Due to the zero-rated taxation system, starting a business in the Bahamas is an attractive option for foreign investors. With the tourism and financial sectors being well-developed and the main drivers of economic growth, the Bahamas remains friendly and open to foreign investors and capital. The laws in the Bahamas regarding Foreign Direct Investment (FDI) provide a conducive environment for investors to set up a business there. In addition, investors from some industries are provided with incentives such as exemption from stamp duty, excise taxes, and property taxes. It also includes an exemption on construction material for certain types of buildings. These collectively entice businessmen or entrepreneurs to register companies in the Bahamas. In this article, our team at Tetra Consultants has detailed the process and requirements on how to set up a company in the Bahamas once you have decided to register company in Bahamas.

Registering company in the Bahamas

- Non-Bahamians or Permanent Residents who are seeking to establish a business in the Bahamas must obtain approval from the Ministry of Finance’s Bahamas Investment Authority (BIA).

- The application to obtain approval from BIA includes a detailed Project Proposal following the official guidelines issued by BIA. The application together with the supporting documents will be forwarded to the National Economic Council and any relevant Government Ministry or Agency if applicable.

- There is a minimum initial capital investment of BS$500,000 and the proposed investment must not be in the restricted industries namely essential services, real estate, local food and beverage, retail, local media, security services, construction, seafood, and local transport.

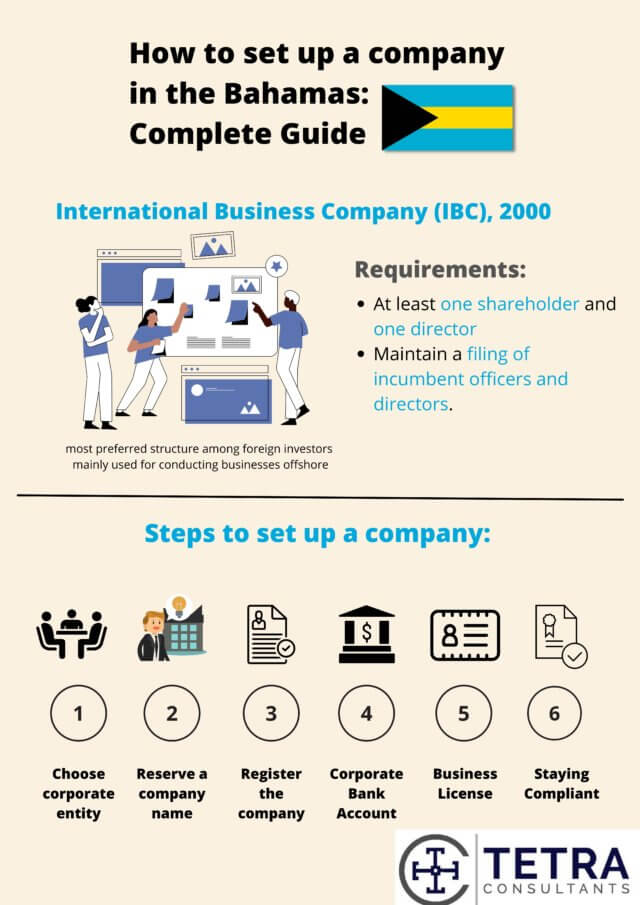

Steps on how to set up a company in the Bahamas

Step 1: Choosing a suitable corporate entity

Step 2: Reserving of the company name

Step 3: Foreign company registration in the Bahamas

Step 4: Corporate bank account opening

Step 5: Obtaining business licenses

Step 6: Staying compliant with regulatory obligations

#1 Choose an optimal business entity for foreign company registration in the Bahamas

Domestic Company

- Domestic Companies are companies that are formed under the Companies Act 1992. These companies can be private companies limited by shares or by guarantee, or public companies.

- To register as a domestic company, there must be a minimum of two shareholders and two directors, and a registered office in the Bahamas. Holding of Annual General Meetings and public disclosure of the names and addresses of its directors and officers are required.

Private companies limited by shares

- This business entity allows the continuation of issuing of shares. Members and managers are limited in their personal obligations to the company. The directors or managers will not be held personally liable for the debts and obligations of the company in the dissolving of the company. Fundamentally, the company has a separate legal entity from its directors and members.

- In registering a company limited by shares, you will need to declare the form of business entity, the maximum number of shares, the authorized capital of the company, the classes of shares and specific details of its rights, limitations and criteria on your company’s Memorandum of Association.

Private companies limited by guarantee

- This corporate structure also provides some form of security for its members. The personal liabilities of the members are separated from the company in the structure. Similar to private companies limited by shares, the directors or managers will not be held personally liable for the debts and obligations of the company in the dissolving of the company. However, members can still be liable for any unsettled amounts with the maximum being the total of their investment or an amount agreed upon previously. In this case, members’ liability is limited to the amount agreed upon in the company’s Memorandum.

- To register as a private company limited by guarantee, you will need to declare the form of business entity, the maximum number of shares, the amount each member intends to contribute in the case of the dissolving of the company, the classes of shares and specific details of its rights, limitation and criteria on your company’s Memorandum of Association.

Private company limited by shares and by guarantee

- This structure would be a hybrid between the two business entities, and registration is fairly straightforward. You will have to declare the form of business entity, the maximum number of shares, the authorized capital of the company, the amount each member intends to contribute, the classes of shares and specific details of its rights, limitations and criteria on your company’s Memorandum of Association.

Public companies

- Generally, shares of a public company are traded freely on the stock exchange whilst shares of a private company are not.

International Business Company (IBC)

- IBC is the most preferred structure among foreign investors because of its minimal requirements. They are mainly used for conducting businesses offshore.

- To register as an IBC, one shareholder and one director are required. Unlike Domestic Companies, Annual General Meetings are not required, with no obligations to file any annual returns or an Annual Statement. However, IBCs are required to maintain a filing of incumbent officers and directors.

Exempted Limited Partnership

- An exempted limited partnership consists of general partners and limited partners. In the case of dissolving a company, general partners may be held personally responsible for the business’s liabilities and debts accumulated by the business, whilst limited partners will not be held personally liable. However, a limited partner is unable to involve himself in the business activities. All exempted limited partnership companies are to provide a registered office in The Bahamas to receive any notice and communication.

- Exempted limited partnership companies are not permitted by law to undertake any business with The Bahamas public unless it is necessary for the growth of its offshore businesses.

#2 Reserving of the company name

- After you have decided on a suitable corporate entity, you may proceed to the next step which is registering a business name in the Bahamas. You may search for the availability of your company’s name through the company search service in the Registrar General’s Department. After which, you can submit your company’s name through the Corporate and Business Registry in the Registrar General’s Department.

#3 Preparation of supporting documents to register a company in the Bahamas

- Before proceeding to register company in Bahamas, you will have to prepare the necessary incorporation documents such as the Memorandum and Articles of Association (MOA/AOA). After the payment of the registration fee and submission of incorporation documents, you will receive a Certificate of Incorporation, and the approved MOA and AOA after approval from the Registry.

#4 Corporate bank account opening

- After the registration of your company, it is recommended to open a corporate bank account with a reputable bank. Typically, the documents required to open a bank account in the Bahamas include a bank form, a copy of the company’s certificate of company registration, copies of the shareholders’ passports, the company’s Certificate of Incorporation, MOA and AOA.

#5 Obtaining business licenses

- Under the Business License Act in the Bahamas, companies conducting business are required to obtain a business license from the business license unit (BLU) of the Ministry of Finance.

- Similar to the BIA, BLU uses the same guidelines and requires information such as the intended nature of business. The cost of the business license is BS$100 and the documents required include the completed application form, copy of Certificate of Incorporation, National Insurance Board Registration, copy of the lease or rental agreement for the business location or Proof of Ownership and the Payment of Real Property Taxes where the business is conducted.

- The business license is required to be renewed annually and annual fees must be made according to your company’s turnover rate.

#6 Staying compliant with regulatory obligations

- In order for your company to continue conducting business legally, timely financial reporting is required. Although businesses are not subjected to any income, capital gains or estate tax, value-added tax may apply for some goods and services.

- Under the newly imposed legislation, your company may have to file a country-by-country annual financial report with the Ministry of Finance.

Conclusion:

You may initially find the process of how to set up a company in the Bahamas intimidating. To simplify the registration process of your company in the Bahamas, you can choose to engage the services of Tetra Consultants. Tetra Consultants provides you with a simple and smooth way to register your company in the Bahamas through our service package, which includes the following: registration of your company with the Registry; the opening of a corporate bank account; obtaining a business license; and annual financial reporting and tax services.

Contact us to find out more about how to set up a company in the Bahamas. Our dedicated team of consultants will revert within 24 hours.