The Cayman Islands is a British-Owned territory that consists of 3 main islands that form its entirety. The islands are famous and known tourism spots, with tourism being one of the country’s main contributors of its economy. In 2019, 88.8% of Cayman Islands GDP production came from the products and service industry, with financial services contributing a whopping 30.4%. The islands also presents the highest quality of life and GDP production amongst its Caribbean neighbours, recording an estimated amount of USD 5.3 billion GDP production in 2021. The mature financial services sector coupled with its tax neutrality environment has given reasons to many foreign investors to register company in Cayman Islands. Before you decide to register company in Cayman Islands, follow along Tetra Consultants as the team shares with you 6 benefits of registering a company in Cayman Islands.

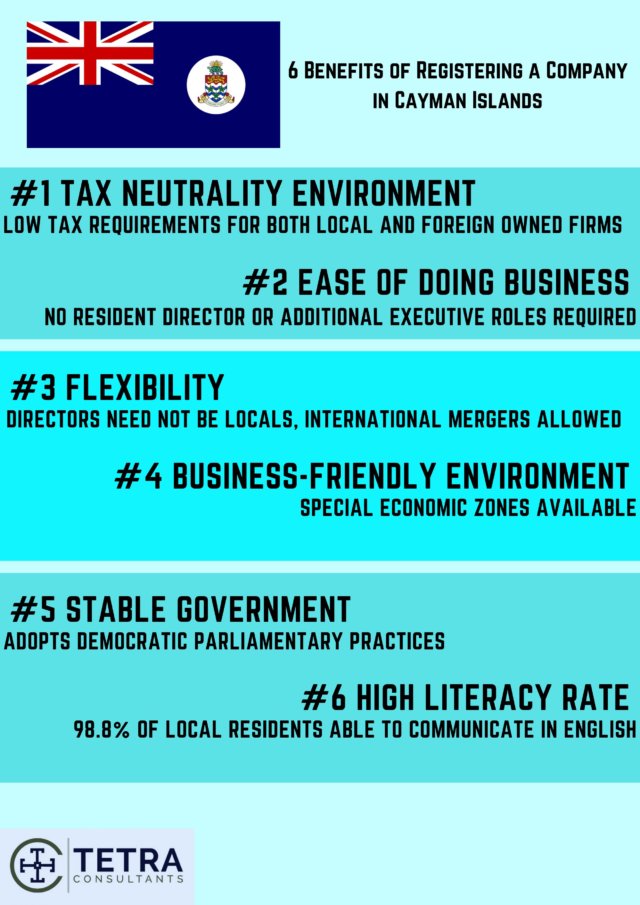

1 Tax Neutrality Environment:

One of the benefits of registering a company in Cayman Islands is the tax neutrality environment that it poses, warranting many to associate the place as Cayman Islands Tax Haven. For businesses that choose to register company in Cayman Islands, they stand to gain significant tax benefits. Whether the ownership of the companies are local or fully foreign-owned, companies are not subjected to corporation taxes, capital gains taxes, income taxes, property or withholding taxes for their conduct of business in this particular jurisdiction. Instead, the government primarily relies on custom duty fees as well as varying licensing fees to form the bulk of their country’s budget.

2 Ease of Doing Business in the Cayman Islands :

The second benefit of registering a company in Cayman Islands is because of the ease of doing business in this jurisdiction. Once you have determined the business structure that you wish to incorporate in and have prepared the necessary due diligence documents, you can expect your company registration to be completed within 1-4 working days. The fees charged are considered to be generally low especially when compared to its Caribbean neighbours and you can expect the fees to increase as the amount of share capital increases. Furthermore, another benefit of registering a company in Cayman Islands is that companies need not require a resident director to be appointed. Corporate laws in Cayman Islands allow the formation of a company with a single director and shareholder, indicating that the same person can hold both directorship and ownership of the company. There are no additional requirements such as Board of Directors or any executive and managerial roles required to be appointed prior to the setting up of the company. Potential investors can also stand to benefit as there are no capitalization prerequisites that investors have to put upfront, unlike starting up in other countries.

3. Flexibility:

The third benefit of registering a company in Cayman Islands is in terms of the flexibility that the business environment in the country provides. Firms looking to register as a company in Cayman Islands need not be local residents of the country. On top of that, mergers across different firms be it local or international are allowed under Cayman Islands’ corporate legislation and the final jurisdiction need not be in Cayman Islands.

4. Business-Friendly Environment:

The Cayman Islands hosts a business-friendly environment, creating another benefit of registering a company in Cayman Islands. The destination is favoured by many financial institutions who have domiciled their offshore investments, and is home to over 11,000 funds that have been registered with the Cayman Islands Monetary Authority. Local authorities such as the Department of Commerce and Investment (DCI) have also started delegating Special Economic Zones (SEZ) which aims to make the conduct of business and trade even simpler. Business who fall under the criteria for SEZ will stand to gain:

- A tax neutral platform

- Easy company formation

- Reduced custom and trade certificate fees

- Express business registration and licensing procedures

- Competitive Employment certificate fees

5. Stable Government:

The government of the Cayman Islands is also considered to be stable and foreign investors inclined, making it another benefit of registering a company in Cayman Islands. Falling under the sovereignty of the United Kingdom, the country adopts similar parliamentary practices and is democratic in nature. The absence of frequent control exchanges and a responsive government allows the conduct of businesses to operate in a stable environment, providing investors with a peace of mind.

6. High Literacy Rate:

The local residents of the Cayman Islands boast a literacy rate of 98.8%, which is another benefit of registering a company in Cayman Islands. Employers do not have to worry about any language barrier when employing or conducting business in Cayman Islands, especially with their official language being English. However, it is important for potential investors to take note that despite the high literacy rate, because of its huge dependence on the tourism sector, a huge percentage of the workforce will be service skewed. Hence, for foreign companies’ employers who are looking for special qualifications or unique skill sets, it might be difficult to do so.

Conclusion:

Engage Tetra Consultants as we make your registration of business in Cayman Islands a smooth and hassle-free process. The team provides a comprehensive service package that includes planning and strategizing with our clients to select a suitable business entity, completing the registration and documentation processes, obtaining required licenses, opening a corporate bank account, and ensuring your compliance with the government regulations.

Contact us to find out more about company registration in Cayman Islands and our dedicated and experienced team will revert within the next 24 hours.

2 comments

Mikko Moisio

December 21, 2022 at 9:20 pm

Hello,

I am going to start a company in the field of life coaching services. I’m a resident of Finland, and run a business registered here (Voodoo People Ltd). When investigating the requirement and possibilites of this new company in Finland, I, and my accountant came up with quite a lot bureoucratical challenges.

1) The business offers the possibility to buy coaching sessions from multiple coaches working under the company. The coach and the client may reside basically anywhere in the World. VAT regulations of a Finnish company are very complicated when selling services to customers in foreign countries. Having foreign employees or even freelancers is also a complex duty.

2) Therefore, I am interested in launching the business off-shore (possible Cayman) to have more flexibility and less bureoucracy when operating.

3) I will personally cover the costs and initial capital for the new company. There will be no other stakeholders involved.

4) Depending upon the costs, the company will or will not have other employees working under it. I can consider the possible other coaches as freelancers who will create an invoice on behalf of their own business, and my company simple pays it. There must be a handy way to pay me compensation for the work to me as a person in Finland.

5) The company will send invoices or use digital payment methods to collect payments from customers world-wide.

6) In addition to coaching fees, the company may receive incoming payments, and outgoing fees for other products/services related to coaching, education, seminars, books, etc.

7) I plan to run this company for several years to come, so I probably need book keeping services, in addition to bank account.

8) It should be possible and preferably easy to expand the services of the company to other fields of business, that are yet unknown. Also the possibility for me to “exit” and sell the whole company to some other party should be possible.

9) I would like the company name to be “Magic People”. Can you see if is available and ready to be used in international business? Based on my own investigation it should be ok.

So, what would be the optimal the location, company type, and other setting you recommend for me to launch a smooth international business in the way described above?

I would like to hear all the possible choices (+ your recommendation) with pros/cons, and all the fees (or approximations) that I would pay to you, plus any third parties, regarding the official policies, right here at the beginning, as well as in future in yearly basis, etc.

Thank you for all the information this far!

Looking forward to hearing and collaborating with you.

Best regards,

Mikko Moisio

Tetra Consultants

January 3, 2023 at 11:52 am

Thank you for reaching out. One of our consultants has contacted you to discuss the above.