Mauritius has established and positioned itself as an international financial center (IFC) of excellence, choice, and reputation in recent years. Coupled with Mauritius’ ongoing achievements in good corporate governance including ranking 13th in the World Bank’s Ease of Doing Business list and being removed from the Council of European Union’s grey list following the implementation of necessary tax and policy reform due to which not only has the country become an appealing proposition for the establishment and management of private equity funds in Mauritius, but it has also transformed into a leader in mending the disparity between investors and jurisdictions in steady need of investment, most of which are located on the African or Asian continents.

Mauritius has entered double taxation avoidance treaties with 42 nations and Investment Promotion and Protection Agreements (IPPA) with 36 countries, 17 of which are African. The IPPAs provide investors with another reason to opt for the Mauritius investment route. Mauritius has also deployed pertinent laws to enforce FATCA and Common Reporting Standards, as well as being a signatory to the Multilateral Convention to Implement Tax Treaty Related Measures to avert base erosion and profit shifting and implementing results from the OECD’s BEPS package domestically and through tax treaty provisions, in an endeavor to abide by international norms.

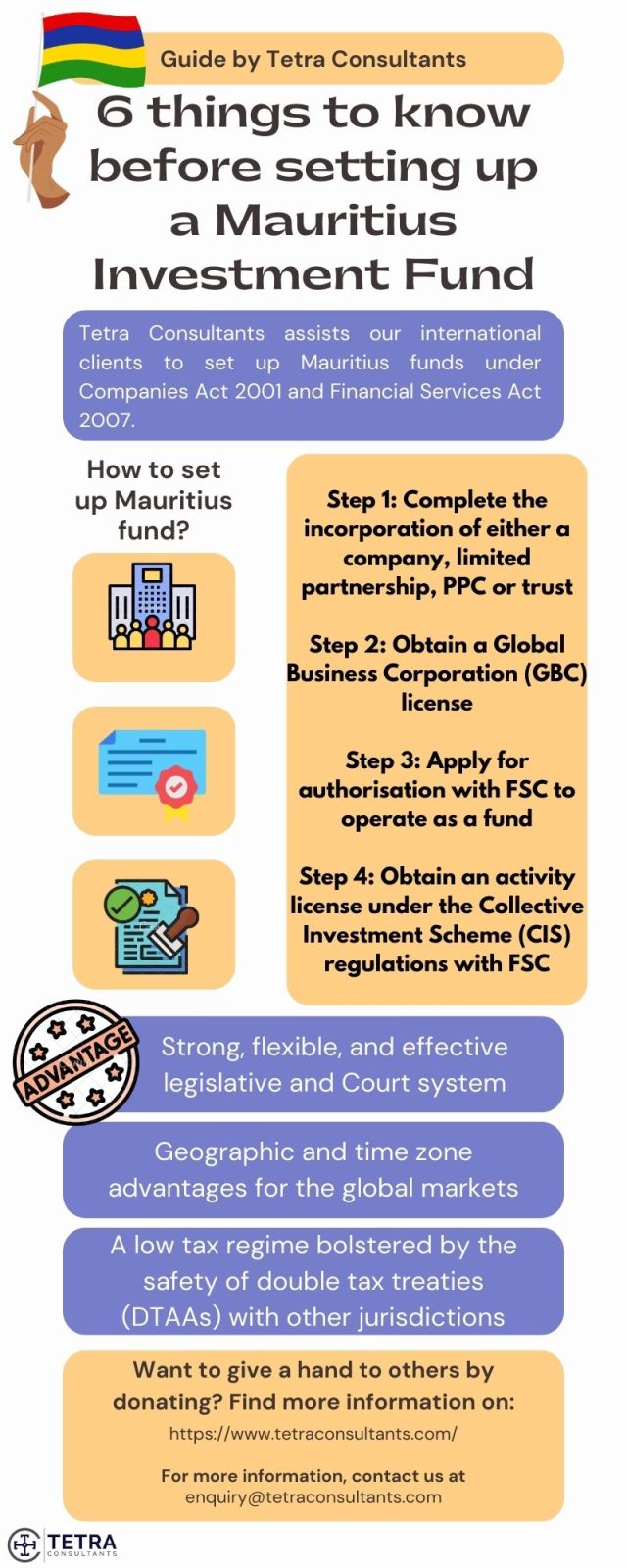

Tetra Consultants is a team of experienced lawyers, chartered accountants, and qualified financial experts who assist international clients with setting up investment funds and acquire fund management license in countries like Mauritius. We provide continuous support from the process to register company in Mauritius, and corporate bank account opening to the final step of securing a Mauritius fund manager license to ensure the smooth functioning of the entity. If you are planning to invest in a Mauritius fund setup, Tetra Consultants’ team of experts through this article has provided the 6 important things to know before you advance to set up a Mauritius Investment fund.

Why should you consider Mauritius for setting up of investment funds business?

Funds established in Mauritius benefit from a low-tax environment and have access to the country’s large network of double-tax treaties. Under the present Deemed Foreign Tax Credit framework, the highest income tax charged on a fund that is tax resident in Mauritius is 3%. Additionally, Mauritius does not levy any capital gains tax and withholding tax on dividends and interest payments.

Mauritius is geographically advantageous since it shares the same time zone as the UAE, allowing transactions to take place with nations all over the world on the same day.

- Furthermore, it is a recognized financial services center with sophisticated regulations and expert service. Mauritius also features a politically stable atmosphere with a legal system inspired by both English common law and French civil law, with the last option of judicial recourse to the Privy Council’s Judicial Committee.

- From the standpoint of view of political and social stability, allied with a strong legal system, contributes to Mauritius is constantly placed first in the Ease of Doing Business rankings. It is also reassuring that there are no currency controls. In other words, no permission is necessary for a foreign investor in Mauritius to repatriate earnings, dividends, or capital gains.

Who is the regulatory authority?

As the integrated regulator for the non-bank financial services industry and worldwide business, the Mauritius Financial Services Commission (FSC) is responsible for licensing, regulating, monitoring, and supervising the conduct of business operations in Mauritius. The FSC, in collaboration with the Mauritius Revenue Authority, will determine, among other things, whether funds in Mauritius meet substantive criteria, as well as formulate policies to permit a dynamic equilibrium between legislation and investment facilitation.

What are the legal structures available to set up a Mauritius fund?

A Mauritius Investment Fund can be formed as a company, a limited liability company, a trust, a limited partnership, a foundation, or any other legal organization authorized or recognized by the Mauritius Financial Services Commission (FSC).

What are the types of funds?

- Funds can be open-ended with a variable share capital that can be classified as CIS, or closed-ended with a fixed share capital that can be classified as private equity funds.

- The difference between open-end and closed-end funds is that open-end funds are required to redeem a participant’s shares at their request, at a price equal to the net asset value of those assets (less fees and commission). This requirement does not exist with closed-end funds.

- Collective Investment Schemes (CIS) are often constituted as a public or private business, a unit trust or a protect cell corporation (PCC). These can be addressed to both retail and non-retail investors. Closed-end funds are subject to less stringent regulation than open-end funds.

- Closed-end funds are distinguished by the fact that investors have no discretion over when and how they withdraw the fund. These are the most common structures for private equity funds. A typical vehicle is a private company limited by shares or limited partnerships. They can appeal to both retail and non-retail investors.

- While Alternative Investment Funds (AIF) are expert funds or professional collective investment schemes (PCIS) that are exclusively available to qualified and experienced investors (or elected sophisticated investors). These can be formed in the form of businesses, limited partnerships, protected cell companies, and trusts.

- Further, there are four types of CIS:

- Global CIS – A fully regulated program that is primarily intended for the general public. A Global CIS does not typically impose the need to acquire a GBC license in the nation and is not eligible for any of the exemptions typically available to funds;

- Professional CIS – A program in which shares are only available to sophisticated investors or through private placements. Governments or public agencies, as well as banks, are examples of sophisticated investors. Most requirements and laws do not apply to a Professional CIS if its interests are not transferred to the public and are not listed on a securities market, whether in Mauritius or abroad;

- Specialised CIS – A plan that invests in real estate, derivatives, or commodities, as well as other FSC-certified commodities.;

- Expert Fund – A plan offered solely to Expert Investors. An expert investor is one who makes an initial investment of at least US$100,000. The majority of the duties and restrictions that apply to Global Funds do not apply to Expert Funds.

What is the tax implication?

- In regards to taxation, every fund structure incorporated in Mauritius is liable to 15% taxation on its net chargeable income (taxable income less deductible costs). Subject to meeting substantial conditions, the fund receives a partial exemption at the rate of 80% in respect of its “foreign sourced income,” meaning dividends and interest earned overseas, resulting in an effective tax burden of 3% at the fund level. Profits or gains from the sale of shares or debentures in operating vehicles are also free from corporate income tax at the fund level in Mauritius. There is also no withholding tax payable in Mauritius in respect of payments of dividends to shareholders, payment of interests, or in respect of redemption or transfer of shares.

What are the substance requirements for forming investment funds in Mauritius?

- To be considered a Mauritius tax resident, the fund must meet substance requirements, which include carrying out its core income-generating activities in Mauritius, employing a reasonable number of suitably competent individuals, either directly or indirectly, to carry out the said core activities, having a minimum level of expenditure that is commensurate to its level of activities, and demonstrating that it is controlled and managed from Mauritius through the fund:

- Having at least two resident directors with adequate professional backgrounds who can act independently at all times;

- Maintaining its primary bank account in Mauritius at all times;

- Keeping and maintaining its accounting records at a registered office in Mauritius at all times, as well as preparing its statutory financial statements, which will be audited in Mauritius.

- The effective management location of a Mauritius fund will be determined by whether strategic decisions relating to the company’s core income-generating activities are made in or from Mauritius, and whether the majority of the board of directors meetings are held in Mauritius or the executive management of the fund is exercised on a regular basis in Mauritius.

Conclusion

- While the Mauritius IFC has emerged as a location of choice in recent years, it remains a country brimming with potential, with a strong emphasis on complying to international norms and making every effort to be classified as a compliant jurisdiction by the necessary organizations. Mauritius is poised to become a key location for investment fund structuring into African and Asian markets.

- Navigating the country of Mauritius’s complex business climate might be a challenging process – a hassle to say the least. However, with key benefits regarding tax rates and a business-friendly environment outlined above, it is easy to see why many businesses would choose to set up in Mauritius. As such, Tetra Consultants hopes that this article has provided you with a much better understanding of the 6 important things to know before setting up an investment fund in Mauritius so that you can make a well-informed decision.

- So, what are you waiting for? Contact us to find out more about the process of setting up a Mauritius Investment fund, and our dedicated and experienced team will respond within the next 24 hours.