Compliance officer for Canada MSB license

- A Canada MSB compliance officer plays an essential role in the compliance of Money Services Businesses with Canada’s anti-money laundering and counter-terrorist financing (AML/CTF) laws in the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). According to FINTRAC, a compliance officer is responsible for implementing compliance programs, conducting risk assessments, and connecting with regulators as the primary contact. There are several international reports, including the World Bank, which reinforce the importance of strong AML frameworks, identifying countries such as Canada, who have strong frameworks purposely designed to protect their financial systems from criminal elements.

- For businesses looking for Canada company registration and operate as an MSB, Tetra Consultants provides expert guidance for the entire process, from ever-proper company incorporation all the way to appointing a qualified compliance officer, and designing a tailored compliance program, Tetra Consultants ensures its clients meet every step of the regulatory process. Our offerings further include training staff and ongoing compliance monitoring to ensure each Money Services Business operates in Canada with the utmost confidence by delivering support and clarity in a complicated regulatory environment.

Benefits of appointing Canada MSB compliance officer

Ensures regulatory compliance

- The compliance officer is the foundation of the MSB (money services business) regulatory compliance in Canada, in particular to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). The compliance officer is responsible for developing, implementing and maintaining AML/CTF policies, risk assessments, and procedures specific to the operations of the business.

- To assist with this activity, the compliance officer utilizes a proactive approach to ensure the MSB is meeting its reporting obligations and records retention under Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), while also reducing the possibility of receiving non-compliance penalties and/or legal action that could disrupt or shut down the business.

Acts as liaison to regulators

- The compliance officer is the official contact between the MSB and regulatory bodies (i.e., FINTRAC). Primarily reporting and submitting the necessary forms on time. The compliance officer is also the main point of contact for regulators in response to inquiries and or audits of activities.

- Having one official contact ensures that there is a single point of contact for reporting and responding. In addition, a dedicated contact who primarily communicates with regulators produces clear, concise, reliable and professional exchanges with regulators building trust over time, which will only help when the MSB is undergoing regulatory review or facing compliance issues.

Manages and mitigates risks

- Financial institutions face serious risks from money laundering and terrorist financing. The compliance officer is constantly monitoring activity, performing risk assessments, and identifying potential weaknesses in the operations of the MSB. By implementing controls and corrective action, the compliance officer is protecting the MSB from financial, reputational, and regulatory impacts that may flow from illicit activity moving through the MSB.

Keeps the MSB aligned with regulatory changes

- AML/CTF regulations are continually updated in response to new and emerging threats, and the compliance officer must keep current with these changes. The compliance officer will make changes to MSB’s policies, procedures, and training programs as required to maintain compliance. Establishing continuous monitoring of regulations will help to ensure that the MSB does not inadvertently breach new rules, as well as maintain a strong compliance position in a changing regulatory environment.

Simplifies compliance for MSBs

- Canada requires an MSB to appoint only one compliance officer who does not need to be a resident of Canada. This flexibility simplifies compliance requirements, particularly for foreign businesses considering entry into the Canadian market by reducing administrative burdens and costs, when compared to jurisdictions where compliance officer requirements are more cumbersome such as multiple compliance officers and Canadian resident requirements. Thus, Canada is a desirable jurisdiction for MSBs.

Facilitates banking and business operations

- The types of banking services the bank or financial institution expects from the MSB may require the MSB to have an impressive compliance framework before offering basic banking services to the MSB. If the MSB has a competent compliance officer, it provides reassurance to the bank or financial institution that the MSB is monitoring its operations and following strict regulatory standards, which may allow them to open an account, process payments, and other banking services. Successful banking operations support the MSB’s chances for a smooth operation every day, maintaining and building credibility with its payment/supply partners and clients.

Supports the development of a strong compliance program

- The compliance officer leads the development of the MSB’s compliance program that suits the MSB by, among other things, developing a risk assessment, booking appropriate internal controls, and training employees. A strong compliance program and regulatory expectations ensures that all employees are aware of their obligations in relation to the MSB’s AML/CTF activities, and that operations comply with the MSB’s regulatory expectations. A structured compliance program also helps to increase operational efficiencies, reduce errors, and contribute to operation integrity.

Who should appoint Canada MSB compliance officer?

- Every Money Services Business (MSB) operating in, or offering services in, Canada must appoint a compliance officer to comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). This applies to local Canadian MSBs as well as foreign MSBs looking to register and operate in Canada. The compliance officer is legally accountable for administering the MSB’s AML/CTF compliance program and acts as the primary liaison with FINTRAC, Canada’s financial intelligence unit.

Following entities must appoint a compliance officer:

All Money Services Businesses (MSBs) conducting business in Canada

- Any MSB that has a physical presence, employees, agents, or branches in Canada must designate a compliance officer for overseeing AML/CTF compliance and for managing regulatory obligations.

Local Canadian MSBs

- Canadian incorporated MSBs or those who have a physical presence in Canada are required to designate a compliance officer by FINTRAC. The compliance officer must be well-versed with respect to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and corresponding regulations.

Foreign MSBs providing services in Canada

- Even if a foreign MSB is not incorporated or physically present in Canada, it must designate a compliance officer in order to receive FINTRAC approval for Canada MSB license. The compliance officer can be located outside of Canada, but they need to have knowledge of Canadian AML laws.

Entities that are registering a company in Canada as an MSB

- Any business that is registering a company in Canada for MSB activities must designate a compliance officer as part of the required compliance program of FINTRAC.

Entities that will have reporting obligations under Canadian AML/CTF laws

- MSBs that engage in money transfers, foreign exchange, or issue negotiable instruments above a threshold must designate a compliance officer responsible for compliance and reporting to FINTRAC.

Eligibility for Canada MSB compliance officer

Knowledge of Canadian AML/CTF legislation

- The compliance officer must have a knowledge of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and related regulations in order to implement and manage the compliance program.

- The compliance officer should have adequate authority and access to senior management or the board to carry out compliance policies and make changes as needed.

Authority and access to senior management

- The compliance officer should have adequate authority and access to senior management or the board to carry out compliance policies and make changes as needed.

Familiarity with the MSB’s business activities

- Knowledge of the MSB’s corporate structure, activities and sector related money laundering and terrorist financing risk criteria is vital to successfully manage compliance.

Can be an owner, director or senior manager

- A compliance officer can be the owner, director, senior manager or other appointed person, such as an output consultant, if they have the knowledge and authority to act.

Physical presence in Canada is not a requirement

- The compliance officer does not need to reside in Canada, but must be able to perform their duties effectively, including communicating with FINTRAC.

Independent from operational roles

- In larger businesses, it is preferable and recommended that compliance officers are not operationally involved in the receipt, transfer or payment of funds so they can have independent oversight.

Canada MSB compliance officer assistance

Certified expertise for active and dormant money services businesses

- Tetra Consultants provides full service outsourced compliance officer services for dormant and active Canadian MSBs. All of our compliance officers are Certified Anti Money Laundering Specialist (CAMS) and Certified Crypto Asset AFC Specialist (CCAS) with 5+ years’ experience in the industry. This is to verify that your compliance department is in safe hands and can ensure that all regulatory requirements can be met by the regulator.

For Dormant MSB

- We can submit your company’s name to FINTRAC, provide full guidance on establishing a robust compliance system, and act as the compliance officer for the interim. Our team will even attend interviews with the bank if needed.

For Active MSB

- We will design our compliance officer service to suit your individual MSB as a client. An example of what to expect: KYC checks, ongoing transaction monitoring and all AML/CFT regulation compliance. We will facilitate audits of your company and all alternate reporting obligations to ensure your money service business is fully compliant.

- Minimum engagement is 3 months. Engagement initiation begins on the submission date to FINTRAC.

Services offered by Tetra Consultants Canada MSB compliance officer

- Create, implement, and keep effective AML/CTF compliance measures for the MSB in its business.

- Create written compliance policies and procedures that meet the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA).

- Create and maintain a risk assessment framework that recognizes products, clients, delivery channels, geography, and business relationships as contributing factors.

- Introduce and continue to maintain an ongoing AML/CTF compliance training program for staff and agents.

- Establish effective records keeping modalities to identify and retain all required documentation.

- Conduct in-house audits and engage independent third parties to assess the effectiveness of the AML/CTF programs.

- Ensure compliance with all reporting obligations under the PCMLTFA, including:

- Large Cash Transaction Reports (LCTRs)

- Electronic Funds Transfer Reports (EFTRs)

- Suspicious Transaction Reports (STRs)

- Terrorist Property Reports (TPRs)

- Large Virtual Currency Transaction Reports

- Identify and assess money laundering and terrorist financing risks in all areas of the MSB’s operations.

- Ensure that appropriate client identification and verification processes during onboarding and transactions are established and adhered to.

- Implement enhanced due diligence (EDD) measures for clients considered high risk.

- Provide regular AML/CTF training to employees and agents to ensure there is an understanding of compliance responsibilities.

- Ensure staff understand their responsibilities with respect to identifying and reporting suspicious activities.

- Arrange for an independent review of the AML/CTF compliance program at least once every two years, or more frequently depending on the risk.

- Keep accurate records of client identity and verification information.

- Maintain transaction records for all MSB activities, and especially for transactions equal to or above CA$3,000.

- Retain internal compliance reports and any external compliance reports as required by law.

- Maintain records for a minimum of five years, as required by FINTRAC.

- Serve as the single point of contact with FINTRAC in preparing all reporting, identifying all audits and compliance reviews, and management of regulatory investigations.

- Act on and respond to any findings resulting from FINTRAC compliance examinations.

- File updates with FINTRAC on any changes to the MSB’s registration information (such as changes to the ownership of the MSB, new business activities, or an agent network).

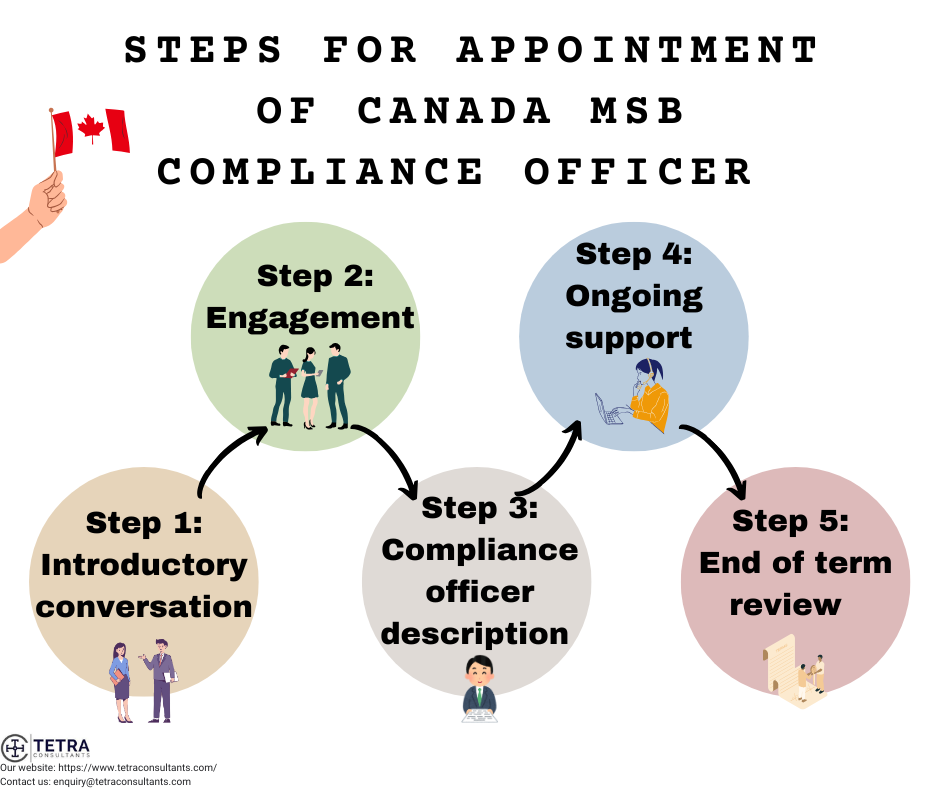

Steps for appointment of Canada MSB compliance officer

Step 1: Introductory conversation

- At Tetra Consultants, we first try to understand your business model, the extent and types of MSB activities (i.e. foreign exchange, money transfer, virtual currency), and your compliance responsibilities as a reporting entity to FINTRAC and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). During this introductory discussion, we will also summarize your key compliance issues and provide some comments about how a dedicated compliance officer can help you meet regulatory expectations while incorporating your operational parameters. This allows us to provide a proposal that clearly meets those objectives.

Step 2: Engagement

- When you are comfortable with our proposed approach, we will move into a formal engagement. Tetra Consultant will provide an appointment letter and invoice that clearly describes the terms of the engagement and meets FINTRAC expectations. This formal step will begin our onboarding process by preparing documentation and resources to develop your MSB compliance framework from the very beginning.

Step 3: Compliance officer description

- After the engagement is confirmed, we will provide the professional profile of the proposed compliance officer, including their CV, qualifications, and previous MSB, or AML/CTF experience. All candidates undergo a due diligence process to adhere to FINTRAC requirements and to demonstrate knowledge of AML laws in Canada, risk-based compliance, and internal controls. You will have a chance to examine their background, request more information, or even review different profiles, in consideration of your preferences.

Step 4: Ongoing support

- During the appointment, your engaged compliance officer will actively maintain your MSB’s compliance with AML/CTF. The officer will conduct regular risk assessments, update your compliance program, carry out transaction monitoring, and review your client due diligence and record keeping in accordance with FINTRAC requirements. Tetra Consultants’ support team will work behind the scenes with the officer to ensure your compliance with reporting requirements, training sessions, internal audits, as well as the monitoring of ongoing regulatory updates, all to ensure complete compliance from start to finish.

Step 5: End of term review

- As we reach the end of the engagement period, Tetra Consultants will review and evaluate the performance of the compliance officer, and, ultimately, get your feedback on the officer’s role and overall contribution. We will then determine if you wish to renew the engagement, increase the level of support, or hand over compliance responsibilities to a staff member in-house. If you want to renew the engagement, we will make the renewal process completely seamless. Conversely, if you do not choose to keep the engagement, we perform a full handover to you, so there is no risk of you losing continuity in compliance.

Cost for appointment of Canada MSB compliance officer

- When you retain Tetra Consultants for appointing a Canada MSB compliance officer, the fees generally cover much more than just recruitment. These services can include the initial review of your business compliance requirements, drafting and reviewing compliance policies, developing customized AML/CTF programs that comply with FINTRAC, and business advisory services, designed and coordinated on the basis of your unique circumstances. Tetra Consultants also provides a full range of recruitment process support, which includes screening documents, conducting interviews, negotiating terms of employment to have a qualified person, and matching candidates that have the required knowledge and skill sets for the role of compliance officer.

- The fees also generally cover ongoing advisory service that includes compliance training programs, risk assessments, and material changes to the compliance framework to reflect changes in regulation. Also, for clients to register company in Canada, Tetra Consultants offers a bundled option of services including offshore company incorporation, regulatory compliance consulting services, and corporate bank account opening services together with compliance officer appointment services. The fact that Tetra Consultants takes a holistic approach to regulatory compliance and corporate governance measures for a MSB up front will ensure that the established compliance requirements become the foundation for long-term and sustainable local operations within Canada’s strict AML/CTF regulated environment.

Why choose Tetra Consultants?

- Hiring Tetra Consultants to appoint a Canada MSB compliance officer can provide unique advantages, simply because of our extensive knowledge and holistic service model. Our team of licensing experts knows the labyrinth that is Canada’s AML/CTF framework and appreciate the vital role a compliance officer plays in managing risk and ensuring regulatory adherence. Tetra Consultants experts provide a complete service support, ranging from the process of identifying, screening, recruiting and appointing a highly skilled compliance officer with the right skills and experience, to developing a tailored compliance Program that adheres to FINTRAC and all requirements.

- Tetra Consultants recruits’ compliance officers and assumes all aspects of administration and HR for the appointment process, such as drafting job descriptions, facilitating the interview process, through to the final stage of negotiating terms of employment, ultimately maximizing the time and resources of our clients.

- We do not only provide the recruiting service to employers we provide the full suite of services for starting or growing a MSB business in Canada. All this makes it easy for MSBs looking to set-up or expand their business in Canada. This holistic approach ensures clients not only comply with the regulatory requirements, but also successfully establish a sustainable and compliant business in Canada’s highly regulated financial industry.

Looking to appoint Canada MSB compliance officer

- Contact us to know more about Canada MSB compliance officer and our team will get back to you in 24 hours.

FAQ

Who needs to appoint a Canada MSB compliance officer?

Can a foreign MSB appoint a compliance officer based outside of Canada?

What qualifications should a Canada MSB compliance officer have?

What services does Tetra Consultants offer for MSB compliance officers?

Do I need to elect a compliance officer if I want to register an MSB company in Canada?

What does a compliance officer for a Canada MSB do?

Does every MSB in Canada have to appoint a compliance officer?

Does the compliance officer have to live in Canada?

How do compliance officers assist with banking?