Compliance officer for El Salvador crypto license

- El Salvador crypto license compliance officer services are a critical part of your ability to operate legally and securely in this innovative country’s rapidly changing digital asset market. Companies applying for El Salvador crypto license need to have a licensed and trained Head of Compliance in place and need to ensure ongoing compliance with strict AML/KYC regulations established by the National Commission of Digital Assets (CNAD). The appointment of the right compliance officer is important not only for being responsible for internal regulatory compliance, but to develop its own reputation and grow trust with regulators, local authorities and stakeholders.

- In the process to register company in El Salvador and submitting your license application, Tetra Consultants is here to help you register your company and work with you from the appointment of a qualified Compliance Officer onward to ongoing compliance support. With experience in local regulatory frameworks and an understanding of El Salvador’s licensing environment, we are confident in keeping your operations compliant and giving you the best opportunity to succeed in this first-class crypto environment.

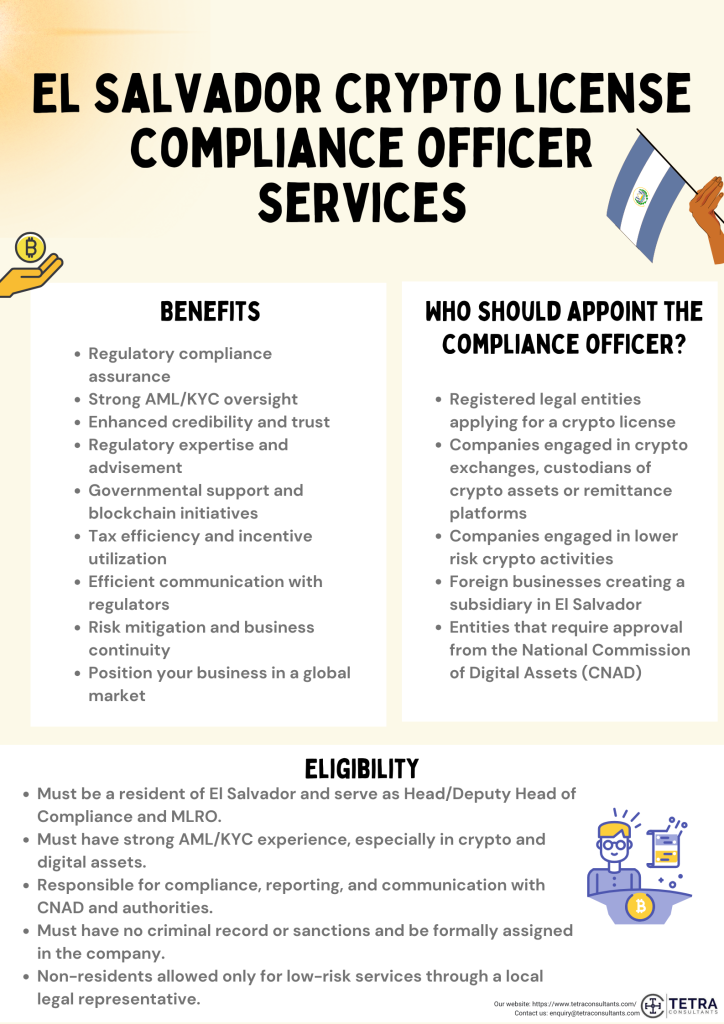

Benefits of appointing El Salvador crypto license compliance officer

Regulatory compliance assurance

- By designating a compliance officer, you can help ensure that your cryptocurrency business operates under a compliant legal and regulatory framework, including the Bitcoin Law and other applicable financial regulations in El Salvador. This allows the company to protect against violations that could result in financial penalties or license suspension.

Strong AML/KYC oversight

- The compliance officer will oversee the implementation and monitoring of an Anti-Money Laundering (AML) and Know Your Customer (KYC) program, allowing detection and prevention of financial crimes. This is especially important in establishing a baseline level of compliance for deploying regulatory expectations while maintaining the integrity of your operations.

Enhanced credibility and trust

- Employing a qualified compliance officer can add an additional layer of credibility in the eyes of regulatory and private actors’ stakeholders. Furthermore, they can demonstrate a serious commitment to operating in a legal and ethical environment, which creates trust for all clients, investors, and partners in a local and international context.

Regulatory expertise and advisement

- The compliance officer can provide ongoing advisement and clarity on changing laws and help your company navigate how to adapt to the new regulations without running afoul of the law or risking costly mistakes. Their expertise can serve as an important asset for maintaining your legal standing for the long haul.

Governmental support and blockchain initiatives

- With El Salvador pushing the envelope on blockchain, compliance officers allow you to align your business with government-supported technology and initiatives locally and nationally in blockchain-related projects and partnerships.

Tax efficiency and incentive utilization

- The Government of El Salvador has tax incentive laws for cryptocurrency licensed companies, including exemptions from income taxes and capital gains taxes. A compliance officer will ensure that your operations are licensed, in accordance with the conditions of the licensing, and remain eligible to benefit from the exemptions under those laws.

Efficient communication with regulators

- Compliance officers are a central point of contact with government entities like the National Commission of Digital Assets (CNAD) to assist with renewing licenses, updating documents, and responding to regulatory requests in a timely manner.

Risk mitigation and business continuity

- By identifying, assessing, and monitoring compliance risk, an officer will protect the business from regulatory damage, operational damage, and reputational damage, ensuring that your business is sustainable while pursuing compliance-driven business operations.

Position your business in a global market

- With good compliance policies and procedures in place, your business will be taken seriously by other jurisdictions, thereby making it easier to attract foreign investment, engage with other jurisdictions, and grow the business into other markets.

Who should appoint El Salvador crypto license compliance officer?

Registered legal entities applying for a crypto license

- Any company registered in El Salvador who intends to apply for either a Digital Asset Service Provider (DASP) license or BTC Service Provider license must appoint a compliance officer. This is a statutory requirement.

Companies engaged in crypto exchanges, custodians of crypto assets or remittance platforms

- Companies engaged in high-risk crypto activity, including exchanges, custodians of crypto assets, or remittance platforms, must appoint a Certified Head of Compliance and Deputy Head of Compliance, both residents of El Salvador.

Companies engaged in lower risk crypto activities

- Companies engaged in lower risk activities, such as non-custodial services, P2P platforms or NFT marketplaces, are still required to have a compliance officer. If the compliance officer is a non-resident of El Salvador, the company may appoint a local legal representative also if the compliance officer is allowed to apply as the compliant officer.

Foreign businesses creating a subsidiary in El Salvador

- According to existing regulatory frameworks if a foreign entity is creating or buying an El Salvador entity for the purposes of applying for a crypto license, it must comply with all local requirements, including appointing residually based officers that meet any relevant national qualification requirements.

Entities that require approval from the National Commission of Digital Assets (CNAD)

- All organizations that have cryptos regulated and permitted by the national CNAD in El Salvador are required to appoint compliance officers as part of the licensing requirement.

Eligibility for El Salvador crypto license compliance officer

- Must be a resident of El Salvador.

- Must be designated as either Head of Compliance or Deputy Head of Compliance.

- Must have a demonstrable understanding and experience in AML/KYC compliance programs, especially with regards to cryptocurrency and digital assets.

- Must be capable of establishing and implementing internal AML/CFT/fraud policies and procedures.

- Must be designated as the Money Laundering Reporting Officer (MLRO) for high-risk crypto company services and report directly to the CNAD.

- Must not be included on any sanctions list and must have no previous criminal charges.

- Must be assigned in the organizational structure with a defined role and responsibilities related to the regulation.

- Must be able to work with and respond to the (CNAD) and other Salvadoran authorities regarding ongoing compliance, reporting, inspections, etc.

- Must participate in developing and keeping compliance documentation, including monitoring reports, reporting procedures, and response plans.

- For non-custodial or lower-risk services, a non-resident compliance officer is allowed, but must be engaged with a local concessionaire or legal representative.

El Salvador crypto license compliance officer assistance

- All our compliance officers are Certified Anti-Money Laundering Specialists (CAMS) and Certified Crypto Asset AFC Specialists (CCAS), all having worked for 5 years or more in the crypto and financial services sector. We understand all regulatory expectations in regard to El Salvador’s crypto regulations along with the relevant authorities. Your compliance function is in the hands of expert practitioners that can implement strong AML/CFT controls and ensure full regulatory compliance.

Services offered by Tetra Consultants El Salvador crypto license compliance officer services

- Ensure that the company is in compliance with relevant legislation regarding:

- Digital Assets

- Bitcoin

- AML/CFT legislation and UIF obligations

- Keep updated on applicable legislation and provide updates to management and staff on regulatory events/updates.

- Act as the primary contact point with:

- Comisión Nacional de Activos Digitales (CNAD);

- Central Reserve Bank (in relation to licensing/registration);

- UIF (in relation to AML compliance and SARs).

- Establish, implement, and maintain an AML/CFT Compliance Programme based on a risk-based approach.

- Oversee:

- Customer Due Diligence (CDD/KYC);

- Enhanced Due Diligence (EDD) for high-risk customers; and

- Ongoing monitoring of client transactions and activities.

- Identify, investigate, and file Suspicious Activity Reports (SARs) with the UIF.

- Implement real-time and post-trade transaction monitoring

- Integrate with blockchain analytics tools and ensure monitoring of wallet addresses and flows.

- Monitor sanctions, violations, and other financial crimes.

- Support initial and ongoing registration with CNAD and Central Bank (if applicable).

- File mandatory regulatory reports (i.e., risk assessments, compliance certifications, audit responses).

- Notice authorities of Material Changes (i.e., business model, directors, UBOs, etc.).

- Conduct a business wide AML/CFT risk assessment.

- Provide regular reports to the Board of Directors on compliance status, risks, and incidents.

- Keep records of all compliance decisions, breaches, and remedial actions as logs.

- Provide regular AML/CFT and crypto compliance training to staff.

- Ensure staff understands the red flags and they understand their reporting obligations.

- Maintain training records and monitor staff compliance.

- Keep all compliance-related documentation for at least 5 to 10 years (as prescribed by UIF).

- Support internal and external audits.

- Co-operate with any regulatory inspections or requests.

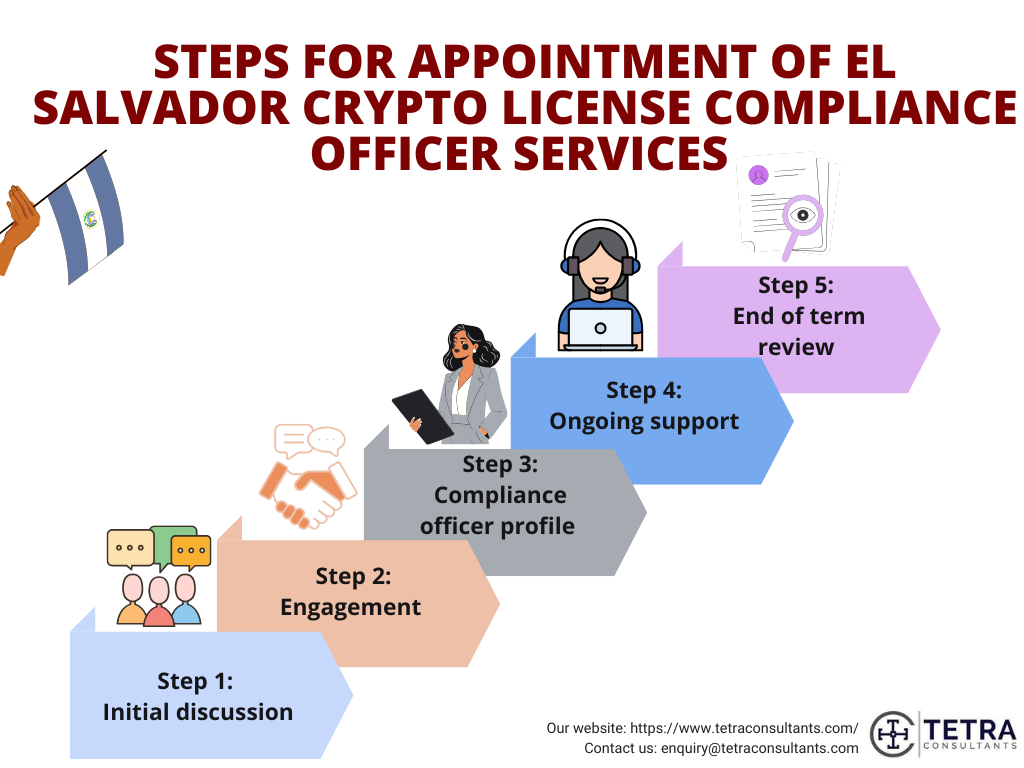

Steps for appointment of El Salvador crypto license compliance officer

Step 1: Initial discussion

- During the Initial Discussion, we encourage you to engage with our team and share your business goals, compliance concerns, and expectations for the compliance officer. The purpose of this collaborative discussion is to gain a better understanding of your business practices and regulatory environment, and to provide you a tailored service proposal in accordance with El Salvador’s Digital Assets Law.

Step 2: Engagement

- Once you confirm your intention to move forward, we move into the Engagement phase. In this step, we formally engage in the partnership through an appointment letter and invoice. The appointment letter outlines our scope of work and provides you with a transparent, professional engagement framework.

Step 3: Compliance officer profile

- After engagement, we move into the Compliance Officer Profile stage. Using our regional experience and recruitment network, we identify and propose candidates who meet El Salvador’s statutory requirements (such as residency, AML/KYC experience, and fit and proper status) and understand the emerging crypto ecosystem. We provide a copy of the candidate’s CVs and credentials, then you will select the candidate to appoint to ensure the candidate is a strong fit for your operations.

Step 4: Ongoing support

- With your compliance officer, we provide ongoing support. Our team and appointed officer remain accessible for meetings, consultations, or regulatory guidance in general, providing support linked to your commercial needs or the new legal developments related to crypto regulation in El Salvador.

Step 5: End of term review

- During the End of Term Review, we will contact you to check your satisfaction and compliance needs before we consider whether to renew, amend, or discontinue the service. This process will ensure you continue to have strong compliance support which ultimately supports your crypto business to grow in a secure and confident manner as El Salvador’s market evolves.

Cost for appointment of El Salvador crypto license compliance officer services

- At Tetra Consultants, we believe that full transparency is at the very core of our business and clients must be fully aware of the costs for appointing compliance officer for El Salvador crypto license services. Our Fee Schedule includes a professional service fee for the appointment of Compliance Officer, regulatory fee and documentation handling and preparation included in the administrative fee, and an Engagement Fee included in the cost for initial consultation and client onboarding. There may also be government filing fees connected with the formal registration and government submission of compliance officer details.

- All applicable costs are clearly indicated in our proposal and engagement letter so that you have complete visibility of your investment and so that there are no hidden charges or surprise costs at any stage of the engagement. This level of transparency is important since it allows you to plan your compliance budget and benefits from our suite of end-to-end regulatory support with a level of comfort you cannot normally get from compliance service providers.

Why choose Tetra Consultants?

- Tetra Consultants is a worldwide consulting company that specializes in international business solutions, regulatory licensing, and compliance advisory. Our team has significant familiarity with global regulations. As a result, we can support clients through complex processes like obtaining a cryptocurrency license in El Salvador. Throughout our process, we are client-focused in an educated and transparent manner, including no hidden fees, with tailor-made solutions for the client’s specific needs.

- Our services support management of regulatory and compliance requirements, but we also provide a complete suite of corporate services, including offshore company incorporation, corporate bank account opening, nominee director and shareholder services, legal representative services, drafting services, and many more. Tetra Consultants provides the full client journey under one roof so you can set up and maintain compliance with your business with ease, focusing on your business growth and strategy with confidence.

- Key reasons to choose us:

- Significant experience in global licensing and compliance, including crypto licenses.

- End-to-end services from company incorporation to compliance after licensing.

- Transparency with our fee schedule. No hidden fees.

- Experience in complicated regulated jurisdictions like El Salvador.

- Client-centric and customizable solutions that respond to your business model.

- Strong global network and access to qualified local practitioners.

- Quick turnaround time and focus on project management.

- Proven track record of successful engagements across multiple industries.

Looking to appoint El Salvador crypto license compliance officer

- Working with Tetra Consultants for your El Salvador crypto license compliance officer services provides a professional, transparent and dependable method for navigating regulatory requirements. With many years of experience navigating complex licensing environments and a commitment to transparency and client communication, Tetra Consultants can help you meet your local statutory obligations with confidence.

- Our expertise ensures that you can enter the rapidly changing landscape of digital assets in El Salvador while your compliance functions are managed by professionals. By partnering with Tetra Consultants in El Salvador, you will have the ability to focus on your business growth while building trust with regulators and stakeholders.

- Contact us to know more about El Salvador crypto license compliance officer services and we will revert in 24 hours.

FAQs

Who must appoint a compliance officer for an El Salvador crypto license?

Does the compliance officer have to be a resident in El Salvador?

What do compliance officers do in El Salvador?

What qualifications must a compliance officer have for a crypto license in El Salvador?

Can the compliance officer’s information be changed after we receive the license?

Why is the compliance officer position important to my crypto business in El Salvador?