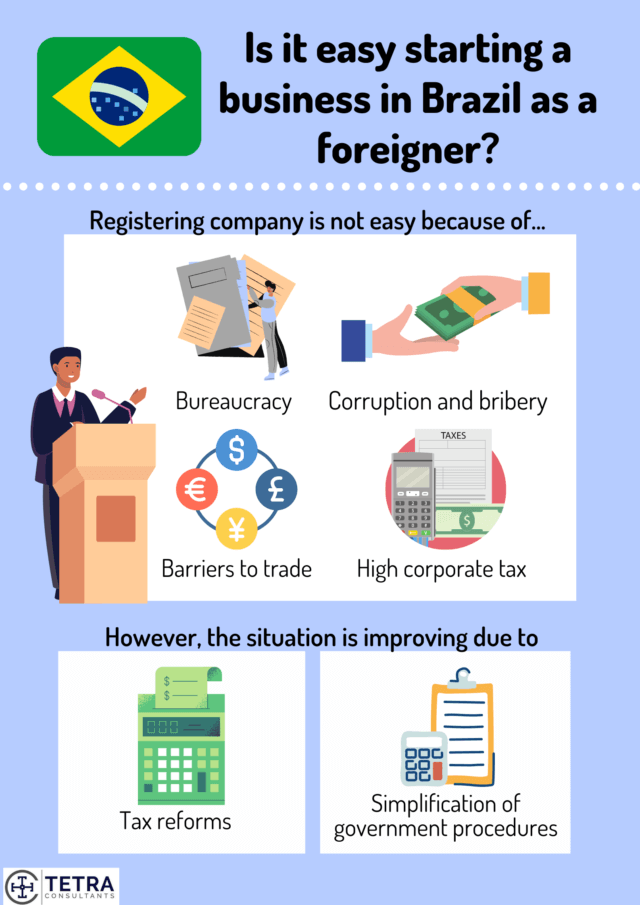

In the 2019 World Bank Ratings, Brazil is rated 124 out of 190 economies in the ease of doing business. With that said, it may seem like it is not easy starting a business in Brazil as a foreigner. What are the factors for considerations which you will have to take into account when you register company in Brazil?

Why Brazil?

Brazil is the largest economy in Latin America and the ninth-largest economy worldwide. As part of the Southern Common Market (MERCOSUR) and BRICS trade groups, it allows for trading and commercial opportunities. Companies incorporated in Brazil can have access to the members’ markets of the trade group. The international trade access is thus attracting foreign investors to start a business in Brazil.

The government has declared its support for foreign investment developing a business-friendly environment to attract foreign investors. In addition, setting up a company in Brazil can be completed without physically visiting the country. The process can be carried out remotely through a Power of Attorney.

Knowing the different types of entities in Brazil:

Generally, there are two options in starting a business in Brazil as a foreigner. You may enter Brazil directly (subsidiary or branch) or through third parties. The most common entity chosen would be the limited liability company (LLC).

By entering Brazil through a subsidiary, the Brazilian company will be fully governed by the law of Brazil, holding the same rights and responsibilities as a local Brazilian company. Whereas, opening a foreign company branch is more complicated as it requires specific authorization from the Brazilian Ministry of Development, Industry and Foreign Trade.

Limited Liability Company (LTDA)

- LTDA is a private limited company regarded as a separate legal entity by the Brazilian authorities where business owners are not personally liable for the company’s debts and liabilities.

- Minimum of 2 shareholders and 1 director of any nationality.

- The legal representative appointed must be a Brazilian permanent resident if no resident director is appointed.

- No minimum paid-up capital.

- No restriction of type of business.

Limited Liability Corporation (SA)

- SA can issue different classes of shares (voting and non-voting). The shareholders have limited liability to the payment of shares depending on which class of share they have subscribed to. This entity is recommended for larger companies seeking to raise funds from the general public.

- Minimum of 2 shareholders and 3 directors of any nationality.

- The legal representative appointed must be a Brazilian permanent resident if no resident director is appointed.

- Need not be listed on the stock exchange.

Restricted industries

Despite being able to own companies in Brazil, there are some restricted industries:

- Radio, TV and publishing

- Cable television

- Air transportation

- Health care

- Security services

- Road transportation

Rules of Company Naming in Brazil:

All company names in Brazil would have to adhere to the five rules:

- Veracity: the real name of the partner or partners must be used, both in the firm as well as in the denomination. The activity indication incorporated into the name must also be real, and it must be explicit in the social object.

- Novelty: a new name must be adopted, and it must be different from names that already exist, in order to avoid mistakes or confusion in the identification of the companies.

- Identification of Type: the legal type of EIRELI or of the partnership must be clearly identified.

- Moral Protection: use of words or expressions that are immoral and go against good manners is forbidden.

- Prohibition to use initials and denominations of public entities: it is not allowed to use initials or denominations of public entities or international entities, or the ones presented in the law and in regulatory acts of public power.

Steps to setting up a company in Brazil:

Once you have considered and decided in starting a business in Brazil as a foreigner, you may proceed with the steps as follows:

Step 1: Planning of your business idea

- Think of a business idea that is unique and feasible.

- The address chosen for the business to operate from must be compatible with the activity of the business.

Step 2: Choosing a suitable corporate entity

- There exist many types of business entities but the most popular incorporation would be LTDA.

Step 3: Reserving the company name with the Brazil Junta Comerciais (Board of Trade).

- The corporate name chosen for your business must contain the type of activity your business will conduct.

- The company name will have to adhere to the 5 rules of company naming in Brazil.

Step 4: Registration with the Board of Trade

- Submission of the Certificate of Incorporation, Memorandum & Articles of Association.

- The entire process of incorporating a new entity in Brazil can take 60-90 days.

Step 5: Corporate bank account opening

- Documents from the shareholders, articles of incorporation, and taxpayer ID are required.

- The process may take from a few days to three months, depending on your relationship with the bank and your financial situation.

Step 6: Tax registration

- Application for a CNPJ number with the Department of Federal Revenue Service.

- The net annual corporate tax rate is 34%

Step 7: Obtaining a business license and permit

- There are a few options in which business licenses are not required but most of the time, it is required.

- Documents such as real estate clearance certificate, a formal request for registration for Business License, statement of responsibility, approved Articles of Association, confirmation of the CNPJ registration, copy of the Identification Document for the Company Administrator and payment of the registration fee for the Business License application are required.

- Some companies may also require obtaining a sanitary permit.

Step 8: Staying compliant

Conclusion:

Starting a business in Brazil as a foreigner may seem intimidating at first sight, with many requirements and procedures. With Tetra Consultants by your side, the registration process of your business in Brazil will be smooth and hassle-free. Our comprehensive service package includes planning and strategizing with our clients to select a suitable business entity, completing the registration process, obtaining required licenses, opening a corporate bank account, and financial reporting and taxation obligations.

Contact us to find out more about how to register a business in Brazil and our dedicated and experienced team will revert within the next 24 hours.

2 comments

steve quigley

August 18, 2022 at 5:46 pm

I am considering opening a business or buying a company off the shelf if that is an option in order to have a Brazilian entity owned and linked to my UK business.

The main function of this entity is for our Brazilian customer who wants to put business through this new Brazilian company, which would be paid via our UK Co. to purchase goods in Brazil and ship them directly to our customer for their overseas operations. The company must be a Brazilian company, the funds would flow via our UK entity, which would need to be in control of those funds paying the suppliers in Brazil.

Could you advise what the costs associated with putting this into place on an urgent basis?

They are looking for us to put this in place within the next 4 weeks, so reading some of your comments this may be impossible? So let me know if there is a fast track system which we could apply?

Tetra Consultants

August 19, 2022 at 5:45 pm

Thank you for reaching out. One of our consultants has contacted you to discuss the above.