ assembly and the members’ register. Lastly, members in a limited liability company have limited liability, which further protects their personal assets.

Sole Proprietorship (Persona Física)

- Individual business owners can also register a company in Costa Rica in their own name. This setup is rarely chosen by foreign investors because of the lack of liability and difficulty scaling.

Step-by-step registration procedure for Costa Rica company formation

Step 1- Initial consultation

- Our team conducts an initial consultation to understand your business goals and objectives. Based on your goals, Tetra Consultants will help you select an appropriate business structure for your business.

Step 2- Company name search and reservation

- Our team then helps you reserve a company name. Tetra Consultants checks the availability of your business name with the Public Registry in order to ensure that the name is unique.

Step 3- Prepare incorporation documents

- Tetra Consultants prepares and notarizes incorporation documents on your behalf in Spanish, such as:

- Article and Memorandum of Association

- List of shareholders

- Valid passport copies

- Legal representative appointment

- Proposed company name

- Description of intended business activities

Step 4- Submit application

- Our team will then submit the full application documents to the National Registry, which includes all the notarized documents. The Registrar may request additional documents such as bank references or certificates of good conduct. Tetra Consultants will provide any additional documents they ask for and ensure that there are no delays.

Step 5- Register with Social Security

- After submitting the documents, Tetra Consultants will register your company as an employer with the Caja Costarricense de Seguro Social (CCSS) for the social security of your employees and set up insurance contributions.

Step 6- Apply for a business license

- Tetra Consultants will submit your application for a commercial business license with the municipality where the business is going to operate. This license will enable legal commercial activity and should be renewed annually.

Step 7- Open a bank account

- At Tetra Consultants, we also provide corporate bank account opening services along with regulatory compliance consulting services to ensure that your business thrives in the strict regulatory framework of Costa Rica. Our team will open a local corporate bank account for your business using the company registration certificate, tax ID, and local address.

Regulatory requirements for Costa Rica company formation

- Costa Rica company formation is controlled by regulations that ensure transparency, compliance with national laws, and proper governance. The main regulatory requirements for forming a company in Costa Rica are:

Registered local address and resident agent

- Every company should have a registered fiscal address in Costa Rica, where the official correspondence and government visits will be received. All Costa Rican companies should appoint a resident agent, such as a lawyer who will act as the local liaison with government authorities. In case none of the directors live in Costa Rica.

Employment and social security compliance

- Employment of staff requires registration as an employer with the Costa Rica Social Security (CCSS), payment of the monthly contributions, and mandatory workers’ insurance with the Work Risk Policy (INS). For qualifying salaries, it is mandatory to do payroll tax withholding and salary reporting to the Ministry of Finance.

Articles of association and incorporation documents

- Companies will have to file a detailed list of incorporation documents like the Articles of Association, which specifies the company name, registered address, capital structure, shareholders/members objectives, powers of management, and procedural matters for profit/loss allocation. If there is any change to the governing documents, they should be notarized and reported to the Mercantile Public Registry.

Minimum shareholders and directors

- Most business structures, like the Corporation and Limited Liability Companies, need a minimum of two shareholders. These can be individuals or legal entities and may be foreign nationals or non-residents. For corporations, it is mandatory to have a board of directors with at least three members.

Public registry and legal bookkeeping

- Companies should be registered with the Costa Rican Public Registry (Registro Nacional), and publish management appointments in the Official Gazette. However, legal bookkeeping requirements consist of maintaining company registers, accounting books, and stockholder records in Spanish.

Documents required for Costa Rica company registration

- Articles of Incorporation and Memorandum of Association, the documents should be in Spanish and must be notarized, with English translation for foreign shareholders

- Document of director’s appointment, along with the list of all directors and officers

- Copies of passports and proof of residence of all directors and shareholders

- Bank reference letter

- Shareholders’ register and share certificates, including details of share distribution, quotas issued, and transfer of shares

- Bank statement confirming paid-up capital

- Notarized power of attorney

- Proof of registered local address

- Proof of payment of state duty or registration fees

- Certificate of criminal record

- Taxpayer identification number (TIN) application

- Business license application

- Employer registration form with the CCSS

Accounting and tax obligations

- In Costa Rica, companies follow strict accounting and tax obligations controlled by the Ministry of Finance. These requirements focus on financial transparency, accurate reporting, as well as statutory compliance. These requirements are:

Financial statements and books

- Companies should prepare financial statements and accounting records in Spanish in accordance with the International Financial Reporting Standards (IFRS). The required books that companies should maintain are Diario, Mayor, and Inventarios y Balances.

- All the records should be maintained for at least a period of five years. At the end of every year, companies should update their information in the Ministry of Finance, file for annual transparency, and the UBO (Ultimate Beneficial Owner) registry, while also maintaining supporting documents.

Employer and payroll obligations

- Companies should register with Caja Costarricense de Seguro Social (CCSS), which is the social security registration fund, and pay 26.67% of wages for social security. The contribution of the employee to this fund is 10.67%.

- Companies should also pay for the mandatory work risk insurance policy. The rate of the policy differs from 0.36%-9.04% of the payroll. Lastly, employees of Costa Rican companies are entitled to the statutory benefits administered by the employer.

Auditing and special compliance

- Audits are usually not mandatory for Costa Rican companies, unless they are operating in regulated sectors like finance, public companies, or insurance. Furthermore, all companies should report their final beneficial owners to the Central Bank’s RTBF system annually by at least 30th April, or within 15 business days of a change.

Tax registration and filing

- Companies should register for a Taxpayer Identification Number (TIN) and for Value Added Tax (VAT), which is set at 13%. Corporate income tax rates differ; the standard rate for companies is 30%. Smaller companies pay taxes in the range of 5-20% on the basis of their gross income thresholds. Dividends for companies are distributed subject to a 15% withholding tax. VAT should be declared monthly, usually on the first 15 days of each month. Annual income tax returns are due by 15th March. Lastly, all Costa Rican companies should pay an annual flat tax on the basis of commercial activity and income.

Why proceed with Costa Rica company registration

Political

- Costa Rica is politically stable. The country has a long tradition of democracy and respect for human rights, which further boosts investors’ confidence. Public security in Costa Rica is also good, regulatory agencies are professional, and the government of the country has a welcome stance toward foreign investment with nominal restrictions outside sensitive sectors.

Social

- The population of Costa Rica is well-educated, multilingual, and mainly urban, with around 75.2% being city dwellers. The culture of the country encourages entrepreneurship, and has increased purchasing power of the middle-class, with a strong trend towards eco-friendly values.

Environmental

- Costa Rica is well-known in the global community because of its strong commitment to environmental protection. The country has renewable energy policies and has taken robust climate change action. The government of the county has ensured that the environmental regulations are strict, and favor sustainable and green investments, which has made it an attractive option for eco-business ventures.

Economic

- Costa Rica has a market-oriented and steadily growing economy. The country has robust GDP growth, low inflation, and an average import tariff rate of 6.8%. Costa Rica has free international trade agreements, which allow businesses access to the US, EU, and Latin America markets. The tax rates in Costa Rica are competitive, with up to 30% corporate tax. However, most of the companies take advantage of territorial taxation, that is, foreign-sourced income is not taxed.

Technological

- Costa Rica is considered to be a technologically advanced country within Central America, with a reliable banking infrastructure, strong transport links, and telecommunications sector. The government of the country has introduced multiple incentives in order to favor high-tech business clusters, innovation, and IT services, which have increased competitiveness for new companies.

Legal

- The regulatory framework of the country is transparent, foreign-friendly, and compliant with international standards. The process of business registration in Costa Rica is well-defined, along with international property protection is reliable. Furthermore, the annual compliance costs for businesses in Costa Rica are reasonable. However, sector-specific regulations may apply, but overall risk in the country is low for standardized business models.

Looking to register your company in Costa Rica

- If you want to register your company in Costa Rica, Tetra Consultants is here to help you. Our team offers end-to-end support, helping you to choose the right business structure, prepare incorporation documents, and open a corporate bank account. Tetra Consultants has years of experience in setting up international businesses, and our team simplifies the procedure of Costa Rica company registration so that you can focus on increasing your business operations. If you are a business owner, small or medium enterprise, or multinational business, our team ensures that the process of Costa Rica company formation is seamless and compliant with local regulations.

- Contact us, and our team will get back to you in 24 hours.

FAQs

Are foreigners allowed to register a company in Costa Rica?

How long does the company registration process usually take?

In Costa Rica, is a local registered address needed?

Can the company be managed remotely?

What are the minimum capital requirements?