Deciding on which countries to expand your business to can be a complex and difficult decision. As an aspiring entrepreneur, you might have heard of the lucrative business environment of Malta and might be wondering about the process of starting a business in Malta as a foreigner too. In this article, Tetra Consultants will provide the ultimate guide on starting a business in Malta as a foreigner, not only offering insights into the key advantages of registering a business there, but also the key types of business in Malta so that you may better understand this business phenomenon and make a more informed decision about whether you should register company in Malta.

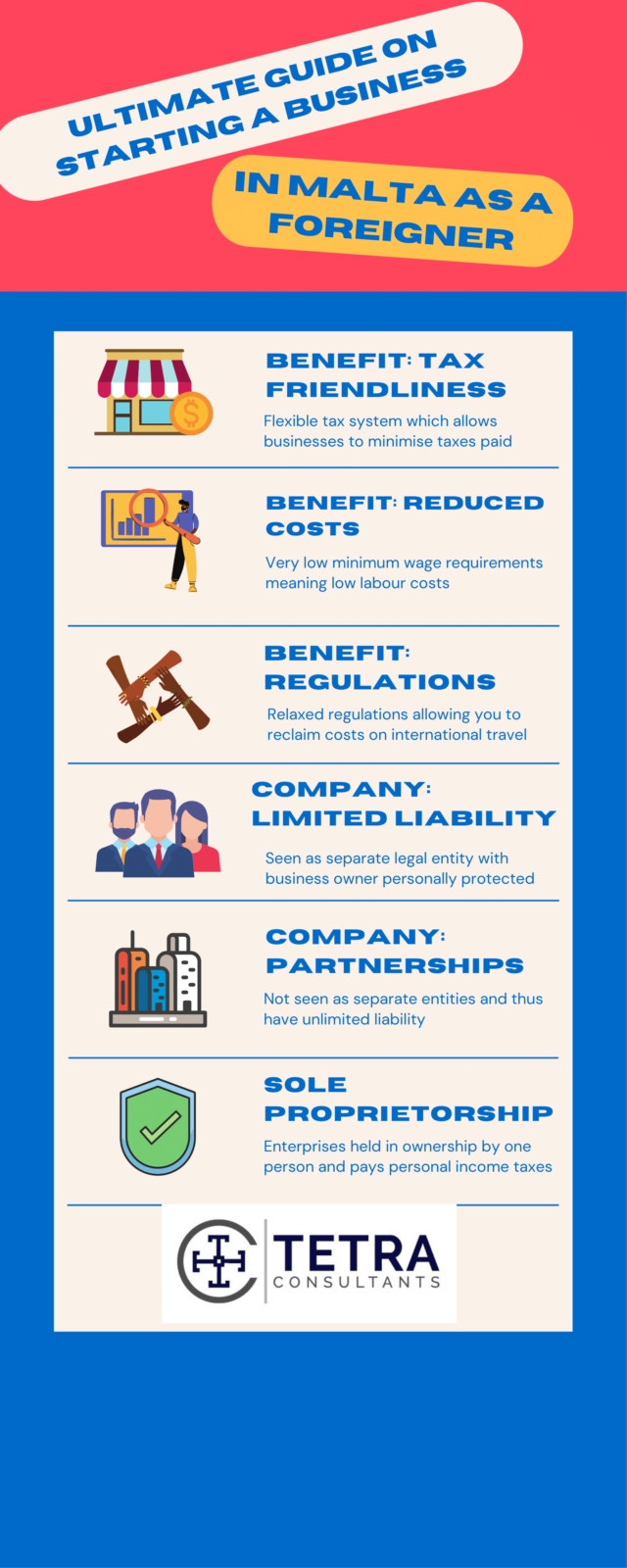

Advantages of starting a business in Malta as a foreigner

1. One of the most tax-friendly environments in the European Union

Upon initial inspection, the corporate income tax rate of 35% may seem exorbitantly high and un-competitive in contrast to the rest of the countries within the European Union.

However, it is very possible for your company to lower this tax rate to between 5 and 7% by dividing all of the profits earned to a holding company which is set up in another country. The best and most commonly used countries to consider for this objective include Cyprus, the Seychelles or Gibraltar. Moreover, Malta has several tax benefits which aid in lowering the company income tax through the full imputation. In addition, various sources of credits are available when dividing profits amongst the different shareholders, thus allowing your business to further minimise its tax burdens.

With regards to another form of tax rates, personal income tax rates, while it may be true that Malta has relatively significant income tax rates and that in the instance where one were to receive a high salary one would face a heavy tax burden, there are multiple ways of reducing and optimising this. As a business owner, by opting to only withdraw as much income as is required, this can effectively lower the tax rate because the income tax rates are in bands. In fact, the country of Malta has an intuitive income tax system in that earners only pay the higher percentages owed on the amount where they have exceeded a certain band.

2. Reduced labour costs and wage concerns

Malta only has a minimum wage requirement of €720 per month, with most employees being satisfied with a monthly salary around €1000 to €2000 for any given job on average. This means that by minimising the wages paid to each of your employees, you can effectively lower labour costs, and thus, maximise profits for your business in Malta.

3. Lower requirements for equity and share capital

In Malta, the share capital requirement to officially start and register a new business in the country is merely €1,165. This means that setting up a company in Malta is far cheaper and more cost efficient than most other places around the world. In addition, only a mere 20% of such capital is required to be kept in the corporate bank account, translating into less physical cash being required to start up your new business. However, one must be aware of the fact that an annual fee of €100 still applies for these businesses. Despite this, low requirements for equity and share capital further lower the costs of starting a new business in Malta.

4. Low social security burdens

While social security is still paid both by the employee and the employer, both parties only have to pay 10% of salary. This percentage is relatively lower than the average social security requirements for many other countries in the world, especially those within the European region, thus ensuring that these costs do not contribute to significant to the cost of hiring employees.

5. More relaxed regulations surrounding expenditure

The legislation of Malta is very relaxed in terms of costs that you can claim back through your business. Business travel costs, for example, are very rarely questioned, meaning that those who like to travel and work can claim back much of the costs through their business. This means that such external expenditure can be minimised as far as possible for your business.

6. Safe environment with low crime rates

The crime rates of Malta are relatively low, offering a safe environment for foreigners despite it being an unfamiliar and different place. While this may seem like a trivial factor, it can contribute to the willingness of your foreign employees to work in Malta for instance, meaning that security and safety can contribute to the ease of setting up or even expanding your business to the country of Malta. Fortunately, its low crime rates and safe environments ensure that this factor is not a concern.

Key types of business structures in Malta you can incorporate under

- Limited Liability Company

There are many different forms of limited liability companies you can choose to set up in Malta. If you opt to set up a private limited liability company, the number of members is restricted to only fifty. Furthermore, it also prevents any invitation to the public to subscribe for any of its shares and debentures. While these private limited liability companies continue to face various forms of taxation, if they successfully fulfill certain metrics which enables them to list themselves as Private Exempt Companies, they can gain and qualify for various tax advantages.

However, other types of limited liability companies are public ones. If the company chooses to publicly offer its shares or debenture, it will not qualify as a private company. Despite this, limited liability companies all ensure that the personal assets of business owners and management are protected from any corporate liabilities. This because limited liability companies are seen as separate legal entities and thus, any corporate debts and burdens will not be personally borne by its owners.

2. General Partnerships

This type of business structure is best suited for medium-to-small sized businesses. There are various types of partnerships, such as En Nom Collectif, which refers to a partnership between two or more partners, one of which must be either an individual or a corporate body. Another type of partnership is known as En Commandite, also known as Limited Partnership, where members hold limited liability over the company.

3. Single Proprietorship or Single Member Company

This broadly refers to an enterprise held in ownership by one person. This can take place either at the time of incorporation or through the acquisition of all shares by one individual shareholder only.

Conclusion

Navigating a new country’s different and unique business climate might be a challenging process – a hassle to say the least. However, with the key business and corporate benefits outlined above, it is easy to see why many entrepreneurs will consider starting a business in in Malta as a foreigner. As such, Tetra Consultants hopes that this article has provided you a much better understanding about the various company types in Malta and the main advantages of starting a business in Malta as a foreigner so that you can truly decide on whether you should register company in Malta yourself.

So, what are you waiting for? Contact us to find out more about the process of starting a business in Malta, and our dedicated and experienced team will respond within the next 24 hours. Tetra Consultants will not only empower you by helping to navigate the different regulations of Malta, but also aid in facilitating the registration of your company there while providing invaluable, nuanced insights into any potential challenges.

2 comments

Bergumans palman

October 16, 2022 at 6:29 am

I like to do business means a restaurant in malta.

Tetra Consultants

October 17, 2022 at 10:09 pm

Thank you for reaching out. One of our consultants has contacted you to discuss the above.