Anjouan Banking License

- An Anjouan Banking License provides international entrepreneurs and financial institutions with an efficient means to engage in the global banking sector with a minimum of bureaucratic red tape and competitive regulatory advantages.

- Located in the Union of Comoros, Anjouan’s financial services sector has been undergoing steady growth, with the African Development Bank’s 2024 Economic Outlook projecting 4.2% GDP growth attributable to financial services and offshore investments. Per the 2024 Global Financial Centers Index, Anjouan is becoming an emerging offshore jurisdiction supporting fintech and digital banking innovation.

- Investors interested in to register company in Anjouan can take advantage of low taxation, flexible ownership structures, and confidentiality protections. Tetra Consultants has extensive experience with offshore financial licensing and takes care of the entire licensing and incorporation process for our clients, ensuring our clients comply with all regulations in Anjouan, as well as international banking regulations.

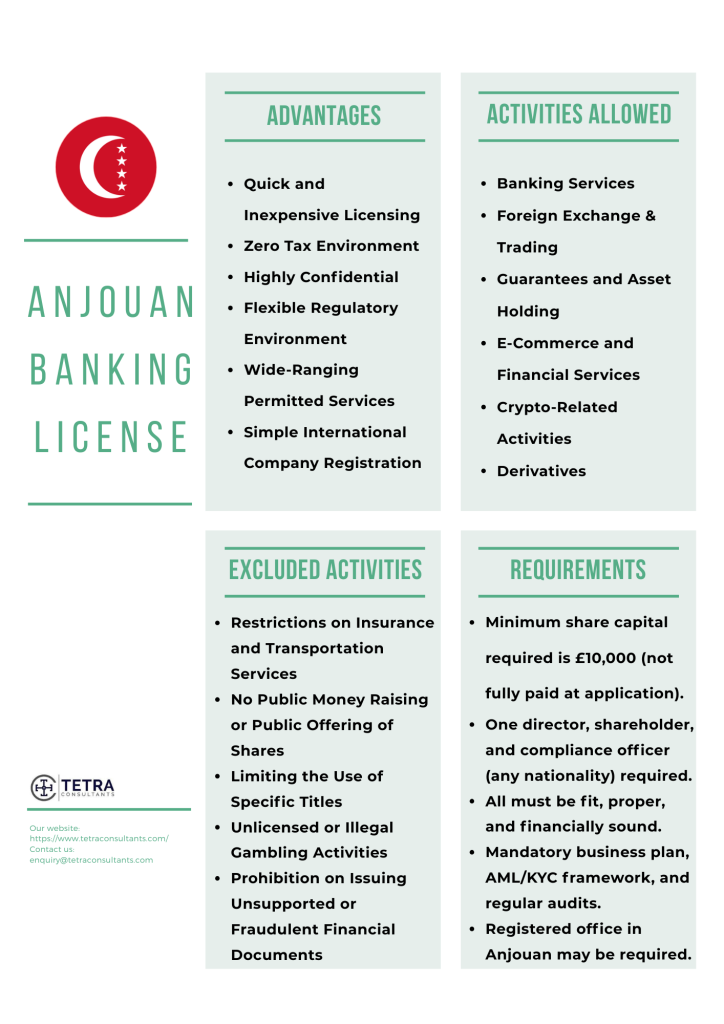

Advantages of Obtaining Anjouan Banking License

Quick and inexpensive licensing

- The licensing and registration process for companies in Anjouan is notably efficient, with far fewer bureaucratic pressures and lower costs than most other competing jurisdictions. This fast-licensing process is advantageous for start-ups and growing companies aimed at getting to market as fast as they can.

Zero tax environment

- Even better, companies that have an Anjouan Offshore Banking License are required to pay zero corporate income tax and no VAT. This positive offshore tax treatment allows organizations to optimize the opportunity for profitability while adhering to local regulations.

Highly confidential

- Anjouan has very strict privacy laws and data protection standards that prioritize the protection of operational and client data, which meet international standards. This legal emphasis on confidentiality in the banking context brings high-net-worth individuals and private banking clients to their business.

Flexible regulatory environment

- The regulatory structure allows for changes to be brought in quickly, making Anjouan a lucrative vehicle for fintech and innovative banking models. Consequently, businesses can adapt to a fast-paced and changing technological and compliance environment and thrive long-term.

Wide-ranging permitted services

- Banks in Anjouan are able to offer a wide range of services, including commercial banking, private banking, international payment processing, foreign exchange, wealth management, custody, lending, and digital asset activity. This flexibility allows for considerable global connectivity from a single jurisdiction.

Simple international company registration

- To form a company in Anjouan for banking, all the founders must provide a legal address, and there are no restrictions on nationality. This flexibility enables cross-border participation and a variety of ownership.

Timeline for obtaining Anjouan Banking License

- The timeline for acquiring an Anjouan Banking License with Tetra Consultants commences with the process of registering the company. This registration process usually takes 2 weeks to complete. After the registration of the company has been completed, we will begin to prepare the documentation for the license. This step requires the client to respond quickly with the information we need in order to complete the paperwork. This process takes about 2 weeks to finalize all of the information requested.

- After the documents have been prepared, we will submit the application, and after approval, the final step is corporate bank account opening, which generally takes around 3 to 4 weeks. Overall, completing the licensing process from company registration to opening your bank account will take approximately 7 to 8 weeks.

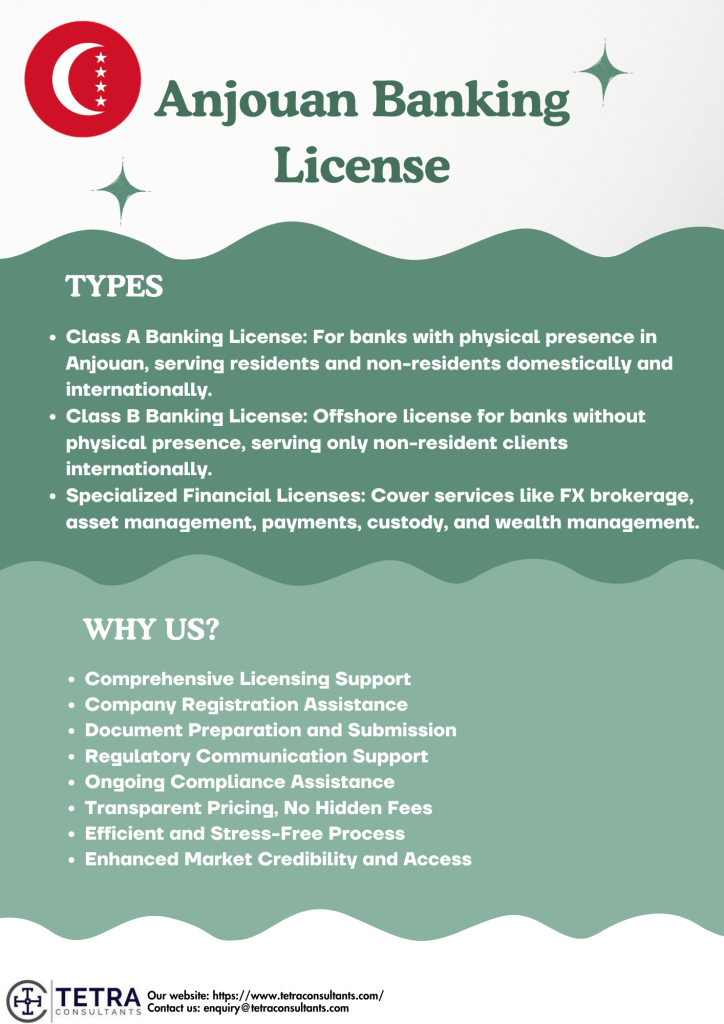

Types of Anjouan Banking License

Class A Banking License

- Class A Banking License is issued to banks that have a physical presence in Anjouan. This license enables these banks to conduct banking activities in the domestic market and internationally in compliance with regulatory obligations, including local presence and regulatory adherence. It is applicable to onshore banking institutions that can serve residents and non-resident clients.

Class B Banking License

- The Class B Banking License is an offshore Banking License issued by the finance authority of the island of Anjouan. This is a full, unrestricted license that allows a bank to conduct international banking activities exclusively with non-resident clients. The license is classified as offshore because it does not require the bank to have a physical presence in Anjouan. This is suitable for international financial institutions that facilitate or engage in offshore banking activities.

Specialized Financial Licenses

- In addition to the general Banking Licenses, Anjouan provides specialized licenses that allow banks to carry on additional services, including foreign exchange brokerage, asset management, payment processing, custodian services, and wealth management. These specialized licenses allow banks to operate in niche markets and offer full financial products in accordance with regulatory guidelines.

Activities allowed under Anjouan Banking License

Banking services

- Licensed entities can receive deposits from clients, make different types of loans, and borrow to fund banking operations. They can also open and operate bank accounts for individuals and businesses, make payments, and issue financial instruments, including credit cards and securities.

Foreign exchange & trading

- The license allows for currency exchange services, as well as trading securities. This includes custody of securities, investing in and selling instruments, and providing brokering services for transactions in capital markets or foreign exchange.

Guarantees and asset holding

- Entities can guarantee financial obligations or any other transaction on behalf of a client. They can also take custody of assets and financial instruments, which may include metals (gold and silver), bonds, and shares on behalf of third parties.

E-commerce and financial services

- The license empowers activities related to e-commerce, allowing for licensed firms to provide services corresponding to online financial services, which may include payments facilitation, virtual marketplace, or other finance-oriented services within the Electronicos commerce ecosystem.

Crypto-related activities

- A company may conduct different activities related to cryptocurrencies, including trading cryptocurrencies and operating exchanges for utility tokens and security tokens, and provide crypto liquidity services, or custody or storage for the digital assets, meeting the increasing demand for crypto-related financial services, not just through a cryptocurrency license but through a Banking License too.

Derivatives

- The license authorizes trading in derivatives, specifically Contracts for Difference (CFDs), allowing entities to offer products that enable clients to speculate price movements of various financial instruments without owning the underlying assets.

Excluded activities under the Anjouan Banking License

Restrictions on insurance and transportation services

- The Anjouan Offshore Banking License prohibits insurance service activities and businesses focused on air and sea transportation. These types of services require a different license that is specific to Anjouan law.

No public money raising or public offering of shares

- Licensed banks cannot invite the public to subscribe to shares, debentures, or any financial securities. The invitation to accept investments from the public is strictly prohibited without proper authorization.

Limiting the use of specific titles

- The use of words like “bank,” “financial institution,” “building society,” “savings,” or derivatives in company names or advertising without authorization and licensing is prohibited in order to prevent misrepresentation.

Unlicensed or illegal gambling activities

- Offshore Banking Licenses Anjouan do not permit banking services related to gambling, as gambling is illegal under Comorian law. Any banking institution involved in gambling could face license revocation and legal action.

Prohibition on issuing unsupported or fraudulent financial documents

- Issuing fictitious financial instruments is expressly prohibited in Anjouan, even where such instruments cannot be legally recognized, for example, letters of credit, guarantees, and other unspecified bank documents, and there is oversight of financial institutions acting contrary to these restrictions.

Regulatory authority for Anjouan Banking License

- The Anjouan Offshore Finance Authority (AOFA) is the regulatory body that licenses and regulates the Anjouan Banking License. AOFA was formed under Anjouan laws, which are defined as an Autonomous Island within the Union of the Comoros. The AOFA is responsible for regulating all financial institutions and offshore banking activity within its jurisdiction, ensuring that licensed banks operate within international regulatory guidelines while maintaining transparency, financial integrity, and data confidentiality.

- The AOFA manages licensing approvals, oversight, and monitoring of prudential requirements, and enforcement of reporting obligations. Additionally, the AOFA has the authority to review changes in ownership and impose penalties for non-compliance. The AOFA’s regulatory framework supports a business-friendly environment with tax concessions, strict privacy protections, and a seamless licensing system that makes Anjouan an ideal location for international financial institutions seeking an offshore banking jurisdiction.

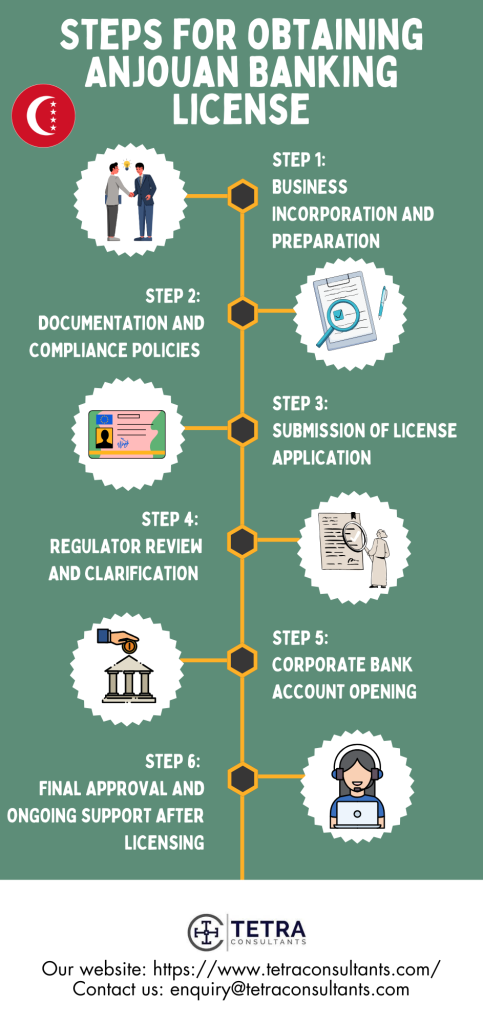

Steps for obtaining Anjouan Banking License

Step 1: Business incorporation and preparation

- Tetra Consultants will file your Anjouan International Business Company (IBC), which will take about 2 weeks. During this time, we prepare all the necessary documents needed for the licensing process.

- Additionally, we can also provide international trademark registration services for your company.

Step 2: Documentation and compliance policies

- Our legal team will draft a comprehensive business plan to meet your banking needs. They will also draft the AML/CFT policies you need, complete all the license application forms required by the Anjouan authorities, and submit them to the relevant authorities for processing.

Step 3: Submission of license application

- Following our confirmation that all operational and statutory requirements are satisfied, including company incorporation, documentation for compliance purposes, and establishment of governance policies, Tetra Consultants will submit a complete application for the Banking License to the regulator for review.

Step 4: Regulator review and clarification

- Our consultants will be in regular communication with the regulator throughout the review period and are able to respond to any questions that arise, provide further documentation if requested, and clarify all points in a timely manner to help the application process move smoothly.

Step 5: Corporate bank account opening

- At the same time, our banking team is reaching out to various local and international banks to find an appropriate banking partner for your company. Once we find a suitable bank to work with, we will assist with the corporate bank account opening, typically within 4 weeks.

Step 6: Final approval and ongoing support after licensing

- Once the Anjouan Banking License is granted by the regulator, Tetra Consultants will provide ongoing support after the licensing. This includes ongoing and continuous guidance on compliance, operational set-up support, and general advice on how to maintain good standing with the regulator.

Documents required for obtaining Anjouan Banking License

- Application form completed in duplicate

- Copy of articles of incorporation and company by-laws verified by affidavit of a resident director

- List of directors with names, addresses, citizenship, and residency

- List of shareholders with names and addresses

- List of officers and managers with their names and positions

- Names and addresses of legal representatives

- Names and addresses of auditors with confirmation letters

- Description of the company’s anticipated offshore banking activities

- Proof of fully paid-up capital or guarantee by a parent company

- Proof of deposit with the National Bank of Anjouan as required by the class of license

- Character references and criminal record clearance for all directors and officers

- Annual accounts for the last three years, audited by an independent auditor

- Statement of assets and liabilities certified by a director or officer

- List of all subsidiary companies and their registered addresses

- References including at least one from an internationally registered bank

- List of proposed non-resident customers if applying for a Class II license

- Passports, utility bills, and bank statements for directors and shareholders

- Draft AML and compliance policies

- Due diligence reports for directors and beneficiaries

Requirements for Anjouan Banking License

- A minimum share capital requirement of around £10,000, which is not required to be fully paid up at the time of application.

- At least one director of any nationality is required to direct and manage the company and ensure compliance with statutory obligations.

- At least one shareholder of any nationality is required, who holds ownership rights as well as control over the significant decisions of the company. Appointment of a compliance officer of any nationality who ensures compliance with statutory and regulatory obligations, Anti-Money Laundering (AML) policies and internal controls.

- All directors, shareholders, and the compliance officer must be fit, and proper individuals demonstrating integrity, financial soundness, and experience relevant to their responsibilities.

- A comprehensive business plan that includes intended banking activities, organizational governance structure, risk-related policies, and financial projections is required.

- A full Anti-Money Laundering (AML) and Know Your Customer (KYC) framework must be implemented and maintained in compliance with regulatory requirements.

- Independent audits on a regular basis, as well as recurring general financial and compliance reports to the appropriate regulatory body for ongoing monitoring, are required.

- A physical location or registered office may need to be established in Anjouan for purposes of regulatory contact and jurisdiction.

Cost of obtaining Anjouan Banking License

- Obtaining an Anjouan Banking License from Tetra Consultants, as spelled out in the pricing, will maintain a clear list of fees associated with licensing, with no hidden charges for the client. Fees generally covered in the process include the application fee for the initial application, the licensing fee based on the scope of the business, and the annual license renewal fee.

- Other fees could relate to compliance services or administration, but Tetra Consultants will inform the client of fees and will provide a detailed analysis before engagement. Price transparency, along with expert facilitation through the company registration, documentation, and licensing process, will ensure an easy, efficient, and cost-effective licensing experience for the client.

Why choose Tetra Consultants?

- When considering an Anjouan Banking License, Tetra Consultants is a highly recommended choice because of their experience and service package, which provides the entire range of support from selecting the jurisdiction and registering the company to preparing documents, obtaining the license, and providing ongoing compliance. Furthermore, Tetra Consultants’ transparent pricing means there are no hidden fees, and clients know all fees at the outset, eliminating any worries. Tetra Consultants also assist with regulatory communication, particularly for the economic substance requirement, which ensures an efficient and stress-free experience for international clients looking for credibility and access to the market.

Looking to obtain Anjouan Banking License

- Securing an Anjouan Banking License presents a strategic opportunity given its flexible regulatory environment, confidentiality provisions, and beneficial tax structure. Working with Tetra Consultants, clients receive professional support throughout the entire licensing process – from company registration to compliance support, providing clients with a seamless licensing process without bureaucratic delays. Tetra’s pricing transparency and personal service provide clients with an efficient partner for banking applications in this growing offshore jurisdiction. Engagement maximizes time and minimizes risk while enabling clients to access the global market.

- Contact us to know more about the Anjouan Banking License. Our team will revert within 24 hours.

FAQs

What is the minimum share capital required for an Anjouan Banking License?

Who can be appointed as directors and shareholders?

Is a compliance officer necessary?

What documents are needed for the application?

Are there annual compliance obligations?

Does the license allow for cryptocurrency activities?

What banking services are allowed?

Is physical presence required?