AUSTRAC digital currency exchange

- AUSTRAC digital currency exchange provider registration is an essential requirement for a business planning to operate legally as a cryptocurrency exchange in Australia. This goes beyond obtaining a registration; it is a full compliance measure under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to mitigate and protect the financial system from money laundering and terrorism financing.

- The process to register company in Australia includes submitting a detailed business plan, AML/CTF policy, police check for key personnel, contracts with third-party compliance services, and substantial documentation that evidences operational integrity. Australia has one of the largest digital currency ecosystems in the world and has the advantage of an ongoing regulatory structure and increasing adoption, with recent statistics and World Bank reports showing that over 31% of adults have participated in the crypto market.

- Additionally, the fintech market has grown rapidly, reaching US$ 4.1 billion in 2024, and is expected to grow considerably to over double that by 2033. This solidifies the appeal for digital assets and fintech innovation in the region. Engaging Tetra Consultants will make the entire process seamless; our team will walk the applicant from setting up the company and drafting compliant documentation to liaising with Australian Transaction Reports and Analysis Centre (AUSTRAC), ensuring business applicants are positioned to capitalize on the opportunities presented by the dynamic digital currency exchange market in Australia.

What is a digital currency exchange?

- Digital currency or cryptocurrency refers to a currency type that exists only in an electronic or digital form. It usually utilizes cryptography for security and operates independently of a central bank. Examples of digital currencies, often called cryptocurrencies, include Bitcoin and Ethereum, as well as stablecoins. Digital currency is used for the direct exchange of value between parties through digital platforms, creating an efficient, borderless means of transaction, and a fundamental aspect of current financial technology.

- A digital currency exchange (DCE) provider is a person, business, or organization that is in the business of exchanging money (both Australian and overseas currency) to and from digital currency. DCE providers facilitate exchanges between fiat money and cryptocurrencies and are therefore a key part of the Australian digital asset market. DCE providers that offer an exchange service must register with AUSTRAC before they can offer the exchange service and comply with the Anti-Money laundering (AML) and Counter-Terrorism Financing (CTF) obligations and requirements for a legal service.

Advantages for AUSTRAC digital currency exchange

Legitimacy and trust in the marketplace

- By registering with AUSTRAC as a digital currency exchange, your business increases its legitimacy among consumers, partners, and regulators. The endorsement shows that your business is participating in Australia’s strong regulatory environment, creating trust and transparency between parties in every transaction.

Increased security and crime prevention

- Requirements to comply with AUSTRAC anti-money laundering and counter-terrorism financing obligations mean your business is safeguarded from being misused for criminal activities. Enforcing best practices, Know Your Customer (KYC), and reporting protocols protects your business against money laundering, terrorism financing, and criminal activity, which may cause your business to sustain significant reputational or financial damages.

Enhanced relationships with banking and payments

- Banks and payment solution providers hold AUSTRAC registered crypto exchanges compared to unregulated fintech organizations. Compliance with AUSTRAC regulations demonstrates that you are serious about compliance and allows you to open and maintain necessary business bank accounts and have stable banking relationships.

Access to growth and market expansion

- The digital assets sector in Australia has been growing quickly, with over 399 AUSTRAC registered crypto exchanges and mainstream adoption continuing to increase. Being registered with AUSTRAC will allow you to take advantage of this unique opportunity, raise investment, increase your user base, and compete effectively in this expanding market.

Continuing compliance and business viability

- Regulatory engagement with AUSTRAC ensures you receive ongoing updates, new policies, and best practices so that your business remains viable. Proactiveness with compliance avoids business disruption through new regulatory requirements and promotes operational viability into the future.

Customer and investor confidence

- Operating in a regulatory framework provides your customers with reassurance that their assets and data are handled in accordance with Australian law and global best practice. This supports customer acquisition and retention by offering peace of mind to customers, in addition to enticing sophisticated investors who are looking for compliance and reliability of digital asset platforms.

Timeline for obtaining AUSTRAC digital currency exchange (DCE)

- Tetra Consultants will coordinate the application process for a Director Identification Number (DIN) for foreign directors that will typically take approximately 2 months. Once the DIN is received, Tetra Consultants will assist with registering your Australian company within 1 week. Following the registration of your company, we will take care of preparing the required documentation to satisfy AUSTRAC licensing requirements. Once the documentation is finalized, we will submit the license application to AUSTRAC, with processing taking approximately 90 days.

- It is typical for AUSTRAC during this time to arrange a video interview with your team as part of their due diligence. We also stipulate that you have a local office or a local director active in order to meet regulatory expectations which can be fulfilled through ours nominee director services in Australia. After your registration approval, Tetra Consultants will help you with the corporate bank account opening, which can take approximately 4 weeks. During this time, we will provide its expertise and dedicated support so that you are assisted through each step in compliance with Australia’s regulatory framework. Overall, the entire process from DIN registration to bank account opening generally spans approximately 6 months.

Who can apply for AUSTRAC digital currency exchange (DCE) provider registration?

Business owners operating digital currency exchanges

- Business owners who offer a service converting fiat money into digital currencies (cryptocurrencies) or the other way around will need to apply for AUSTRAC DCE registration in order to operate in Australia legally. Our team can help you secure a cryptocurrencies license if required.

Companies operating crypto trading platforms

- Companies that operate platforms for crypto-to-crypto transactions or for the conversion of crypto to fiat currency must have registration to comply with regulatory obligations and enforcement action.

Individuals or organizations offering digital currency exchange services

- Any individual or organization engaged in the business of providing digital currency exchange services in Australia will require registration to satisfy their obligations under AML/CTF.

Service providers for digital currency exchange who are expanding into Australia

- Service providers, or businesses, outside Australia that wish to conduct digital currency exchange activities in Australia will need to register with AUSTRAC to lawfully enter the market.

Entrepreneurs who are establishing a new digital currency exchange

- Entrepreneurs who will start a new digital currency exchange in Australia will need an AUSTRAC registration before they can start operations.

Activities allowed under AUSTRAC digital currency exchange provider registration

- Exchanging Australian or foreign currency for digital currency (cryptocurrency).

- Exchanging digital currency for Australian or foreign currency.

- Operating as an AUSTRAC cryptocurrency ATM provider offering currency exchange services.

- Facilitating the buying or selling of cryptocurrencies as part of an exchange business.

- Engaging in the exchange service in a commercial and ongoing manner, rather than occasional or personal transactions.

- Providing on and off ramps between fiat and digital currencies as a designated service under AML/CTF law.

- Implementing AML/CTF compliance programs to monitor and report suspicious transactions.

- Reporting threshold transactions and suspicious matters to AUSTRAC as required by law.

- Keeping records related to exchange transactions as stipulated for regulatory purposes.

- Offering services in a manner that does not pose unacceptable money laundering and terrorism financing, or other serious crime risks.

Excluded activities under AUSTRAC digital currency exchange provider registration

- Services that do not involve an exchange, such as gifting or airdrops of digital currency without consideration, are excluded.

- Digital currency custody or wallet services that do not involve exchange are not covered under this registration.

- Peer-to-peer digital currency transfers without an exchange of value are excluded.

- Central bank digital currencies (CBDCs) and their transactions are explicitly excluded from digital currency exchange provider obligations.

- Activities such as issuing or managing digital tokens that are not exchanged also fall outside the registration scope.

- Businesses inactive in offering exchange services will face registration cancellation by AUSTRAC.

- Providing personal financial advice or investment services related to digital assets without exchange activities is not covered.

- Non-commercial, occasional exchanges or personal transactions are excluded from registration requirements.

Steps for AUSTRAC digital currency exchange provider registration

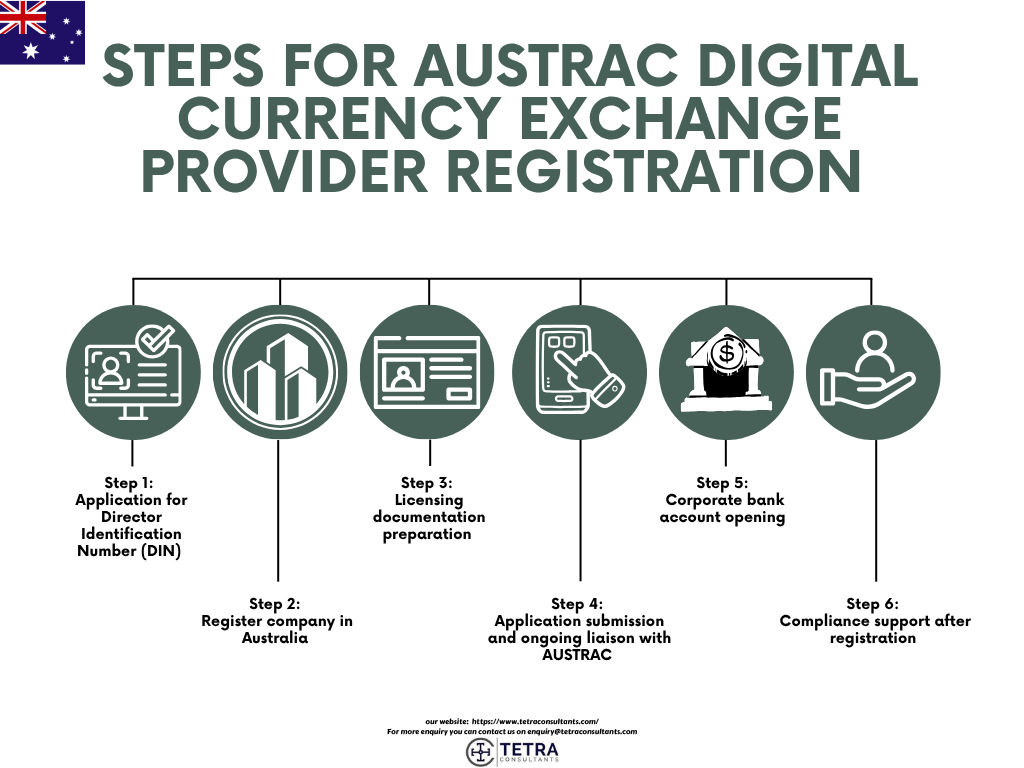

Step 1: Application for Director Identification Number (DIN)

- Tetra Consultants will help you apply for the Director Identification Numbers on behalf of your foreign directors, if applicable. We will review and prepare all necessary documents for lodgment complying with all regulations. This process generally takes approximately two months, and the DIN is necessary to register company in Australia.

Step 2: Register company in Australia

- Once Tetra Consultants has received all of the DINs, we will register your company in Australia as soon as possible, which the incorporation process typically takes approximately one week to complete. Tetra Consultants will take care to ensure that all necessary legal documents are filed and will conduct all necessary compliance checks prior to incorporation.

Step 3: Licensing documentation preparation

- Upon incorporation, our team prepares all the necessary documentation for the AUSTRAC application for a digital currency exchange license, including compliance programs, business plans, and applicable policies, to meet AUSTRAC requirements.

Step 4: Application submission and ongoing liaison with AUSTRAC

- We then submit your application for the license to AUSTRAC and liaise with the regulatory authority throughout the assessment process, which could take up to 90 days. We also prepare your team if AUSTRAC requires a video interview or if any further information is requested.

Step 5: Corporate bank account opening

- Once the structures have been approved, we can assist you with corporate bank account opening with a recognized Australian bank such as Commonwealth Bank, Macquarie Bank, ANZ and many more which usually is completed in around 4 weeks, and we will liaise for you on the documentation and online KYC process to limit your involvement.

Step 6: Compliance support after registration

- As Tetra Consultants guide you through the registration process, we will continue to provide the ongoing compliance support you need. Thus, we will assist you to ensure your business is compliant with regulatory obligations and support any updates or changes necessary in order to stay sustainable in Australia.

Renewal of AUSTRAC digital currency exchange (DCE) provider registration

- Renewal with AUSTRAC as a Digital Currency Exchange (DCE) provider is a regulatory requirement that occurs every three years that confirms obligations for compliance and eligibility to operate. Tetra Consultants can support clients by managing when registrations expire and sending reminders to complete the renewal application starting 90 days in advance of the expiration date, which allows clients to be prepared for AUSTRAC DCE registration renewal.

- Tetra Consultants provides guidance to clients on the proper completion of restructuring requests and declaration forms to avoid processing delays. It is essential that the renewal is lodged before the expiry date. Otherwise, the registration automatically lapses, and the registrant is prohibited from continuing to provide digital currency exchange services legally. When the application is lodged, clients receive a reference number.

- Accordingly, Tetra Consultants will handle follow-up communications with AUSTRAC to confirm renewal. The renewal will help a registrant remain compliant with AUSTRAC’s regulations, thus maintaining trust with AUSTRAC and consumers while avoiding penalties or interruptions to services.

Documents required for AUSTRAC digital currency exchange (DCE) provider registration

- Application form (AUSTRAC Business Profile Form) completed and submitted.

- Valid identification for all directors, key persons, and ultimate beneficial owners (UBOs).

- Police certificates or non-criminal records for all directors, key staff, compliance officer, and UBOs (issued within the past 6 months).

- Appointment documents for a local Australian director.

- Appointment of documents for the compliance officer (with evidence of AML experience or training).

- Comprehensive AML/CTF program, including KYC procedures, risk assessments, and transaction monitoring.

- Detailed business plan outlining intended services, organizational strategy, target market, and employee count.

- Organization chart listing all key personnel with roles and responsibilities.

- Office lease agreement or virtual office contract with Australian address (hot desk capacity, if applicable).

- Contracts/agreements with third-party service providers (KYC, transaction monitoring, compliance consultants, etc.).

- Bank account agreement (local or international financial institution).

- Proof of registration or licenses from any foreign jurisdiction if the business operates overseas.

- ML/TF risk assessment document completed before applying.

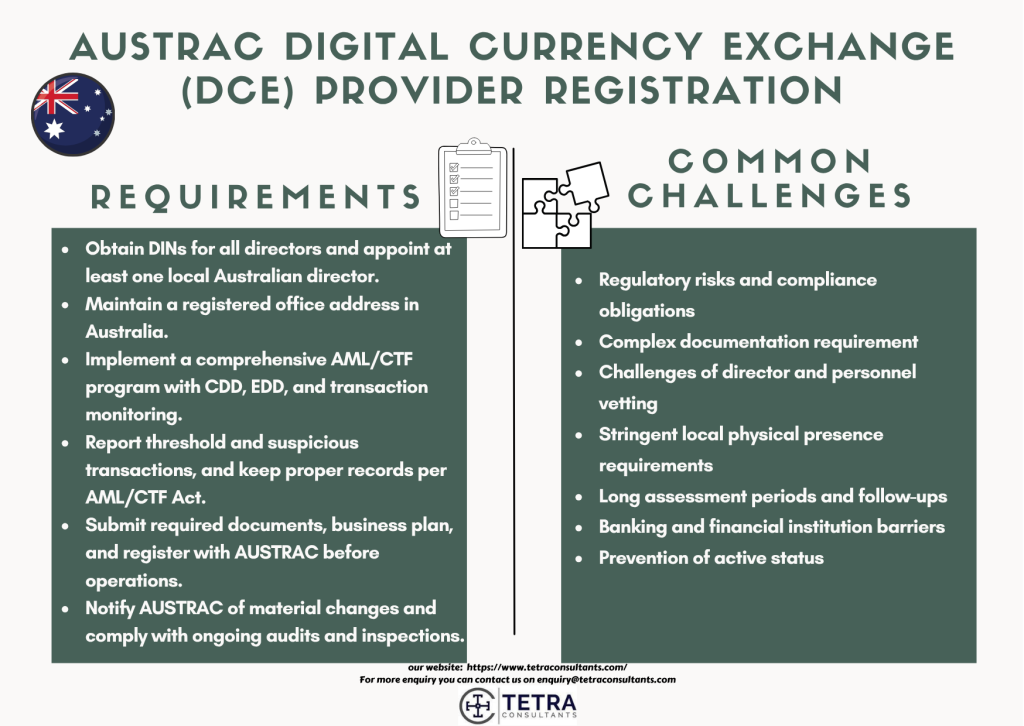

Requirements for AUSTRAC digital currency exchange (DCE) provider registration

- Must provide a valid Director Identification Number (DIN) for all directors including foreign ones.

- Appoint at least one local director residing in Australia to meet regulatory expectations. To comply with this requirement, we provide nominee director and shareholder services to our clients.

- Submit a valid Australian registered office address as official company location.

- Prepare and maintain a robust Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) program tailored to digital currency exchange operations.

- Demonstrate the ability to comply with Customer Due Diligence (CDD), Enhanced Due Diligence (EDD), and ongoing transaction monitoring obligations.

- Ensure accurate and timely reporting of threshold transactions and suspicious matters to AUSTRAC as per the AML/CTF Act.

- Maintain proper record-keeping systems for all transaction data and reports in compliance with statutory timelines.

- Provide clear and detailed business plans showing operational strategies and risk management approaches.

- Register with AUSTRAC before commencing digital currency exchange services; unregistered operation is a criminal offense.

- Submit all necessary documents including proof of identity for beneficial owners and directors, compliance policies, and operational manuals.

- Regularly update AUSTRAC on any material changes to corporate structure or activities affecting risk profiles.

- Comply with annual or periodic audits and inspections to ensure ongoing adherence to regulatory standards.

Common challenges while proceeding for AUSTRAC digital currency exchange (DCE) provider registration

Regulatory risks and compliance obligations

- If a business poses a risk of money laundering or the terrorist financing, AUSTRAC may refuse, suspend or cancel registration under the AUSTRAC digital currency exchange register. In any case, effectively managing these regulatory risks will require businesses to have thorough AML/CTF programs and implement other compliance obligations. This is where Tetra Consultants can assist in ensuring that you have robust compliance frameworks that meet AUSTRAC’s expectations.

Complex documentation requirement

- The registration process is extensive and requires an array of documentation, including detailed business plans, AML/CTF Policies, ongoing Reporting systems, etc. Incorrect or missing documents will delay registration approval. Tetra Consultants can help streamline document preparations, ensuring accuracy and completeness without delaying submissions.

Challenges of director and personnel vetting

- AUSTRAC mandates comprehensive vetting of directors and key personnel, which can complicate the approval process if there is a negative history. Tetra Consultants provides nominee director and shareholder services and can assist you in performing the appropriate due diligence to support your Australian Business’s AUSTRAC obligations.

Stringent local physical presence requirements

- AUSTRAC may require offices, or Australian based directors to be actively engaged to meet compliance, which can be difficult when you are an international applicant. Tetra Consultants can assist you in accommodating local directors and offices to help you meet the AUSTRAC requirements without complications.

Long assessment periods and follow-ups

- Applications can take up to 90 days to assess interviews and requests for additional information throughout the process. Tetra Consultants takes care of all communication with AUSTRAC, prepares clients for interviews, and ensures follow-ups are completed to keep the process moving forward.

Banking and financial institution barriers

- Opening a corporate bank account can be made more difficult because banks tend to have cautious banking policies towards crypto businesses. Tetra Consultants uses its extensive network within the industry to assist and help clients open banking relationships in a timely manner and through the cumbersome KYC process.

Prevention of active status

- Inadequate activity can result in AUSTRAC penalties for inactive or dormant registration. Tetra Consultants monitors your compliance continuously through the AUSTRAC digital currency exchange register to ensure you meet the activity requirements to not have your registration cancelled, which also ensures your activity remains regulatory for compliant business activity.

Looking for AUSTRAC digital currency exchange (DCE) provider registration

- When you partner with Tetra Consultants, your registration as an AUSTRAC digital currency exchange (DCE) provider will be a seamless and smooth experience through an overly complicated regulatory environment. Our team has extensive experience going through every phase, going from regulatory compliance consulting to offshore company registration, and application submission as a complete, tailored solution to fit all AUSTRAC’s rigorous policies and procedures.

- We also assist in tackling obstacles such as excessive documentation, appointed local directors, and banking relationships. We even offer international trademark registration, so that you will be fully compliant. Our hands-on approach allows you to communicate with regulators in a timely manner and go through the steps of preparing for interviews or follow-ups.

- Tetra Consultants provides you with confidence in your AUSTRAC registration and the continual legal operation of your business in Australia’s growing digital currency environment to ensure a strategic positioning of sustainable growth while maintaining full regulatory compliance.

- Contact us to know more about AUSTRAC digital currency exchange (DCE) provider registration and we will get back in 24 hours.

FAQ

Who must register with AUSTRAC as a DCE provider?

What is the difference between enrolment and registration?

Do I need to be an Australian citizen to register?

Can I use a virtual office for registration?

How often must I renew my AUSTRAC DCE registration?

What happens if I operate as a DCE provider without registration?

What are the ongoing compliance obligations after registration?

Can AUSTRAC refuse, suspend, or cancel registration?