Costa Rica crypto license

- The Costa Rica crypto license is becoming more popular because of the country’s progressive regulatory framework, rapid expansion of the digital asset space, and, in 2026, there will be an estimated 567,000 total active digital asset users, and the market value is projected to reach almost US$20.3 million in 2025.

- Costa Rica has not demonstrated a strong inclination to regulate cryptocurrencies with legislation, however, businesses engaged in cryptocurrency must comply with existing financial legislation, which requires some substantial anti-money laundering (AML) and counter terrorist financing (CTF) protocols.

- Costa Rica’s political climate is very stable, it has a great technology base, and it does not tax capital gains on cryptocurrency transactions, making it attractive to blockchain entrepreneurs.

- Engaging with Tetra Consultants to obtain a cryptocurrency license, whether it may be for exchanges and/or for wallet services, will take some planning and knowledge about compliance requirements in your jurisdiction. Tetra Consultants’ process offers company registration, documentation, and corporate bank account opening.

- We have substantial experience as it relates to maintaining long-term AML/KYC compliance, operational disclosure, regulatory relationships, and partnering with foreign agents.

Benefits of Costa Rica crypto license

Favorable tax implications

- Costa Rica does not impose capital gains tax on cryptocurrency transactions. Moreover, its territorial tax system will only tax local income, allowing international crypto businesses to significantly reduce their tax liability and operate at maximum efficiency.

Fast and simple incorporation

- The incorporation process is very fast, simple, and inexpensive. Costa Rica has minimal limits, which creates a lower barrier to entry for start-ups and international companies.

Regulation supportive of growth

- The regulatory environment in Costa Rica is permissive and generally supportive of innovation, with few obstacles to entry. Businesses can legally offer cryptocurrencies under general commercial laws without being restrained to a license requirement like in other parts of the world.

Operational freedom

- Crypto companies in Costa Rica can conduct activities such as exchange, storage, NFT, GameFi, and even gambling without getting separate licenses for each, promoting a flexible and adaptable business model.

Friendly business environment

- Costa Rica is known for political stability, strong legal protections, developed telecoms infrastructure, and a bank that are becoming increasingly friendly to crypto businesses, and these conditions are vital for long-term growth and international growth.

Minimal financial reporting requirements

- Crypto companies are not subject to audits and do not have to submit financial reports on a regular basis, making continued compliance easier and lowering costs.

Timeline for obtaining Costa Rica crypto license

- The timeline to obtain a Costa Rica crypto license with Tetra Consultants is structured in clear stages. The incorporation of your company and document preparation will take roughly 1 week. Once your operational and statutory requirements are established, your license application will be submitted to the regulators for review. We complete this step efficiently to address any comments the regulators may have quickly, to not cause delays.

- Our team will proactively interact with local and international banks to secure interest from these banks and finalize a bank account accordingly. The banking team provides information to help you assess which bank might suit your needs, based on minimum deposits, travel requirements, and internet banking facilities. A corporate bank account is expected to take roughly 4 weeks to open. The entire exercise provides an efficient route towards obtaining regulatory approval in Costa Rica.

Regulatory authority for Costa Rica crypto license

- Costa Rica’s primary regulatory authority for the purposes of obtaining a crypto license is the Superintendencia General de Entidades Financieras (SUGEF). As of now, Costa Rica does not have a distinct crypto licensing regime as of 2025; in practice, crypto companies are regulated in accordance with general financial laws, such as the Anti-Money Laundering Act (Law No. 7786) and the regulations for terrorist financing. Bill 22-837 and Bill 23-415 (Crypto assets Market Law) are recent legislative proposals that form a comprehensive framework for virtual asset service providers (VASPs) to be registered and compliant with SUGEF, particularly focused on AML and KYC requirements, and adherent to various FATF recommendations.

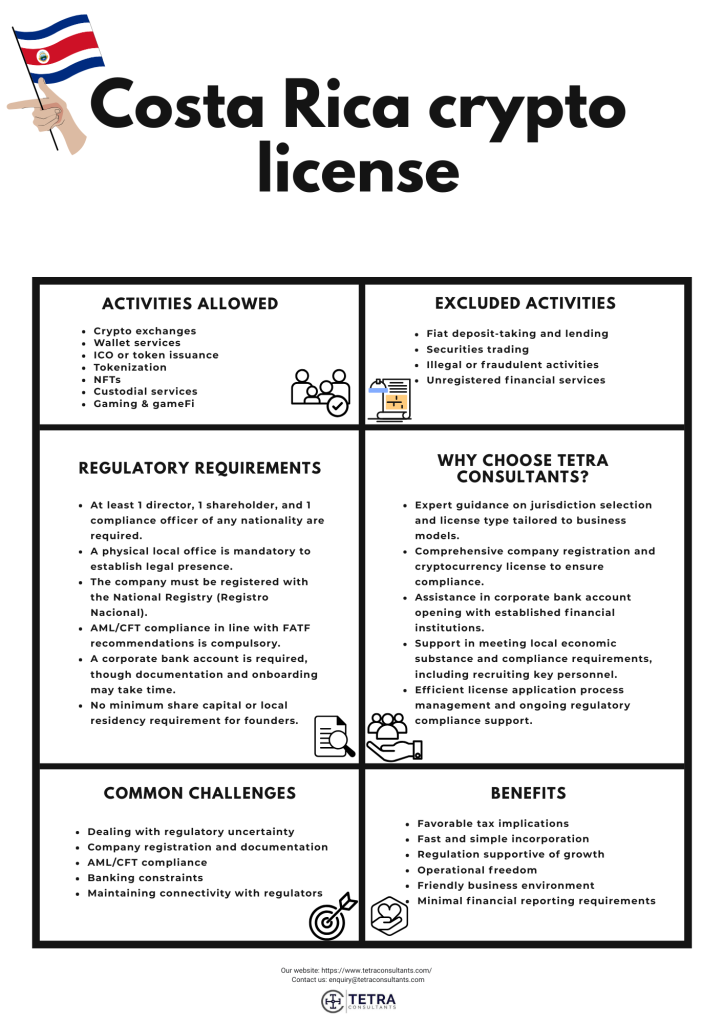

Activities allowed in Costa Rica crypto license

Costa Rica’s crypto-friendly framework provides a wide array of activities for companies with a crypto license or suitable registration embedded in local law. The activities that are allowed include:

Crypto exchanges:

- Setting up platforms for crypto-to-crypto and crypto-to-fiat exchanges is allowed as long as businesses do not violate the anti-money laundering procedures and do not violate any general commercial law.

Wallet services:

- Providing custodial and non-custodial (wallet) services is allowed, although there are some compliance obligations consistent with the standards imposed on financial operators.

ICO or token issuance:

- Projects can launch ICO or ITO and token issuances as long as the person who issues the tokens does not consider the tokens to be securities. Otherwise, SUGEF registration is required.

Tokenization:

- It is legal to tokenize real-world or digital assets into blockchain-based tokens, for example, for payment or fractional ownership.

NFTs:

- Minting NFTs and conducting marketplace operations are permitted, however, there have been increasing amounts of use cases for digital collectibles, art, and GameFi projects.

Custodial services:

- There are clients’ crypto assets custodial services that are permitted to both individuals and institutions with the recommended AML controls in place.

Gaming & gameFi:

- Crypto gambling, GameFi, and web3 game platforms are allowed and there is great opportunity within Costa Rica’s established framework of gaming businesses.

Excluded activities in Costa Rica crypto license

- Excluded activities under the Costa Rica crypto license are defined by general legal and financial statutes, regardless of the absence of a specialized crypto law.

Fiat deposit-taking and lending:

- Accepting deposits or making loans in fiat must have a banking license in a traditional manner, it is prohibited under the crypto license.

Securities trading:

- Securities trading type activities (e.g., any token defined as a security) must comply with Costa Rican securities laws. If you do not get registered and complain, these activities are excluded.

Illegal or fraudulent activities:

- Any business activity that has money laundering, terrorist financing, or illegal online gambling potential is not permitted, nor should one want to go down that road. The criminal penalties for AML/CFT violations can be severe.

Unregistered financial services:

- Operating financial activities that require registration with SUGEF or other authorities without proper authorization is not allowed.

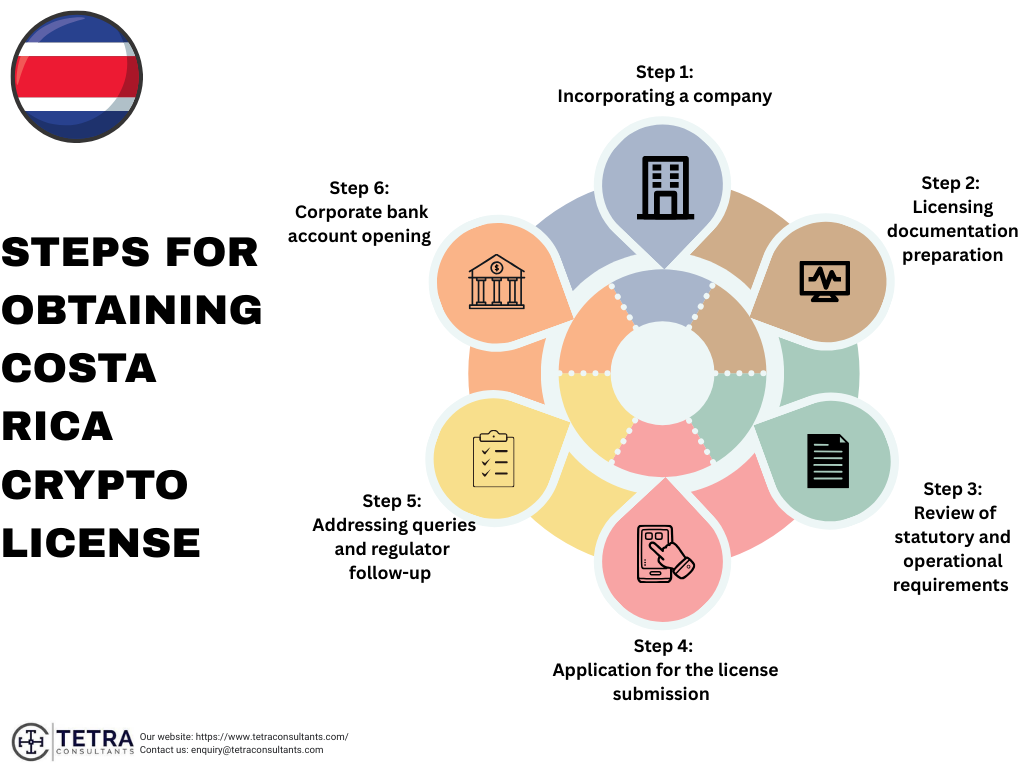

Steps for obtaining Costa Rica crypto license

Step 1: Incorporating a company

- Tetra Consultants will begin by helping you to incorporate a Costa Rica company, which is needed to apply for the crypto license. Our legal and corporate services lawyers will complete the registration of your company by obtaining all statutory documents and registering with the required authorities. Our approach is efficient, so we expect that your company will be registered within one week and fully compliant local entity.

Step 2: Licensing documentation preparation

- Once your company is formed, our legal team will prepare and draft the relevant documentation for your crypto licensing application, which involves pre-filling application forms, drafting corporate resolutions, and ensuring compliance with any regulatory requirements. By utilizing our knowledge, base of experience, and knowledge of Costa Rica’s licensing structure, we will make sure that all documents are accurate and prepared for submission, maximizing the chance for no delays or outright rejection by regulators.

Step 3: Review of statutory and operational requirements

- Prior to submission, Tetra Consultants will engage with you to review and finalize all operational and statutory requirements as mandated by local Costa Rican Authorities. Further, we will ensure that the business model, corporate governance structure, and compliance framework align with the regulators’ expectations.

- Our consultants will provide clear steps in aligning your operations with the local laws so that public consultation will be seamless, and we will be ready for the steps leading to licensing.

Step 4: Application for the license submission

- Once all the requirements have been established, Tetra Consultants will submit your crypto license application to the relevant authorities in Costa Rica. We will act as your point of contact with the regulators, so your application goes through an intense review with as little delay as possible.

- In the event that the regulators have any questions or clarifications, we will coordinate contact with them on your behalf, as best we can, at a time to react and answer, while transparency remains.

Step 5: Addressing queries and regulator follow-up

- Regulators may raise queries or ask for further documentation during the evaluation phase. Tetra Consultants will fully assist you in resolving these queries by preparing the explanations, documents or compliance changes. Our legal and compliance team will continue to engage until these queries from regulators are all resolved, and the application has the greatest chance of being approved.

Step 6: Corporate bank account opening

- Alongside the licensing stages, our banking team will simultaneously begin discussions with local and international banks to open a corporate bank account for your business. We will prepare a comparison table that illustrates banks that have expressed interest and what they need from you for your corporate bank account, minimum deposits, online banking capabilities, travel obligations, and how they deal with client funds. When you select the preferred bank, we will manage the whole application and onboarding process for your corporate account and aim for it to be opened within four weeks.

Cost for obtaining Costa Rica crypto license

- At Tetra Consultants, we are fully transparent when we facilitate the acquisition of a Costa Rica crypto license so that you are informed of all costs from the start, these fees can be broken down into; government filing fees, company incorporation fees, license application fees, compliance costs, corporate bank account opening fees, etc. Our pricing structure is available clearly with no surprises, so you can budget accordingly. We promote fairness and accountability, so our clients get value-added services and maximum clarity during the licensing process.

Regulatory requirements for Costa Rica crypto license

- At least 1 director, 1 shareholder, and 1 compliance officer of any nationality are required for company formation under Costa Rica’s crypto license framework.

- A physical local office is mandatory to establish a legal presence in Costa Rica and satisfy regulatory expectations.

- The company must register as a legal entity with the National Registry (Registro Nacional).

- Compliance with anti-money laundering (AML) and counter-terrorist financing (CFT) policies aligned with FATF recommendations is obligatory.

- Corporate bank account opening is essential for conducting financial transactions.

- No minimum share capital requirement or local residency is enforced for founders.

Common challenges in obtaining a Costa Rica crypto license

Dealing with regulatory uncertainty

- Costa Rica does not have specific crypto-related laws, meaning legal compliance may be murky. Tetra Consultants provides a clear analysis of uncertain regulations and helps structure a compliance framework according to your needs.

Company registration and documentation

- Finalizing company registration and drafting solid legal documents can be daunting. Tetra Consultants incorporates and drafts policies, terms of service, compliance manuals, etc, quickly and efficiently.

AML/CFT compliance

- It is difficult to comply with FATF-aligned anti-money laundering and counter-terror financing standards. Tetra Consultants helps you implement stringent AML/CFT programs to remain compliant and diminish risk.

Banking constraints

- The corporate banking accounts for crypto businesses are always subject to scrutiny and delays. Tetra Consultants can utilize their bank network and documentation preparation to develop parent bank onboarding.

Maintaining connectivity with regulators

- Communicating with regulators and keeping up to date with laws and regulations is important. Tetra Consultants offers case-specific ongoing working relations to help keep your business compliant and model your business structure to be proactive about regulatory changes.

Why choose Tetra Consultants?

- Hiring Tetra Consultants guarantees a hassle-free and seamless process of acquiring a Costa Rica crypto license. We provide specialized guidance that is custom-suited to the specific needs and business models of cryptocurrency projects, ensuring clients get an intuitive sense of local regulations and requirements from the very beginning.

- Tetra Consultants takes care of company registration, compliance documentation, and coordination with regulatory bodies, reducing delays and inefficiency. Our skilled team delivers constant assistance with AML/CFT compliance, corporate bank account opening, and regulatory news. With an all-encompassing approach, we streamline intricate legal processes, ensuring the best possible chances of successful licensing.

- This expert service equips clients with peace of mind to concentrate on business expansion, supported by Tetra Consultants’ trusted expertise in Costa Rica’s crypto landscape.

- Key reasons to choose Tetra Consultants:

- Expert guidance on jurisdiction selection and license type tailored to business models.

- Comprehensive company registration and offshore financial licenses services as required for compliance.

- Assistance in corporate bank account opening with established financial institutions.

- Support in meeting local economic substance and compliance requirements, including recruiting key personnel.

- Efficient license application process management and ongoing regulatory compliance support.

Conclusion

- Costa Rica is well positioned for launching a crypto business allowing firms to operate within a political stable and flexible regulatory framework. Costa Rica further allows for crypto businesses to operate legally without needing a specific crypto license, while satisfying any overall financial laws or AML/CFT laws.

- Tetra Consultants will help you through the licensing process, including ensuring good registration of the company, regulatory compliance consulting, and banking and with the support of Tetra Consultants you share risk and shorten the time to market as your partner to licensing the business in an efficient manner that is compliant and in a meaningful way that allows you to license, register, and incorporate as well as to comply with the local legal requirements.

- Contact us to know more about the Costa Rica crypto license, and our team will get back with you in 24 hours.

FAQs

What specific license is required for operating a crypto exchange in Costa Rica?

Is a local physical office mandatory for a crypto company in Costa Rica?

Are there capital requirements for crypto company registration?

What anti-money laundering (AML) standards apply?

Can foreign nationals be directors or shareholders?