AUSTRAC remittance service provider registration

- The AUSTRAC remittance register plays an important role in the financial regulatory landscape of Australia. Any business or individual offering money transfer or remittance services should adhere to the regulatory framework of AUSTRAC to ensure transparency, accountability, as well as prevention of financial crimes. Businesses will also have to register company in Australia. Getting the AUSTRAC remittance service provider registration is a legal obligation, as it is a mark of legitimacy and credibility in the remittance industry. The rise in regulatory scrutiny and a strong focus on anti-money laundering (AML) compliance have made it mandatory for businesses operating in the AUSTRAC remittance sector to understand the requirements, procedures, and ongoing compliance regulations related to registration. At Tetra Consultants, we are set out to help our clients in getting AUSTRAC registration, allowing them to operate easily while fulfilling all the legal and compliance obligations.

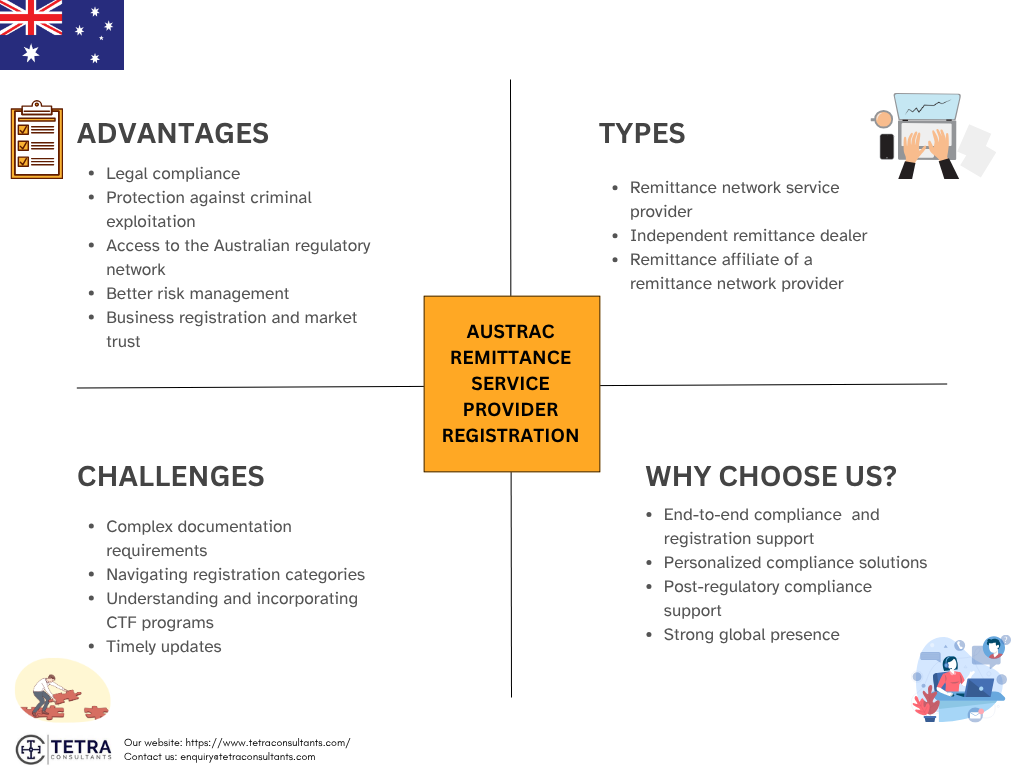

Advantages of the AUSTRAC remittance register

Legal compliance

- For any business that is offering remittance services, registration is compulsory under Australian law. Operating a business without registering it leads to major penalties, this also includes fines and imprisonment. Registration also ensures that your business adheres to Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws and regulations, protecting your business from any legal risks as well as enforcement actions.

Protection against criminal exploitation

- Unregistered operators are typically at a higher risk of being used for criminal activities, which damages their business reputation as well as integrity. By registering their remittance businesses, owners can reduce the risk of their business being used for money laundering and terrorist financing schemes while improving the overall security of the financial system.

Access to the Australian regulatory network

- Registered entities can easily become a part of the collaborative system that supports law enforcement as well as regulatory agencies in order to prevent and investigate financial crimes. This connection can further support operational resilience and continuous improvement of the compliance programs.

Better risk management

- By registering your business, AUSTRAC shares the critical information with you that helps you to adhere to legal obligations and incorporate strong AML/CTF controls. This further reduces the risk of your business being exploited by criminals, such as moving illicit funds, which also consists of proceeds from serious crime and terrorism financing.

Business registration and market trust

- Registration helps businesses to maintain and improve their reputation and along with the reputation of the remittance sector. Registration fosters trust with customers, partners, as well as regulators by showcasing the commitment of business owners towards ethical practices and regulatory standards.

Types of AUSTRAC remittance register

Remittance network service provider (RNP)

- An RNP mainly establishes a network of remittance affiliates under its brand, and it also manages compliance for the networks, while also setting operational standards. The RNP is responsible for ensuring that all its affiliates adhere to the AML/CTF regulations. Registration as an RNP is best for those businesses that want to operate, monitor, or brand various independent outlets or agents all under one umbrella.

Independent remittance dealer (IRD)

- An IRD is a standalone provider that offers remittance services directly to the customers, who are not linked to the RNP network. It is the responsibility of IRDs to take care of their AML/CTF obligations, compliance programs, and directly report them to AUSTRAC. This type of remittance service provider is best for single outlets or small businesses that want to operate independently.

Remittance affiliate of a remittance network provider

- These are businesses or individuals that are authorized and supervised by the RNP to offer remittance services. Affiliates operate within the compliance and reporting framework of the RNP and use the parent’s network technology, guidance, and brand. Registering as an affiliate is best for agents or franchises that do not independently set compliance rules but also operate within a larger remittance network.

Costs and timeline of getting the AUSTRAC remittance register

- The overall timeline of the AUSTRAC remittance service provider registration procedure usually takes around 4 to 6 months, based on the complexity of your business model. Usually, it takes around 2 months to register Director Identification Number (DIN) for foreign directors. Once the DINs get approved, our team will then register your Australian company within one week. After incorporation, our team will then prepare the required documents as per the licensing standards of AUSTRAC. We will then submit the application to the AUSTRAC, which takes around 90 days to evaluate it. During this time period, the regulator may conduct a video interview with your management team in order to verify business operations. In some cases, AUSTRAC will also need a local active director or a local office in Australia. After the registration is approved, Tetra Consultants will then help you in opening a corporate bank account, which usually takes an additional 3 to 4 weeks.

- At Tetra Consultants, we maintain transparency about project costs. Our team makes sure that our clients know about all the costs before engagement. This approach helps us to eliminate any unexpected expenses and provide financial clarity throughout the registration procedure. Our service fees will cover every stage of the registration process from corporate structuring and preparing documents to submitting licenses and post-registration support, enabling our clients to get full compliance.

Regulatory authority for AUSTRAC remittance register

- The regulatory authority responsible for the AUSTRAC remittance register is AUSTRAC itself. AUSTRAC stands for the Australian Transaction Reports and Analysis Centre. It is the national anti-money laundering and counter-terrorism financing regulation, and the financial intelligence unit (FIU).

- AUSTRAC operates under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) along with the repealed Financial Transaction Reports Act 1988. The regulatory role of AUSTRAC consists of overseeing more than 19,000 business entities offering designated services like remittance, digital currency exchange, bullion, gambling, and financial services. It also ensures that these entities adhere with the strict AML/CTF regulations by monitoring, reporting, recognizing risks, enforcing compliance, and supporting law enforcement efforts to punish financial crime.

Activities allowed under the AUSTRAC remittance register

- Accepting instructions from the customers to transfer money or property internationally or domestically.

- Facilitate cross-border transactions by multiple means such as cash, electronic transfers, cheques, and other valuable instruments.

- Undertaking reporting obligations that have been mandated by the AUSTRAC like submitting International Funds Transfer Instructions (IFTIs) for transfers that are more than AUD 10,000. Businesses will also have to submit Suspicious Matter Reports (SMRs), for any suspicious transactions and compliance reporting.

- Businesses can offer money transfer services, which are commonly known as remittance or money transfer businesses.

- Incorporating customer identification, verification (KYC/CDD), along with AML/CTF risk mitigation programs.

- Participate in activities that have a geographical connection to Australia, and where the service provider acts as an intermediary to send and receive money on behalf of the clients.

- Maintain transaction records and information of clients as per the regulatory requirements.

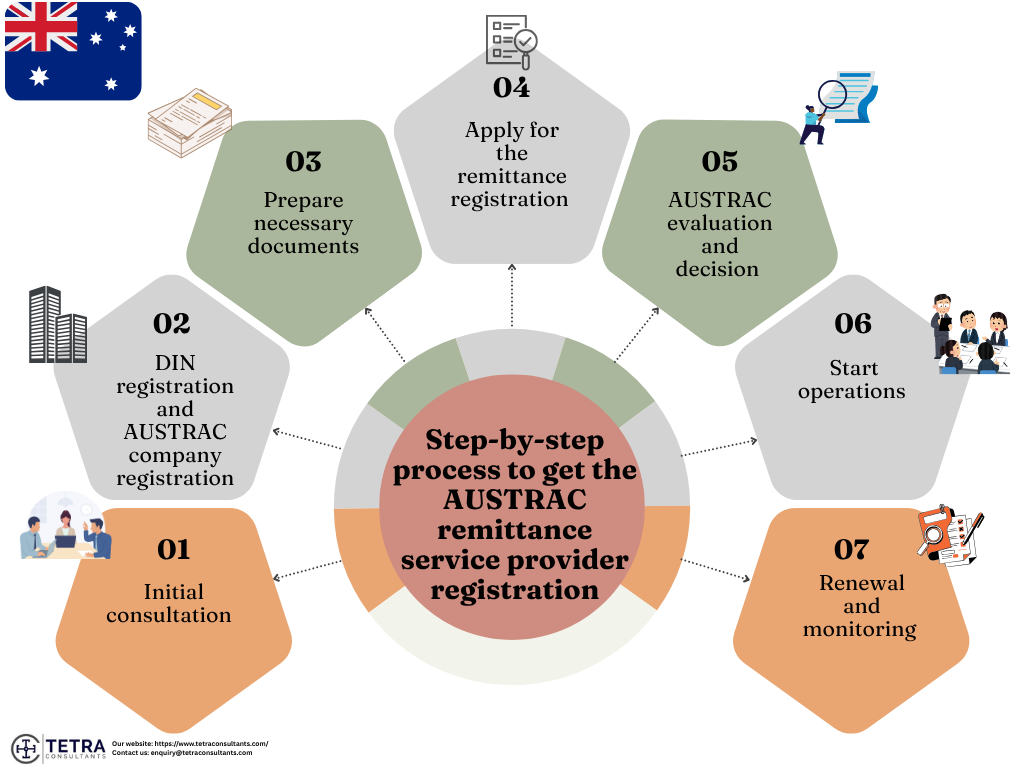

Step-by-step process to get the AUSTRAC remittance service provider registration

Step 1- Initial consultation

- Our team will conduct an initial consultation, where we will understand how your business model carries our effective remittance services and fulfills the geographical link criteria of the AUSTRAC. Tetra Consultants will also identify the correct business type, whether it is independent remittance dealer, remittance affiliate, or remittance network provider.

Step 2- DIN registration and AUSTRAC company registration

- All directors of an Australian company should get a Director Identification Number. This number is a unique identifier that remains with the directors regardless of their future appointments. Tetra Consultants will help to obtain DINs for each director through the Australian Government portal. Our team will also register the legal entity that will offer remittance services with the Australian Securities and Investment Commission (ASIC).

Step 3- Prepare necessary documents

- Our team will then start preparing the necessary documents for your business, which includes:

- AML/CTF program and money laundering/terrorism financing (ML/TF) risk evaluation of your business

- Comprehensive description of all your remittance services and compliance policies.

Step 4- Apply for the remittance registration

- Our team will then apply for the remittance registration via the AUSTRAC Online account. Tetra Consultants will then complete the registration form and add specific remittance details such as ownership, risk controls, affiliates, intended services, and then upload all the supporting documents.

Step 5- AUSTRAC evaluation and decision

- AUSTRAC will then review your business application for completeness, AML/CTF compliance capacity, and check the viability of your business. Our team will answer any additional questions or document requests during the review. After reviewing everything, AUSTRAC will then list your business on the remittance sector register.

Step 6- Start operations

- After registration, Tetra Consultants will guide you through the AML/CTF obligations, transaction reporting to the AUSTRAC, maintain records, and ongoing KYC/CDD. Furthermore, at Tetra Consultants, we also offer corporate bank account opening services, and after registration, our team will help you open a bank account in an Australian bank.

Step 7- Renewal and monitoring

- Registration is valid for a period of three years. Renewal applications should be submitted to the AUSTRAC 90 days before the expiry. Regulatory compliance monitoring is compulsory, and Tetra Consultants will assist you even after registering your business.

Documents required for the AUSTRAC remittance service provider registration

- Completed registration form through AUSTRAC Online, specific to your chosen remittance services

- Business contact information and the place of operation

- Financial statements that show the viability of the business

- Details of the business structure, such as sole trader, corporation, and partnership

- Name and detailed information of the main personnel and associates who are engaged in the business

- Official registration numbers like the Australian Business Number (ABN), Australian Company Number (ACN), and foreign registration details, if they are applicable

- Disclosure of civil, criminal, and enforcement actions related to the business or main personnel

- An AML/CTF Program and a Money Laundering/Terrorism Financing Risk Assessment that is completed and maintained to fulfill the regulatory standards

- Description of the remittance services that the business is offering

- Documentation of customer identification and verification procedures (KYC/CDD), along with record-keeping policies

- Recent official police clearance certificates and national police checks for each key person involved in the business, issued within the last six months. Accepted documents consist of the National police Certificates, National Police History Checks, and foreign equivalents

- Evidence of the compliance program, along with ongoing reporting capabilities to the AUSTRAC

Requirements for the AUSTRAC remittance sector register

Enrolment and registration process

- It is mandatory for businesses to first enroll with AUSTRAC and then complete a formal registration through their AUSTRAC online account, for specific remittance service or remittance network provider roles.

Renewal and enforcement

- In Australia, the registration is valid for only a period of three years, and renewal is required on expiry. AUSTRAC can easily suspend, cancel, and revoke registrations for non-compliance, with penalties enforced on unregistered or non-compliant business entities.

Ongoing compliance obligations

- Registered providers can maintain AML/CTF compliance, monitor transactions, report any suspicious matters, conduct international fund transfers, and keep their business records for up to seven years. The service providers should notify AUSTRAC regarding any changes in the business details or main personnel.

Mandatory registration

- Any business in Australia offering designated remittance services should be registered with the AUSTRAC before starting its business operations. It is an offense to offer these services with registration under the AML/CTF Act.

Publication and transparency

- AUSTRAC maintains a public remittance sector register that includes the following information:

- Registered business or individual name

- Type of registration

- Updates on corrections or any changes that are made to the register

- Registration start date and main business details

- Conditions imposed on registrations

- Network affiliation if it is applicable

Common challenges and how we can help

Complex documentation requirements

- Applicants will have to provide detailed business documents such as, ownership, risk assessments, AML/CTF programs, along with recent police clear certifications for key personnel. Preparing and organizing this information is a time-consuming and meticulous task. At Tetra Consultants, our team helps to collect, certify, and present all the required documents correctly in order to avoid any delays or refusals.

Navigating registration categories

- For the AUSTRAC remittance register service provider, there are different registration categories, such as remittance network provider, independent dealer, or affiliate, that need specific information along with compliance approaches. Individuals often find it difficult to select the correct registration category and fulfill compliance obligations. At Tetra Consultants, our team understands your business goals and activities, and based on that, we help you in selecting the right registration category.

Understanding and incorporating CTF programs

- One of the most important components of the AUSTRAC remittance register is storing AML/CTF policies. Business owners often consider it a significant compliance burden to develop effective AML/CTF controls, monitor transactions, fulfill customer due diligence, maintain records, and report processes based on the AUSTRAC expectations. At Tetra Consultants, our team helps in creating effective AML/CTF frameworks, policies, record keeping, and controls compliant based on the AUSTRAC rules.

Timely updates

- It is important for business operators to keep AUSTRAC informed regarding any of material changes to the main business structure, services, compliance programs, and main personnel. If there is any inconsistency or delay in the update, then it will lead to a suspension or cancellation. Tetra Consultants offers regulatory compliance consulting services. After registering your business as a service provider, our team ensures that any changes in the key personnel, policies, and business structure are effectively communicated to AUSTRAC.

How can Tetra Consultants help with AUSTRAC remittance register

- At Tetra Consultants, we have expertise in offering end-to-end compliance as well as registration support to those businesses that want to enter the robust financial sector of Australia. Our team of legal and regulatory experts has years of experience in dealing with AUSTRAC and remittance service provider registration, along with similar financial licenses in other jurisdictions. Here is why our international clients choose us:

- Personalized compliance solutions– Our team understands your business model, operational structure, and target market effectively before creating a personalized compliance framework as per your specific business needs.

- Post-regulatory compliance support – Even after registering your business, Tetra Consultants supports it throughout its entirety.

- Strong global presence– Tetra Consultants operates in more than 50 jurisdictions, providing insights about international regulatory standards.

Looking to get an AUSTRAC remittance service provider registration

- If you want to start a business that provides remittance and money transfer services in Australia, then getting your business registered on the AUSTRAC remittance register is significant. If you fail to register your business, it will face major penalties and even reputational damage. Partnering with the right partner will help you easily navigate the complex process of the AUSTRAC remittance register.

- Tetra Consultants is your trusted compliance marketer, ensuring that your business fulfills all the requirements under the AUSTRAC remittance service provider registration framework. From creating effective AML/CTF policies to preparing all the documents, our team simplifies the process.

- Contact us Today to get your AUSTRAC remittance service provider registration, our team will get back to you in 24 hours.

FAQs

What does the AUSTRAC remittance register mean?

Who can apply for the AUSTRAC remittance service provider registration?

Does AUSTRAC charge a registration fee?

What happens if a business is operating without AUSTRAC registration?