Costa Rica gaming company set up

- Costa Rica gaming company set up has become one of the most established options for international online gaming operators. The country is now hosting hundreds of businesses in this particular sector. Unlike traditional gaming hubs, Costa Rica does not issue any specific gaming licenses; instead, the companies in this jurisdiction operate as “data processing businesses” while following the applicable laws, along with compliance standards. This has made Costa Rica as a low-barrier, and cost-effective solution for business owners who want to set up their operations in the online gaming industry. The process of Costa Rica company registration is efficient; however, for companies navigating through the local compliance is difficult. This is where Tetra Consultants steps in. At Tetra Consultants, our experts are well-versed in Costa Rica company set up and will help you to set up your online gaming business in this jurisdiction.

Why should you opt for a Costa Rica gaming company set up

- Going for a Costa Rica gaming company setup provides major benefits in terms of tax efficiency, low regulatory barriers, and rapid global market entry, which makes it an attractive destination for online gaming. Here is why you should opt for a Costa Rica gaming company setup:

Regulatory flexibility

- Costa Rica is known for its flexible regulatory environment. Companies do not need a special gaming license; setting up a business entity and stating gaming as a business activity is sufficient, considering no services are provided to Costa Rican residents. This allows for fast setup and avoids difficult compliance routines that are found in other jurisdictions.

Inclusive license coverage

- A single Costa Rica company setup allows for a broad range of gaming products like casinos, poker, fantasy sports, bingo, sportsbooks, and crypto gaming. All these services are provided under one roof, further eliminating the need to get multiple licenses for multiple products and verticals.

Innovation potential

- Business owners owning a gaming company in Costa Rica enjoy significant latitude for innovation, which includes the integration of blockchain, tokenized assets, as well as NFT-based game mechanics. This is due to the open approach of Costa Rica to digital assets and new gaming models.

Advantages of a Costa Rica gaming company set up

- A Costa Rica gaming company setup offers substantial benefits, including tax efficiency, quick market entry, cost savings, and regulatory flexibility, which makes it a highly attractive option for international gaming businesses.

Tax benefits

- Costa Rica operates on a territorial tax system, which implies that only the income generated inside the country is taxable. Gaming companies mainly target foreign users to benefit from the zero-gambling tax on international revenue. This feature enables business owners to increase their profits and reinvest earnings without a heavy domestic tax burden.

Skilled workforce and infrastructure

- Costa Rica has a skilled workforce and a stable political environment. The country is best for gaming companies that want skilled software engineers, support teams, and strong digital infrastructure for hosting and processing payments.

Low setup and maintenance costs

- The cost for company formation is relatively low with minimal initial and ongoing costs. There are no paid-up capital requirements and basic due diligence, which makes the jurisdiction accessible for startups and established operators.

International market targeting

- The regulatory framework of Costa Rica is created for cross-border operations. While local gaming and advertising are banned in the country, operators can still reach users globally. This positions Costa Rica as a strategic hub for international gaming brands in both fiat and crypto verticals.

Are foreigners allowed to proceed with a Costa Rica gaming company set up

- Yes, in Costa Rica, foreigners are allowed to set up their own gaming company. There are no nationality or residency restrictions for directors, shareholders, or beneficial owners in the gaming sector of Costa Rica. Individuals as well as corporate entities from abroad can proceed with the Costa Rica company formation.

- Gaming companies established by non-residents can legally target global markets, except for the Costa Rican markets. The residents are strictly prohibited from using locally based gaming platforms.

Costs and timelines

- The overall timeline for the Costa Rica gaming company setup is efficient when compared to other jurisdictions. At Tetra Consultants, the typical time for company incorporation and preparation of documents is around 1 week. After this, our team will move ahead with the application process for your gaming business. The review and approval of your business application by the regulator may take a few weeks, based on their speed and the complexity of your case. Tetra Consultants will also open your corporate bank account, which usually takes an additional 3 to 4 weeks once a suitable bank is selected.

- The costs for a Costa Rica gaming company setup differ on the basis of your business structure, government fees, and whether you require any additional services. At Tetra Consultants, we believe in no hidden fees; all the fees are clearly communicated to you during the initial consultation. This helps us to ensure that you know exactly what you are paying for and enables you to plan your budget accordingly.

Types of legal structures available in a Costa Rica gaming company set up

- When moving ahead with a Costa Rica gaming company set up, business owners will have to choose an appropriate legal structure. The right entity will predict the ownership of your company, its flexibility, and compliance obligations. Here are some of the most common legal structures available in Costa Rica:

Sociedad Anónima (S.A.) – Corporation

- This entity is equivalent to a corporation or a public limited company and has become one of the most popular structures for gaming businesses serving global markets, especially when multiple investors or complex shareholdings are required.

- The entity should have a board of directors with at least three officers: president, secretary, and treasurer. A minimum of two shareholders is needed in a corporation.

Sociedad de Responsabilidad Limitada (S.R.L.) – Limited Liability Company

- This structure is similar to a limited liability company and is usually chosen by smaller gaming businesses that want simple management and more privacy. This entity is managed by one or more managers, and no formal board is needed. Lastly, a limited liability company requires at least two partners who can be individuals or legal entities, and there are no nationality restrictions.

Sole proprietorship

- This structure is less common for Costa Rica gaming license registration, as it does not offer limited liability protection. This entity is owned and operated by one individual who is personally responsible for business debts as well as obligations. From a business point of view, this structure is unstable because of liability risks and credibility concerns with global partners and payment processors.

Branch office of a foreign company

- This entity is an extended form of an international business wanting to expand into Costa Rica. This structure allows the foreign parent company to directly operate in the country under its own name. A branch office requires registration of the parent company’s incorporation documents as well as appointment of a local representative. Lastly, the foreign parent company is fully responsible for operations in Costa Rica.

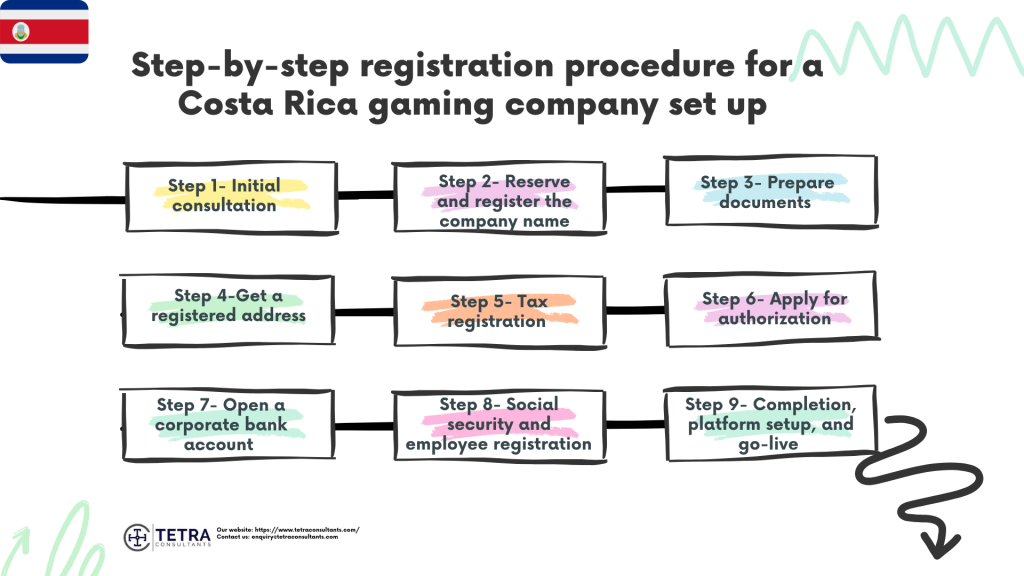

Step-by-step registration procedure for a Costa Rica gaming company set up

Step 1- Initial consultation

- Our team will begin with Costa Rica gaming company registration by first understanding your business needs and objectives. Based on this, Tetra Consultants will recommend a suitable business structure based on your goals.

Step 2- Reserve and register the company name

- Tetra Consultants will help you choose a relevant name for your business. Our experts will ensure that the chosen business name is unique and reserve the company name at the Costa Rican National Registry.

Step 3- Prepare documents

- After choosing a relevant business name, our team will move ahead with preparing your incorporation documents. This includes:

- Drafting and notarizing articles of incorporation, shareholder/board registers, and a power of attorney for a legal representative.

- Our team will collect notarized passports, address proof, and source of funds for directors, shareholders, and UBOs.

- Tetra Consultants will then file application documents with the National Registry.

Step 4- Get a registered address

- Tetra Consultants will then help you to secure a lease or a proof of registered office in Costa Rica.

Step 5- Tax registration

- Tetra Consultants will then register your business with the Ministry of Finance in order to get a Tax Identification number (TIN), VAT, and other relevant taxes. Our experts will also complete the UBO declaration form with the Central Bank.

Step 6- Apply for authorization

- Tetra Consultants will then help you to apply for authorization to perform gaming activities, which is approved by the Public Registry. Additionally, we will also provide registered office services in Costa Rica.

Step 7- Corporate bank account opening

- At Tetra Consultants, we provide corporate bank account opening services. Our team will open your corporate bank account in a suitable bank.

Step 8- Social security and employee registration

- If your business requires staff, Tetra Consultants will register your business for social security (Caja Costarricense de Seguro Social) and get occupation risk insurance.

Step 9- Completion, platform setup, and go-live

- Tetra Consultants will also prepare AML/CFT policies, business plan, and market access policy to ensure that your business remains compliant and there are no penalties. Our team will also register for corporate tax and Law 9050.

- At Tetra Consultants, we also offer regulatory compliance consulting services to ensure that your business remains compliant and can survive in the strict regulatory environment of Costa Rica.

Regulatory Requirements for a Costa Rica gaming company set up

- Costa Rica iGaming regulatory compliance consists of essential regulatory requirements that need to be fulfilled by companies in order to set up their operations in Costa Rica. Here are the requirements that companies need to follow:

Incorporate company and get license

- Businesses interested in setting up their operations in Costa Rica will have to incorporate as a corporation or a limited liability company, with a minimum of 2 shareholders. Companies will also have to get authorization to perform gaming activities from the Public Registry.

Platform data and responsible gambling

- Companies will have to develop and maintain strong internal policies to promote platform transparency, game rules, privacy, payout outcomes, and responsible gaming practices. Lastly, companies will need to secure hosting for gaming platforms and user data. The infrastructure of the gaming business should be based in Costa Rica for proper legal clarity.

AML/KYC and documentation

- Businesses will have to comply with the national AML/CFT legislation law of Costa Rica (Law 7786/2002 and Law 8204), which requires the implementation of:

- Proper KYC onboarding, customer identity verification, and monitoring suspicious transactions.

- Businesses will also need to have systematic record-keeping of all player deposits, financial transactions, and bets. These records should be available for external audits and maintained for a period of five years.

- Lastly, companies will have to file for Ultimate Beneficial Owner (UBO) declarations for better transparency.

Documents required for a Costa Rica gaming company set up

- Articles of Incorporation

- Approval of company name reservation

- Office lease agreement

- UBO declaration

- Shareholder/director appointment

- Notarized power of attorney

- Passport of all directors, shareholders, and beneficial owners

- Source of funds

- Proof of address of all shareholders, directors, and UBOs

- Business plan

- Responsible gaming policies

- AML/CFT policy and processes

- Local tax registration (NIT/D-140 form)

- Social security registration

Accounting and tax obligations

- Costa Rica gaming company formation requires companies to follow mandatory accounting procedures and tax obligations on the basis of general business and AML laws. Here are the obligations that companies will have to follow:

Annual financial statements

- Companies will have to prepare annual statements in Spanish, which include ledgers, journals, shareholder meetings, and inventories. Records should be maintained for a period of 5 years in order to ensure a reliable audit trail of both business and gaming activity.

Disclosure of beneficial owners

- UBO declarations should be filed with the Central Bank, but should not be disclosed to the public.

Record keeping

- Companies will have to maintain all operational records, such as customer identity/KYC, AML/CFT logs, betting, and transaction data, for a minimum period of 5 years for regulatory review.

No audit requirement

- Businesses do not need to hire or appoint an auditor or even undergo compulsory audits, unless it is requested by shareholders or needed for tax/banking due diligence.

Corporate tax returns

- Companies will have to file for annual corporate tax returns even if there are no taxes due, and include legal entity tax in order to remain in good standing.

Social security and occupational insurance

- Those gaming companies that hire staff should register for the Costa Rican Social Security Caja Costarricense de Seguro Social and pay monthly contributions, along with proper occupational risk insurance.

Municipal business license renewal

- Companies will have to renew the business license every year and pay the applicable municipality/registration fees.

Territorial taxation principle

- Taxes are only imposed on income sourced within Costa Rica, implying that international gaming revenue from non-residents is not taxed locally.

Special sector levy (Law 9050)

- Gambling operators in Costa Rica will have to pay a fixed annual tax on the basis of the number of local employees, declared quarterly to the tax authority. This tax is sector-specific for the gaming sector.

Why proceed with the Costa Rica gaming company set up

Political

- Costa Rica has a stable democracy, and the government of the country is supportive and has fostered a pro-business climate that encourages foreign investment. The Costa Rican government supports tech-driven business owners and maintains regulatory flexibility for online gaming companies. The current policies of Costa Rica for the gaming sectors have created a predictable administrative procedure and low bureaucratic barriers.

Social

- The local population of Costa Rica consists of more than 1.4 million active gamers, and has shown open interest in mobile, social, and crypto gaming. The country puts strong emphasis on technical and vocational education and has created an educated and reliable workforce for gaming support and development.

Legal

- There is no formal gambling license needed for online gaming in Costa Rica targeting non-residents, which allows rapid and cost-effective market entry. The process of company formation in Costa Rica is transparent, with limited ongoing compliance and solid protection for the rights of investors. This has created a safe legal atmosphere for international businesses.

Technological

- Costa Rica supports online gaming and payment platforms as it has high digital penetration and an advanced internet infrastructure. Over the past few years, Costa Rica has become a hub for blockchain, AI, and cryptocurrency solutions, which has made it easy for gaming companies to thrive in this nation. Lastly, collaborations with top-tier international software companies and fintech providers have further increased the market reach and enhanced the operational capabilities of Costa Rica gaming companies.

Economic

- Costa Rica supports a fast-growing iGaming market. For the year 2025, the predicted gambling sector revenue is US$794 million, with steady compound growth. In Costa Rica, only locally sourced income is taxed, which has resulted in zero tax on most of the international gaming revenue and more competitive profit margins. The cost of business setup and operations is low in Costa Rica. The labor costs are also relatively low in Costa Rica, which further enhances the appeal of the country for gaming startups and expansion.

Environmental

- Costa Rica promotes sustainable business operations, which include eco-friendly server hosting and strong IT infrastructure. The national policies of the country encourage the adoption of renewable energy and low-carbon business activities, which further provide gaming companies with opportunities to improve their brand reputation.

Looking to register your gaming company in Costa Rica

- Starting an online gaming business in Costa Rica is a profitable venture. However, businesses often find it difficult to navigate the company incorporation process and opening a corporate bank account. This is where Tetra Consultants steps in; our team simplifies the entire process of Costa Rica gaming company setup, from company incorporation to opening a bank account, ensuring that your business thrives in the regulatory environment of Costa Rica and faces no penalties.

- Contact us, and our team will get back to you within 24 hours.

FAQs

Can foreigners register a gaming company in Costa Rica?

Are there any restrictions for Costa Rica gaming companies?

What are the main requirements for a Costa Rica gaming company set up?

Do I need any specific gaming license for a gaming business in Costa Rica?