The first thing that comes to mind when people mention Cambodia would probably be Angkor Wat, the largest religious structure in the world, and a World Heritage Site. Known officially as the Kingdom of Cambodia but more commonly referred to as just Cambodia or Kampuchea, the country is now making waves as one of the fastest-growing economies in Asia, with an average growth rate of 7.6% over the past decade. Therefore, it might be a good option for you to register a company in Cambodia due to its growth potential. The first step in doing so would be to choose a suitable corporate structure. This is one of the most important steps since there are different company structures in Cambodia, with each company structure being tailored for different types of businesses. When deciding the most suitable company type, it is important to consider various factors that include but are not limited to the availability of personal liability protection, tax ramifications, ownership and management flexibility as well as compliance requirements. Before the start of the engagement, Tetra Consultants will fully understand your business before recommending the most optimum type of company in Cambodia. Some considerations we take into account include the type of business activity, corporate tax obligations and nationalities of shareholders and directors. Our consultants will also offer more information on the requirements of setting up these entities. Generally, most of our international clients would choose to register a limited liability company. Also known as a private limited company, registering your private limited company in Cambodia would allow you to benefit from a good mix of ease of incorporation, tax benefits and liability protection, allowing you to expand your business alongside Cambodia’s rapidly growing economy.

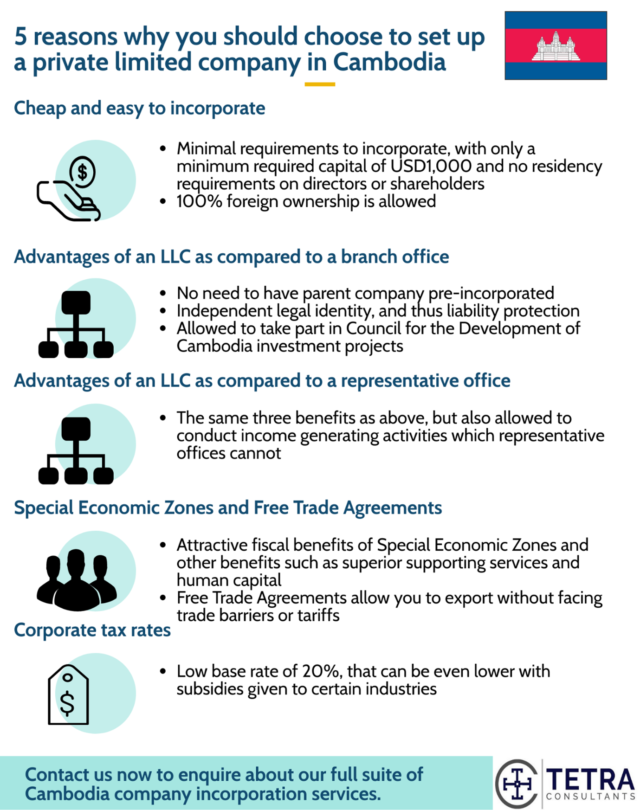

Cheap and easy to incorporate

It is relatively cheap and easy to incorporate your private limited company in Cambodia since you only need a registered agent, office address and a minimum required capital of USD1,000. You will also need minimally 2 shareholders, 1 director. Although these positions are not subject to any nationality requirements, you will need a local secretary. 100% foreign ownership of your company will also be allowed. This grants you the flexibility and autonomy to manage your business and operating activities without needing to source for a local partner, which might be difficult if you do not have your own contacts. Tetra Consultants can also help you to meet these requirements as we offer local secretary services and provide our international clients with a registered office address.

Advantages of an LLC as compared to a branch office

LLCs are considered as its own independent identity, whilst a branch office is seen as an extension of its parent company. This has a few implications. Firstly, an LLC can be incorporated even without having a parent company already established. This makes it a suitable corporate structure for new business entrants. Secondly, having an independent identity from its parent company prevents the parent company from being wholly liable for the debts and obligations incurred by the LLC. This would not be the case for a branch office, which might leave the assets or reputation of your parent company at risk if your branch office were to engage in riskier business ventures. Lastly, the Council for the Development of Cambodia has special investment projects which only LLCs can take on.

Advantages of an LLC as compared to a representative office

Similarly, an LLC offers the same three advantages as it does over a representative office as it did over a branch office. One additional advantage that an LLC offers over a representative office is that it allows businesses to carry out income generating activities in the country. Representative offices usually cannot do so and are only suitable for conducting market surveys and research.

Special Economic Zones and Free Trade Agreements

Two complementary policies which further enhance the attractiveness of private limited companies in Cambodia would be special economic zones that offer preferential business and tax policies, or free trade agreements which allow you to import raw materials and export finished products with minimal taxes and trade barriers.

There are 22 special economic zones in Cambodia, offering incentives such as full corporate tax exemption for a period of up to nine years and free repatriation of profits. They will also be exempted from both value-added tax, as well as import and export duties. Apart from these monetary incentives, special economic zones also offer benefits in other areas, such as the consolidation and upscaling of supporting industries and infrastructure, attraction and retention of human capital, and encouragement of international cooperation. A self-reinforcing effect with the reputation of the special economic zone also comes into play, further enhancing the zone’s competitiveness and attractiveness to businesses. As they attract better services and talent, their reputation also increases, allowing them to attract even better services and talent. With many international companies and countries investing in the special economic zones, international trade and cooperation would also be enhanced.

Being part of the Association of South East Asian Nations (ASEAN), Cambodia also gets to enjoy the trade agreements that allow for free trade both within ASEAN as well as with its trading partners. Having recently agreed a bilateral agreement with China and entered the Regional Comprehensive Economic Partnership, your Cambodia company would also be in a good position to export your products globally.

Corporate tax rates

Cambodia has one of the lowest tax rates in Southeast Asia, operating based on a tiered system. This means that not everyone has to pay the standard corporate tax rate of 20%, with smaller companies being allowed to pay a tax rate of between 0 to 20% instead. Small and medium firms (annual turnover of less than USD 1 million and less than 100 employees) will also qualify for additional tax subsidies. These are either granted to specific industries such as agricultural or agro-industrial products, food production and processing, information technology research and development or management or granted when firms incorporate in specific cluster zones as mentioned above. They would also qualify for additional incentives if they are new companies, or contribute substantially to Cambodia’s economy by using local raw materials or creating employment.

Much like many other jurisdictions, Cambodia also offers a territorial taxation policy whereby non-resident taxpayers are only taxed on income earnt within Cambodia as opposed to their global income, reducing their tax obligations.

How can Tetra Consultants assist you?

Cambodia company registration is hassle-free if you are familiar with the entire registration process. With Tetra Consultants at the wheel, you will be able to channel your time and energy into other more important aspects of your business.

With our lean-and-mean mentality, you can rely on our team of experts to provide you a seamless experience throughout the whole process of starting business in Cambodia. Our ultimate goal is for your company to be operationally ready within the stipulated time frame of 10 weeks.

Our service package includes everything you will require to register business in Cambodia:

- Cambodia company registration with Cambodia Ministry of Commerce (MEC)

- Local company secretary and registered address

- Opening a local or international corporate bank account

- Tax registration

- Cambodia business visa applications

- Annual accounting and tax services

Contact us to find out more about Cambodia company formation. Our team of experts will revert within the next 24 hours.