BVI compliance officer services

- If you are planning to operate a regulated business in the British Virgin Islands, especially in the area of financial services, virtual asset businesses, or even investment management. Then, opting for BVI compliance officer services is not only a regulatory requirement but rather a strategic advantage. If you are applying for a BVI VASP License, looking for approval for a BVI approved investment manager license or planning to register company in BVI, then the right compliance structure will ensure smooth operations, mitigation of risks, and long-term sustainability of your business.

- The present regulatory landscape is constantly evolving, and the BVI Financial Services Commission (BVI FSC) has increased its emphasis on governance, AML/CFT controls, risk management, and corporate transparency. As a result, businesses across various industries are now turning to specialized BVI compliance officer services in order to fulfill their statutory obligations, while also maintaining operational integrity.

- At Tetra Consultants, we support our international clients and provide them with end-to-end regulatory compliance consulting services to ensure that their business is meeting all the legal requirements of the BVI. Our expert team of professionals, risk analysts, and legal experts makes sure that your business is not only fulfilling statutory expectations but is also exceeding them through proactive compliance planning.

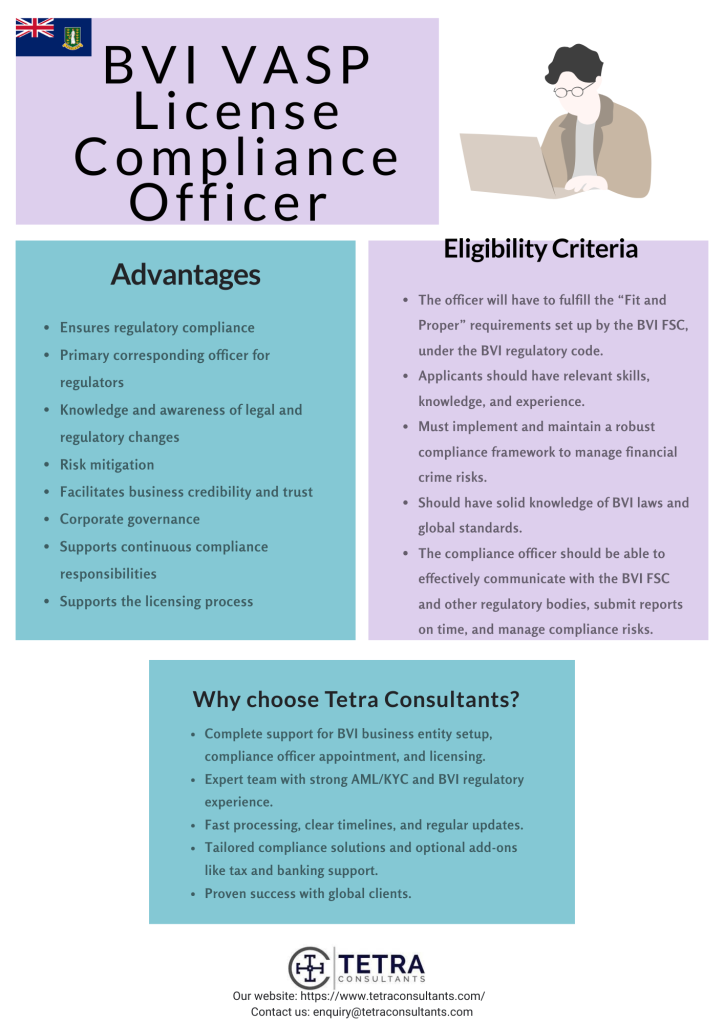

Advantages of appointing BVI compliance officer services

- Opting for the BVI compliance officer services is beneficial for your business. The compliance officer will act as the primary communicator with regulatory authorities, provide timely updates regarding legal changes, and manage necessary filings along with reports to keep your company in good standing. Here are the main benefits of compliance officer services:

Business credibility and trust

- Hiring a knowledgeable compliance officer will improve the credibility of your company with customers, partners, and even financial institutions. It also facilitates better access to the partnerships and international markets that also demand strict adherence to the regulatory standards.

Ongoing compliance and corporate governance

- The compliance officer also manages all regulatory responsibilities, like submitting changes to the BVI Financial Services Commission (BVI FSC), preparing the auditor letters, and renewing the licenses. They offer regular training to the staff and directors regarding compliance matters and report the compliance risks, as well as breaches, to the board, to ensure that the company fulfills the FSC’s expectations for good corporate governance.

Regulatory compliance and mitigation of risks

- A compliance officer ensures that compliance is followed with all the legal and regulatory requirements of the BVI. This also consists of the anti-money laundering (AML), and counter-terrorism financing (CTF) obligations. The officer will establish and maintain internal controls along with compliance manuals. This will further reduce the operational, financial, and reputational risks associated with business activities, especially for Virtual Asset Service Providers (VASPs).

Corporate governance

- The compliance officer will make sure that all the key personnel and directors are fulfilling the fit and proper framework. The officer will also ensure that the governance frameworks of the company are good and are up to the BVI FSC’s expectations.

Who should appoint BVI compliance officer services

- BVI compliance officer services should be hired by all individuals and businesses who are conducting regulated financial services in the British Virgin Islands, as required by the Financial Services Commission (FSC). This consists of the BVI business companies, registered partnerships, and approved individual VASPs who provide virtual asset services.

Regulated financial services entity

- Entities licensed or regulated under the BVI financial services legislation, which consists of those involved in investment business, virtual assets, and insurance. These businesses need a designated compliance officer. The officer will ensure compliance with the AML, CTF, and other regulatory laws, while also acting as the primary communicator of the business with the regulatory authorities.

VASP-specific requirements

- Under the BVI VASP Act, all the VASP applicants, as well as license holders, such as BVI business companies, partnerships, or individuals, will have to hire a qualified compliance officer. The officer will have to fulfill all the FSC standards for skills, experience, along with fit and proper criteria. A compliance officer will then help you with licensing applications, risk management frameworks, along with ongoing reporting.

Eligibility criteria

- The eligibility criteria for hiring a BVI compliance officer include:

- The officer will have to fulfill the “Fit and Proper” requirements set up by the BVI FSC, under the BVI regulatory code. The individual should display honesty, integrity, capability, competence, and financial propriety.

- Applicants should have relevant skills, knowledge, and experience, especially in the area of AML, CTF, and regulatory compliance within the virtual asset or financial services space.

- The officer should be familiar with the BVI law and global standards that are applicable to the VASPs.

- The compliance officer should be proficient in conducting customer due diligence (CDD/KYC), enhanced due diligence (EDD), suspicious activity report (SAR) investigation, ongoing reporting, and risk-based compliance assessments.

- The compliance officer should be able to effectively communicate with the BVI FSC and other regulatory bodies, submit reports on time, notifications, and manage compliance risks.

- The applicant should be able to establish, incorporate, and maintain a strong compliance framework that is aligned with the BVI law and regulatory standards.

- The BVI FSC evaluates the candidates on the basis of these criteria and then approves the appointment, ensuring that the candidate is able to maintain the compliance responsibilities and even uphold good corporate governance standards.

Services provided by Tetra Consultants BVI compliance officer services

- When you choose Tetra Consultants for BVI compliance officer services, you will get a wide range of services from initial onboarding through regulatory support. Our services are created to make sure that your company meets all the regulations under the BVI laws and the regulations imposed by the BVI FSC. Here the all the services that we provide:

- Our team will help your business adhere to the relevant laws, which also includes the VASP Act 2022 (that is for virtual-asset service providers), FSC regulations, and the applicable AML/CFT laws

- Our team will guide you throughout the application process, communicate with the regulators, prepare necessary documents, and make sure that your compliance structure is meeting FSC expectations

- Our team at Tetra Consultants will draft and incorporate a strong compliance infrastructure that is tailored to your business. This will include:

- Compliance manuals, policy documentation, and internal controls

- System and processes for any suspicious activity reporting that will be reported to the BVI Financial Investigation Agency (FIA) and record-keeping,

- AML/CFT programs that cover customer due diligence, transaction monitoring, ongoing customer risk evaluation, and transaction monitoring.

- Monitor legal and regulatory frameworks and see if there are any changes, and will update policies and processes accordingly

- Ensure that the appropriate transaction monitoring systems are in place for both the fiat as well as virtual asset transactions.

- Act as a liaison with the BVI FSC and will respond to any regulatory requests or inspections.

- Take a risk-based approach to compliance and create a compliance risk evaluation

- Monitor and handle any cross-border activities in adherence with the applicable law

- Maintain a compliance monitoring program and test the control effectiveness of all the compliance policies

- Provide staff training to your team that is aligned with the compliance requirements, which includes:

- KYC/EDD procedures

- Sanctions compliance

- Data protection and regulatory updates

- AML/CFT processes

- The director will also ensure that the key personnel of your business such as directors, officers, and senior management, fulfill fit-and-proper standards, and also maintain an appropriate structure

- Maintain proper records of:

- All the business transactions

- Internal/external compliance reports

- Risk evaluations

- Client due diligence

- Provide regular updates to the Board of Directors or governing body regarding the compliance risks, issues, controls, and any breaches

Steps for opting for BVI compliance officer services

Step 1- Initial consultation and compliance evaluation

- Our team will begin the process by understanding your business activities, licensing requirements, and regulatory exposure. Tetra Consultants will conduct a thorough evaluation to determine the specific compliance needs of your business. This consists of reviewing your corporate structure, risk levels, and outlining the compliance personnel that your company should appoint.

Step 2- Selecting qualified candidates

- Our team will then shortlist highly professional candidates who meet the fit and proper criteria of the FSC. Our team will evaluate the candidate on the basis of:

- AML/CFT expertise

- Experience with the BVI regulations

- Sector-specific knowledge

- Professional integrity and track record

Step 3- Preparing compliance manuals and AML/CFT framework

- Before submitting the appointment, our team will prepare compliance documents that are personalized as per your business model. This consists of:

- AML/CFT policies

- Internal control processes

- Record-keeping policies

- Suspicious activity monitoring procedure

- Risk-based compliance manual

- KYC/EDD onboarding framework

Step 4- Submitting appointment documents to the BVI FSC

- Tetra Consultants will then submit all the required documents to the FSC, which consists of:

- Personal questionnaires (PQs)

- Fit-and-proper declarations

- Police clearances

- CO/MLRO appointment forms

- AML/CFT training certificates

- Supporting identity and qualification documents

Step 5- Respond to the FSC queries and clarification

- During the review procedure, the FSC will request additional clarifications regarding the background and expertise of the candidate. Tetra Consultants will respond to all the queries on your behalf, ensuring that there are no delays.

Step 6- Approval of the compliance officer

- Once the FSC approves the appointment, your company will be officially recognized as compliant, fulfilling all the statutory requirements. Our team will ensure that you receive all the documents of confirmation, along with guidance on the next steps.

Step 7- Implementing compliance processes

- After the approval, our team will integrate all the compliance procedures into your everyday operations. The compliance officer will then start with his duties. This consists of:

- Conducting AML staff training

- Incorporating risk-evaluation frameworks

- Setting up the transaction monitoring tools

- Ensuring that all the record-keeping systems are updated

- Establishing clear reporting workflows

Step 8- Review

- At the end of the engagement cycle, our team will then reach out to get your feedback and see whether you would like to renew or terminate the compliance officer. Based on this, our team will assist you with whatever option you have chosen.

BVI licenses covered by Tetra Consultants

- Tetra Consultants help our clients in getting a wide range of regulatory licenses in the BVI jurisdiction. Our team ensures that there is full compliance with the FSC requirements from beginning to end. Our team prepares all the application documents, drafts all the compliance frameworks, and appoints qualified personnel. If you are entering the financial services sector of the BVI, then we provide end-to-end support to ensure that there is a smooth licensing experience.

BVI VASP License

- As per the BVI VASP License Providers Act those businesses that deals with virtual assists like exchanges, custodians, wallet providers,, and token issuers will have to get a BVI VASP License, Our team at Tetra Consultants offers full assistance with the application, this consists of preparing AML/CFT policies, risk evaluation frameworks, and appointment of the compliance officers, in order to meet the FSC standards.

BVI Approved Investment Manager License

- Those businesses that offer investment management services in or from the BVI should get the BVI Approved Investment Manager License. Our team will prepare the application, review your business model, draft the internal controls along with governance structures in order to ensure that your company is meeting all the statutory obligations. We also advise on suitable fund structures, director requirements, along with ongoing compliance duties.

Cost for appointing a BVI compliance officer services

- The cost of opting for BVI compliance officer services differs on the basis of your business activities, what regulatory licenses your business holds, and the level of adherence required. Those entities that are applying for a BVI VASP License or a BVI Approved Investment Manager License usually require more than the extensive oversight, which can impact the overall service fee. Usually, the cost consists of appointing a qualified compliance officer, MLRO, or a deputy MLRO, preparing AML/CFT manuals, ongoing transaction monitoring, annual compliance reviews, along with support during the FSC inspections. At Tetra Consultants, our team will provide you with transparent and fixed fee pricing that is personalized as per your regulatory obligations, making sure that you get a comprehensive compliance solution without any hidden fees.

Why should you choose Tetra Consultants?

- Selecting the right partner for the BVI compliance officer services is significant in order to maintain a strong regulatory foundation in the BVI. At Tetra Consultants, we stand out as trusted advisors with years of experience in supporting international businesses across multiple industries. Our team has taken one step beyond basic compliance monitoring; we provide strategic, end-to-end support in order to help your business stay ahead of its competitors.

- Here are the main reasons why you should choose us:

- Dedicated compliance professionals

- We have strong local partnerships in the BVI

- Proven track record for successful license approvals

- Our solutions are personalized as per your business model, and ensure strong AML/CFT systems are in place

- Fast and effective processing

- We also provide optional value-added services such as tax filing, offshore financial licenses, accounting, and corporate bank account opening services.

Looking to appoint BVI compliance officer services

- If you are now ready to operate your business in the BVI or are planning to expand your operations in this jurisdiction, then opting for a trustworthy BVI compliance officer services is one of the most significant steps. The BVI FSC has increased its stringent requirements for every licensed business entity in the BVI. If you are applying for a BVI VASP License, an approved investment manager license, or managing an existing regulated structure, then you need to have a strong and proactive compliance framework.

- At Tetra Consultants, our team will assist you in hiring a compliance officer, from appointing managed professionals to managing daily monitoring, reporting, and audits. Our team will handle all your business responsibilities so that you can focus on growing your operations. We ensure that your business is fully compliant, audit-ready, and well-positioned in the competitive market of the BVI.

- To opt for BVI compliance officer services, contact us today, and our team will get back to you in 24 hours.

FAQs

Is appointing a compliance officer mandatory in the BVI?

Can foreign professionals work as compliance officers in the BVI?

Do I need a compliance officer before applying for a BVI license?

What are the responsibilities of a BVI compliance officer?