Register company in Cambodia

To register company in Cambodia is hassle-free if you are familiar with the entire registration process. With Tetra Consultants at the wheel, you will be able to channel your time and energy into other more important aspects of your business.

With our lean-and-mean mentality, you can rely on our team of experts to provide you a seamless experience throughout the whole process to register company in Cambodia. Our ultimate goal is for your company to be operationally ready within the stipulated time frame.

Our service package includes everything you will require to run your company in Cambodia:

- Cambodia company registration with Cambodia Ministry of Commerce (MEC)

- Local company secretary and registered address

- Opening a local or international corporate bank account

- Tax registration

- Cambodia business visa applications

- Annual accounting and tax services

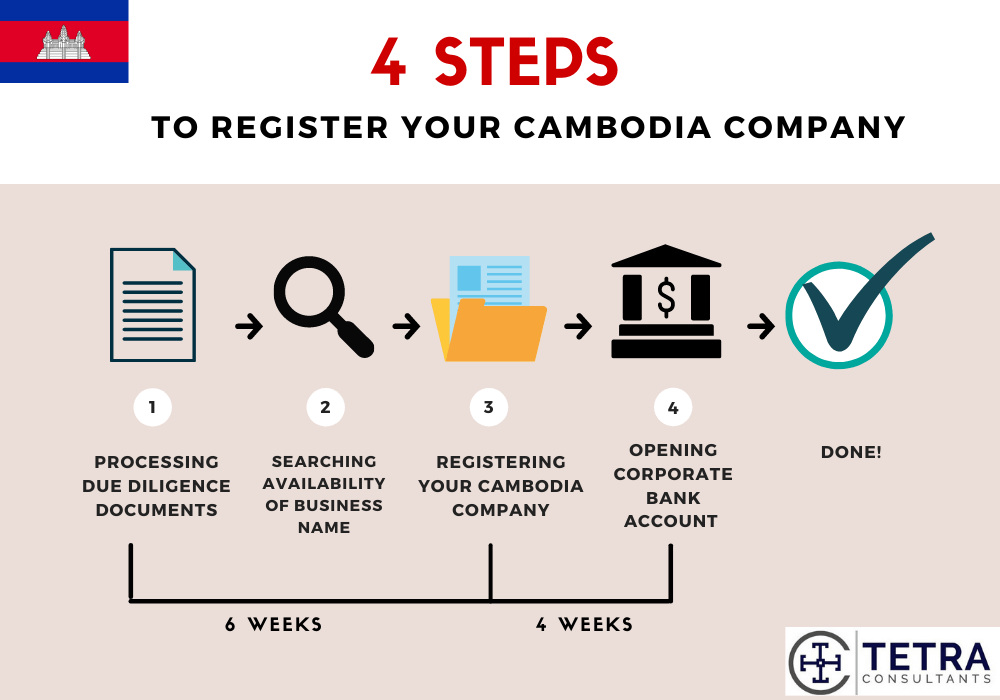

How long will it take to register company in Cambodia and open corporate bank account?

- Tetra Consultants will complete the process to register company in Cambodia through a seamless and fuss-free procedure. Upon receiving the required due diligence documents of the directors and shareholders, Tetra Consultants will proceed ahead with the search for the availability of your preferred business trade name under the Ministry of Commerce Cambodia – Business Registration Department.

- The process to register company in Cambodia can be carried out remotely and therefore, you do not need to travel to Cambodia during the registration process. On average, the Cambodia company can be registered within 6 weeks.

- After Tetra Consultants has registered your company, you can expect to receive the documents of your new company including a certificate of formation, memorandum & articles of association as well as a register of directors and shareholders.

- Within 4 weeks upon registering your company, Tetra Consultants can assist in opening a corporate bank account with a local Cambodian bank or with an overseas global bank depending on your business goals and objectives.

- Consequently, you can expect to start operations and issue invoices with your Cambodian Company within 10 weeks upon engaging Tetra Consultants.

- If you are keen to know more about the process to register company in Cambodia, Tetra Consultants has prepared a step-by-step explanation of all steps required for the setting up of your company.

Introduction to register company in Cambodia

- In recent years, Cambodia, officially known as the State of Cambodia, has seen a positive uptake in the number of foreign investors registering companies in the country. Furthermore, Cambodia has been observing a constant and steady upward growth in its Gross Domestic Product (GDP) for the past decade.

- The country has one of the highest Gross Domestic Product growth rates globally and the nation is known for its consistent economic improvement. Per the IMF World Economic Outlook Database, Cambodia Ranked 7th globally in terms of Real GDP Growth Rate out of the 192 countries listed. Agriculture and Garments export serves as cornerstones of the nation’s economy.

- Cambodia serves as an ideal location for company registration due to continual growth in the economy and the presence of pro-investment government policies emplaced to attract foreign direct investments into the country.

- The Cambodian government offers benefits such as full foreign ownership of corporations and tax holidays. With a supportive government accompanied by the availability of a sizeable labour force, Cambodia is an exceptional country to set up a business.

What is the best business to register company in Cambodia with?

- Prior to starting the registration process for your company in Cambodia, it is essential to fully understand the kind of business you are starting in Cambodia. This includes considering factors, including the cost of labour, taxation, and requirement of business license, as this differs from business to business.

- The business sectors in Cambodia currently revolve heavily within the garment, light manufacturing, agricultural, construction, and tourism industries. However, the Royal Government of Cambodia seeks to achieve and transform the nation into a middle-income economy by 2030.

- As such, efforts and incentives are placed in hopes of diversifying the country’s economy beyond traditional business sectors such as garment, footwear, and agriculture. Foreign investors can benefit from the government’s diversification efforts and gain a significant amount of support when registering a company in Cambodia.

- Cambodia’s manufacturing business sector is one of the crucial contributors to the nation’s economy. The manufacturing industry accounts for up to one-third of Cambodia’s economy. Furthermore, Cambodia was titled as Europe’s leading supplier of bicycles in 2017, illustrating how established the manufacturing industry is in Cambodia. Cambodia has one of the lowest labour costs in Asia and thus an exemplary fit for labour-intensive manufacturing businesses.

- The Garment and textiles manufacturing business sector is a key and crucial driver of the nation’s growth and development, contributing to up to approximately 65% of the nation’s total merchandise exports.

- Cambodia’s Agricultural industry accounts for 20% of the country’s economy. Furthermore, agriculture output has seen a consistent and stable upward growth in output in recent years. As a result of the Cambodian government’s attempt to support and enhance the growth of the agriculture business sector, materials, machinery, and equipment utilised in agricultural production are exempted from import duties in Cambodia.

- As a result of the Cambodian government’s goal to achieve nationwide middle-income status by 2030, the country is undergoing fast-paced urbanisation which generates an abundance of business opportunities for foreign investors. With an increase in industrial activities, the country’s demand for energy to sustain these activities rises.

- Hence, the Cambodian government has been encouraging private sector participation in the development of a national solar park in recent years. Progressive efforts to increase the nation’s coverage of power transmission and distribution provide relevant foreign investors and business owners a timely opportunity to register a company in Cambodia.

- Furthermore, to sustain the country’s rapid urbanization, there is an imperative need for increased physical and digital connectivity in Cambodia. Following the growth in the Logistics and transport business sector, the Cambodian government has recently released an updated version of the Logistics Master Plan Development, aimed at resolving the nation’s need for a developed and expanded logistical capacity. As such, government-backed business opportunities are available for interested foreign investors and business owners.

- Regarding Cambodia’s road to adopting a digitised economy, the Ministry of Posts and Telecommunications established new initiatives to encourage businesses to utilize and tap on digital solutions, embracing digital technology in day-to-day operations. Thus, for an IT company, Cambodia might be a good place to set up a business.

- Additionally, the Cambodia Security Commission is developing new rules and policies to facilitate the ease of integration of Financial Technology (FinTech) Firms into the Cambodian market. A significant percentage of the nation’s population does not have access to secure payment methods which highlight the demand for innovative digital solutions and thus translating into opportunities for FinTech related companies.

How to register company in Cambodia?

Step 1: Check to see if you meet all the requirements:

- Choose a suitable business entity for your firm.

- Declare a registered office address.

-

- If you wish to set up your business in Phnom Pneh, you must register your address with the Phnom Penh Municipal Officer.

- You must have a local resident agent for your business.

Step 2: Reserve your desired company name:

- Ensure that your proposed company name is available by checking the list of company names in Cambodia.

- You must also pay a fee of approximately $10.

Step 3: Apply to register company in Cambodia with the Ministry of Cambodia Business Registration Department:

- You must first create a CamDigiKey account.

- You will then be required to key in relevant information and upload some documents.

Step 4: Make the required payment:

- The payment fee differs depending on your business structure.

Step 5: Receive confirmation once the process to register company in Cambodia is completed:

- You will receive the article of incorporation and certificate of incorporation.

- You must get both these documents stamped to get final approval.

Step 6: Complete the post-registration procedures:

- You must open a bank account and deposit the required initial capital (depending on your business entity).

- You must also register for tax by applying to the General Department of Taxation in Cambodia.

- We understand that the process may seem slightly complex and would like to offer you our services to make this process hassle-free for you so that you can focus on running your business.

Types of companies in Cambodia

- Cambodia offers foreign investors a list of different types of business entities to choose from when incorporating a company within the country. Tetra Consultants will provide you with assistance, guiding you along the registration procedure to be carried out with the Cambodia Ministry of Commerce (MEC).

- Cambodian business entities are subjected to a flat Corporate Tax Rate of 20%. As stated, Cambodia’s Corporate Tax Rate is relatively low in comparison to the Worldwide Average Statutory Corporate Income Tax Rate of approximately 24%, measured across 176 jurisdictions. However, you do not need to pay any corporate taxes if you set up a representative office or a company in the Special Economic Zone (SEZ).

- A mandatory statutory audit by The Ministry of Economy and Finance is applicable for all Cambodian business entities. Corporations are subjected to a compulsory annual statutory audit, usually conducted at the end of each fiscal year. These regular and timely reviews ensure business integrity, keeping corruption rates low.

Limited Liability Company (Private Corporation)

- A Cambodia limited liability company (LLC) is a private limited company regarded as a separate legal entity by the Cambodian government. The limited liability company is distinct from its directors and stockholders. Hence, business owners are not personally liable for the company’s debts and liabilities. A Cambodia LLC is often the common choice amongst foreign investors when registering a company in Cambodia.

- A minimum share capital issuance of 1,000 shares each with a minimum par value of $1 is needed for Limited Liability Companies. Additionally, a foreign company or investor partaking in complex projects may be subjected to higher capital requirements.

- There must be at least 2 shareholders of any nationalities (local Cambodian not required) with full foreign ownership of the company’s share capital granted, accompanied by full capital repatriation.

- A maximum of 30 shareholders of any nationality is allowed. The restrictions on the transfer of shares to be elaborated explicitly under the company’s Articles of Incorporation.

- Minimum 1 Director of any nationality is necessary.

- Resident Company Corporate Secretary is needed.

- A company must have a registered office in the Kingdom of Cambodia under the Law of Commercial Enterprises (LCE).

Limited Liability Company (Public Limited Company)

- A Cambodia Public Limited Company is a type of Limited Company in Cambodia and is similar to a Private Limited Company. Cambodia’s Law on Commercial Enterprise enables and authorizes a Public Limited Company to issue securities to the public.

- A minimum share capital issuance of 1,000 shares each with a minimum par value of $1 is needed for Limited Liability Companies. Additionally, if your company is partaking in any form of a complex project, you may be subjected to higher capital requirements.

- There must be at least 2 shareholders of any nationalities (local Cambodian not mandatory) with full foreign ownership of the company’s share capital granted, accompanied by full capital repatriation.

- A Public Limited Company can have more than 30 shareholders of any nationality.

- Minimum 3 Directors of any nationality are needed.

- A company must have a registered office in the Kingdom of Cambodia under the Law of Commercial Enterprises (LCE).

Branch Office

- A branch office is a viable option when a foreign company wishes to expand its company in Cambodia. Owners of international business in Cambodia can establish an extension of the parent company by setting up a branch office in Cambodia.

- The purpose of a Branch Office is to facilitate operation and revenue generation in Cambodia on behalf of the foreign parent corporation.

- The parent company must account for all the liabilities and debts of the Branch Office.

- The name of the Branch office has to be identical to that of the parent company’s corporate name.

- An additional 14% withholding tax will be imposed on the remittance of branch profits.

- Minimum 1 Director of any nationality is needed.

- A local Cambodian stockholder is not necessary and the minimum number of shareholders depends on the parent company.

- A company must have a registered office in the Kingdom of Cambodia under the Law of Commercial Enterprises (LCE).

Representative Office (RO)

- Foreign investors interested in gaining an in-depth understanding of doing business and exploring investment opportunities in Cambodia have the option of setting up a Representative Office (RO) within the country.

- A Representative Office aids foreign investors to comprehensively evaluate the viability of doing business in Cambodia before finalizing a decision to set up a company in Cambodia.

- Representative Offices in Cambodia are prohibited from partaking in business activities such as regular buying and selling of goods, engaging in manufacturing, processing, or construction-related activities in Cambodia. Hence, the Corporate Income Tax does not apply to Representative Offices in Cambodia.

- There is no minimum amount of paid-up capital.

- There is no minimum number of stockholders.

- Minimum 1 Director is necessary (does not have to be a Cambodian local).

- A company must have a registered office in the Kingdom of Cambodia under the Law of Commercial Enterprises (LCE).

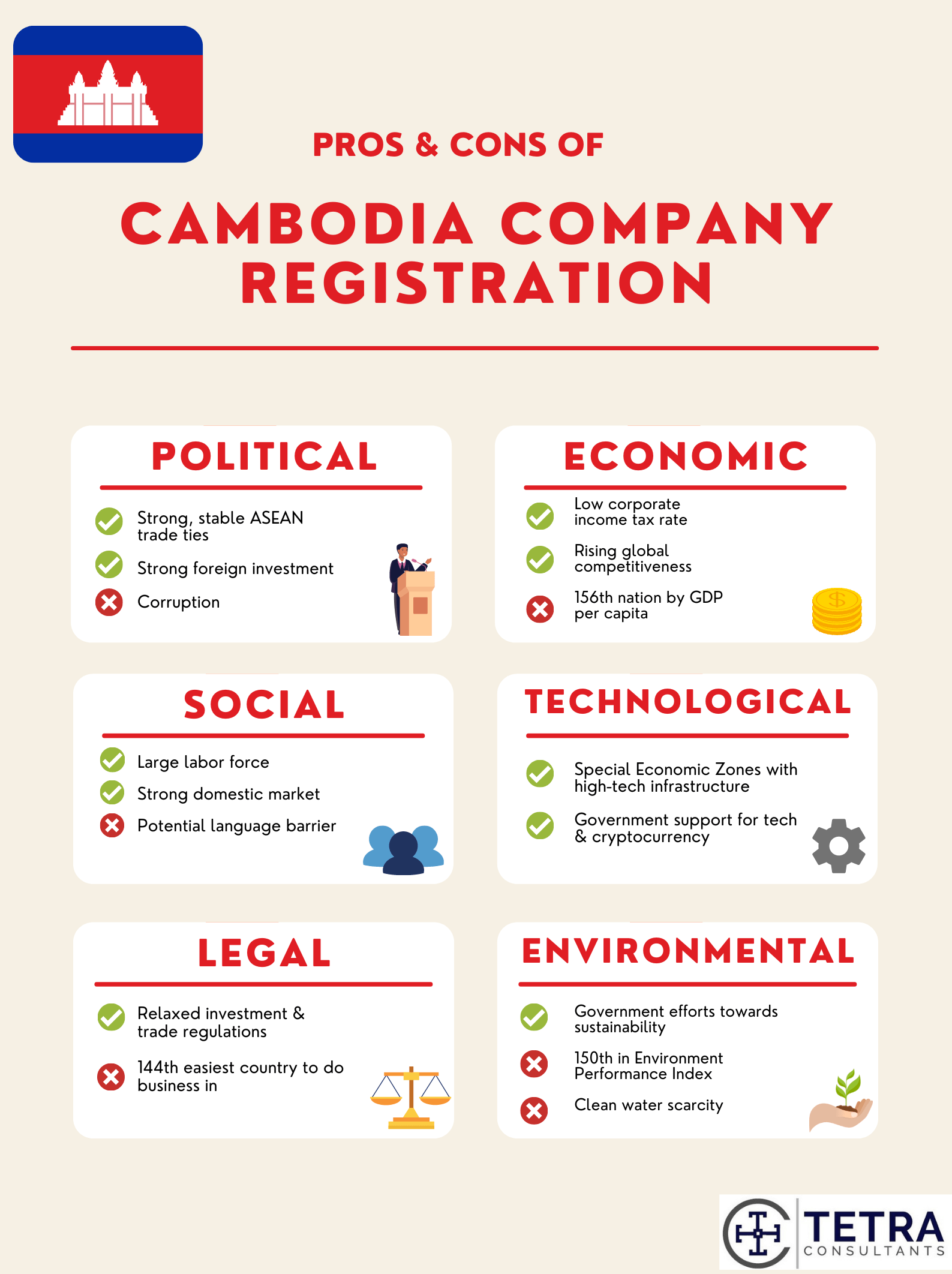

Pros and cons of Cambodia company registration

The Cambodian government highly values foreign direct investments and has provided foreign investors with a business-friendly environment in Cambodia. The nation lays out numerous attractive benefits to facilitate and ease the integration of international business owners into the country’s economy.

Furthermore, Tetra Consultants adopts a PESTLE framework to help you comprehensively analyse the feasibility and practicality of setting up a company in Cambodia.

Political

- Cambodia maintains a stable and commendable political relationship with its neighbouring countries. With the help of the nation’s ASEAN membership, it has opened up a wide array of business opportunities for Cambodia due to high market exposure across multiple countries in the region.

- Foreign business investments from neighbouring countries accelerated the success of Cambodia’s transformation into a free-market economy. As such, Cambodia has become one of the fastest developing countries in Asia. The Cambodian government’s positive political ties with neighbouring countries provide business confidence and assurance to foreign investors.

- According to the Corruption Perceptions Index (CPI) published by the Transparency International Organisation, Cambodia ranked 162thout of the 180 countries evaluated. The CPI measures the perceived levels of public sector corruption in Cambodia. As such, Cambodia’s less than ideal ranking suggests a higher risk of corruptive activities which negatively affects an investor’s confidence in the nation’s political stability.

- Cambodia establishes global diplomacy relationships with several nations and is a member of the United Nations, World Trade Organisation, and ASEAN. Furthermore, the nation’s healthy diplomatic relationships and preferential trade agreements grant Cambodia preferential export access to many developed nations and economies.

Economic

- Corporations in Cambodia are subjected to one of the lowest corporate income tax rates in the world. Properly structured, business owners are granted a tax holiday by the Cambodian government for up to 9 years. Thereafter, a 20% Corporate Income Tax will be applicable which is relatively low in comparison to the Worldwide Average Statutory Corporate Income Tax Rate of approximately 24%, measured across 176 jurisdictions.

- With reference to the Global Competitiveness Report published by the World Economic Forum, Cambodia has recently attained a national record-breaking high score in 2019. Cambodia observed an increase in its ranking on the leaderboard by 4 places accompanied by a significant increment of 1.9 in the nation’s score in comparison to the country’s performance in 2018.

- Cambodia’s continual progression in the nation’s global competitiveness illustrates the country’s up and rising position in the global economy.

- Despite the nation’s strong and consistent growth in GDP, Cambodia’s overall GDP per capita falls pale in comparison to global economies. According to The World Bank, Cambodia ranked 156th out of the 190 countries evaluated in terms of GDP per capita.

Social

- Cambodia has a population size of approximately 16 million, with a labour participation rate of 83.4%. As such, foreign investors will gain access to a large labour force. However, it is imperative to understand that the majority of Cambodia’s labour force falls under the manufacturing and agricultural business sectors.

- Cambodia’s rapidly flourishing middle-class consumer market provides foreign investors with an attractive market for businesses. Additionally, as per The World Bank, Cambodia has an extensive and vast population size of approximately 16 million. The immense nature of the nation’s overall population grants business owners access to a strong domestic market.

- According to the EF English Proficiency Index, Cambodia has a relatively low proficiency in English. Cambodia ranked 94thout of the 100 countries listed under the EF English Proficiency Index. Moreover, Cambodia’s official and business language is Khmer and corporate documents will not be in English.

- Hence, foreign investors may face difficulties when communicating with the local Cambodian government authorities and bankers. If needed, Tetra Consultants will arrange for a translation service conducted by a certified translator.

Technological

- The Cambodian government has established several uniquely designed Special Economic Zones (SEZ) where business and trade regulations differ from the rest of the country. SEZs are an integral part of the Cambodian government’s strategy to increase the influx of foreign direct investments into the nation.

- Cambodia’s Special Economic Zones provide foreign business owners with modern infrastructure and technology to meet the specific needs of businesses. For example, Special Economic Zones are equipped with modern and high-tech drainage systems providing a conducive and ideal environment for business owners.

- Cambodia takes cautious yet progressive steps towards the Financial Technology (FinTech) and cryptocurrency business sector. Just recently, the National Bank of Cambodia (NBC) announced the soon-to-be-launched peer-to-peer payment platform known as Project Bakong.

- The blockchain-based money transfer platform seeks to unify participating players in the current payment space. Project Bakong aims to facilitate and simplify payments between end-users regardless of the institution users are banked under. Cambodia’s recent gain in momentum in the cryptocurrency industry provides a business-friendly and innovative environment for foreign investors.

- Cambodia recently launched a government-funded start-up centre to provide tech start-ups with the relevant assistance and funding necessary to integrate into the nation’s economy. The newly established government-backed start-up aims to prepare for the nation’s transition into the digital age, fostering new tech start-ups in the country.

- Furthermore, the Cambodian government pledged to establish an annual USD 5 million funds to strengthen the nation’s tech business sector. The positive efforts adopted by the government reinforces the legitimacy of the cryptocurrency business sector in Cambodia.

Legal

- Foreign investors experience relaxed investment laws and trade regulations as the Cambodian government seeks to further expand the nation’s GDP growth. In recent years, the Cambodian government eased regulations on trade and foreign investments, granting full foreign ownership of a Cambodia-based corporation. As such, foreign investors are no longer compromised and limited to a maximum of 49% of share capital ownership as practiced in several Southeast Asian countries.

- Foreign investors and business owners in Cambodia gain access to Duty-Free imports of capital goods with no limitations placed on capital repatriation. As such, relaxed investment policies enacted by the government helps to alleviate the fiscal financial burden on Cambodian business owners.

- Despite the Cambodian government’s efforts to attract foreign direct investments, the nation’s ease of doing business is comparatively weaker than other countries. In accordance with the World Bank’s Ease of Doing Business Index, Cambodia ranked 144thout of the 190 countries listed under the Ease of Doing Business Index.

Environmental

- The Cambodian government understands the importance of establishing a balance between the nation’s economic development and environmental conservation. Multiple national development documents are governing the nation’s environment preservation and conservation efforts. Cambodia’s National Environment Strategy and Action Plan (NESAP) demonstrate governmental efforts to work towards sustained and stable social and economic growth in the country.

- Despite the government’s efforts to balance the nation’s industrial growth and environmental well-being, Cambodia ranked 150th out of the 180 countries assessed on the Environment Performance Index. Cambodia’s less than favourable ranking illustrates the need for more stringent environmental policies.

- Cambodia is undergoing rapid urbanisation and it has led to detrimental effects on the environment such as scarcity of clean water. Only 24% of the Cambodian population has access to a safely managed water supply.

Find out more about Cambodia company registration!

Contact us to find out more about Cambodia company registration. Our team of experts will revert within the next 24 hours.

FAQ

How to run a business in Cambodia?

- In order to run a firm in Cambodia, first, you must complete the registration process of the company as mentioned before. Following this, you must ensure that you are compliant with the laws and regulations of the government.

How much does it cost to set up a company in Cambodia?

- Depending on the services you need from Tetra Consultants, the total engagement fee will differ. Our services include planning and strategizing with your company, assisting you in the incorporation process, ensuring that you are compliant, and more.

- This total fee includes the registration fee charged by the Cambodian government.

- For a company, the registration fee is approximately $250. Additional costs that will be incurred include the fee to reserve a company name (approximately $10) and the fee for tax registration (approximately $100 for medium and large taxpayers and $5 for small taxpayers).

- We will discuss with you the total engagement fee you would need to pay before we start the registration process for your company.

How do I dissolve a company in Cambodia?

- You must first inform the tax department about your business.

- An auditor will be sent within two months and you will be required to clear any pending tax issues you have.

- You must then inform the creditors about this decision.

- You are also required to publish a report in the newspaper.

- Using the online portal, you must upload multiple statements including intent to liquidate and intent to dissolve, Resolution date, your consent, and more.

- The Ministry of Commerce will issue a certificate of dissolution to your organisation.

What are the major industries in Cambodia?

- The major industries in Cambodia are the agriculture and manufacturing industries. The manufacturing industry alone contributed to 31% of Cambodia’s GDP in 2016. Specifically, under this, the garment sector is one of the largest sectors accounting for almost two-thirds of the factories in Cambodia. The agricultural industry accounted for 26% of Cambodia’s GDP in 2016.

Can a single person open a private limited company?

- Yes. One person can incorporate a private limited company. Such a company is called “Single Member Limited Company” and requires at least one director.