For investors and business owners looking to expand into Australia, one of the first few considerations will be the cost to register a business in Australia. Once you are clear on the expenses required, it will be easier to plan overhead expenditures and the level of investments in the country.

As of 2021, Australia boasts the 12th largest economy and holds the longest track record of steady economic growth, documenting 27 years of economic growth without a recession until 2017. Besides having a strong performing economy, Australia also has a stable political environment, low unemployment rates and a high degree of transparency. All these factors make Australia a very attractive place for foreign companies to expand their business. To register business in Australia, it is first important to understand the initial costs and fees required.

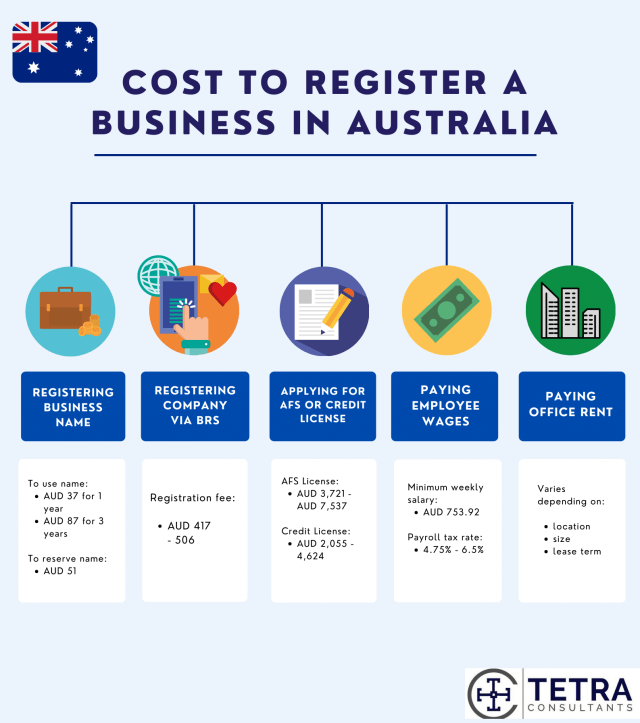

Cost to register a business in Australia at each step of the process:

Step 1: Registering your business name

Step 2: Registering your business with the Australian government

Step 3: Applying for a financial services license or credit license

Step 4: Paying wages to your employees

[ps2id id=’step1′ target=”/]#1 Registering your business name

- When you start a business in Australia, the first thing you will have to do is, of course, to register your company’s name with the Australian Securities & Investments Commission (ASIC). You will then need to pay a fee to be able to use the name. The charges are as follows: AUD 37 for 1 year and AUD 87 for 3 years. If you wish to reserve your company’s name before the application, you will have to pay an additional fee of AUD 51. The company’s name can be reserved for up to 2 months on the ASIC website.

[ps2id id=’step2′ target=”/]#2 Registering your business with the Australian government

- Another key consideration is the cost to register a business in Australia with the government’s Business Registration Service (BRS). This fee can range from AUD 417 to AUD 506, based on the type and structure of the company. For a proprietary limited company in Australia that has share capital, the fee incurred is typically AUD 506. To find out more about the fees required to register company in Australia, you can refer to the schedules of corporation fees readily available on the ASIC website.

[ps2id id=’step3′ target=”/]#3 Applying for a financial services license or credit license

- If your company provides financial services or sells financial products to clients, you will have to get an Australian Financial Services (AFS) license. The online application fee can range from AUD 3,721 for financial planners with low complexity products to AUD 7,537 for a company that sells and offers advice on more complex financial products.

- Alternatively, if your company is involved in credit activities such as credit contracts and mortgages, you will also need to apply for a credit license. The fees are AUD 2,055 for a non-credit provider company and AUD 4,624 for a credit provider company.

[ps2id id=’step4′ target=”/]#4 Paying wages to your employees

- Before you proceed with Australia company formation, it is essential to understand how much you will have to pay your workers in Australia so that you can get a better estimate of your annual wage expense. As of 1st July 2020, the minimum wage in Australia is AUD 19.84 and the maximum number of working hours per week is 38. This translates to a weekly salary of around AUD 753.92.

- In addition, you will also need to pay taxes on employee wages. Depending on the state your company is situated in and the amount of annual taxable wages, tax rates can range from 4.75% to 6.5%. Currently, Queensland has the most competitive average rate of 4.75%. For more information on the amount of payroll tax incurred in the different states, you can visit the Payroll Tax Australia website.

[ps2id id=’step5′ target=”/]#5 Paying office rent

- The cost of rent will differ significantly depending on the location and size of the rented office building, as well as the lease term. You will have to seek professional advice from a tenant advisor and do research on the premises you are interested in renting. You may wish to compare similar deals and rents in the same location to make sure that you are not paying more than the market average.

Need help evaluating the cost to register a business in Australia?

Before Australia company formation, you will need to take into consideration the different registration costs associated with starting up a business. There are also many costs incurred after registering the company, such as wage and rent expenses, which you may wish to consider before you decide to expand your business to Australia.

Tetra Consultants will provide you with a quick and easy way to register your business in Australia. Once you have engaged our services, we will complete registration within 1 week and open a corporate bank account for your company within 4 weeks. Our services also include the provision of a nominee resident director, which is a requirement if you wish to set up a company in Australia. The nominee resident director recommended by Tetra Consultants will not be granted access to the corporate account or be actively involved in the management of the company, unless otherwise requested. Instead, the nominee resident director will play a more passive role in the preparation of the annual report and other compliance affairs. Thus, you can rest assured that your authority will not be diluted.

Contact us now and we will revert within 24 hours.