Register company in Saint Kitts and Nevis

- If you are looking to expand your business operations in the Caribbean, then Register company in Saint Kitts and Nevis is a strategic move, offering you a combination of tax advantages, political stability, as well as ease of doing business. The country is known for its investor-friendly business policies, strong regulatory framework, and flexible corporate structure, leading to more and more individuals applying for the Saint Kitts and Nevis Golden Visa. If you are a start-up, SME, or multinational corporation, Tetra Consultants is here to help you establish your presence in Saint Kitts.

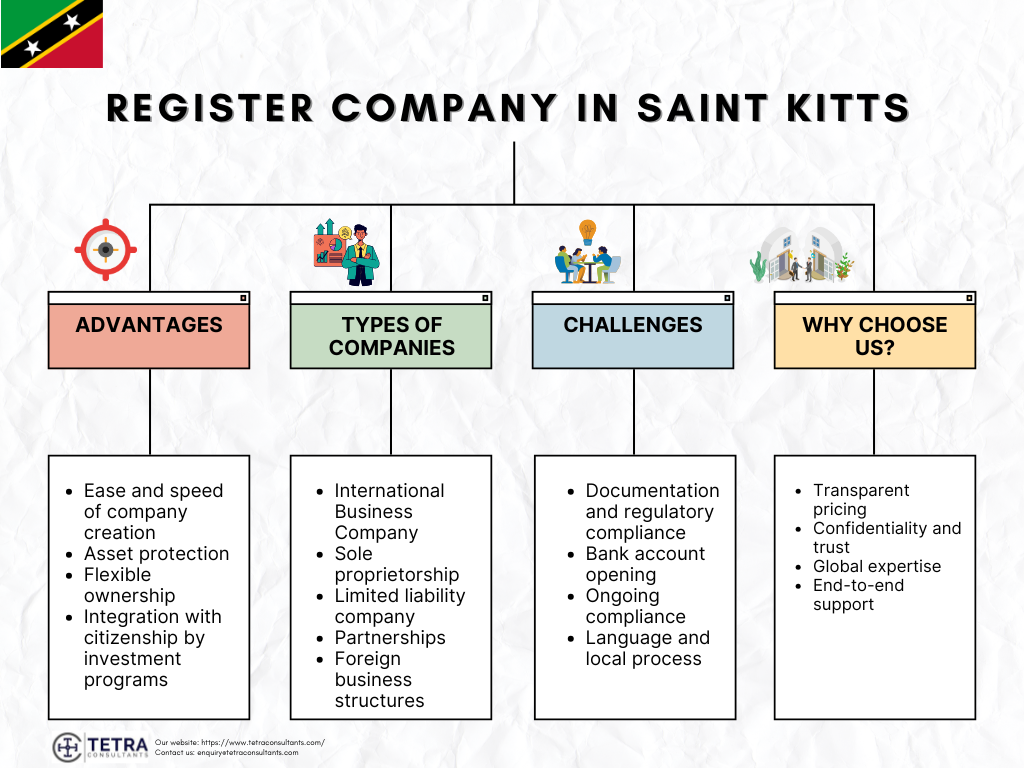

Advantages to Register company in Saint Kitts and Nevis

- Registering a company in Saint Kitts provides major advantages that make it an attractive destination for foreign business owners and investors:

Ease and speed of company creation

- The registration procedure in Saint Kitts is straightforward and is usually completed within a few days, with nominal bureaucratic barriers. There are also nominal capital requirements, and physical presence in the jurisdiction is not mandatory, enabling seamless online incorporation.

No financial reporting requirements for specific entities

- International business companies in Saint Kitts and Nevis do not have to file the annual financial statements, which reduces administrative burdens, while maintaining proper records is still needed.

Asset protection

- In Saint Kitts, there are strong regulatory frameworks that protect the assets of a company from creditors as well as legal claims, improving security for entrepreneurs.

Integration with citizenship by investment programs

- In most cases, company registration in Saint Kitts can be linked to citizenship benefits, providing additional benefits to high-net-worth individuals.

Flexible ownership

- In Saint Kitts, there are no residency or nationality restrictions for directors, shareholders, and foreign investors can easily own 100% of their company, gaining full control as well as flexible management.

Why should you Register company in Saint Kitts and Nevis?

- Registering a company in Saint Kitts provides a myriad of compelling benefits, which make it a popular choice for international business owners, businesses, and investors. Here is why you should Register company in Saint Kitts and Nevis:

Attractive tax benefits

- Saints Kitts works on a territorial tax system. Income produced outside of this country is not subject to local taxation, and there are no taxes charged on income, capital gains, gains for offshore companies, and inheritance. This enables businesses to increase profitability and keep more of their earnings.

No financial reporting obligations for IBCs

- International business companies in Saint Kitts and Nevis are not required to file annual declarations or financial statements, though proper records should be maintained. This decreases ongoing administrative burdens.

Stable and investor friendly climate

- Saint Kitts and Nevis are politically stable, following the English Common Law, and the government of the country is supportive of business culture and actively encourages foreign investment. This stability, along with global recognition, adds credibility to the business registered in the jurisdiction.

Privacy and confidentiality

- Saint Kitts has robust privacy laws. Details regarding the shareholders and directors are not disclosed to the public registries, offering high levels of confidentiality as well as anonymity. Furthermore, Saint Kitts is also not part of the Common Reporting Standard (CRS), which creates an additional layer of privacy for foreign business owners.

Are foreigners allowed to Register company in Saint Kitts and Nevis?

- Foreigners are allowed to Register company in Saint Kitts and Nevis with no nationality or residency restrictions. This implies that individuals from any country can fully own and operate businesses in Saint Kitts. Foreigners can also own 100% of company shares in Saint Kitts and are also eligible to be directors and shareholders in a company. Lastly, in Saint Kitts foreigners face no legal barriers to company ownership and management in Saint Kitts and Nevis.

Costs and timelines

- The process of company formation in Saint Kitts is simple, straightforward, and efficient. Once our team at Tetra Consultants get all the required KYC documents, we can register the company within 1 week. Furthermore, opening a corporate bank account in Saint Kitts takes at least 3 to 4 weeks.

- The overall costs to Register company in Saint Kitts and Nevis differ based on the type of company, and additional services that you opt for. At Tetra Consultants we offer a transparent pricing structure with no hidden fees. Our team exclusively communicates all the charges to you, ensuring that there are no extra charges and you know what exactly you are paying for.

Legal business structures available in Saint Kitts

- To Register company in Saint Kitts and Nevis, there are multiple legal business structures, each suited to different operations, liability, and tax preferences. Here are the most commonly used legal forms:

International Business Company

- IBC is created under the Nevis Business Corporation Ordinance or Companies Act. These entities are mainly used by international/offshore businesses and are not permitted to do business with the residents of Saint Kitts and Nevis. The structure of this entity is like holding or investment companies. IBCs in Saint Kitts are restricted from engaging in banking, insurance, collective investment activities, assurance, and from owning local real estate. The entity is created for non-resident operations and provides strong privacy, with no requirements for annual accounts and returns in several cases.

Sole proprietorship

- In this structure, the entity is owned by a single person, who is personally liable for all the debts and obligations of the business. It is simple to set up, but it provides no liability protection.

Limited liability company (LLC)

- There are two types of limited liability company: private or public LLC.

- A private LLC requires 1-50 shareholders and at least 1 director. The liability of shareholders is limited to their capital contributions, and there are no minimum capital requirements. For a private LLC, it is mandatory to have a registered office in Saint Kitts and Nevis and appoint a secretary.

- A public LLC needs at least 51 shareholders and 3 directors. This entity can offer shares to the public, but it is mandatory to file audited accounts. Shareholder liability in a public LLC is limited to their capital contributions.

- Furthermore, for limited liability companies in Saint Kitts there are no specific residency requirements for directors or shareholders. There is no obligation for directors and shareholders to be residents of Saint Kitts and Nevis. However, the minimum age of directors and shareholders should be 18 years.

Foreign business structures (Subsidy or Branch office)

- In Saint Kitts and Nevis, foreign companies may work as an external company (branch office, which is not a separate legal entity, and is governed by the foreign parent) or can be established as a local subsidiary (which can be a private LLC, public LLC, or IBC). Branches act as extensions of the parent company and are not independent from the legal entities.

Partnerships

- Partnerships are created with the motive to earn profit by two or more individuals. Similar to a limited liability company, there are two types of partnerships: general partnerships and limited partnerships. In general partnerships, all partners share equal liability and responsibility, while in limited partnerships, the liability of the partners is up to their capital contributions.

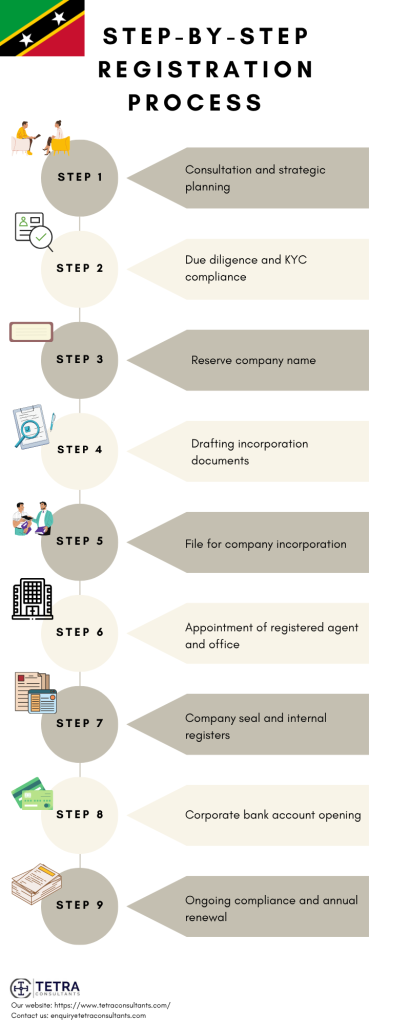

Step-by-step registration process

- Registering a company in Saint Kitts consists of multiple significant stages, from planning and due diligence to incorporation as well as post-registration compliance. At Tetra Consultants, our team ensures a seamless experience throughout this procedure. Here is the step-by-step process:

Step 1- Consultation and strategic planning

- In the first step, we start with an in-depth consultation to understand your business goals, preferred business structure, and type of industry. Our team will assess your needs and will recommend the most suitable business structure on the basis of your goals, tax efficiency, asset protection, as well as compliance needs.

Step 2- Due diligence and KYC compliance

- Before moving ahead, the regulations of Saint Kitts require Know Your Customer (KYC) documents for all shareholders and directors. At Tetra Consultants, our team will collect, review, and double-check all the necessary documents and ensure full compliance with the anti-money laundering (AML) laws.

Step 3- Reserve company name

- In this step, our consultants help you to choose and reserve a unique name for your business with the Saint Kitts Registrar of Companies. Our team ensures that your desired company name is available and searches and submits the request to secure the chosen name quickly.

Step 4- Drafting incorporation documents

- It is mandatory for all companies to submit their legal documents, such as the Articles of Association, Memorandum, and shareholder/director information. At Tetra Consultants, our legal team drafts and personalizes these documents on the basis of your company’s structure, as well as its intended business activity, and ensures adherence to local laws.

Step 5- File for company incorporation

- Our team then files the incorporation documents with the Financial Services Regulatory Commissions (FSRC) to officially register your company and secure your Certificate of Incorporation.

Step 6- Appointment of registered agent and office

- The law of Saint Kitts has made it mandatory for every company to have a local registered office and agent. At Tetra Consultants, our team offers compliant registered office access, and we act as your registered agent to ensure continuous local representation.

Step 7- Company seal and internal registers

- Once incorporated, companies will have to maintain a company seal, minutes book, and shareholder register. Our consultants prepare and deliver all the necessary corporate governance materials, which include the company’s seal and registers.

Step 8- Corporate bank account opening

- After getting the company seal and internal registers, Tetra Consultants will assist you in corporate bank account opening service, which will be needed to handle all the operational transactions and client payments.

Step 9- Ongoing compliance and annual renewal

- In order to stay in good standing, it is mandatory for every company to renew its registration, pay the annual fees, and maintain corporate records for a period of five years. At Tetra Consultants, our team provides ongoing compliance services and regulatory compliance consulting to ensure that you can easily carry out your business operations in a highly regulated environment of Saint Kitts.

Compliance and taxation obligations for Saint Kitts company formation

Compliance

- All registered companies in Saint Kitts and Nevis (such as IBCs, LLCs, and local companies) should renew their company registration on an annual basis by paying the renewal fee in order to maintain good standing.

- Companies should also maintain proper accounting records to showcase their financial positions and business transactions, even though it is not mandatory to submit them annually (this is based on the type of company).

- Most of the companies do not have to file for the annual financial statements unless specifically needed by their activities or business sector. For instance, IBCs are not usually obligated to submit annual disclosures or accounts.

- If businesses are engaging in regulated activities such as finance or gambling, they must have a relevant business license and should be kept up to date.

- On incorporation, companies should submit the Know Your Customer (KYC) documents of all their directors and shareholders. This is significant for adhering to anti-money laundering regulations.

- All companies should file a CIT-101 (simplified tax return) form annually with the Inland Revenue Department (IRD), regardless of their tax liability. Companies with a permanent establishment or tax residency should file a CIT-100, declaring their taxable income in the country.

Taxation obligations

- The standard corporate tax rate for resident companies (on worldwide income) in Saint Kitts is 33%, and for non-residents (on the income sourced within St. Kitts and Nevis). Furthermore, some companies can also be qualified for substantial tax exemptions, like a fixed annual fee in place of tax, especially for IBCs conducting no local business.

- Tax return forms such as CIT-101 and CIT-100 should be filed within 3.5 months of the financial year end. Late filing penalties are charged at 5% for tax due, done 1% for every month being delayed, and 12% per annum on the overdue amounts.

- The standard VAT rate is up to 17%. Registration for VAT is needed only if the sales are more than EC$150,000 in a 12-month period. There are certain exemptions for some goods and services, such as basic food items, education, and insurance.

- It is mandatory for companies with employees to pay social security contributions of 6% of their salaries.

- In Saint Kitts, no taxes are charged on personal income, inheritance, capital gains, or wealth.

- Non-resident recipients of dividends, royalties, or interest from St. Kitts and Nevis are subject to at least 15% withholding tax.

Common challenges of Saint Kitts company registration

Documentation and regulatory compliance

- While the business setup process is usually straightforward, preparing all the essential documents like articles of incorporation, proof of payment, declarations, KYC for directors/shareholders, as well as Memorandum, and Articles of Association, is a difficult task. Strict adherence is required to avoid any delays. At Tetra Consultants, our team will prepare all the documents on your behalf to help you fulfill all the compliance requirements.

Bank account opening

- While the process to Register company in Saint Kitts and Nevis is usually straightforward, opening a corporate bank account is a difficult and time-consuming task, because of strict anti-money laundering (AML) laws. At Tetra Consultants, our team will help you to open a corporate bank account in the most suitable bank with which your profile matches the most, to reduce the risk of rejection.

Ongoing Compliance

- While annual filings are needed for specific types of companies in Saint Kitts, it is mandatory for companies to maintain internal records for at least five years, as well as ensure annual renewals and filings of tax forms, on time to avoid any penalties. At Tetra Consultants, our team will offer you post-incorporation services that consist of tracking annual renewal deadlines, submitting necessary filings, and updating company records from time to time. It is the work of our team to ensure that your company remains in good standing.

Language and local process

- In Saint Kitts, English is the official language and is widely spoken; applicants find it difficult to navigate through the bureaucratic system and business culture of the country. At Tetra Consultants, our team is highly familiar with the the regulatory framework of Saint Kitts and how to get through it. We will act as your single point of contact, and our experts will handle all the communications with the registrar, local authorities, and FSRC, and ensure that you do not have any burden.

Documents required

- Incorporation forms

- Proof of residence address

- Professional reference letter

- Notarized copies of passport of all the directors and shareholders

- Company name Approval certificate

- Reference letter from a bank

- Due diligence/KYC documents

- Memorandum and articles of association

- Registered agent agreement

- Proof of the registered office address

- Curriculum Vitae (CV)

Why choose Tetra Consultants for St Kitts company formation

- Selecting the right business partner to guide you through the company registration process is significant. At Tetra Consultants, we have more than a decade of experience and a strong reputation. Here are the reasons why our clients trust us:

- Transparent pricing– At Tetra Consultants, we provide fixed and transparent pricing with no hidden fees, so that our clients know exactly what they are paying for.

- Confidentiality and trust– We treat our client data and communications with utmost discretion. Throughout the process, our experts ensure to safeguard your privacy and sensitive information.

- Global expertise- At Tetra Consultants, we have 10+ years of experience in handling offshore company incorporation, enabling us to provide you with accurate and jurisdiction-specific guidance at every step of the way.

- End-to-end support– Our team is with you from start to end, becoming your point of contact and reducing your burden.

Looking to Register company in Saint Kitts and Nevis

- If you want to establish a company in Saint Kitts, then going through Register company in Saint Kitts and Nevis is mandatory. The country is known for its investor-friendly business atmosphere, strong asset protection, and full foreign ownership. However, going through the process of company formation in Saint Kitts is a daunting task. Hence, by collaborating with Tetra Consultants, you can easily gain expert guidance and end-to-end incorporation support, thereby reducing your burden.

- Contact us, and our team will get back to you in 24 hours.

FAQs

Can I remotely register a company in Saint Kitts and Nevis?

What type of business activities are allowed in Saint Kitts?

Is it mandatory to have a local director and shareholder?

Do I have to visit in person to open a corporate bank account in Saint Kitts?

What are the annual maintenance requirements in Saint Kitts?