Czech EMI License

- The Cech EMI License has become a regulatory authorization provided by the Czech National Bank (CNB) that enables businesses to issue electronic money and offer payment services with EU directives. With the help of a Czech EMI License, organizations can easily increase their fintech operations, not only within the Czech Republic but also in the European Union. The financial landscape of Europe has become increasingly competitive, and getting a Czech EMI License ensures credibility, adherence, as well as a strong presence on the EU market. Tetra Consultants helps businesses to obtain the Czech EMI License. Our team helps organizations to get through the complex application procedure while also ensuring regulatory compliance.

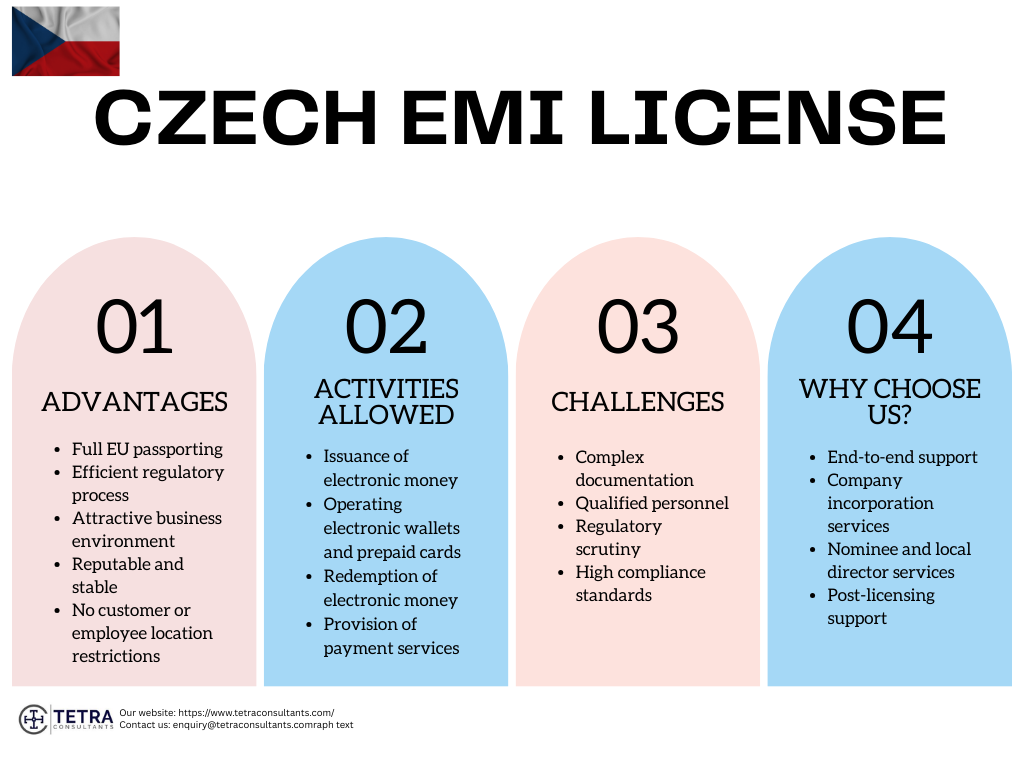

Advantages of the Czech EMI License

- The Czech EMI (Electronic Money Institution) license provides major benefits for businesses focusing on offering electronic payment services and e-wallet solutions across the EU and beyond. Here are the main advantages of the Czech EMI License:

Full EU passporting

- Through the Czech EMI License, your business can operate not just in the Czech Republic but also in the entire European Union. This offers wide market access and the chance to attract consumers from all the EU member states without any need for additional local licenses.

Efficient regulatory process

- Getting an EMI license in the Czech Republic is usually considered to be a straightforward and less bureaucratic process when compared to other countries in the European Union. Furthermore, the application and business process in the Czech Republic are more business friendly leading to more and more investors opting to register company in Czech Republic.

Attractive business environment

- The Czech Republic also has a favorable business climate that has low taxes, a skilled workforce, and an efficient process of company registration. This makes the Czech Republic suitable for both startups as well as established fintech.

Reputable and stable

- The Czech Republic is known for its stable and reputable jurisdiction, along with a strong legal framework, which improves the standing and credibility of your organization with its partners and clients. Furthermore, the Czech Republic is a member of the European Union and the North Atlantic Treaty Organization (NATO), which further reinforces stability.

No customer or employee location restrictions

- Companies can easily attract clients from across the world, as well as locate their employees as they can see fit. There are no EU-imposed limitations on the consumer base or the workforce location.

Types of Czech EMI License

- The Czech Republic provides two main types of EMI licenses these are:

Full EMI License

- The full EMI license allows issuing electronic money and offering payment services across the entire European Union, with full passporting rights. The requirements of this license consist of establishing a legal entity in the Czech Republic, which includes a physical office, a minimum share capital of €350,000, and strong AML/compliance frameworks.

- With this license, companies can manage e-wallets, issue and redeem electronic money, process payments, and also serve both Czech and EU clients with no limitations on service volume.

Small scale/semi-EMI License

- This license is commonly known as semi-EMI, a license that is intended for companies with limited payment turnover or those who are just starting out. There are certain restrictions on a semi-EMI license, such as maximum transaction volume, capital, limited service range, and geographic limitations. Lastly, this license has low initial capital requirements and a regulatory burden, which makes it accessible for startups that want to test the Czech markets.

Costs and timeline for getting the Czech EMI License

- Tetra Consultants will help you in registering your Czech entity within 3 weeks of getting all the necessary due diligence documents. Our team will also prepare your AML/CFT policies, secure a physical office, and also appoint a local director and AML/CFT officer. We will also submit your complete EMI license application to the Czech National Bank. The approval process usually takes 8 to 10 months, based on your application and if there are any queries. Once the license is provided team, our team will then move ahead to open a corporate bank account for your company, which usually takes an additional 3 to 4 weeks. Overall, the entire procedure takes approximately 9 to 12 months from beginning to end.

- The total cost of getting a Czech EMI License is based on multiple factors like the scope of services, business structure, and the support level needed. At Tetra Consultants, we follow a transparent fee structure with no hidden charges. All our prices are communicated to you during the initial consultation, so you know exactly what you are paying for.

Regulatory authority for the Czech EMI License

- The primary regulatory authority that is responsible for the Czech EMI License is the Czech National Bank (CNB). The CNB is responsible for overseeing and issuing licenses to electronic money institutions and payment service providers in the Czech Republic.

- The CNB reviews all the applications, grants, or denies EMI licenses, and supervises all the ongoing activities of the licensed entities. It also ensures compliance with the Czech laws, and relevant EU directives. Lastly, the CNB is also tasked with the supervision of the financial market and the implementation of the anti-money laundering (AML) standards for the EMIs.

Activities allowed under the Czech EMI License

- The Czech EMI License authorizes a broad range of financial activities, mainly focused on electronic money and payment services. Here are the activities that are allowed under the Czech EMI License:

Issuance of electronic money

- This license allows companies to create and distribute digital funds that will act as a substitute for cash and can be used for payments and stored-value purposes.

Operating electronic wallets and prepaid cards

- Companies can offer e-wallet solutions and prepaid payment products in order to store and spend electronic money.

Redemption of electronic money

- Companies can also return the stored value to the consumers in cash or transfer it to a bank account on request.

Provision of payment services

- Companies can facilitate payment transactions, which consist of deposits, withdrawals, and money transfers. It also covers both domestic and international payments, consisting of direct debts, credit transfers, and standing orders.

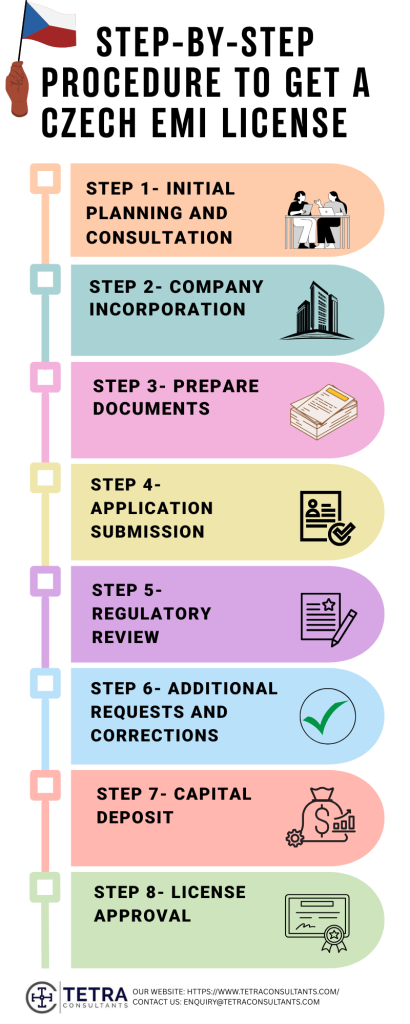

Step-by-step procedure to get a Czech EMI License

Step 1- Initial planning and consultation

- The first step is to conduct a consultation in order to understand your business goals, legal requirements, and licensing needs. Our team at Tetra Consultants will also ensure that your business model fits with the EMI license conditions.

Step 2- Company incorporation

- Tetra Consultants helps you to register a legal entity in the Czech Republic. Our team also drafts a detailed business plan, financial projections, articles of association, and secures a registered physical office address on your behalf.

Step 3- Prepare documents

- After incorporating your company, our team works on collecting the following documents:

- Company registration papers

- AML/KYC policies

- Evidence of the initial capital

- Information on directors/shareholders (CVs, criminal record checks, necessary qualifications, and experience)

- Description of operational controls and risk management

- Details of IT and security infrastructure

- Business and the financial plan for the next three years

Step 4- Application submission

- After collecting the documents, our team then moves ahead with submitting your business license application electronically to the Czech National Bank (CNB). We include all the relevant documents to ensure that there are no delays.

Step 5- Regulatory review

- The CNB then reviews your business application, evaluates your business and financial plan, and also conducts relevant background checks on the directors and shareholders.

Step 6- Additional requests and corrections

- CNB also requests additional documents or raises questions. Tetra Consultants communicates with the CNB on your behalf, responds to any queries, and provides clarifications if required.

Step 7- Capital deposit

- In this step, you need to deposit the necessary share capital in the bank account of the company. Tetra Consultants provides corporate bank account opening services and helps you open a corporate bank account. After depositing the funds, you can set up your technological infrastructure.

Step 8- License approval

- Upon approval, you will receive the EMI license from the CNB. This allows you to begin your operations. Tetra Consultants provides regulatory compliance consulting services, and our experts will help you to maintain regulatory compliance, submit regular reports, and financial statements to the CNB.

Common challenges and how we can help

Complex documentation

- Applicants applying for a Czech EMI License should prepare an extensive package, consisting of a detailed business plan, financial projections, organizational structure, AML/KYC policies, and IT and security descriptions. At Tetra Consultants, our team helps you with writing and translating the business/financial plans, along with the necessary documentation to ensure regulatory compliance.

Qualified personnel

- Applicants should also appoint a local director and an AML/CFT office with experience in the financial services. Hiring suitable candidates is a difficult task for foreign businesses. At Tetra Consultants, our team provides you with a local director and AML/CFT officer in order to fulfill Czech regulatory obligations.

Regulatory scrutiny

- The Czech National Bank strictly examines the backgrounds and qualifications of the directors and founders. It also evaluates how transparent the ownership of the company is, as well as the plans for compliance and fund protection. At Tetra Consultants, our team helps you prepare the application thoroughly and provides expert and regulatory advice. We also communicate with the bank on your behalf to ensure that there are no barriers in the application process.

High compliance standards

- Applicants should present strong AML/CFT measures, along with a detailed internal control framework. Furthermore, in the Czech Republic, EMIs’ business must ensure that their payment systems are robust, secure, and effectively aligned with the EU data protection guidelines, such as the General Data Protection Regulation (GDPR). At Tetra Consultants, our team prepares the AML/CFT policies, compliance manuals, along with a risk management framework, in adherence to all CNB’s and EU’s guidelines.

Documents required for the Czech EMI License

- Formal application to the Czech National Bank (CNB)

- Business plan for the next three years

- Proof of initial capital

- Directors and founders’ documents, which include their CVs, experience proof, identity/address proof, criminal record checks from the Czech Republic, or their residence countries

- Description of offered services

- Method for calculating capital adequacy, and documentation of how capital requirements will be fulfilled

- Proof of legal entity. Such as the memorandum and articles of association, certificate of incorporation, and evidence of the registered office in the Czech Republic or the EU

- Financial plan for the next three years

- Descriptions of management and control systems, which consist of proposed organizational structure, internal control framework, risk management, and AML compliance procedures

- Documentation on technical infrastructure, which consists of IT security, systems for processing/e-money management, and data protection

- Policies and manuals, which consist of AML/KYC procedures, client fund protection, operational procedures, and IT/security descriptions

How can Tetra Consultants help with the Czech EMI License?

- The process to get a Czech EMI License consists of complex regulatory requirements, strict documentation standards, along with ongoing compliance regulations. At Tetra Consultants, our team effectively understands your business model to ensure that you fully adhere to the Czech and EU regulations throughout the licensing procedure. Here are why our clients choose us:

- End-to-end support- Our team manages all the processes effectively, from start to end.

- Nominee and local director services- Our team provides you with qualified directors and nominees in order to fulfill the regulatory obligation.

- Post-licensing support- Our team offers continuous advisory for audits and compliance.

- Company incorporation services- Our team helps you to set up your Czech legal entity, along with a registered office.

Looking to obtain a Czech EMI License

- Getting a Czech EMI License is a credible move for companies involved in the fintech sector of the Czech Republic. With the help of this license, you can easily expand your presence in the European Union, allowing you to offer regulated financial services and issue electronic money throughout the EU. At Tetra Consultants, our team simplifies your journey to get the Czech EMI License by providing you with ongoing support throughout the application process, along with post-regulatory compliance support.

- Contact us, and our team will get back to you within 24 hours.

FAQs

What is the difference between the Full EMI License and the Small EMI License?

Can a foreign company apply for this license?

How can Tetra Consultants help me with the Czech EMI License?

What is the minimum capital requirement to get this license?