Register company in Bahrain

To register company in Bahrain is hassle-free if you are familiar with the entire incorporation process. With Tetra Consultants at the wheel, you will be able to dedicate your time and resources to other more important channels.

As Bahrain has limited natural resources, it primarily relies on foreign investment and tourism. Therefore, the country is more welcoming of international entrepreneurs and more hungry for business start-ups.

With our lean-and-mean mentality, you can rely on our team of experts to provide you with a seamless experience throughout the whole registration process. Our ultimate goal is for your business to be operationally ready within the stipulated time frame.

Our service package includes everything you will require to register company in Bahrain:

- Company registration with the Bahrain Ministry of Industry Commerce and Tourism (MoICT)

- Local company secretary and registered address

- Corporate bank account opening

- Annual accounting and tax services

How long does it take to register company in Bahrain and open a corporate bank account?

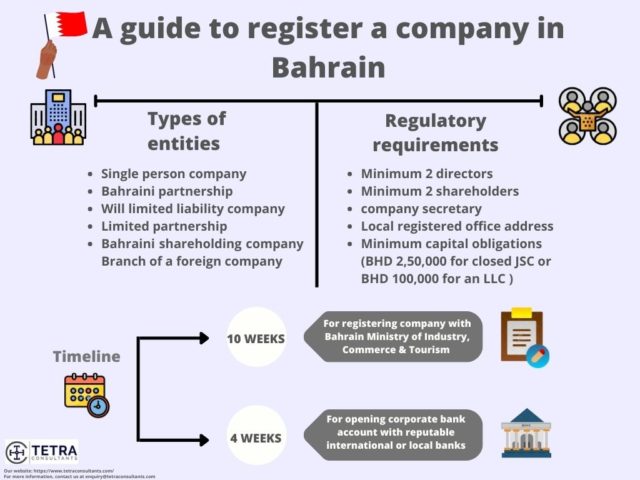

- Tetra Consultants will complete your Bahrain company registration within 10 weeks.

- After receiving the required due diligence documents of the directors and shareholders, we will proceed to check on the availability of your preferred company name and prepare the required incorporation documents.

- Throughout the process of registering a company in Bahrain, we will offer non-travel solutions that are meant to be convenient for you.

- After the setup is completed, we will courier the documents of your new company to your preferred address. The documents will include the Certificate of Incorporation as well as the Memorandum of Association.

- After completion of company registration in Bahrain, Tetra Consultants will open a bank account for your company. This will take around 4 weeks to complete.

- Even during the opening of the bank account, we will seek to provide you with non-travel banking solutions.

- Within 14 weeks of our engagement, you can expect your company to be fully set up and ready for business.

Can a foreigner start a business in Bahrain?

- Yes, Bahrain permits 100 percent foreign ownership of new entities and the establishment of representative offices or branches of foreign companies without Bahraini sponsors or local partners.

- In 2017, the Government of Bahrain expanded the number of sectors in which foreigners are permitted to maintain 100 percent ownership in companies to include tourism services, sporting events production, mining and quarrying, real estate, water distribution, water transport operations, and crop cultivation and propagation.

- In May 2019, the Government of Bahrain loosened foreign ownership restrictions in the oil and gas sector, allowing 100 percent foreign ownership in oil and gas extraction projects under certain conditions.

Types of companies in Bahrain

- There are many types of business structures in Bahrain each with distinctive features in terms of personal liability protection, tax ramifications, ownership, and management flexibility as well as compliance requirements.

- Prior to the start of the engagement, Tetra Consultants will fully understand your business before recommending the most optimum business entity in Ireland. Some considerations we take into account include the type of business activity, tax obligations, and nationalities of shareholders and directors. Our consultants will also offer more information on the requirements imposed to set up these entities. Foreign citizens can set up the following different types of companies in Bahrain with 100% foreign ownership:

Bahrain Shareholding Company (B.S.C.) – Public

- The key distinction of public limited companies is the ability for them to be publicly listed on the stock exchange. With a public limited company, you can benefit from the protection of limited liability and easier access to capital. Primarily adopted by large businesses, a public limited company allows shares to be freely and easily transferable. Shareholders are protected according to the level of their contribution to the capital. With limited liability imposed on the shareholders, in any event of winding up, you will not have to worry about incurring the debts and obligations of your public limited company. However, this does come at the cost of stricter compliance regulations.

- Unlike a private limited company, it is compulsory for your public limited company to hold an Annual General Meeting. In addition, to set up a public limited company, you will minimally require 5 directors and 7 shareholders (foreign investment is allowed on the basis of approval granted by the Bahrain Ministry of investment and commerce) and additionally meet a statutory minimum share capital of BHD1,000,000. Your public limited company also must meet the additional requirement of a secretary and a local registered office.

Bahrain Shareholding Company (B.S.C.) – Closed

- A closed Bahrain shareholding company, commonly known as a closed joint stock company, consists of a minimum of two shareholders who subscribe to it by way of negotiable shares that are not offered to the public for subscription. Shareholders are liable for the company’s debts and obligations only to the extent of the value of their shares.

- For a closed joint stock company, the minimum share capital required is BHD250,000 (a minimum of 50% of the capital to be paid initially at the time of incorporation, the balance to be paid within 3 years). There must be a minimum of three directors, irrespective of their nationality, that is a closed joint stock company can be 100% foreign-owned. There is no requirement for the local director. However, depending on the business activity, there may be a requirement for minimum Bahraini ownership. Additionally, such types of companies are required to have a minimum of 2 shareholders (irrespective of their nationality), a registered agent, and a locally registered office.

- Closed joint stock companies must adhere to strict regulations provided by the Ministry of Industry and Commerce and must invite and obtain no-objection clearance from the ministry for holding their annual general meetings. If a company’s activity is also regulated by the Central Bank of Bahrain, it must also invite them to all annual general meetings.

Will Limited Liability Company (W.L.L.)

- A Bahrain limited liability company must consist of a minimum of two and a maximum of 50 partners who are natural or legal persons wherein partners are responsible for the debts and liabilities of the company only to the extent of their shareholding in the capital The minimum share capital required is BHD20,000. The company cannot issue public shares. A WLL can be 100% foreign-owned. There is no requirement for local resident director.

- Limited liability companies have less stringent requirements to pass resolutions than Bahrain shareholding companies and there is no requirement to invite and obtain the approval of the Ministry of Industry and Commerce to hold annual meetings.

- Under a limited liability company if the number of partners falls below 2, the company must introduce new shareholders within a period of 30 days, or by force of the law, be converted to a single-person company, or proceed to dissolution. A limited liability company cannot issue public shares, negotiable warrants, or debentures.

Partnership Company

- A partnership company is a company formed without limited liability between two or more natural or corporate persons, in which all partners have joint unlimited responsibility to the extent of their entire personal assets for the partnership’s debts and liabilities. There is no requirement for minimum share capital. There must be at least one manager.

- A partnership company can be 100% foreign-owned. There is no requirement for a local director.

Commandite by Shares

- A commandite partnership by shares is a company established between two categories of partners – one of which is that of joint partners who are jointly responsible, to the extent of their entire personal wealth for the company’s obligations, and the other is that of limited partners (shareholders) who are not liable for the company’s obligations except to the extent of their equity (shares) in the capital.

- To form a limited partnership by shares there must be a minimum share capital of BHD20,000. There is also a requirement of a minimum of three members on the company control board from among the limited partners if the number of these partners exceeds ten. There must be at least one manager.

Single Person Company (S.P.C.) Steps to register a company in

- A single-person company (SPC) is a company the capital of which is fully owned by a single natural or corporate person. The owner is liable for the company’s debts and obligations only to the extent of the value of his capital investment in the company. The minimum share capital required is BHD50,000. There must be at least one director. Foreign and non-GCC nationals can set up an SPC if there are no restrictions on their business activity.

- One of the advantages of an SPC is that there is no requirement to hold annual or extraordinary general meetings of the company; the company must simply file its audited financial reports with the Ministry of Trade and Commerce.

Foreign Company Branch

- A branch of a foreign company that is incorporated and registered outside the Kingdom of Bahrain may be established as an operational office, a representative office, or a regional office.

- The liability of the company must be in accordance with the parent company. The parent company setting up the foreign branch company must provide a guarantee and appoint a branch manager. The foreign branch company must adhere to the laws of its parent company in all decisions.

List of Free Zones in Bahrain

Designed strategically, the Free Trade Zones in Bahrain help business investors to experience a specialized infrastructure with world-class facilities. With a multi-modal connectivity route, the destinations help the business investors to carry out their business operations at ease. The Kingdom of Bahrain boasts three Free Trade Zones (FTZs) that include:

Bahrain Logistics Zone (BLZ)

- Bahrain’s Logistics Zone (BLZ) is regulated and managed by the Ports and Maritime Affairs at the Ministry of Transportation and Telecommunications. Located along 1-2 km of land, the BLZ turns out to be an ideal place for a more straightforward and cheaper logistics business. Designed to suit the end-to-end requirements, the BLZ provides tailored solutions satisfying business needs.

Bahrain International Investment Park (BIIP)

- Established in the year 2005, the Bahrain International Investment Park (BIIP) is Bahrain’s flagship site that has been built to attract multinational and export-oriented global businesses. Designed to attract Foreign Direct Investment (FDI), the region of BIIP is one of Bahrain’s free zone that provides multiple business options to foreign investors. The companies located in the BIIP enjoy duty-free access to carry out business operations in the Kingdom of Saudi Arabia, the United Arab Emirates, and Oman.

Bahrain International Airport (BIA)

- The Bahrain International Airport (BIA) was established in 1927 as the first airport in the Arabian Gulf and has been a magnificent business setup locally for global investors. Located in Muharraq, the island is situated in the northeast of Manama, the capital city. The free zone is maintained by the Bahrain Airport Company (BAC), a wholly-owned subsidiary of Mumtalakat.

- The BIA is one of the critical drives of Bahrain’s economy and is reputed in the aviation and financial center.

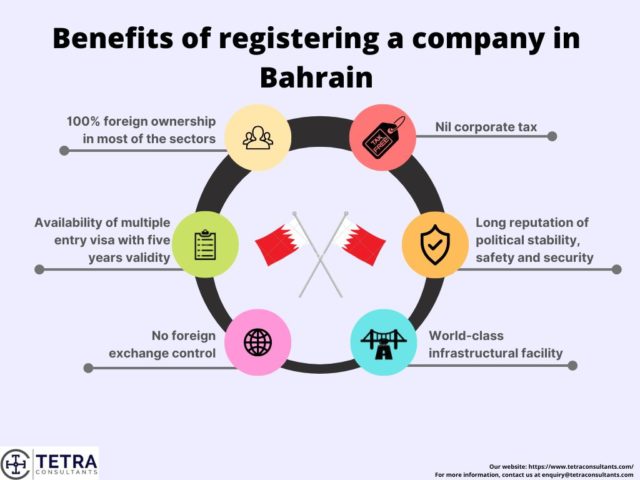

What are the benefits of registering a company in Bahrain?

Our team of dedicated consultants equipped with the laws and regulations of Bahrain has summarized the benefits of registering a company in Bahrain for you:

- 100% foreign ownership in most sectors, whether you are an entrepreneur or an established business you can choose your own partner.

- Free-holding of properties for foreigners

- No restrictions on repatriation of capital and profits and no exchange controls

- No excessively strict visa, residence, and work permit requirements to inhibit foreign investors and expats from moving freely in Bahrain

- No free zone restrictions, operate your business in the area that works for you

- Lower operating costs, run your business or corporation for 30% less than elsewhere in the region.

- Transparent regulation and increased stability.

- With business-friendly tax laws of 0% corporate tax rate, you can keep more of your profits.

- Excellent support services from local government authorities

How to register company in Bahrain?

- Tetra Consultants advises you to read through this guide to fully understand the steps required on how to incorporate a company and set up a bank account in Bahrain.

- By systematically following the steps below, you can expect to start conducting business with your Bahrain company within 14 weeks.

Step 1: Choosing a suitable corporate entity to register company in Bahrain

- After understanding your business goals and activities, our team of dedicated consultants will recommend the most suitable corporate entity for you to carry out your business.

- Prior to incorporating a Bahrain company, you will be advised on the optimum paid-up share capital, corporate structure, legislations, and whether there is a need to apply for any licenses to operate your business.

Step 2: Reservation of company name

- Tetra Consultants will reserve your preferred company name with the Bahrain Commercial registry by conducting the initial name search availability and by following the guidelines given by the Bahrain Ministry of Industry Commerce and Tourism (MoICT).

- The company owners/investors are allowed to propose three company names and the names which violate the guidelines will be rejected. In case all three names are rejected, we will have to propose another alternative of three names from the beginning.

Step 3: Submission of application for obtaining Commercial Registration

- The third step of registering a business is submitting registration papers to the Ministry of Industry Commerce and Tourism (MOICT) for obtaining commercial registration without any business license. The process is different for companies and individual investors.

- For individual establishments, the commercial registration papers are submitted to the Bahrain Investors Center (BIC).

- For Companies/organizations, the commercial registration papers are submitted to the Ministry of Industry Commerce and Tourism (MOICT) through the use of the ‘SIJILAT portal’.

Step 4: Acquiring other licenses and approvals

- While commercial business registrations are permitted to start operations right away after getting commercial registration from MOICT, however, certain specially mentioned businesses are required to obtain permits and authorization from multiple government authorities and regulatory agencies.

- According to your business activities, Tetra Consultants will also assist in acquiring a valid business permit and license where necessary.

Step 5: Preparation of supporting documents required for final approval to register company in Bahrain

- Our team will also assist with renting a local office address. The registered office will be used to maintain all corporate records and official documents.

- Our legal team will prepare the lease agreement required to be presented before the Bahrain authorities during the process of taking approval from the Ministry of Works, Municipalities Affairs, and Urban Planning for the commercial address of the company.

- In most cases, the directors and shareholders are required to provide basic KYC documents. Some of these documents include the names of directors, certified true passport copies, proof of address, bank reference letter, and CV for our internal due diligence checks.

- According to the business activity and corporate structure, Tetra Consultants will also draft articles of association, business plan, and other incorporation documents.

- Your articles of association drafted will include key information about your company and directors, the amount of subscribed share capital, share classes, duration of the company, and other information with regard to your business activities.

Step 6: Corporate bank account opening

- Depending on your business structure, the documents required will be slightly different.

- Tetra Consultants will help in consolidating the documents and opening a corporate account with a reputable bank of your choice in Bahrain for transferring the capital funds required before the incorporation process.

- Typically, directors and shareholders are not required to travel during the process. However, if travel is required, we will have a representative accompany you to the bank meeting. Alternatively, our team will negotiate to conduct a conference call instead or request a waiver.

- Once the account has been successfully opened, Tetra Consultants will instruct on injecting the required minimum amount of capital required for the incorporation of your Bahrain company and acquiring the bank deposit certificate to be submitted for final approval.

- Once done Tetra Consultants will assist in converting the capital account into a fully operational corporate bank account and courier the internet banking token and access codes to your preferred address.

Step 7: Obtaining the final approval for registering the company with the Bahrain Ministry of Industry Commerce and Tourism (MoICT)

- This is the last step of company formation in Bahrain. Now we will submit all required documents to the Bahrain Ministry of Industry Commerce and Tourism (MoICT) for final approval to be obtained.

- Once final approval is granted, your company is registered. Tetra Consultants will courier the Certificate of Incorporation, Memorandum and Articles of Association, and other corporate documents to your preferred address.

Step 8: Tax registration Number

- Following the setup of your new Bahrain corporate home, Tetra Consultants will continue to provide you with the necessary accounting and tax services to ensure that you can continue to legally conduct business while staying compliant with regulatory obligations.

- Tetra Consultants will assist you in obtaining the Tax Identification Number (TIN) for filing VAT returns and availing exemptions for your business.

What are the documents required to register company in Bahrain?

This is dependent on the type of company intending to be registered. However, the general documentation required does not differ substantially when taking this into consideration.

- Name of the Company

- Notarized passport copies and details of all its managing directors, supervisory directors, and any existing proxy holders

- The company’s registered address details

- Article and memorandum of association

- A description of the company (purpose)/ business plan

Accounting and tax obligations in Bahrain

- Bahraini companies are completely free of taxation except for companies in oil, gas, oil exploration, mining, and refining sectors taxed at 46%.

- Value-added tax (VAT) is imposed on goods and services at a uniform rate of 5%. Financial and insurance services and real estate businesses are VAT exempt. No VAT is levied on food items and education. Oil and gas exploration is also free of VAT.

- Foreign Commercial and residential properties attract 10% Municipal Tax and 2% stamp duty is levied on sales and registration of real estate properties.

- The import duty of 5% is levied on imported goods. Alcohol and cigarettes attract 125% and 100% duty. All imported goods in Bahrain need customs clearance from the Director-General of Customs.

- Bahrain is free of withholding tax, capital gains tax, and payroll tax.

- All companies are required to submit audited financial statements within 6 months of financial year-end and file quarterly tax returns as a formality to show the authorized share capital and any change in the company. Non-compliance with such requirements attract 1% monthly fines.

- Bahrain has a Double Taxation Avoidance Agreement (DTAA) with more than 40 countries motivating foreign entrepreneurs for company formation in Bahrain.

Why do companies register in Bahrain?

Political

- The Bahraini government maintains a pro-business commercial environment and supports business start-ups.

- According to the rankings for the Index of Economic Freedom 2022, Bahrain is the fourth freest economy in the Middle East and North Africa (MENA) region and is the 74th freest economy in the world.

- The Kingdom of Bahrain was ranked among the top 20 global economies in attracting direct investment, according to the Financial Times’ Greenfield FDI Performance Index 2021. Bahrain ranked 15th among 84 countries from around the world that were included in the report. The Kingdom also ranked 2nd in the Gulf and 3rd in the Middle East and North Africa (EDB Bahrain, 2022).

Economic

- Bahrain has become a country that possesses a modern global economy. It boasts a long track record of economic achievements over the past few decades. Furthermore, the financial services sector in Bahrain has witnessed continuous thriving for over 40 years.

- Bahrain’s financial sector has been selected as the most advanced and secured place in the Arab Gulf, as mentioned in the Global Competitiveness Report of 2019 published by the World Economic Forum. Accordingly, the Kingdom of Bahrain was ranked 4th among 141 countries.

- Ranked 43rd among 190 economies in the ease of doing business report of 2020, Bahrain has also been recognized as a High-Income country by the World Bank and the country’s high income can be attributed to oil and natural gas, aluminum export, and tourism.

Legal

- Bahrain is considered one of the most open economies in the Middle East and North Africa (MENA) region. With several free trade agreements, excellent infrastructure, and strong financial institutions, Bahrain is well-positioned to provide traders and investors access to regional and international markets.

- Bahrain is only one of two Gulf Cooperation Council (GCC) member countries to have a Free Trade Agreement (FTA) with the United States. In most sectors, Bahrain permits 100 percent foreign ownership of a business or branch office, without the need for a local partner, and has no tax on corporate income, personal income, wealth, capital gains, withholding, or death/inheritance. Additionally, Bahrain has no restrictions on the repatriation of capital, profits, or dividends.

- After previously ranking 62nd in 2019, Bahrain strengthened business climate conditions and improved to 43rd out of 190 countries in the World Bank’s “Doing Busines 2020” report. The World Bank recognized Bahrain as one of the top 10 most improved economies after implementing the highest number of regulatory reforms, improving in almost every area measured by the Doing Business report.

Technology

- Bahrain has climbed by a spot to rank 78th on the Global Innovation Index 2021, which checks the pulse of the most recent global innovation trends.

- Bahrain features the region’s highest internet and social media penetration rates, reaching 99% in 2020, according to government surveys. Bahrain is currently upgrading the internet infrastructure and featured 5G network coverage of 95% in 2020.

- Bahrain has some of the best quality infrastructures in the world, Bahrain ranks first globally in Telecommunication Infrastructure Index (TTI) calculated and published by the United Nations in 2020.

Social

- Bahrain’s economy is the lowest in terms of basic constituent costs. This is an added value for investors, as the rental value of office and industrial space is less than any other country in the Gulf Cooperation Council (GCC). The cost of living is low, which makes the income levels more competitive than all other neighboring countries.

- The Bahraini workforce is characterized by being the highest in the Gulf Cooperation Council (GCC) in terms of educational attainment, skills, and efficiency. This allows investors to reduce the size of the necessary spending to bring in foreign labor.

- Bahrain is a welfare state. Medical care is free and comprehensive for both nationals and expatriates.

Environmental

- While the Kingdom of Bahrain had ranked first in the Gulf region and sixth in the Middle East in the Environmental Performance Index (EPI) 2016, issued at the World Economic Forum. The quality of air is decreasing ranking Bahrain at the 90th position under the Environmental performance index released by the World Economic Forum in association with Yale University 2022.

Looking to register company in Bahrain?

Contact us to find out more about how to register a company in Bahrain. Our team of experts will revert within the next 24 hours.

FAQ

How much does it cost to register a company in Bahrain?

- Depending on the services you need from Tetra Consultants, the total engagement fee will differ. Our services include planning and strategizing with your company, assisting you in the incorporation process, ensuring that you are compliant, and more.

- This total fee includes the registration fee charged by the Bahrainian government. We will discuss with you the total engagement fee you would need to pay before we start the registration process for your company.

How long does it take to register a company in Bahrain?

- Tetra Consultants will register your Bahrain Company within 10 weeks.

What is the minimum capital required for company registration in Bahrain?

- For a joint-stock company, the minimum capital required is BHD2,50,000 and for a limited liability company, the minimum capital required is BHD20,000.

What is the minimum number of shareholders for company registration in Bahrain?

- The minimum number of shareholders would depend on the requirements of the business. A minimum of two shareholders are usually required for a business in Bahrain.

Are there any nationality requirements for company incorporation in Bahrain?

- No there are no forms of nationality requirements for companies in Bahrain.

Is there any foreign investment restriction in Bahrain?

- No, there is no foreign investment restriction in Bahrain. However, it is important to carry out research and due diligence for investing in a particular sector.

Do I have to take a lease with a local Bahrain office for company registration?

- Yes, a physical office is required in Bahrain.

Are the details of shareholders and directors of a company publicly available?

- Yes, the details of the shareholders and directors of a company are available to the public.

What are the most common company types in Bahrain?

- The Limited Liability Company and the Free Zone company are the most common registered company types in Bahrain

Can I own a business in Bahrain?

- 100% foreign possession is allowed in fitting a business in Bahrain. Sector-specific and/or company sort restrictions could apply.