Payroll Outsourcing Malaysia

- Payroll outsourcing Malaysia is currently on the rise. Managing payroll in Malaysia is a complex and time-consuming task, especially due to changing tax laws, statutory requirements, as well as compliance obligations. Furthermore, more and more individuals are opting to register company in Malaysia. As businesses continue to grow and increase their workforce, handling payroll in-house leads to costly errors, inefficiencies, as well as non-compliance risks. Tetra Consultants provides comprehensive payroll outsourcing Malaysia services, allowing businesses to focus on their core business operations while our team ensures timely and compliant payroll management.

What is payroll outsourcing Malaysia?

- Payroll outsourcing Malaysia stands for the subcontracting of all the payroll-related functions to a third party. This consists of processing employee salaries, calculating statutory deductions (like employee provident fund, social security organization), and producing pay slips. It also includes managing the tax filings and ensuring adherence with the Malaysian labor laws and tax regulations.

- By delegating the payroll task to the third-party service providers, companies can easily avoid in-house payroll software, stay up to date with the legal changes, or allocate internal HR resources to the repetitive tasks. Outsourcing payroll functions ensures accuracy, continuity, efficiency, and compliance, and is significant in a jurisdiction such as Malaysia.

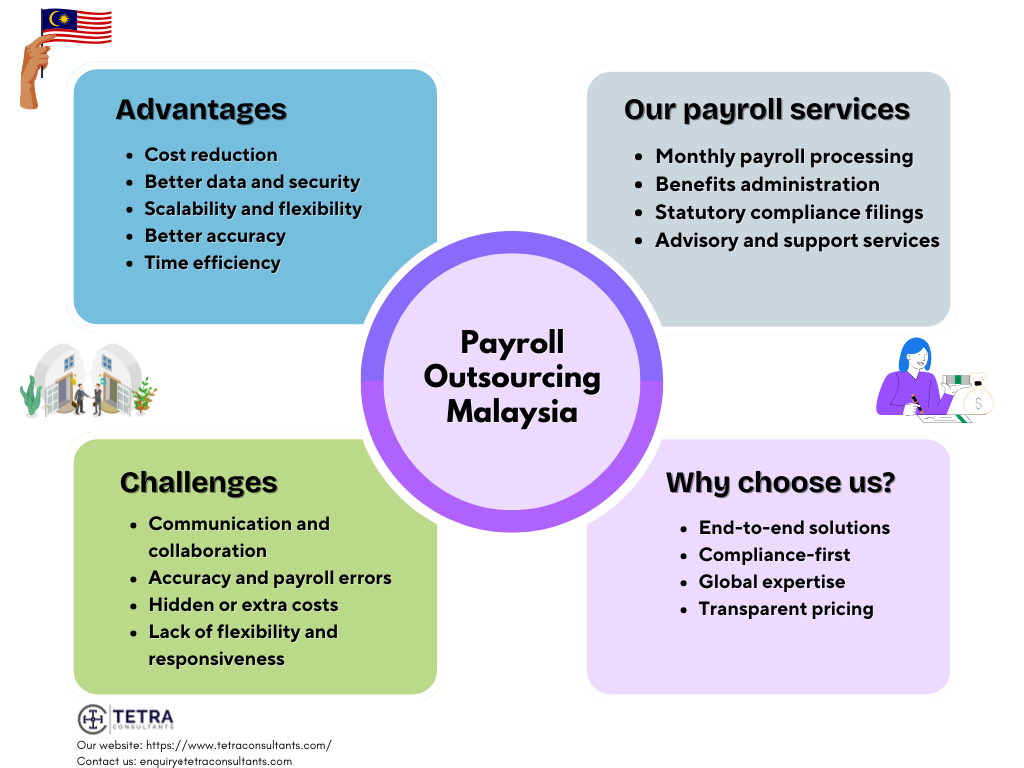

Advantages of Payroll Outsourcing Malaysia

- Payroll outsourcing Malaysia has become a go-to solution for companies wanting to streamline operations, improve compliance, and reduce administrative burden. Here are some of the main advantages of payroll outsourcing:

Cost reduction

- Outsourcing cuts down expenses that are related to hiring, training, as well as maintaining an in-house payroll team. Businesses can save time on payroll software, hardware, as well as data security infrastructure, as the third-party service provider can ease their load.

Better data and security

- Third-party service providers such as Tetra Consultants use advanced encryption technology and secure servers. This offers a strong level of protection that is better than in-house setups.

Time efficiency

- Payroll tasks are handled effectively, which frees up HR and finance teams and enables them to focus on strategic, as well as value-added activities. Regular payroll processing is handled on time, even during busy business cycles, which frees up the internal team and reduces their burden.

Scalability and flexibility

- Payroll services can also be expanded or reduced based on the size of your business or needs. It is best for firms that have fluctuating staff levels or seasonal workers. Third-party service providers can easily handle all the payroll-related difficulties arising from international expansion or acquisitions.

Better accuracy

- Payroll service providers have expertise in tax and labor regulations, which reduces the risk of costly mistakes as well as penalties. Errors in salary, tax, as well as benefits can easily be reduced through standardized and automated software.

Our payroll outsourcing Malaysia solutions

- At Tetra Consultants, we offer end-to-end payroll outsourcing solutions in Malaysia along with offshore company incorporation and corporate bank account opening services. Our services are personalized to suit the needs of businesses of all sizes, as well as industries. Here are our services:

Monthly payroll processing

- We focus on calculating gross and net salaries, processing bonuses, overtime, commissions, as well as deductions. Our team also prepares and distributes pay slips to the employees.

Tax administration

- This consists of calculating and withholding applicable taxes, generating and filing year-end documents. We also manage tax submissions and employee declarations.

Benefits administration

- Our team works in managing the benefits of employees like their health insurance and retirement funds. This also consists of deducting premiums as well as contributions from payroll and facilitating enrollment along with claims processing.

International payroll services

- If your business has employees from other countries, we also handle their payroll. Our team can easily manage currency conversions along with cross-border compliance while adhering to international labor and tax laws.

Statutory compliance filings

- At Tetra Consultants, we also manage statutory deductions, filing returns, and producing compliance reports. Our team ensures timely remittance of taxes and contributions.

Reporting and analytics

- We generate payroll summaries and audit-ready reports. Our experts offer business intelligence and data analytics on payroll trends.

Advisory and support services

- Our team also provides expert advice on the payroll regulation changes in Malaysia. If needed, we also conduct audits and risk evaluation, and support payroll-related queries as well as troubleshooting.

Common challenges of payroll outsourcing and how we can help

Communication and collaboration

- Misunderstandings and delays in sharing the employee information, last-minute salary updates, and changes in compliance regulations can lead to payroll errors or even missed deadlines. At Tetra Consultants, our team is constantly in touch with your business and is updated with the latest payroll regulations of the jurisdiction in which your company is located.

Accuracy and payroll errors

- Mistakes in calculations of salaries, deductions, and tax withholding could occur if the information provided is incomplete or not updated on time. At Tetra Consultants, we have experts who are well-versed in accounting, and we use payroll software to minimize errors.

Hidden or extra costs

- Third-party service providers have unexpected charges outside their basic package, such as customized reporting or urgent corrections, which make outsourcing more expensive than it needs to be. At Tetra Consultants, we follow a no-hidden fees policy to ensure that you know what services you are paying for and are able to manage your budget accordingly.

Data security and privacy risks

- Most of the time, companies find it difficult to handle sensitive employee data to a third-party service provider, as it exposes companies to sensitive information to data breaches, hacking attempts, and even unauthorized access. Tetra Consultants incorporates high-grade encryption and secure services, as well as strict access controls to safeguard client data.

Lack of flexibility and responsiveness

- Companies have found that payroll providers usually work on fixed timelines and processes that are inflexible to urgent and last-minute changes, such as bonus payouts or new hires. At Tetra Consultants, our team ensures that all communication is clear, and we are responsive to all your queries, even the last-minute ones, as our goal is to reduce your business stress.

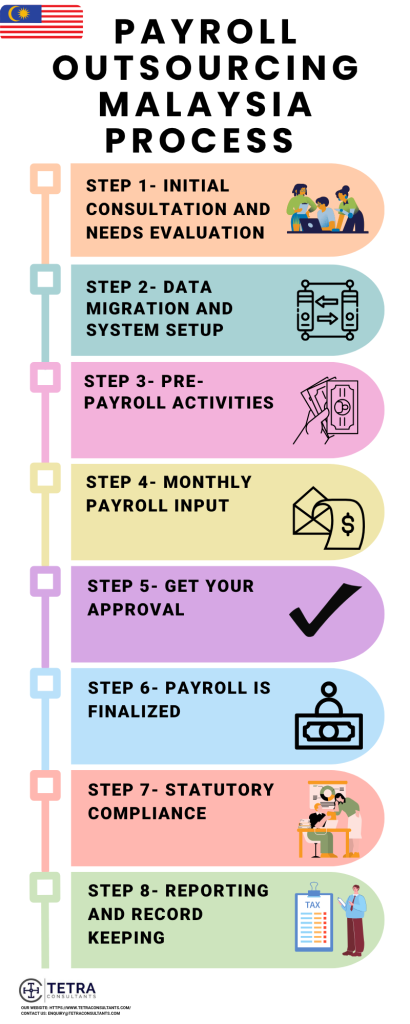

Our payroll outsourcing Malaysia process

- The payroll outsourcing Malaysia process with Tetra Consultants consists of a structured sequence of steps created to ensure adherence with local regulations and offer accurate, timeline payroll management to businesses. Here is our step-by-step process:

Step 1- Initial consultation and needs evaluation

- The process starts with our team engaging with your business in a detailed discussion. This helps us to understand your payroll needs, frequency, number of employees, and any specific requirements. A thorough review is considered to personalize the service as per the needs of your business.

Step 2- Data migration and system setup

- Once our team clearly understands your business needs, we proceed with the system setup. Our experts then configure a payroll system and combine it with your present HR system. We also set up the profiles of employees, upload salary structures, tax rules, and leave balances while also ensuring that the system is fully compliant with the Malaysia’s Employment Act and Lembaga Hasil Dalam Negeri (LHDN) requirements.

Step 3- Pre-payroll activities

- Our experts ensure that your business is registered with the Malaysian authorities and finalize the payroll policies that consists of pay periods, deductions, benefits, and allowances.

Step 4- Monthly payroll input

- Tetra Consultants then calculate the monthly salaries, which also include new employees, unpaid leave, and overtime hours. We then use this to calculate your gross salary deductions, as well as net pay.

Step 5- Get your approval

- After the calculation of net pay of employees, our team drafts a payroll report that is sent back to your internal finance team to be reviewed.

Step 6- Payroll is finalized

- Once the draft gets approval from your team, we will then move ahead with the payroll process. Salaries are then distributed through the medium of bank transfer.

Step 7- Statutory compliance

- Tetra Consultants then submit all your payments and statutory filings of your business to Malaysian government bodies within a specific duration. Our team ensures computations with all the mandatory requirements, such as:

Step 8- Reporting and record keeping

- Our team then generates detailed payroll reports, which consist of management summaries, accounting entries, as well as statutory remittance documentation. Tetra Consultants also helps with year-end processes like the EA form (annual income statement), and tax filings.

- Furthermore, at Tetra Consultants, we also provide regulatory compliance consulting services to ensure that your enterprise is easily able to adjust in the changing regulatory environment of Malaysia.

Common challenges of Payroll Outsourcing Malaysia and how we can help

Compliance and statutory issues

- In-house team finds it difficult to keep up with frequent changes in Malaysia’s tax laws, labor legislations, as well as reporting requirements, which causes errors in the payroll process. At Tetra Consultants, our experts are up to date on tax and labor law changes and our team effectively handles statutory deductions while also filing returns on time. This reduces the risk of audit and fines.

Handling multiple pay schedules

- Businesses that have a diverse workforce often find it difficult to manage different pay cycles, which leads to confusion among internal team and increases the risk of errors. At Tetra Consultants, our team can effectively manage diverse pay cycles, which reduces the disruptions in cash flows, and manual reconciliations.

Data security

- Companies are often scared to share sensitive information of their employees like salary, banking, and other information with third-party service providers as it increases the chances of data breaches. At Tetra Consultants, we have invested in secure, and encrypted cloud software, and our team has regulated access which protects sensitive information. Furthermore, our team also complies with international and local data protection laws to maintain the confidentiality of our clients.

Employee queries

- Most of the companies have found out that third-party service providers are not familiar with their employees, which leads to delayed responses, and dissatisfaction among employees. At Tetra Consultants, we have a dedicated team who work on resolving employee queries, addressing issues promptly, ensuring continuity.

Documents required for payroll outsourcing Malaysia

- Employment contract

- Tax declaration forms

- Timesheets/Attendance records of employees

- Statutory forms, this includes Form EA, Form E, and other forms relevant for EPF, SOCSO, AND EIS

- Identity documents like the National registration identity card (NRIC) for locals whereas passport for foreign employees

- Details of bank account

- Commission slips and bonus approvals

- Leave applications

- Expense claim slips

Costs for payroll outsourcing Malaysia

- The cost for the payroll outsourcing Malaysia depends on multiple factors which consists of number of employees, frequency, and if you need additional services such as tax advisory, and year-end reporting. While companies view outsourcing payroll as an additional expense, it has usually been proven as a cost-effective option, as it frees up the administrative burdens of the in-house team, and enables them to focus on their core operations. At Tetra Consultants, we have transparent pricing structures, customized as per the needs of your business, with no hidden fees and extra charges.

Industry specific payroll outsourcing Malaysia

- Tetra Consultants caters to the unique payroll requirements of multiple industries. We customize our payroll solutions to suit the varied industrial norms, regulations, as well as employee benefit structures. Here are the main industries that we serve in:

Banking and financial services

- The banking, finance, and insurance sectors have highly structured pay scales, commissions, and incentives. Our team handles tax deductions, regulatory compliance, as well as confidential handling of sensitive financial information.

Healthcare

- Our team manages the payroll of medical personnel with dynamic shift patterns, allowances for night and hazard duty, and adherence to healthcare labor regulations.

Engineering and manufacturing

- We understand that this industry consists of hourly wages, overtime, statutory benefits, and different shifts. Our experts manage accurate time tracking, compute overtime, and adhere to labor laws that regulate factory workers and operational staff.

Life sciences

- This industry consists of pharmaceuticals, biotechnologies, and companies involved in manufacturing medical devices. These industries need specialized allowances, bonuses linked to their R&D achievements, and adherence to strict labor laws. Our experts ensure adherence to relevant regulations and also manage complex employee benefit schemes.

Information and communication technology

- The ICT sector consists of a myriad of compensatory models that consist of flexible salaries, remote worker payments, and project bonuses. Tetra Consultants integrates flexible work systems in order to ensure timely statutory contributions and address the diverse needs of employees as per their contracts.

Why choose Tetra Consultants for payroll outsourcing Malaysia

- Tetra Consultants is a trusted service provider of corporate solutions, which also includes payroll outsourcing to local SMEs and international businesses. Here are the main reasons why businesses choose us:

- Global expertise- At Tetra Consultants, we have more than ten years of experience working in multiple jurisdictions.

- Transparent pricing- Tetra Consultants has a transparent pricing structure, ensuring that our clients know exactly what they are paying for.

- Compliance-first- At Tetra Consultants, our main focus is on regulatory compliance, ensuring that our clients do not have to pay any fines or penalties.

- End-to-end solutions- Tetra Consultants manage all the functions of your payroll. This consists of monthly salary processing to year-end reporting along with compliance audits.

- Contact us, and our team will get back to you within 24 hours.

FAQs

How much does payroll outsourcing cost?

Do I have to provide any specific payroll software or system?

Can I ask for personalized payroll reports?

What type of business do you work with?

Is my employee data safe during payroll processing?

Company Incorporation

Resident Director Service

Malaysia Free Trade Zones

Accounting & Tax

Cryptocurrency License

Digital Asset Exchange License

EMI License

Manufacturing License

Wholesale Retail Trade License

Immigration Services

Payroll Outsourcing

Personal Income Tax Services

Successful Case Study