Compliance officer for Australia AFS license

- The Australia AFSL compliance services are important for financial service providers who want to be able to legally and efficiently do business in Australia. In short, this compliance service ensures that financial services provide adhere to the rigorous requirements of the Australian Securities & Investments Commission (ASIC) under the Corporations Act 2001. There is a complicated and lengthy process in applying for and maintaining an Australian Financial Services (AFS) License, and you really need someone with experience to help you through the process from the application stage all the way until managing compliance on an ongoing basis.

- Many businesses who want to plant their flag need to initially register company in Australia as a starting point. This will allow you to meet your legal obligations in association with Australian tax collection and other legal requirements for running your business in Australia. In this situation, Tetra Consultants offers a full-service solution for international clients by providing assistance to register company, plus complete Australia AFSL compliance service. Part of the latter would involve appointing an afsl compliance officer, who would be in charge of the compliance framework, regulatory compliance, and risk management.

- With Tetra Consultants’ experienced team you will be able to benefit from an all in one, end to end service solution that takes the complexity out of compliance obligations, and helps you enter the market sooner, making Tetra Consultants a trusted partner for financial businesses in Australia’s continually changing environment.

Benefits of Australia AFSL compliance service

Ensures regulatory compliance:

- The Australia AFS license compliance services aids with compliance with the regulatory framework that the client’s business needs to adhere to which is decided by the Australian Securities and Investments Commission (ASIC) and the Corporations Act 2001. Compliance also involves ensuring compliance with conduct, disclosure, reporting and financial information, and risk management obligations. Compliance with legislative obligations will greatly decrease potential penalties, suspension or revocation of the license by ASIC. There is no value in maintaining a valid AFS license if there are no ongoing obligations to be met. Companies need to comply with their obligations, in order to operate legally and sustainably in Australia’s financial market.

Enhances your business credibility:

- If your business has a valid Australia AFSL compliance services, it shows your customer base that information or practices will be upheld by honesty, Efficiency, and fairness in the delivery of financial services and products. More and more customers prefer dealing with licensed businesses rather than non-licensed businesses primarily due to the colour of professionalism and reliability the license represents, as regulated by ASIC. Being a valid league with ASIC also represents safety and trustworthiness to investors.

Reduces compliance costs and burdens:

- Compliance is not a cheap or easy process to both understand and put in place when dealing with ASIC compliance obligations as they are complicated, expensive, and time-consuming. Getting such assistance from a compliance company means that your business obligations can possibly be met more efficiently and cost-effectively and without the risk of costing you compliance mistakes or compliance period time delays. This frees a company to focus on prioritizing the running of its business, within budgeted allocated resources, while ensuring compliance with license conditions and regulatory changes.

Facilitates market entry and expansion:

- An AFS license is required to legally provide a broad variety of financial products and services in Australia, and compliance services allow businesses to comply and continue to keep their AFS license in good standing so the business can enter a new market segment and broaden their offerings without interruption from the regulations. This creates a legal framework for future sustainable growth while keeping a competitive edge in the financial sector.

Supports risk management and promotes consumer protection:

- Compliance program functions include staff training, internal controls, consumer dispute resolution processes, etc. These risks will decrease operational risk and protect the interests of consumers and align the business with ASIC’s objectives to maintain the integrity of the market. If risk management steps are taken, even more breaches from occurring will be reduced, while developing the value of the business by demonstrating responsible business conduct.

Provides compliance oversight that is relevant to the needs:

- When appointing an afsl compliance officer with compliance services there is a dedicated expert to oversee regulation for compliance, and there is guidance if a business needs to amend its operations for regulatory compliance – such oversight is owned by the business to keep it license valid and create a willingness for responsibility within the business.

Services offered by Australia AFSL compliance officer

Establishing and monitoring compliance systems:

- The compliance officer makes sure that the licensee’s Compliance frame is able to meet all obligations set out under the Corporations Act 2001 and the operational regulatory requirements of ASIC. This includes providing documentation on policies and processes and controls that demonstrate ongoing compliance with license conditions.

Building a compliance culture:

- The compliance officer does more than put a framework in place to comply with the conditions. They encourage integrity, ethics, and trust to create a workplace culture of compliance. The compliance officer’s cultural leadership can assist and support the licensee’s directors to create a workplace that values compliance in everyday business practice.

Identifying and managing risks:

- The compliance officer continually monitors workplace activity to continuously identify compliance risks to the licensee, evaluate if systems and controls are appropriate, and proactively implement steps to manage regulatory risks.

Training and communication:

- The compliance officer provides training and communication obligations to authorized representatives and staff to ensure that they understand their obligations from a compliance perspective on a regular basis.

Incident management and breach reporting:

- The compliance officer reactively manages compliance incidents, including timely investigations, reporting to ASIC where required, and ensuring that impacted customers are notified and compensated when required.

Supervision and monitoring of representatives:

- The compliance officer oversees the acts of the authorized representatives to ensure compliance with internal policies and regulations while ensuring substantial monitoring and supervision controls are in place.

Supporting senior management and directors:

- The compliance officer supports senior management as their key compliance adviser, educating them on their compliance duties, and setting the tone for compliance in their organization.

Ensuring adequate resources:

- The compliance officer assists to ensure that the licensee provides sufficient human, technology, and financial resources for the licensee to comply with applicable laws and regulations.

Regulator of Australia AFS license

- The Australian Securities and Investments Commission (ASIC) is the government body that regulates the Australian Financial Services (AFS) license. ASIC is the body that receives applications for the Australia AFS license compliance service, considers them, issues the license, and polices the regulation of the AFS license holders. The AFS license allows businesses to give financial product advice, deal with financial products, operate registered schemes, provide custodial services, and more. ASIC’s role grapples with much more than this, having a broader remit to ensure that licensees are fit and proper, have enough financial resources, and can meet ongoing obligations in compliance, training, and dispute resolution.

- The regulation is contained under the Corporations Act 2001 and particularly Chapter 7 which contains the legislation for obtaining and holding an Australia AFS license. The licensee’s obligations extend to only providing financial services efficiently, honestly, and fairly. If there are any breaches, the consequences for the license could range from penalties to cancellation of the license. In addition to those obligations, ASIC issues regulatory guides and imposes reporting and conduct obligations on licensees under the Corporations Act 2001, to make sure that the Australian financial services industry is characterized by integrity.

Who need to have Australia AFS license compliance officer?

- All AFS licensees with a financial services business in Australia.

- Businesses that give financial product advice or deal in financial products under the authority of an AFS license.

- Licensees with registered managed investment schemes or that provide custodial or depository services.

- Entities with superannuation trustee services, claims handling services, or corporate collective investment vehicle (CCIV) services.

- Licensees are required to have a strong compliance capability to comply with the ASIC regulatory and statutory obligations found in the Corporations Act 2001.

- Business provides financial services that comply with license conditions, including risk management, breach reporting, compliance monitoring, compliance and internal audit oversight.

- Companies that are required to supervise authorized representatives and responsible managers.

- Companies wanting to provide and cultivate a culture of compliance, ethics, and regulatory accountability within their organization.

- Entities that want to provide evidence to ASIC that they are resourcing compliance oversight and regulatory relationships.

Eligibility for Australia AFS license compliance services

- Must be appointed by a legally Australian entity followed by being hold, or apply for, an AFS license.

- Proven capability with relevant qualifications (minimum diploma) related to the financial service company is providing.

- Relevant industry experience and ability to properly manage compliance obligations.

- Must be fit and proper person per ASIC, which includes:

- Good name and character (no criminal convictions, bans or disqualifications)

- No history of regulatory breaches or financial misconduct

- Current national criminal history, personal history and bankruptcy checks (less than 12 months old)

- Ability to ensure safekeeping, oversight and management of compliance and risk management systems required by the Corporations Act 2001.

- Demonstrable knowledge and ability to meet all AFS license conditions and ASIC regulatory guides (e.g. RG 104, RG 166).

- Ability to oversee representatives of the entity to ensure compliance with financial services laws.

- Demonstration of understanding of conflict of interest, breach reporting and dispute resolution obligations.

- When fulfilling this compliance role, one must have sufficient financial, technological, and human resources to meet compliance functions.

- Ability to provide ASIC with all requested proof documentation during the license application and ongoing compliance.

Australia AFS License compliance officer assistance

- Tetra Consultants provides comprehensive outsourced compliance officer services for new and existing AFS license holders in Australia, with experienced personnel familiar with the Corporations Act 2001, the ASIC Regulatory Guidelines (RGs) and ongoing compliance obligations. Each compliance officer we appoint will have earned credentials, such as Certified Compliance Professional (CCP), and several are also Certified Anti-Money Laundering Specialists (CAMS). With 5+ years of practical experience in the financial services industry, our officers will implement compliant oversight and risk management to oversee your firm’s operations.

- Letting us manage your AFS compliance function means you can have confidence in:

- Ongoing maintenance and monitoring of compliance frameworks.

- Timely preparation and lodgment of compliance related reports to ASIC.

- Oversight of your risk management framework specific to your financial services authorizations.

- Implementation and reporting of your AML/CTF programs according to AUSTRAC expectations.

- Training and support for Responsible Managers and key personnel.

- We strive to keep your business compliant, audit ready and efficient while establishing trust with regulators and your customers.

Services offered by Tetra Consultants Australia AFS license compliance officer

- Ensure all services provided are permitted under the AFS license.

- Ensure ongoing compliance with all conditions attached to the AFS license.

- Establish and implement systems to manage conflicts of interest.

- Ensure compliance with ASIC’s financial requirements, including solvency and net assets in RG 166.

- Design and implement a Compliance Management System (CMS) and maintain it.

- Write, review and update compliance policies, procedures, manuals, and internal controls.

- Integrate all regulatory obligations into the organization’s running.

- Conduct regular compliance monitoring and internal audits to identify instances of non-compliance.

- Identify and investigate examples of non-compliance or operational incidents.

- Maintain a breach register and assess all breaches for materiality.

- Report substantial breaches to ASIC, in accordance with section 912D of the Corporations Act.

- Conduct training sessions on compliance with staff and representatives.

- Ensure all staff fulfil ASIC’s training requirements and their Continuing Professional Development (CPD).

- Engage with senior leadership to maintain a robust risk management framework.

- Identify, assess, and manage regulatory, operational, and reputational risks throughout the business.

- Monitor internal controls to ensure their effectiveness and that they adequately mitigate the identified risks.

- Maintain records in accordance with the Corporations Act and ASIC Regulatory Guides RG 104 and RG 166.

- Follow internal policies for recording documentation such as client file notes, adviser logs, and disclosure records.

- Act as the primary communication contact with ASIC on all compliance questions.

- Liaise with ASIC for all requests including surveillance reviews, investigations, or formal inquiries.

- Prepare and submit regulatory filings as required such as breach reports, financials, and applications for variations to your license.

- Ensure all relevant AFS licenses are filed in the timeframes prescribed in relevant documentation, such as changes to Responsible Managers, services being offered, or the address.

- Manage and submit annual compliance certifications as required.

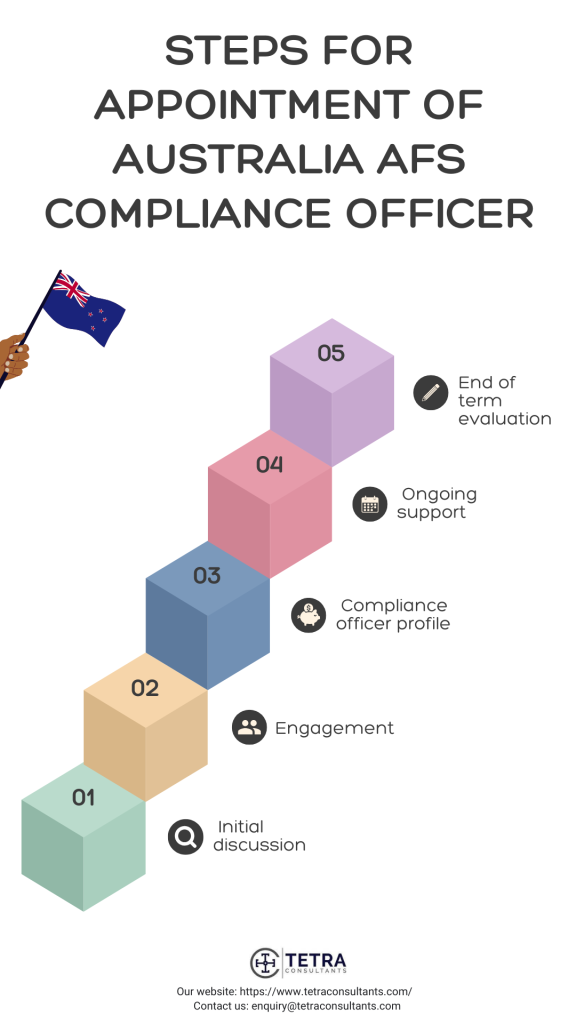

Steps for appointment of Australia AFS compliance officer

Step 1: Initial discussion

- When you are ready to get started, Tetra Consultants will start with a comprehensive discussion to understand your business model, AFS license requirements and compliance issues. This will allow us to properly assess your operational needs and shape and define the compliance officer role for your circumstances. Whether you wish to apply for a new AFS license or wish to take the next steps to refine your compliance approach, our team will provide clarity about the roadmap ahead and how our compliance officer can support your operations from day one.

Step 2: Engagement

- When you are happy with our suggested approach, we will formalize the engagement by providing an engagement letter and sending an invoice. Our team knows it’s essential that all documentation is unambiguous, clearly articulated and consistent with Australian regulatory expectations. Our team provides clarification on how the service engages with ASIC requirements around the “fit and proper” requirements as well as the obligations outlined in the Corporations Act as well as ASCI Regulatory Guides.

Step 3: Compliance officer profile

- Once formally engaged, we are able to share with you the CV and the details of the potential compliance officer. All of the compliance officers we use are carefully vetted and have significant experience working in the Australian financial services industry, have recognized experience in regulatory compliance, risk management and internal controls. You will have the chance to assess and decide if you accept their expertise and if you require further information or profiles. We will also ensure the worker matches ASIC’s competency and experience expectations as they apply to AFS licensees.

Step 4: Ongoing support

- Throughout the appointment, your compliance officer will be involved in your business operations. Tetra Consultants will ensure he/she is available for ongoing compliance meetings, internal audits and training sessions. The Compliance officer will also use his/her experience to assess your compliance management system (CMS), maintain breach registers and ensure ongoing obligations are met, including RG 166 financial compliance, ASIC lodgments and risk assessments. Our back-end team, with whom the compliance official works to check on any technical questions, and documentation they need to draft, is constantly updated on regulatory news and generates bespoke technical compliance notes for you to use for an exemplary compliance management function.

Step 5: End of term evaluation

- As the engagement term is coming to an end, Tetra Consultants will conduct a review to discuss the compliance officer’s contributions, any changes in your business or license scope, and if you would like to renew, extend, or change the engagement. Based on your feedback we can recommend continuing with that officer, suggest a different one, or transfer back in-house with proper handover and training.

Key compliance documents and proof required for Australia AFSL compliance services

FS01 – Online Application Form

- The primary application form submitted electronically to ASIC, capturing essential business details, structure, and the scope of financial services offered.

A5 – Business Description

- A comprehensive document outlining:

- a. The types of financial services and products the business intends to provide.

- b. Target client base (retail, wholesale, or both).

- c. Business operations, growth projections, income sources, and delivery methods.

- d. Examples of typical transactions to clarify business activities.

B1 – Description of organizational competence

- Demonstrates that the nominated Responsible Managers have the qualifications, skills and experience necessary to effectively manage the financial services to which the license relates. Includes:

- A description of the relevant industry experience of the Responsible Managers.

- Details of qualifications relevant to the authorized services.

- Details of how the compliance and risk management roles and responsibilities are shared.

Statements of personal information for the Responsible Managers

- Signed declarations confirming:

- Identity and acceptance of roles.

- Good fame and character.

- Adequate criminal history and bankruptcy checks confirming that there are no criminal convictions or bankruptcy disclosures that would disqualify the Responsible Manager (to be made in reference to the most recent checks).

- Fit and proper status under ASIC’s criteria.

B5 – Financial proofs

- Evidence indicating that the applicant has the financial assets and capacity required to operate sustainably, includes:

- Recent and signed financial statements including balance sheets and profit and loss.

- Recent and projected cash flow forecasts that demonstrate the applicant can meet its ongoing obligations.

- Evidence that the applicant has sufficient financial resources available to operate retail and wholesale client services.

People proofs for fit and proper persons

- For each of the key individuals that control or influence the business, includes:

- Copy of the completed statements of personal information.

- National criminal history checks (obtained in the last 12 months).

- Bankruptcy checks (obtained in the last 12 months).

- Copy of qualification certificates and references.

Additional proof documents (if requested by ASIC)

- Copies of compliance policies and procedures.

- Risk management framework.

- Internal dispute resolution framework.

- Conflict of interest in management documentation.

Cost of appointing Australia AFS license compliance services

- Clients engaging Tetra Consultants for the appointment of an Australia AFS license compliance officer will need to consider a number of costing elements, which will typically include professional service fees for appointment of the compliance officer and ongoing advisory support for complying with obligations set out in the regulations. In addition, to be licensed, there will be costs associated with the licensing application and lodging with ASIC, and to maintain the AFS license.

- The establishment of a compliance framework may incur additional costs for establishing (drafting) and reviewing policies and procedures in line with the Australian Securities and Investment Commission requirements. Clients will also need to budget training programs for responsible managers and staff to ensure continuing competence and awareness of compliance obligations.

- Ongoing costs for monitoring and reporting compliance will also be included within this multi-service offering and will include breach management and risk assessments. Tetra Consultants may also assist clients with services such as offshore company incorporation, nominee director and shareholder services, corporate bank account opening, and many more which are often tied to setting up a compliant Australian financial services business. These cost elements provide the full coverage of services necessary to appoint and support a suitable AFS license compliance officer.

Why choose Tetra Consultants?

- Tetra Consultants specializes in providing the best assistance and advice throughout the process of appointing an AFSL compliance officer. With extensive experience in Australian financial services regulation, their team will help ensure that your business fulfills all ASIC obligations timely and accurately. Tetra Consultants can help clients customize compliance-related solutions, such as providing client-specific compliance manuals, risk management frameworks, and ongoing advisory to ensure their license is maintained through ongoing compliance. Using Tetra Consultants experience and advice, clients will benefit from the efficiencies in the application process and reduced regulatory risks through continuous compliance monitoring, so you can continue to focus on your core business and do business with confidence.

Key reasons of choosing Tetra Consultants:

- Professional assistance with appointment of officers and ongoing support for AFSL compliance

- Bespoke compliance frameworks for your business structure based on ASIC regulations

- Comprehensive end-to-end advice on your license application and ongoing compliance

- Expert legal and advisor team on hand

- Advice on risk management, breach reporting and training of your employees

- Assistance with ASIC communication and documents

- Complete registration services including company registration and establishing business bank accounts

- Specialist in assisting international clients to set up businesses in Australia.

Looking for Australia AFS license compliance services

- Australia AFS license compliance services are critical for businesses wishing to operate efficiently in Australia’s heavily regulated financial sector. These services do not only satisfy ASIC’s rigorous compliance obligations, but also assist businesses to construct, improve and modify the compliance framework required to keep compliant with changing legislation and industry regulations.

- By using the services of an regulatory compliance consulting expert, businesses will have email cover against risks and issues leading to costly breaches, while navigating the often complex but sometimes unreasonable requirements that regulation demands; allowing them to keep their license/ right to operate in good standing.

- Tetra Consultants can assist clients with compliance by focusing on strategic planning, determining how the business operates, and remediation, which gives clients the compliance tools to meet compliance deadlines while keeping your compliance aligned with business objectives. Tetra Consultants will provide the necessary support to allow financial service providers to focus on growing and servicing clients while satisfying themselves that they are as compliant as their circumstances allow within the regulatory constraints.

- Ultimately, by doing business with Tetra Consultants, you will work with a trusted advisor who is passionate about compliance, thus enabling and maintaining success in the Australian market and lessening the funds limiting compliance issues, by making compliance challenges less problematic.

- Contact us to know more about Australia AFS license compliance services and our team will get back to you in 24 hours.

FAQ

What is the purpose of an AFSL compliance officer?

Who is required to appoint an AFSL compliance officer?

What are the general obligations for AFS licensees?

What compliance documents are required for AFS license applications?

How does ASIC monitor compliance with AFSL holders?

What happens if a compliance breach occurs?

Can Tetra Consultants assist with AFSL compliance?