BVI Approved Investment Manager License

- The BVI Approved Investment Manager License has steadily become one of the most sought-after regulatory licenses in the financial industry. Moreover, investors, fund managers, as well as financial services providers are increasingly opting for the British Virgin Islands (BVI) as their preferred jurisdiction because of its flexible regulatory framework, global recognition, and business-friendly atmosphere.

- The BVI-approved investment manager license is commonly known as the “Approved manager” regime. It is a streamlined and regulatory licensing option that is available in the British Virgin Islands (BVI). The license is available to qualified investment managers and advisers, and is governed by the Investment Business Regulations, 2012. At Tetra Consultants, we help our clients obtain a BVI Approved Investment Manager License. Our team will guide you through the application process to secure the license while also ensuring compliance with the regulatory requirements.

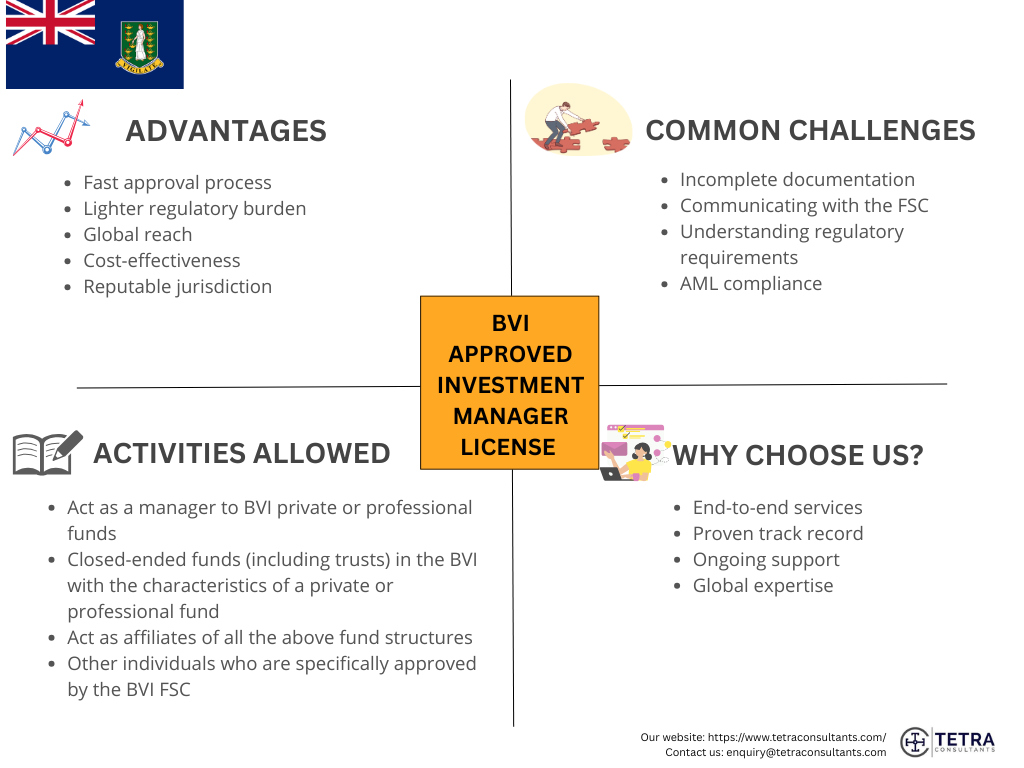

Advantages of BVI Approved Investment Manager License

Fast approval process

- The application process for BVI Approved Investment Manager License is fast and secure. The applications are usually processed within 4 to 5 weeks. It is due to the fast application process that managers can quickly start their operations.

Lighter regulatory burden

- In the BVI Approved Manager license, the BVI regulatory code does not apply. This implies that there is no need to appoint an auditor, compliance officer, or even maintain a comprehensive compliance manual. However, managers should still appoint a money laundering reporting officer (MLRO) and adhere to the anti-money laundering laws.

Global reach

- A manager can offer services to BVI and a specific non-BVI jurisdiction, which increases their target market as well as client base.

Cost-effectiveness

- The regime reduces initial and ongoing compliance costs, which makes it an attractive option for small managers and start-ups. Furthermore, there is no audit requirement, and the ongoing licensing fee for this license is relatively low.

Reputable jurisdiction

- The BVI offers a stable legal and regulatory environment, a neutral tax regime, and is recognized internationally as a credible as well as highly regulated financial center. This further improves the credibility of the license managers, leading to more and more investors opting to register company in BVI.

Costs and timeline for getting the BVI Approved Investment Manager License

- The process of getting a BVI Approved Investment Manager License is quick and efficient. Our team helps you in incorporating a BVI business company when all the necessary documents are provided, which usually takes 1 week. During the incorporation stage, we also prepare your licensing application, including all the required compliance documents, and submit your application to the BVI FSC. The review and approval process usually takes around 4 to 5 weeks, based on your application. After we get the license, our team then moves ahead with opening a corporate bank account, which usually takes an additional 3 to 4 weeks.

- The total cost of getting a BVI Approved Investment Manager License is based on multiple factors, such as your business structure, funds, and whether you require any additional services. While the approved manager regime is created to be cost-effective, there are still government fees, annual renewal fees, and ongoing compliance costs. At Tetra Consultants, we offer a transparent fee structure to ensure that you have a clear understanding of all the necessary costs before starting the process.

Regulatory authority for BVI Approved Investment Manager License

- The regulatory authority that is responsible for the BVI Approved Manager License is the British Virgin Islands Financial Services Commission (BVI FSC). The BVI FSC oversees all the applications, approvals, as well as ongoing compliance for the BVI Approved Managers. This consists of:

- Ongoing oversights like annual financial returns, anti-money laundering (AML) compliance, as well as new changes to the business information.

- Enforces new requirements under the Investment Business (Approved Managers) Regulations and other applicable financial services laws.

- Reviews and processes applications for the Approved Manager Status.

- The BVI FSC is the sole regulatory body for the financial services business in the BVI. The BVI FSC ensures that the approved managers comply with the fit-and-proper criteria, AML/CTF regulations, reporting standards, and other rules set up by the BVI law.

Activities allowed under the BVI Approved Investment Manager License

- The BVI Approved Manager License enables the holder to conduct the following activities:

- The license can allow a manager to act as an investment manager or investment advisor to:

- BVI private or professional funds that are registered under the Securities and Investment Business Act (SIBA).

- Closed-ended funds (including trusts) in the BVI with the characteristics of a private or professional fund.

- Act as affiliates of all the above fund structures.

- Funds from reputable and recognized jurisdictions (non-BVI) that have equivalent characteristics to the BVI private or professional funds.

- Other individuals who are specifically approved by the BVI Financial Services Commission (FSC), on a case-by-case basis.

- These permissions enable BVI Approved Managers to manage as well as to provide advice to a broad range of private, professional, and closed-ended fund vehicles, within the BVI and in the key recognized international jurisdictions.

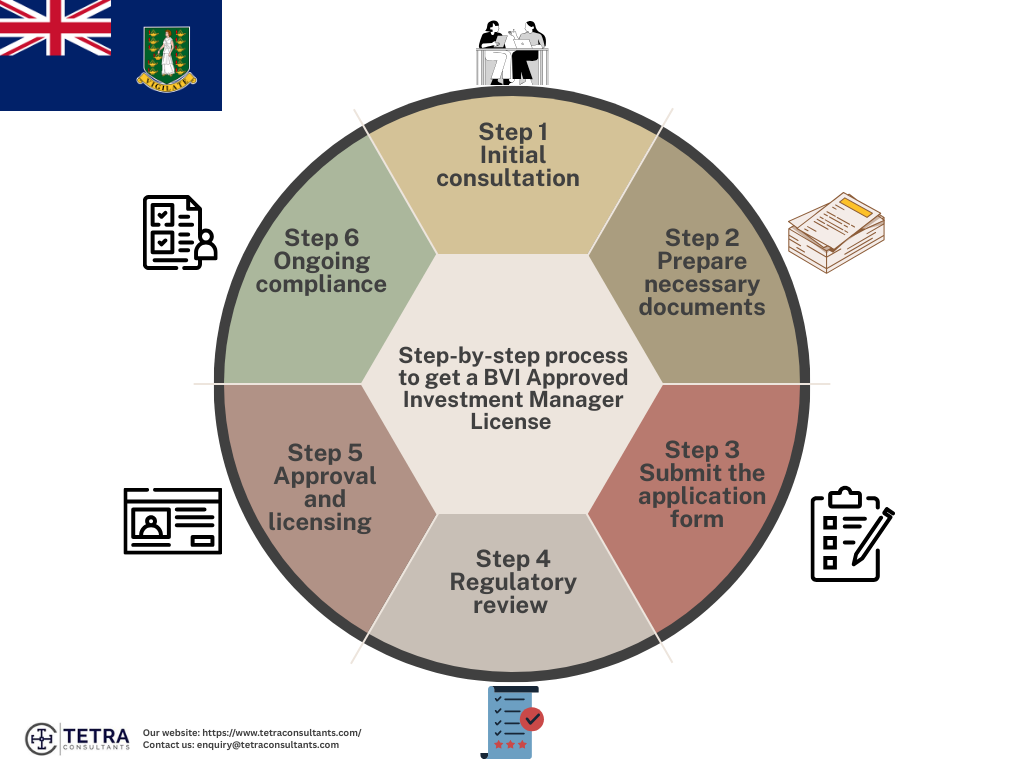

Step-by-step process to get a BVI Approved Investment Manager License

- At Tetra Consultants, the application process to get a BVI Approved Investment Manager license consists of several stages:

Step 1- Initial consultation

- Before moving ahead with your license application, our team conducts an initial consultation. In this meeting, we evaluate your business model, funds, and see if you are fit to apply for the approved manager’s license. Our experts also confirm that your BVI qualified funds are within the asset limits (that is $400 million for open-ended, and $1 billion for closed-ended funds)

Step 2- Prepare necessary documents

- After the initial consultation, Tetra Consultants then move on to prepare the necessary documents. This usually consists of lists and details of the funds to be managed. Our team also confirms all the details about the planned fund activity, the intended date to start business, and if there are any delegations of the business functions.

- Based on the documents you have provided, our team then moves ahead with preparing your business plan, compliance manual, and other documents required for the BVI Approved Investment Manager License.

Step 3- Submit the application form

- After preparing the necessary documents, Tetra Consultants will then move ahead with submitting your application form to the BVI Financial Services Commission (BVI FSC). Our team includes all the relevant documents that may be needed and ensures that the application form is signed by a director or general partner.

Step 4- Regulatory review

- The FSC then reviews your business application, and it may request additional clarification to ensure compliance. At Tetra Consultants, our team communicates with the FSC and provides all the additional clarifications and ensures that the process goes smoothly.

Step 5- Approval and licensing

- Once your application is approved, you will get the license from the FSC. Through this license, you can easily begin your business operations.

Step 6-Ongoing compliance

- After getting the license, at Tetra Consultants, we also provide regulatory compliance consulting services and corporate bank account opening services. Tetra Consultants then file for the annual returns and financials with the FSC. Our team also ensures compliance with the AML/CTF regulations and promptly notifies the FSC if there are any significant changes or if your fund exceeds AUM thresholds.

Common challenges and how we can help

- While the procedure to get the BVI Approved Manager License is efficient and cost-effective, applicants usually face multiple challenges during the process. Now, without adequate guidance, applicants make several mistakes, which lead to the delay or their application being rejected. Here are some common challenges and how Tetra Consultants help:

Incomplete documentation

- There are many applications that get delayed because they are mission-critical documents, or the application form is not filled with the required documents, like the business plan or compliance manual. At Tetra Consultants, our team prepares all the documents on your behalf and ensures that they are correctly filed with your application to ensure that there are no delays.

Communicating with the FSC

- Communicating with the FSC or following up is a tedious process. Applicants who are not familiar with the local regulatory practice find it difficult to communicate with the FSC to answer necessary queries or provide further clarification.

- At Tetra Consultants, our team communicates with the FSC on your behalf. We provide a reliable channel for all regulatory communication, which reduces the risk of missing any regulatory requirements.

Understanding regulatory requirements

- Applicants often fail to interpret the eligibility criteria. This further leads them to file their application with the incorrect documents or fail to fulfill the ongoing compliance obligations.

- At Tetra Consultants, our team easily interprets the regulatory requirements, clarifies eligibility criteria, and provides up-to-date insights into the BVI rules. This helps to streamline the entire application process and reduce any errors.

AML compliance

- Applicants find it difficult to draft the AML procedures and appoint a qualified MLRO officer with specific knowledge of the BVI regulatory framework.

- At Tetra Consultants, our experts draft the AML manuals and also help you with the appointment of the MLRO officer. Our teams ensure compliance with the BVI anti-money laundering standards to ensure that there are no penalties in the future.

Requirements for BVI Approved Investment Manager License

- Eligibility

- The applicant should be a BVI business company or a BVI limited partnership.

- Assets under management (AUM) limits

- Open-ended funds- These funds are up to $40 million.

- Close-ended funds- These funds are up to $1 billion.

- Corporate governance

- At least two directors for companies

- At least one general partner for a limited partnership

- Ongoing regulatory obligations

- License holders will have to pay the annual FSC renewal fee

- File annual return and AML return with FSC

- Submit annual financial statements (not mandatory to be audited) that are signed by a director or general partner

- Appoint and maintain an AMLRO, also maintain AML/CTF policies

- Notify the FSC if there are any new changes in the business information or if the AUM is more than the regulatory caps

- It is mandatory to appoint a BVI authorized representative to act as liaison with the FSC

Documents needed for BVI Approved Investment Manager License

- Certificate of incorporation or limited partnership agreement

- Charter or Articles of Association

- Memorandum of Association or Deed of Partnership

- Resume or CVs of each director, general partner, and senior officer of the applicant company and partnership

- Resume of each individual who will carry out the day-to-day investment business functions of the company

- Copies of the Investment management or advisory agreement will be needed between the applicant and each fund or person to whom the services will be provided

- Number and details of each fund that the applicant intends to manage or advise (includes name, address, and jurisdiction)

- Offering documents or certificates of incorporation for the funds

- Confirmation and details regarding the delegation of relevant business functions, which consists of delegation agreements and delegates’ profiles

- A written declaration by the authorized representative or legal practitioner of the applicant stating that the application is complete and fulfills all the regulatory requirements

- A written confirmation from the BVI-licensed legal practitioner of the applicant agreeing to act for the applicant

- A copy of the AML and counter-terrorism financing policies of the applicant and procedures

How can Tetra Consultants help with BVI Approved Investment Manager License?

- Getting a BVI Approved Investment Manager license is a difficult procedure for the fund managers, as the process requires careful planning, regulatory understanding, as well as strict adherence to the BVI FSC. At Tetra Consultants, our team has years of experience in offshore licensing and regulatory compliance, along with a strong track record of helping our clients. Here are the reasons why our clients choose us:

- End-to-end services- Our team provides assistance throughout the process, from incorporating the BVI business company to preparing documents and offering regulatory compliance support.

- Track record– Tetra Consultants has a successful track record of guiding investment managers, hedge funds, and private equity firms.

- Ongoing support– Our team is there with you at every step, we will help you with annual filings, provide advisory support. And compliance updates so that your business grows.

- Global expertise- At Tetra Consultants, our team has worked with multiple clients from various jurisdictions. Our experts understand the multiple needs of fund managers and create solutions to help them.

Looking to obtain BVI Approved Investment Manager License

- If you are planning to establish or expand your investment management business, getting a BVI Approved Investment Manager License is significant. BVI is recognized worldwide as a leading jurisdiction for fund management. However, navigating through the application process is a complex step, especially if you are not familiar with the regulatory requirements. At Tetra Consultants, our team ensures that you have a smooth journey, and we are there from beginning to end.

- Contact us, and our team will get back to you within 24 hours.

FAQs

Who can apply for this license?

What type of funds can I manage through this license?

Are foreign fund managers allowed to apply for this license?

Can the license be renewed?

What are the main compliance requirements that I have to follow after getting this license?