Costa Rica crypto-authorized company set up

- Costa Rica crypto-authorized company set up is rapidly growing in popularity for fintech entrepreneurs and blockchain founders, as Costa Rica is emerging as one of the go-to locations for digital asset companies. In recent years, there have been more foreign-owned startups because of the low regulatory hurdles, and 2025 alone saw over 7,000 companies established in the country, spanning blockchain, gaming, and fintech.

- If you are looking for a Costa Rica company set up for virtual asset services, then the process is relatively straightforward. The jurisdiction allows founders flexibility in structuring their operations. This regulatory and corporate environment makes it possible to establish either a crypto-friendly or fully crypto-focused business in Costa Rica with relative ease.

- Despite the structure of Costa Rica Crypto license framework being less rigid than European Union policies and other major offshore financial centers, compliant entities would be able to conduct business legally if they were to follow anti-money laundering guidelines and general business laws. These unique features, as well as favorable tax conditions and a rapidly growing digital economy, create favorable conditions for strong crypto projects that would be likely to scale.

- From start to finish, Tetra Consultants will assist with each step in the process of establishing a crypto-authorized company in Costa Rica. We will take care of registering the new company, documentation, and establishing the required bank account, as well as managing AML/CFT compliance processes, and providing clients with guidance on local substance requirements. Our experts will help you navigate the smooth registration process, giving you peace of mind that your new business can grow and operate with a full understanding of the regulatory obligations it faces.

- Our services include:

- Costa Rica company registration

- Registered office address services

- Costa Rica Crypto Authorization application

- Preparation of business plan and AML/CFT policy

- Corporate bank account opening

Benefits of a Costa Rica crypto-authorized company set up

No regulations specific to cryptocurrency

- The Costa Rican government has no laws specifically addressing cryptocurrency yet, giving a crypto company the opportunity to operate as a corporation under standard corporate provisions and financial regulations. This allows for entry into the market without any agonizing or a lengthy, thorough approach to strict regulation.

Cost effective and quick incorporation

- Company registration is very quick, and entrepreneurs do not need to install complex arrangements for local directors or shareholders, and no minimum share capital exists. Entrepreneurs can complete the establishment and conduct commerce operations, allowing them to quickly enter the market.

Liberal business environment

- Businesses are free to participate in many activities including crypto trading, NFT platforms, and gaming, without needing to be licensed. This freedom opens the door for innovation and experimentation with new financial products.

Favorable tax system

- In Costa Rica, businesses pay tax only on profits made in Costa Rica, and profits made elsewhere are not generally taxed. For businesses that are doing crypto operations focused on a global market, this opens the door to a great deal of tax efficiency. Thus, Costa Rica is a favorable domicile for businesses with international ventures.

Minimal reporting and compliance burden

- Most cryptocurrency-licensed corporations are not subject to any mandatory audit or financial reporting obligations. This minimizes ongoing administrative complexity and costs of operations.

Political and economic stability

- The country is politically stable and has a well-developed technological infrastructure and an internationally acceptable approach to foreign investment, which enables companies to feel confident in their operational base over the long term.

Protection of assets and privacy

- Local laws offer excellent privacy for shareholders and beneficial owners, and there is no public registry containing company information. This allows confidentiality and asset protection for founders and investors.

Timeline for the Costa Rica crypto-authorized company set up

- The timeline for registering a Costa Rica crypto-authorized company is efficient and set up to allow the transition from incorporation to operations to happen quickly. We process the company registration in approximately 1 week and then finalize the preparation of the license application documents. When the statutory and operational requirements are in place, we submit the application to the regulators for approval and assist you through the review process.

- Simultaneously, we work with several banks to match the best corporate banking solutions available to you, and once they are selected, we will assist you in opening the account. The entire process of registering your company and getting a corporate bank account will usually take 4 weeks, depending on regulatory reviews and additional formalities.

Activities allowed under the Costa Rica crypto-authorized company

Cryptocurrency exchanges:

- Companies that facilitate currency exchange between cryptocurrency and cryptocurrency or cryptocurrency and fiat are allowed within the framework of AML and common commercial laws.

Wallet service providers:

- Custodial wallet and non-custodial wallet services are both permitted as long as they meet AML and CFT regulation standards to safeguard client money.

ICO and token issuance:

- ICO process and token issuance are permissible as long as tokens are not deemed securities per Costa Rica’s law.

Tokenization:

- Using blockchain to create tokens ostensibly for the purposes of providing fractional ownership or payment for either physical or digital assets will meet the criteria for being legal.

NFTs:

- Minting and trading Non-Fungible Tokens (NFTs) including digital art and collectibles, and operating NFT marketplaces are completely permitted.

Custodial services:

- Companies can provide custody services over crypto assets to individuals and institutions and apply suggested AML controls.

Gaming and GameFi:

- Crypto gambling, GameFi, and Web3 gaming platforms are allowed under Costa Rica’s existing gaming regulatory framework.

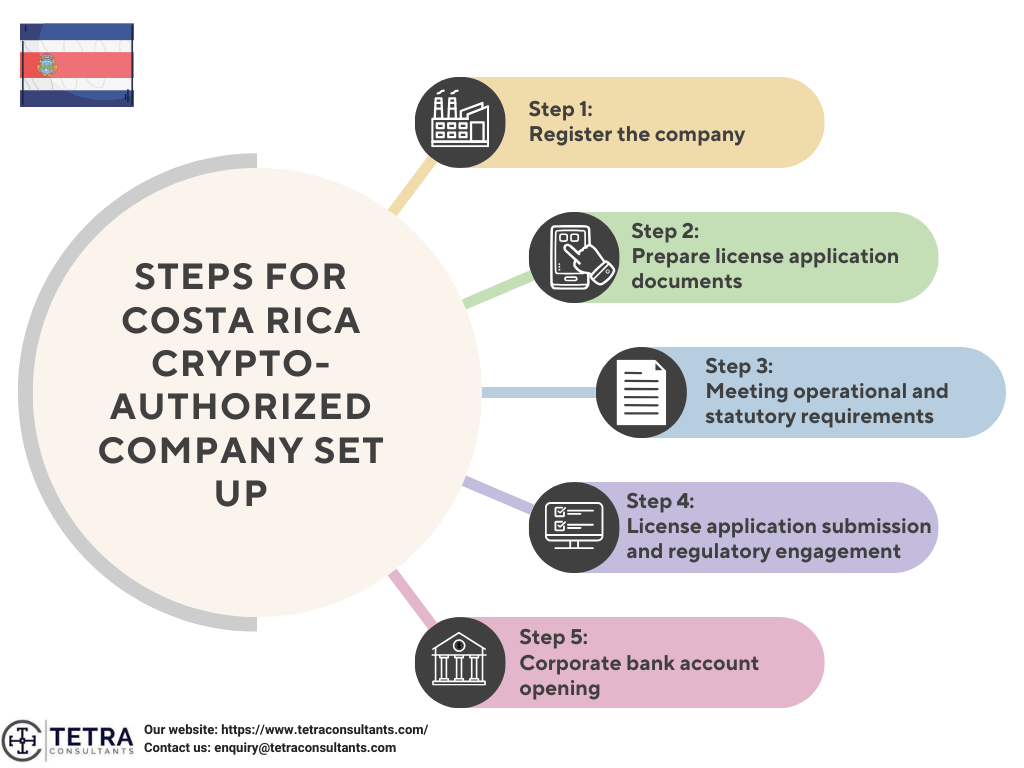

Steps for Costa Rica crypto-authorized company set up

Step 1: Register the company

- Initially, we will start by helping you to register your Costa Rica company and file the necessary paperwork. Generally, it takes around 1 week to incorporate the company, so you will be able to start operating relatively quickly.

Step 2: Prepare license application documents

- Our legal team will draft and pre-fill the license application forms for your company. We will ensure all necessary information is recorded accurately to satisfy regulatory requirements and avoid delays in obtaining your operating license.

Step 3: Meeting operational and statutory requirements

- Further, we help you set up the operational and statutory requirements for the license application. Our team helps you ensure your company is compliant with local regulations and is ready for submission.

Step 4: License application submission and regulatory engagement

- Once you are fully set up, we will submit the application to the regulators to get your license. We actively monitor the process and assist with responding to any queries or issues that may arise from the authorities during the review stage.

Step 5: Corporate bank account opening

- At the same time, we engage multiple local and international banks to express interest in taking you as a client. We summarize a table of banks to include details such as minimum deposits, travel requirements, internet banking, and how they handle customer funds. Once chosen, we will provide assistance during the account opening process so that you can open a corporate bank account within approximately 4 weeks.

Regulatory requirements for a Costa Rica crypto-authorized company set up

- Apply for a legal entity with the Costa Rican National Registry, which includes designing and filing the Articles of Association and details about shareholders.

- The company name must be unique, and the corporate documents must outline the business activities of the company, including crypto-related activities.

- A registered office address in Costa Rica for legal compliance purposes and official communication.

- Create AML/CFT procedures in compliance with international standards, even if there is no crypto licensing framework in place.

- A corporate bank account opening in Costa Rica to facilitate financial transactions for the business. Opening a bank account may require additional compliance due to the crypto activities, which may lead to further scrutiny.

- Maintain tax registration and follow the territorial tax principle, which taxes only income sourced in Costa Rica.

- Keep the company’s registries and the company’s ownership private, as Costa Rica does not publicly disclose beneficial ownership.

- Comply with general financial and corporate regulations, as there is no specific legislation for crypto.

Documents required for the Costa Rica crypto-authorized company set up

- Articles of Incorporation (Company Charter)

- Notarized copies of the passports of the Shareholder and the Director

- Proof of registered office address in Costa Rica

- Business description including crypto-related activities

- Proof of source of funds and business plan (for KYC/AML compliance)

- Shareholders register and share certificates (if applicable)

- Compliance policies such as AML/CFT guidelines

- Bank reference letter (sometimes requested for bank account opening)

- Tax identification application documents

Cost for a Costa Rica crypto-authorized company set up

- At Tetra Consultants, we believe that transparency is important and that the process of a Costa Rica licensed crypto company formation should be hassle-free. We will outline all the applicable fees so you will not have any surprises along the way. The associated costs will be for registration of your company, legal and documentation costs for preparing and submitting the license application, and government fees. There would also be costs for completing the statutory requirements and supporting compliance during the process.

- Additionally, bank-related charges such as account opening fees, minimum deposits, and other service charges are also communicated clearly. When we explain any fees, they are explained in advance of the investment, so you can plan your investment without worrying about hidden costs or surprises. We want you to have trust and clarity.

Why choose Tetra Consultants?

- Tetra Consultants stands out as a trusted partner for company formation due to our comprehensive and client-centric approach. We offer end-to-end solutions, including offshore company incorporation, corporate bank account opening, and regulatory compliance consulting, ensuring a smooth and efficient setup process.

- Our global network of experts provides personalized guidance tailored to each client’s business model and jurisdictional requirements. By minimizing the need for clients to travel and managing all local formalities, Tetra Consultants allows businesses to focus on growth without administrative hassles. Our commitment to transparency, timely communication, and deep regulatory knowledge makes us a preferred choice for entrepreneurs seeking reliable corporate services.

Key aspects of choosing us include:

- Comprehensive, end-to-end support from company registration to compliance.

- Expertise in crypto regulatory environments ensuring tailored advice.

- Strong global banking relationships aiding swift corporate bank account opening.

- Transparent pricing with no hidden fees or surprises.

- Efficient handling of all local formalities remotely without the need to travel.

- Dedicated client service with timely communication and updates.

- Proven track record across multiple jurisdictions including crypto and fintech sectors.

Conclusion

- Costa Rica cryptocurrency business registration provides an easy cost effective opportunity for entrepreneurs to enter the digital assets space. With a good tax regime and minimal barriers to entry, registering a cryptocurrency business in Costa Rica allows companies to flexibly operate under general corporate law while remaining compliant with AML/CFT policies.

- From Tetra Consultants’ perspective, we will do our best to facilitate the registration process throughout. We make sure that our clients legally and operationally comply with all local regulations. Our clients leverage our experience to receive whole process support from incorporation to bank account opening, so they have the freedom to grow their crypto businesses with peace of mind and confidence that they are compliant.

- Contact us to know more about the Costa Rica Crypto authorized company set up, and we will revert within 24 hours.

FAQs

What is a Costa Rica crypto-authorized company set up?

Can nonresidents set up a cryptocurrency company in Costa Rica?

Do you need a physical office?

Is there a minimum capital contribution?

What are the compliance obligations?

Are the beneficial ownership information publicly accessible?

How can Tetra Consultants help you?