Personal Income Tax Filing Malaysia

- Navigating through personal income tax filing Malaysia is a challenging task, especially for those individuals who are not familiar with the local tax laws, digital filing systems, and deadlines. If you are a Malaysian resident, a foreign emigrant working in the country, or someone with various income sources, it is essential to understand your tax obligations to stay compliant with the Inland Revenue Board of Malaysia (LHDN). Furthermore, more people are opting to register company in Malaysia, due to its strategic location and business-friendly regulations.

- At Tetra Consultants, we have expertise in the personal tax filing process for people from all walks of life. Our personalized tax services are created to ensure accurate, on-time, and hassle-free submissions while also optimizing your tax benefits. This page provides a detailed overview of personal income tax filing Malaysia, the services we provide, challenges that you can face, and why you should choose Tetra Consultants.

What is personal income tax filing Malaysia?

- Personal income tax filing Malaysia is a compulsory annual obligation that all individuals who earn income within the country will have to fulfill. The Inland Revenue Board of Malaysia (LHDN) needs residents and non-residents who meet certain income thresholds to report their annual earnings, claim the applicable reliefs or exemptions, and settle any outstanding tax liabilities. The process of tax filing includes submission of Form BE (for residents without any business income). The form is submitted online through the e-Filing platform.

- Understanding the Malaysian taxation system is important as it is multi-tiered, provides reliefs, and deductions. The system constantly makes changes in its regulations. In a situation where the forms are submitted incorrectly or deadlines are missed, it leads to penalties or even legal action in severe cases.

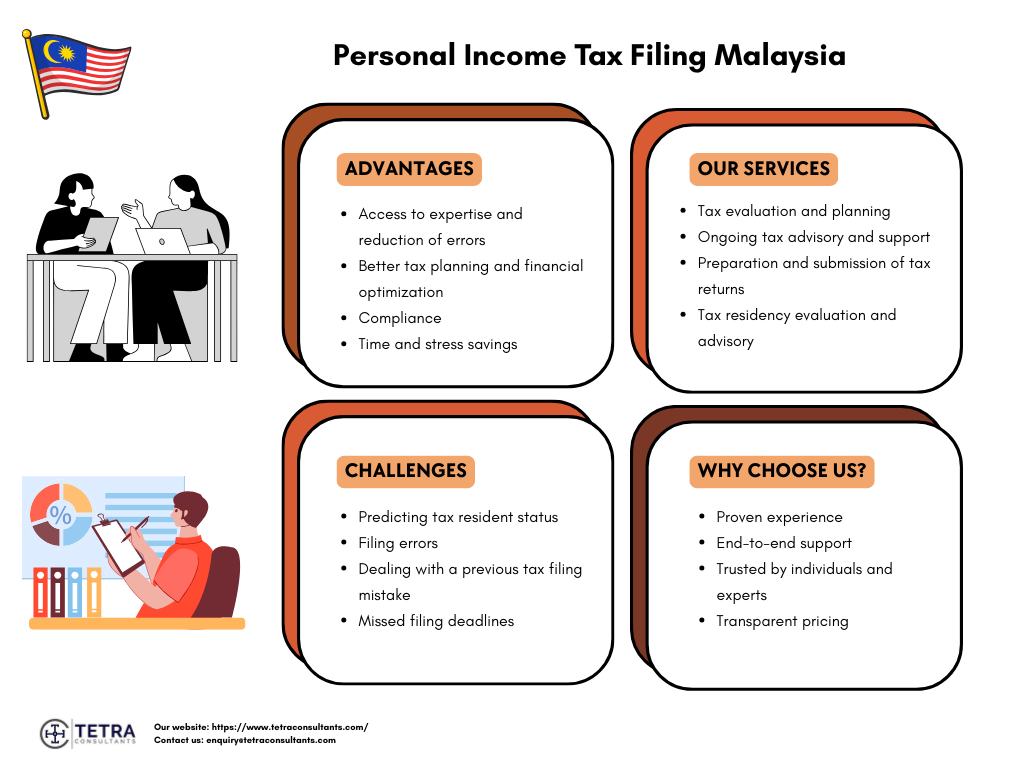

Advantages of using Tetra Consultants personal income tax filing Malaysia

Access to expertise and reduction of errors

- Our tax experts are up to date with the latest tax laws, deductions, as well as regulations about the Malaysian regulatory framework. Our team can easily recognize all the available exemptions and credits that will maximize your refund and reduce your liabilities. Furthermore, we also systematically review all your documents, which reduces the chance of mistakes and notices from the Malaysian tax authorities.

Compliance

- Our experts ensure that your tax returns adhere to all the Malaysian taxation laws and recent updates. Tetra Consultants ensures that proper returns are prepared and filed, in order to decrease your chances of audit notices and penalties.

Effective tax planning

- Tetra Consultants also suggests better tax planning strategies and recommends legal ways in which you can reduce your taxes.

Time and stress savings

- We understand that handling your own taxes is a difficult task. Outsourcing this tax can save you time and help you manage your complex finances. At Tetra Consultants, our team ensures that all your tax returns are completed and filed on time, so that you can avoid any penalties and reduce your burden.

Services we provide for personal income tax filing Malaysia

- Tetra Consultants offers end-to-end solutions for personal income tax filing Malaysia. Our team is there to support you at every stage of the tax filing process, from start to finish.

Ongoing tax advisory

- Our team offers continuous advisory support to help you stay informed about the recent tax updates, changes in policy, and new strategies to apply, to help you stay compliant and efficient in all your future tax filings.

Tax evaluation

- Our experts understand your tax needs, along with your income sources and residency status. Tetra Consultants calculates your total taxable income, and based on that, we advise you regarding the applicable deductions and reliefs to optimize your taxation liabilities.

Preparation and submission of tax returns

- Our consultants also prepare your income tax return in compliance with the Malaysian tax laws as well as regulations. We ensure that all the necessary forms, like Form BE, Form B, or M (for non-residents), are filled out correctly and submitted through the e-Filing system of LHDN on time.

Tax residency evaluation and advisory

- Our experts work on understanding your tax residency status. This status impacts your applicable tax rate, available reliefs, as well as filing obligations. We also evaluate the duration of your stay, sources of income, and employment terms to understand your residency classification under the Malaysian tax law.

Ongoing advisory

- Tetra Consultants maintains regular communication with you and reminds you about deadlines, policy updates, and how recent changes in your personal situation can impact your taxes. This ensures that you are complying with the latest regulations and are efficient in your future tax filings.

Common challenges and how Tetra Consultants can help

Filing errors

- First-time tax filers usually find it difficult to go through the e-Filing system of Malaysia, mainly because of the different language, selection of forms, and technical navigation. Incorrect form submissions or even missed sections can usually lead to penalties and incomplete filings.

- At Tetra Consultants, our team handles the e-Filing procedure on your behalf. We also ensure that the correct forms are filled in and submit the return directly through LHDN’s online platform.

Predicting tax resident status

- Residents, emigrants, and freelancers who travel regularly find it difficult to determine whether they qualify as tax residents under the Malaysian regulatory framework. This status creates a huge impact on their tax rates, exemptions, and the filing procedure.

- At Tetra Consultants, our team calculates your staying period, employment term, and income sources to correctly predict your residential status. Furthermore, we also ensure that your tax return is filed in accordance with the LHDN’s tax residency rules, in order to avoid misclassification.

Dealing with a previous tax filing mistake

- Some taxpayers realize that they have made some errors in previous tax filings, such as underreporting income or claiming incorrect reliefs, but they do not know how to amend these mistakes. Ignoring these mistakes usually leads to penalties or even enforcement action.

- At Tetra Consultants, our team helps to file amended returns or initiate voluntary disclosures with the LHDN. We handle documentation, as well as communication, in order to rectify previous mistakes while also reducing penalties and reputational risk.

Missed filing deadlines

- In Malaysia, the tax filing window is short, especially for those individuals who earn business income. Missing this deadline leads to fines, interest charges, and even investigation by the tax authority.

- At Tetra Consultants, our team maintains a proactive compliance calendar for all our clients and notifies you in advance regarding the upcoming deadline. Our team also ensures the timely preparation as well as submission of your tax return, in order to avoid any late filing penalties.

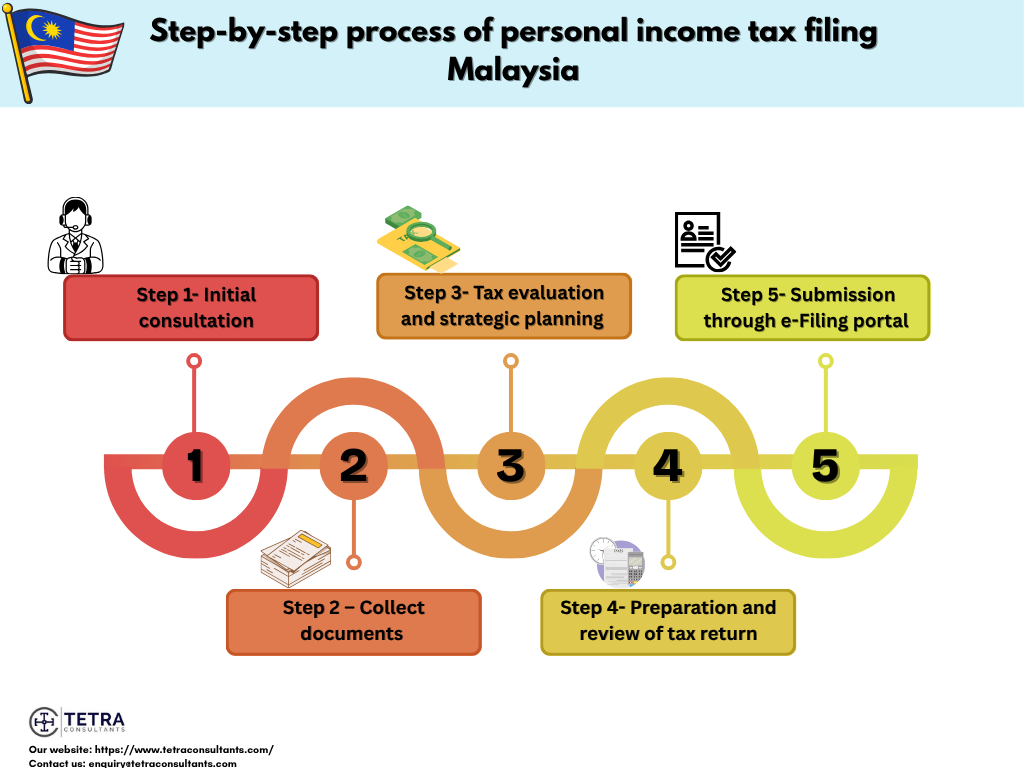

How to get started with personal income tax filing Malaysia with Tetra Consultants

- Engaging with Tetra Consultants for your personal income tax filing Malaysia is an easy and simple procedure. Our team aims to eliminate any confusion, reduce your administrative burden, and ensure timely and accurate filings, whether you are a Malaysian citizen, expatriate, or a businessman with various sources of income. Here is how you can get started for personal income tax filing Malaysia with us:

Step 1- Initial consultation

- The process starts with an initial consultation with our team. In this meeting, our team assesses your individual taxation needs and circumstances. We also evaluate your income sources, employment or business structure, tax residency status, and your previous filing history. Furthermore, if you have any queries or concerns regarding tax filing, our team will also answer them.

Step 2- Collect documents

- After the consultation, our team offers you a checklist of all the needed documents. These usually consist of employment income records, deductions reports, previous tax filings, and rental income details.

Step 3- Tax evaluation and strategic planning

- After going through all your documents, our team will evaluate your total taxable income and assess opportunities for deductions and reliefs. If you are married or earning from diverse sources, we will recognize the most tax-effective filing approach.

Step 4- Preparation and review of tax return

- Our team will now prepare your tax return and make sure that every detail is correct and adheres to the LHDN regulations. Moreover, before submitting the return, we review the draft with you to ensure transparency and get your confirmation.

Step 5- Submission through e-Filing portal

- Once your draft receives approval, we submit your tax returns through the e-Filing portal of LHDN.

Documents needed for Personal income tax filing Malaysia

- Identification card (IC/MyKad), Police IC, Army IC, or international passport (for foreigners)

- Tax identification number (TIN) or Tax reference Number (if registered)

- Latest salary statement or annual income statement issued by the employer

- Dividend or interest income statements

- Business registration certificates (for business owners)

- Partnership certificates or even company incorporation documents if declaring business income

- Employees Provident Fund (EPF) contributions statement and insurance premium receipts

- Receipts for tax reliefs, rebates, or exemptions (such as medical expenses, insurance premiums, education expenses, and even lifestyle purchases)

- Donation receipts

- Form EA as a reference for official income and tax deducted details (you can get this from your employer or LHDN portal)

- Last year’s tax return (for reference and prefilled fields)

- Marriage certificates (for joint evaluation or claiming spouse-related reliefs)

Why choose Tetra Consultants

- Tetra Consultants has a solid reputation for being a reliable partner for individuals and businesses looking for expert tax and compliance services in Malaysia. We have more than 10 years of experience, and our experts are well-versed with Malaysian regulatory framework. Here are the reasons why individuals choose us:

End-to-end support

- From consultation to submission, we handle the entire process, hence reducing your tax burdens and ensuring your peace of mind.

Transparent pricing structure

- At Tetra Consultants, we have a no-hidden fee policy, we have a clear pricing structure, where you know exactly what we are paying for.

Trusted by individuals and experts

- We have successfully helped multiple local and foreign individuals and businesses manage their annual tax obligations with confidence and accuracy. Our team has also helped with individuals to start their own business ventures in Malaysia by offering them offshore company incorporation services.

Proven experience

- Our team has a decade of experience in handling all your personal income filings across various sectors and income brackets. We also provide regulatory compliance consulting services to ensure that if you have a business in Malysia, you can easily adjust in its regulatory environment and stay up-to date with all the legal changes.

Confidentiality

- We believe in confidentiality, and your personal and financial information is treated with the highest security.

- To know more about personal income tax filing Malaysia, contact us, and our team will get back to you in 24 hours.

FAQs

Who is eligible to file personal income tax in Malaysia?

Can I revise my tax return if I have made a mistake?

In Malaysia, is rental income taxable?

How long should I keep my taxation documents?

Company Incorporation

Resident Director Service

Malaysia Free Trade Zones

Accounting & Tax

Cryptocurrency License

Digital Asset Exchange License

EMI License

Manufacturing License

Wholesale Retail Trade License

Immigration Services

Payroll Outsourcing

Personal Income Tax Services

Successful Case Study