Compliance officer for Czech Cryptocurrency license

- Czech Cryptocurrency license compliance officer services are vital for legal and competitive businesses in the Czech Republic’s rapidly developing digital asset landscape. With obligations to ensure increasing compliance, businesses must ensure compliance is met, and AML/CTF frameworks put in place. Stipulating a compliance officer professional is a core requirement of a Czech Cryptocurrency license and is indicative of a strong internal control procedure and reporting culture.

- Tetra Consultants offer complete practice for clients to appoint a competent compliance officer and to fully understand the ongoing compliance requirements. Once the client has appointed the team from Tetra Consultants, we will be confident to register company in Czech Republic and apply for Czech Cryptocurrency license with full comprehension of regulatory obligations. Once we give the client peace of mind, we can assist their business in complying and remaining audit ready whilst expanding the customer crypto operations in the Czech market.

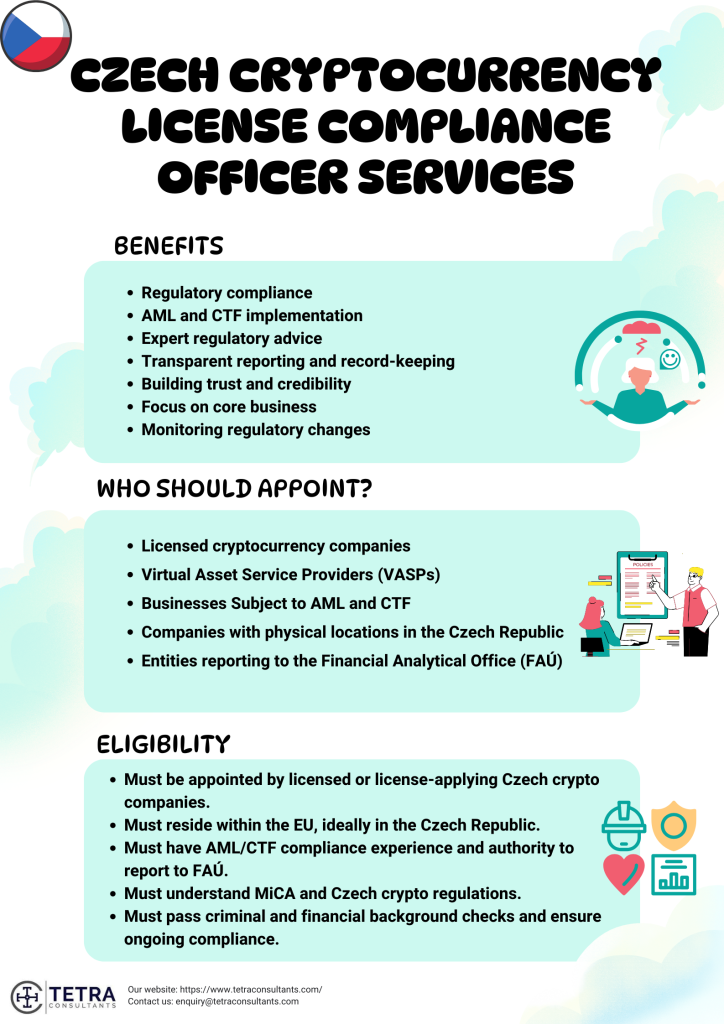

Benefits of Czech Cryptocurrency license compliance officer services

Regulatory compliance

- A dedicated compliance officer keeps your business in strict compliance with all applicable Czech laws and regulations concerning cryptocurrency activities. Implementing these controls helps reduce the risk of legal challenges and breaches of regulation while minimizing the risk of potential fines or disruptions to your business.

AML and CTF implementation

- Your compliance officer will develop, implement and ongoing monitor your anti-money laundering (AML) and counter-terrorism financing (CTF) policies to mitigate the potential for your platform being utilized for money laundering or terrorism financing, helping to preserve the integrity and good reputation of your business.

Expert regulatory advice

- A compliance officer will remain connected to changes in the regulatory environment and provide you with specific and expert advice on what is required to obtain and maintain a Cryptocurrency license in Czech Republic. In addition, their advice will keep you in the clear, signaling what you need to do to comply with evolving law

Transparent reporting and record-keeping

- Transparent reporting systems, and strong internal control measures, signal that you are following proper documentation procedures. These procedures indicate that your business has established necessary measures to be audit-ready and prepared for regulatory assessments, at any time.

Building trust and credibility

- Compliance management signals that you run a professional operation, which gives confidence to all stakeholder’s clients, partners, and investors that your company is ethically and responsibly operating in the digital asset industry.

Focus on core business

- By outsourcing complicated compliance matters to accountants and compliance officers, business owners and management can spend more time focusing on growing their business, developing their products, and setting the strategic direction of the company.

Monitoring regulatory changes

- Compliance officers will continuously monitor and keep you informed about regulatory developments and potential changes to Czech laws related to cryptocurrency. This diligent monitoring will help ensure that your team can quickly respond to any regulatory change while remaining compliant and with little to no disruption to business operations.

Who should appoint Czech Cryptocurrency license compliance officer services?

Licensed cryptocurrency companies

- Companies holding a valid Czech Cryptocurrency license under the Czech Ministry of Trade and Industry are required to appoint compliance officers in accordance with organizational rules and the regulations of the license.

Virtual Asset Service Providers (VASPs)

- Businesses who provide cryptocurrency services, including VASP services such as exchange, wallet, and trading, are required to appoint compliance officers to meet the Czech licensing requirements.

Businesses Subject to AML and CTF

- All licensed cryptocurrency businesses are subject to Anti Money Laundering (AML) and Counter Terrorism Financing (CTF) requirements, including the appointment of a Money Laundering Reporting Officer (MLRO), and/or a compliance officer.

Companies with physical locations in the Czech Republic

- To obtain a Czech Cryptocurrency license, companies must have physical office space in the Czech Republic and appoint a compliance officer based in the jurisdiction where it is registered.

Entities reporting to the Financial Analytical Office (FAÚ)

- For all licensed entities, they appoint compliance officers. The officers have the task of carrying out AML/CFT policy procedures and reporting suspicious transactions to the Czech Financial Analytical Office (FAÚ), the jurisdictional financial intelligence unit responsible for compliance activities.

Eligibility for Czech Cryptocurrency license compliance officer services

- Must be appointed by organizations that possess an active Czech Cryptocurrency license or are applying for a license.

- Must be within the European Union generally and Czech Republic jurisdiction.

- Must have adequate knowledge and experience in AML / CTF compliance.

- Responsible for developing and monitoring the controls for AML and CTF, established by Czech legislation.

- Must serve as the Money Laundering Reporting Officer (MLRO) or compliance officer and have the authority to report suspicious activity to the Financial Analytical Office (FAÚ).

- Must have sufficient knowledge and understanding of MiCA, as well as the Czech crypto regulatory landscape to ensure continuing compliance.

- Must be fit and proper, meaning that the person must obtain due diligence, including a clean criminal record check and a clean financial record check for directors and senior compliance staff.

- Once a crypto license is obtained, the officer must continue to ensure compliance with regulations, including internal controls and availability for audits.

- Must comply with AML Act Section 22 whereby the obligations for reporting must be met, and every effort should be made to engage with Czech financial intelligence authorities.

Czech Cryptocurrency license compliance officer assistance

- All of our compliance officers are Certified Anti-Money Laundering Specialists (CAMS) and Certified Financial Crime Compliance professionals, with no less than 5 years of on-the-ground experience in the financial and crypto sectors. Our officers understand the Czech Republic regulatory framework applicable to VASPs, the Czech AML Act, EU AMLD5/6, and other positions from the Czech National Bank and FAÚ.

- Tetra Consultants will assist your cryptocurrency business in the Czech Republic by designing a comprehensive AML/CFT framework, managing all on-going regulatory reporting, being your primary point of contact with the authorities, and providing your business with seasoned compliance professionals who are entirely dedicated to the highest levels of integrity and compliance.

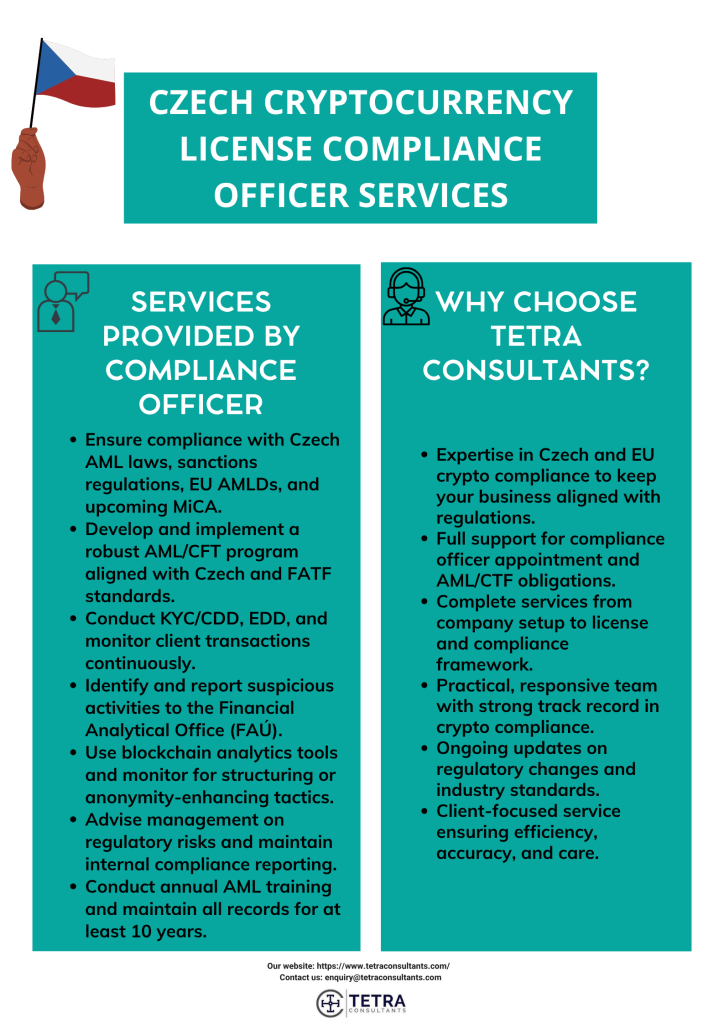

Services offered by Tetra Consultants Czech Cryptocurrency license compliance officer

- Ensure that the company is in compliance with:

- Czech Act No. 253/2008 Coll. on AML (Zákon o některých opatřeních proti legalizaci výnosů z trestné činnosti)

- Act No. 69/2006 Coll. on the implementation of international sanctions

- Czech Trade Licensing Act

- EU AML Directives (5AMLD, 6AMLD) and forthcoming MiCA obligations;

- Design, implement and maintain an AML/CFT compliance program to the level of Czech law and FATF recommendations;

- Oversee:

- Customer Due Diligence (CDD/KYC) for natural persons and legal entities;

- Enhanced Due Diligence (EDD) for high-risk clients;

- Ongoing monitoring of transactions and relationships;

- Ensure procedures in place to recognize Politically Exposed Persons (PEPs) and sanctioned persons/entities.

- Investigate and escalate suspicious activity.

- File Suspicious Transaction Reports (STRs) to the Financial Analytical Office (FAU).

- Maintain logs of reported incidents and internal investigations made because of information obtained from clients.

- Ensure that monitoring systems know how to detect:

- Structuring,

- Anonymity-enhancing features (mixers, privacy coins),

- High volume or unusual transfers;

- Make use or incorporate blockchain analytics tools where it is deemed appropriate.

- Advise senior management and the Board on compliance issues, regulatory developments and areas of risk exposure.

- Prepare and present ongoing compliance reports for senior management.

- Monitor and respond to breaches of internal compliance policies.

- Deliver annual AML/CFT training to all employees.

- Train employees on how to identify suspicious activities and raise red flags.

- Document and maintain records of all training.

- Maintain records of:

- Customer identification information.

- Transaction records.

- Compliance decisions.

- STRs and audit trails.

- Make sure records are maintained for 10 years as required by Czech AML law.

- Liaise with auditors or regulators during inspections.

- Begin the process of aligning with the Markets in Crypto-Assets Regulation (MiCA) coming into force across the EU in 2025.

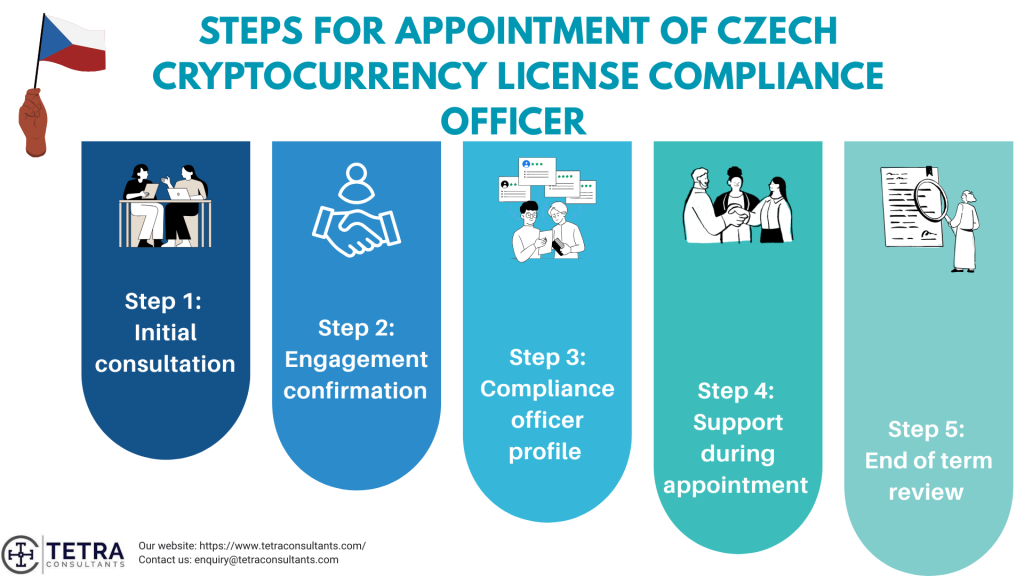

Steps for appointment of Czech Cryptocurrency license compliance officer

Step 1: Initial consultation

- We will begin with a consultation to understand your crypto business model, licensing structure, and regulatory obligations under the Czech AML Act and EU legislation. The objective is to have you discuss your internal systems, policies, and risk exposure so that we can agree on the level of compliance support you need from our appointed officer.

Step 2: Engagement confirmation

- After we come to agreement on the scope of work, outlines of deliverables, and responsibilities of each party, we will send you an appointment letter and bill for service. The appointment letter will detail the compliance officer’s role, and duration of engagement and reporting responsibilities, to have full transparency and mutual agreement from the start.

Step 3: Compliance officer profile

- Following acceptance, we will send you the details CV for your appointed compliance officer, showing their professional qualifications, experience and detailed understanding of Czech and EU crypto compliance requirements. You can also conduct a short introductory meeting with the officer if you wish before your appointment is finalized.

Step 4: Support during appointment

- At all stages of the appointment, your compliance officer will support you in implementing the risk-based AML/CFT framework consistent with those expected by the Czech FAÚ and EU standards. We will support regulatory reporting, transaction monitoring, audits and be your main point of contact for relevant authorities.

Step 5: End of term review

- As the appointment term reaches its end, we will conduct a full review of your overall compliance positioning and regulatory compliance performance. Depending on the outcome, you may elect to extend the appointment, modify the scope of your compliance function, or introduce internal compliance with confidence.

Cost for Czech Cryptocurrency license compliance officer services

- When you Engage with Tetra Consultants for a compliance officer under your Czech Cryptocurrency license, you can expect full transparency and no hidden fees or ambiguous deliverables. We walk you through every step from the initial consultation and through your post-licensing practitioner support, so you know exactly what you are getting.

- Our compliance officers are CAMS certified and have significant aptitude with Czech AML laws and EU directives. We will advise you based on your business model, work with you on day-to-day AML/CFT items and ensure that your internal compliance framework complies with local regulatory expectations.

- We keep close watch on any changes issued by the Financial Analytical Office (FAÚ) and EU regulators, so that your business stays compliant and prepared for external audit at any time. As we navigate through your compliance obligations through our regulatory compliance consulting, we make sure each of our processes is structured, and communication is clear so that you can manage your regulatory obligations as effectively and confidently as possible throughout the engagement.

Why choose Tetra Consultants?

- Engaging Tetra Consultants as your Czech Cryptocurrency license compliance officer will provide businesses with a reputable source who has the subject matter expertise to ease regulatory complexity and improve operational efficiencies. What separates Tetra Consultants from others is that our team has extensive subject matter expertise in Czech crypto regulations, our team promotes transparent communication with the client, and Tetra Consultants provides end-to-end services from offshore company incorporation, obtaining your license, corporate bank account opening and ongoing compliance.

- Expertise in Czech and EU crypto compliance to keep your business aligned with regulations

- Full support for compliance officer appointment and AML/CTF obligations

- Complete services from company setup to license and compliance framework

- Practical, responsive team with strong track record in crypto compliance

- Ongoing updates on regulatory changes and industry standards

- Client-focused service ensuring efficiency, accuracy, and care

Looking to appoint Czech Cryptocurrency license compliance officer

- Engaging Tetra Consultants for Czech Cryptocurrency license compliance officer services represents a lot more than regulatory compliance. It allows your business to gain a strategic advantage in the complex Czech crypto landscape. With its extensive experience and knowledge of Czech and EU regulations, Tetra Consultants team never has your business misconstrue or misapply compliance requirements but always provides purchaser-oriented solutions that suit each distinct business model of the company being consulted.

- The services we provide include licensing, corporate structure, employment of quality compliance officers, and continuous regulatory updates, all of which bolster your company’s operating capabilities. With us, the business will have a proactive ally who leads your company through regulations, tackles challenges, and liaises with regulators so that the clients continue focusing on innovation and maximizing growth within the evolving cryptocurrency space in the Czech Republic. This type of comprehensive support is also key to your entity’s success and maintaining confidence amidst shifting regulatory frameworks.

- Contact us to know more about Czech Cryptocurrency license compliance officer services and our team will revert in 24 hours.

FAQs

Who is required to have a compliance officer in order to obtain a Czech Cryptocurrency license?

What are the compliance officers' responsibilities?

Can the compliance officer be based outside of the Czech Republic?

What are the requirements in qualifications for the compliance officer?

Is it compulsory for crypto startups to appoint a compliance officer?

Could Tetra Consultants provide compliance officer services?