Czech Crypto License

- Obtaining a Czech crypto license is now hassle-free with Tetra Consultants’ assistance. As a cryptocurrency business owner, it might be tough to choose a specific jurisdiction because there are so many reputable and trustworthy countries for launching a cryptocurrency business. Investors should evaluate a number of things before deciding on the Czech Republic as their cryptocurrency company’s headquarters. For instance, if it is entirely legal to use bitcoin for cryptocurrency transactions.

- The Czech Republic sees itself as a leader in the sector of cryptocurrencies. For example, Prague is home to the first Bitcoin-only café in the world, has one of the highest densities of Bitcoin ATMs in the world, developed the first hardware wallet and mining pool, and allows you to pay your gas bill in Bitcoin. Additionally, a start-up business in the Czech Republic can raise financing using cryptocurrencies as this is possible through ICOs. There are 42 ICOs in the Czech Republic, and citizens there can simply take part in these processes. The Czech Republic, which is ranked 6th among 249 nations on the list, offers one of the most alluring marketplaces for cryptocurrency operations globally.

- You must be familiar with the characteristics of the Czech legal system in order to operate and apply for the Czech Crypto License. It will be challenging for you to comprehend the legal system if you are the owner of a foreign corporation and wish to operate lawfully within the EU. Therefore, it is always preferable to seek the assistance of consultants who focus on this practice area. They will ensure that the documentation has been filed out correctly, confirm that it is legally authorized, and instruct you on what to look for when registering a company. Tetra Consultants’ team of professionals will perform a thorough consultation, respond to any inquiries, and offer suggestions for how to expedite the cryptocurrency license issuing.

What are the advantages of obtaining a Czech Crypto License?

The Czech Republic is one of the best countries to start a crypto business and obtain a Czech crypto license. Our team of experts advises you to read through this section to know the potential advantages of forming a cryptocurrency business in the jurisdiction.

- Businesses that deal in cryptocurrencies in the Czech are now subject to the same regulations as financial institutions. It implies that such companies and businesses dealing in cryptocurrencies are well protected, in contradiction to many other nations.

- Operating in a secure environment of the Czech Republic with proper authorization is made possible by effective Czech effective regulation and governmental oversight. By understanding that the business is adequately safeguarded and controlled, customers are more likely to trust it.

- In this nation, traditional transactions and cryptocurrency are not the same. Even though the utilization of cryptocurrency is very flexible your account cannot be interred and withdraw the cryptocurrency since these operations are extremely protected and private.

- There are low tax rates with no tax on any capital gains or reinvested income, as well as minimal yearly fees for maintaining a crypto company.

- The Czech government is financially and politically stable and further particularly committed to the growth of international commercial relationships, which supports ongoing, active development and maintenance of cryptocurrency businesses.

- Czech is considered an advantageous nation for cryptocurrency operations additionally owing to simple business registration requirements, cheap taxes, minimal maintenance expenses, no restrictions on residency status, and several other benefits.

What are the laws governing a Czech Crypto License?

- A thorough set of regulations for bitcoin enterprises has not yet been created in the Czech Republic. Currently, there is no distinct regulatory framework for cryptocurrency activity, and cryptocurrencies are not regarded as a kind of legal tender. The majority of cryptocurrency businesses that engage in business operations linked to cryptocurrencies must abide by standard laws intended to protect the Czech financial sector.

- Czech Republic remains one of the first EU nations to adopt legislation governing virtual currencies and their legal status. The “Security of Internet Payments and Cryptocurrency” summary was filed by National Bank President Miroslav Singer in April 2015. Based on the filed document, if there are no guidelines from Czech law, then this text establishes that EU rules apply to virtual currencies. Hence, the Czech Republic is still among the most stable nations when it comes to virtual currency regulation. This strategy promotes the development of blockchain-based fintech businesses and boosts the growth of foreign investment in the nation. Additionally, all pertinent EU regulations are followed, such a permissive approach stimulates entrepreneurship and experimentation with quickly developing offerings and services.

- AML/CFT regulations governing cryptocurrency business in the Czech Republic: Even though there is almost no regulatory oversight of cryptographic activities in the Czech Republic, the government has implemented the fourth EU Anti-Money Laundering Directive (4AMLD), the fifth Anti-Money Laundering Directive (5AMLD), and the sixth Anti-Money Laundering Directive (6AMLD), which require cryptocurrency exchanges and crypto purse providers to implement stringent internal AML/CFT procedures. These guidelines cover standard due diligence procedures, intelligence collection, documentation, and storage, AML/CFT risk assessment, beneficial ownership, and reporting suspicious transactions. They also cover how to conduct customer transactions and improve customer due diligence for customers depending on high-risk jurisdictions.

- MiCA regulations: The Czech Republic transposed MiCA regulations via its Digital Finance Act, effective February 15, 2025, which required that all crypto-asset service providers obtain a full CASP license, replacing the previous VASP regime. Licenses will be tiered based on the types of services engaged in and imposed capital requirements of €50,000 – €8 million, along with due governance, AML/KYC compliance, risk management, client asset separation, and reporting obligations. Licensed companies are entitled to operate with EU-wide passporting and EU harmonization of a single legal framework, which improves consumer protection and market integrity, as it is subject to supervision from the Czech National Bank.

- In actuality, national regulatory bodies have gone further, including a larger spectrum of cryptography-related commercial operations. As a result, companies that deal in, store, maintain, or mediate the acquisition or selling of virtual currencies or provide other services relating to cryptography are subject to AML/CFT regulations. Virtual currency is defined in this sense as a digital asset that does not qualify as fiat money but is still recognized as a form of payment by parties who are not the unit’s issuers. The following anti-money laundering/terrorist financing laws apply to companies engaged in crypto-related economic activities in the Czech Republic:

- The AML Act (Act 253/2008 Coll.), which sets out the principles of the AML/CFT

- Money Laundering Ordinance (Decree No 281/2008 Coll. ), which provides requirements for corporate policies and procedures in the field of combating money laundering/terrorist financing

- Criminal Code (Law No. 40/2009 Coll.), which defines criminal acts

- Law on International Sanctions (Law No. 69/2006 Coll. ), which provides the rules for the imposition of international sanctions

- General laws governing cryptocurrency business in the Czech Republic: General legislation can help cryptographic companies to understand where their activities should be located within the current regulatory framework of the financial market. Companies engaged in activities related to cryptography in Czech should consider the following general laws governing financial services:

- Trade Licensing Act (Act No. 455/1991 Coll.)

- Law on Banks (No. 21/1992 Coll.)

- Act on Obligations on the Capital Market (No. 256/2004 Coll.)

- Law on Management Companies and Investment Funds (Law No. 240/2013 Coll.)

- Law on Insurance (No. 277/2009 Coll.)

What are the types of Czech Crypto Licenses?

- At this time, it cannot be claimed that comprehensive regulations for the crypto business have been enacted in the Czech Republic. But the nation has already made a lot of progress in this regard. This has led to the development of a flexible licensing system where a corporation may select the kind of permit that is appropriate for its activities.

- Therefore, obtaining a work permit is necessary if you wish to work in the Czech Republic without running into legal issues. It should be noted that there will not be any issues with this if you work authentically and transparently. There is no corruption or bureaucracy here, but your business must abide by all rules set forth by the state regulator.

- In Czech, there is no specific license types that have been implemented like for cryptocurrency exchanges in Lithuania or Estonia. Since this kind of asset is regarded as a commodity in the Czech Republic, a cryptocurrency exchange license is identical to a standard trading license or permit.

Different classes of Czech crypto licenses

- Class 1: services include the purchase, sale, or offering of crypto-assets, portfolio management, transfer, order execution, token placement, and investment advice; minimum paid-up share capital is €50,000.

- Class 2: includes all class 1 services, custody of crypto-assets, and exchange for fiat or other crypto-assets; minimum paid-up share capital is €125,000.

- Class 3: includes all class 2 services plus management of trading platforms, infrastructure, and maintenance of liquidity; minimum paid-up share capital is €150,000.

What are the activities allowed under a Czech Crypto License?

Having a Czech cryptocurrency license gives its holder the ability to provide the following services to his clients:

- Exchange one digital currency for another and real money (crypto vs fiat exchange) and vice-versa (fiat vs crypto exchange).

- Create cryptocurrency wallets to store customers’ money on them.

- Make transactions between customer accounts.

- Provide processing services.

- Open accounts for business, including online trading (merchant accounts).

- Provision of a crypto wallet service (custodian crypto wallet service).

- Client cryptocurrency storage services (crypto storage service).

- Make a cryptocurrency transfer (crypto transfer service).

- Full-featured cryptocurrency exchange.

- Issue Visa/MasterCard debit cards that can be used to transfer and withdraw money.

Who is the regulatory authority regulating a Cryptocurrency business in Czech Republic?

- In the Czech, the cryptocurrency business is mainly regulated and monitored by the Czech National Bank. Hence, if you want to establish a cryptocurrency exchange business in the Czech Republic, you will need to get a cryptocurrency license from the country’s financial watchdog (CNB). The license will grant you the authorization to run your cryptocurrency business in compliance with the laws and regulations of the jurisdiction. Without a valid Czech crypto license, you may be fined or even shut down by the authorities.

- In addition to CNB, all financial market participants are supervised by the Financial Analytical Office (FAU) for AML/CFT purposes. The authority closely cooperates with the Czech National Bank (CNB) which is responsible for the general supervision of the financial market in the Czech Republic. Other national regulatory authorities are the Czech Inspection Authority and the Ministry of Finance.

What is the assistance granted by the Czech government for the Cryptocurrency business and applying for a Czech Crypto License?

- Despite the government’s lax stance on the cryptocurrency industry, developing and new crypto businesses in the Czech Republic are given the chance to apply for funding from connected and non-governmental projects. Startup incubators and accelerators provide assistance with the development, promotion, and sale of cryptographic products and services.

- To begin with, all Czech cryptographic businesses are eligible to use the FinTech CNB contact point so long as they can demonstrate how their good or service satisfies the criteria for financial innovation. This point of contact functions as a better communication channel and is made to enhance the efficiency of players in the innovative financial market and provide guidance on securing relevant authorization. Filling up a contact form at the CNB website will get qualified businesses’ regulatory advice. However, as this service is not meant to take the place of qualified legal counsel, we suggest you get complete consultation from our team of professionals instead. When it comes to funding and other important business aspects, you can additionally benefit from the following initiatives:

- Government organization CzechInvest offers the seven-month CzechStarter incubator program, where companies can get funding, access to seminars, and professional guidance.

- The Blockchain Connect Association/Czech Alliance was established to encourage the adoption of blockchain technology throughout the nation, expedite growth, and get rid of fraud and corruption.

- The Cryptoanarchy Institute aims to advance a decentralized economy that permits unrestricted information dissemination and the widespread adoption of such cryptocurrency-based goods and services.

What are the documentation and regulatory requirements for obtaining a Czech Crypto License?

- In order to obtain any of the above-mentioned Czech crypto licenses, your entity needs to follow the standard authorization procedure and comply with the minimum regulatory requirements as outlined by the regulating body.

- Tetra Consultants’ team of experts has been specializing in supporting cryptocurrency projects for more than a decade. Over time our team has gained extensive experience and vast knowledge in the field of FinTech and blockchain technologies, AML/CFT, as well as the legal regulation of financial and investment activities. Given the knowledge and experience, our team can accurately guide you on the requirements to be adhered to in order to set up a cryptocurrency business and obtain a cryptocurrency license in the Czech. In this section, our team has summarized the relevant requirements to be fulfilled for the same.

Requirements with respect to a company

- Register a Czech entity with a unique company name.

- Obtain a registered legal address with a minimum one-year term.

- Prepare and notarize the memorandum of association.

- Open a corporate bank account with a Czech financial institution.

- Transfer the authorized minimum capital, which depends on the basis of the class of license that the company is applying for.

- Obtain any other relevant trading license at the Czech Trade Registry.

- Draft a comprehensive business plan reflecting business continuity, operational model, and financial projections.

Governance and local personnel requirements

- Appointment of at least one resident or non-resident director who is fit and proper (qualified, with no criminal record).

- Directors can be individuals or corporate entities; foreign individuals do not require visas but must have full legal capacity under Czech trade licensing law.

- All directors are required to have extensive knowledge and experience in management roles, financial, and crypto areas.

- The company must have at least 1 AML specialist that is licensed across the EU. It is mandatory to have a physical office in Czech Republic.

- Recruitment of at least two local employees in the Czech Republic, one of whom can serve as the AML officer.

- Mandatory appointment of a Chief Compliance Officer (CCO) and a Money Laundering Reporting Officer (MLRO) responsible for AML/CFT compliance and liaising with authorities.

- At least one EU tax-resident director must be appointed to ensure transparency and strong regulatory oversight.

AML/CFT and data protection requirements

- Develop and implement internal AML/CFT policies covering client identification, risk assessment, and suspicious activity reporting.

- Appoint a trained AML/CFT officer (MLRO) aligned with the company’s operating model and reporting framework.

- Deploy modular AML/KYC solutions and automated transaction monitoring systems to meet EU anti-financial crime standards.

- Establish GDPR-compliant data protection procedures for secure data exchange with authorities.

- Ensure segregation of client assets, use of qualified custodians, and obtain insurance against theft or loss.

Operational and risk management requirements

- Prepare a white paper with legal and technical disclosures (mandatory for token issuers).

- Develop an operational sustainability and risk management program, including marketing strategy, territorial coverage, and outsourcing policies.

- Establish policies ensuring security of client funds and compliance with EU financial safety regulations.

- Regular internal audits with compulsory reporting to the Czech National Bank to ensure compliance and mitigate risks.

- Use trusted EU-based financial institutions for custody and settlement services to strengthen investor trust.

Reporting and financial requirements

- Adherence to AML/KYC procedures, suspicious activity reporting, and cooperation with Czech regulators.

- Maintain accurate financial records in line with International Financial Reporting Standards (IFRS).

- Annual filings must include a balance sheet, revenue and expense statement, cash flow summary, and changes in equity, along with tax returns.

- Entities exceeding €3,000,000 turnover, €1,500,000 in assets, or 50 employees must undergo an independent financial audit.

What are the documents required to obtain a Czech Crypto License?

- When applying for the Czech crypto license you are required to provide the following information together with the license application:

- Corporate documents such as a notarized Memorandum and Articles of incorporation, Certificate of incorporation, and detailed information about the applicant entity.

- Identity documents including copies of notarized passports, utility bills (of last three months), and income statements of founders, directors, and shareholders.

- Certificates confirming no criminal record, unpaid taxes, and debts of founders, directors, and shareholders.

- Business plan incorporating strategy and operational policies and procedures of the applicant entity.

- All of the given information will probably be forwarded to the appropriate national supervisory authorities so they may assess the applicant’s eligibility to engage in the legally permitted cryptographic activity. Qualified applicants are given a license that may only be used for operations that the Trade Licensing Authority has authorized. If the license is conditional, the licensee will not be permitted to begin cryptographic operations until the requirements set forth by the authority are met.

- By law, all licensees must report to any regulatory agency upon additional inquiry and request. If the entity fails to do so, its conditional licenses may be suspended for engaging in fraudulent activities. It should be reminded that starting a permitted cryptographic activity without first acquiring a license is prohibited. Without a license, a cryptographic business is deemed fraudulent, subject to a fine of up to 500,000 CZK (about 20,204 EUR), and required to stop operations.

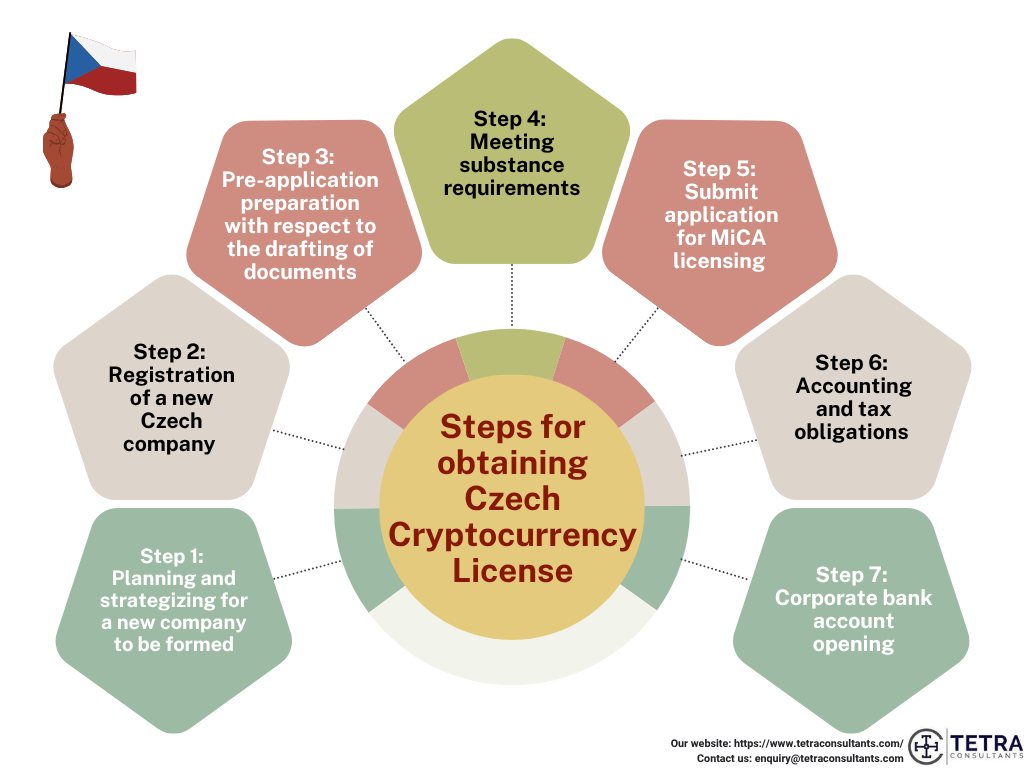

What is the process of obtaining a Czech Crypto License?

- Prague, the capital of Czechia, is currently one of the cities with the greatest concentration of cryptocurrency ATMs (evaluated in BTC), making it one of the most desirable locations for crypto investors to launch their ventures. People who want to start a business selling digital goods and related services must adhere to the requirements prescribed for this type of commercial business.

- Tetra Consultants’ team of licensing experts will thoroughly guide you on how to apply for a crypto license in the Czech Republic, what these requirements are, and what they entail. In the section below, our team has outlined the most prevalent steps that take place during the course of applying for a Czech crypto license.

Step 1: Planning and strategizing for a new company to be formed

- Tetra Consultants assist international clients with the process to register company in Czech Republic. To officially begin with the process our team will ensure the collection of KYC documents of the prospective shareholders, directors and beneficial owners of the company to be incorporated to ensure the reliability of the project.

- Once confirmed our team will get the power of attorney signed by the client in order to represent the actions to be taken on the client’s behalf.

- Once the power of attorney is signed, our team will require you to provide the three alternative company names to be reserved with the Czech Trade Registry.

Step 2: Registration of a new Czech company

- Tetra Consultants’ team of experts will analyze the long-term business needs and goals of the company. Based on the thorough description, our team will guide you on the most suitable type of business structure to be incorporated in the Czech.

- A Limited Liability Company (SRO) is the most preferred form of entity structure in the Czech Republic for the cryptocurrency business. This entity structure gives the advantage of incorporation with minimal regulatory requirements like low capital requirement (CZK 1), a director and shareholder, a registered legal address, and a company secretary.

- Tetra Consultants will assist with the registration of a limited liability company with the Czech Republic Trade Registry by a registered legal address and a company secretary who will represent the entity in Czech.

- Tetra Consultants’ legal team will assist with the preparation of incorporation documents like Memorandum and Articles of Association and notarization of the same with the public notary. If required our team will also assist with the translation of such documents to the Czech Republic’s local language by a certified translator. Once the entity is registered, our team will send the Certificate of Incorporation and other authorized documents to the address given by the client.

Step 3: Pre-application preparation with respect to the drafting of documents

- Tetra Consultants will simultaneously proceed to the preparation of necessary policies and other authorization documents including AML/CFT policies, Insurance policies, etc.

- Our team of consultants will also assist you in preparing a comprehensive business plan as well as planning a compliance program. The business plan and compliance program will be drafted in writing for your further review and in accordance with the Act and associated regulations imposed by the regulatory authorities in Czech and also following the regulations and guidelines for digital money under the EU directives.

- Tetra Consultants team is further proficient with the implementation of written compliance policies in upkeeping the license. Our team will review the adopted compliance policy and advise you on how you can more effectively update and improve the compliance program. We will also assist you with the drafting of an effectiveness review of the compliance program.

Step 4: Meeting substance requirements

- As the local regulator, CNB requires you to ensure fulfilling the economic substance requirements like a local registered address and local employees in Czech, Tetra Consultants will assist you to meet them. Our team will assist with the recruitment of local qualified employees to join the team.

- Tetra Consultants’ HR team will undertake candidate shortlisting and preliminary interviews for key employees, including the compliance officer. Following that, you can narrow down the final list of prospects to choose who is best suited to join the team. Tetra Consultants will assist in the preparation of an employment contract with the agreed terms once the candidate has been selected.

- As all crypto companies in the Czech are required to have an AML Officer/MRLO, Tetra Consultants will also assist in recruiting a fit and proper compliance officer. The compliance officer will also be equipped with the necessary knowledge to ensure that your business remains compliant. Once hired, our team will notify the Financial Analytical Unit (FAU) regarding the appointment of an AML officer and contact person with the required identification documents, experience certificates, and employment contract of the relevant personnel.

Step 5: Submit application for MiCA licensing

- Once authorization and registration are complete, Tetra Consultants will help you prepare and submit the MiCA license application to the Czech authorities. Our team will ensure compliance with all EU regulatory standards, will prepare the documentation accurately, and liaise with regulators on your behalf to maximize speed of approval.

Step 6: Accounting and tax obligations

- Tetra Consultants’ team of Chartered Accountants will ensure that your newly established cryptocurrency company continues to meet regulatory laws set by the Czech Revenue Agency. This includes providing you with monthly bookkeeping, preparation of financial statements, and annual tax return filings.

Step 7: Corporate bank account opening

- A cryptocurrency business in the Czech must set up the necessary infrastructure in order to operate properly and offer unhindered services related to the cryptocurrency exchange. This infrastructure includes opening a corporate account with a bank or payment system (SWIFT, SEPA), opening a corporate account on a cryptocurrency exchange, setting up automated accounting of dealings and transactions, and ensuring the collection and secure storage of data about customers and their transactions.

- Tetra Consultants will assist in consolidating the required corporate documents for corporate bank account opening with a reputable local bank in the Czech Republic that provides relevant services as mentioned above.

- Typically, directors, and shareholders are not required to travel to the Czech to open a corporate bank account. However, if travel is required, we will have a representative accompany you to the bank meeting. Alternatively, our team will negotiate with the banks to conduct a conference call instead or request a waiver.

- Once the bank account has been successfully opened, Tetra Consultants will courier the internet banking token and access codes to your preferred address. Further, our team will provide the instruction to maintain the minimum capital required to apply for a crypto license in Czech.

What is the tax implication of cryptocurrency business in the Czech?

- Individual tax: Depending on how they are used, cryptocurrencies are taxed differently in the Czech Republic. Individuals who trade cryptocurrencies are generally subject to a 15% tax, whilst businesses face a tax rate of 19%. Sellers of products and services that accept cryptocurrency payments are often taxed in the same way as their competitors, even if those competitors accept payments in conventional money, such as Euros. Although taxing cryptocurrencies in the same way as traditional currencies may be challenging, the Czech government warned that taxpayers must make every effort to understand the complex legal system in order to avoid being accused of tax avoidance.

- Czech nationals who sell products and services using cryptocurrency must pay income taxes on those sales. Cryptocurrencies are taxed in the same way as “traditional money” in this situation. Profits from cryptocurrency transactions are subject to a 15% tax rate for individuals. This tax rate is equivalent to the taxes imposed on international payments. Transactions involving cryptocurrencies and foreign currencies are thus taxed similarly. Cryptocurrency recipients are subject to the same taxes as other taxpayers. Their tax base is made up of the proceeds from selling cryptocurrencies plus the market value of those assets less any losses.

- Corporate income tax: Companies that use cryptocurrencies have larger tax obligations than individuals do, with a rate of 19%. Businesses that use cryptocurrency for commercial transactions must get a license for operation and pay taxes to the Social Fund and the Health Fund in order to optimize taxation. Those that utilize cryptocurrencies for business include those whose whole business model is centered on cryptocurrencies and businesses that trade on cryptocurrency exchanges like Coinbase. For example, crypto mining companies utilize it for commercial reasons, they must apply for a license and pay taxes to the Social fund and the Health fund. Because their business is only focused on mining cryptocurrencies for profit, mining companies specifically employ cryptocurrency for commercial reasons. As a result, mining operations are subject to a 19% tax in the Czech Republic.

- The Czech government claimed that despite the lack of clarity around the taxation of cryptocurrencies, the country’s convoluted tax code does not absolve inhabitants of their need to abide by the law and refrain from engaging in tax evasion. In addition, Czech authorities have shown extreme initiative in their search for taxpayers who use Bitcoin to evade taxes. In the year 2017, the Czech government required banks, cryptocurrency exchanges, and other financial service providers to strictly identify their clients. As a result, the Czech law intends to increase cryptocurrency transparency and make it more difficult for taxpayers to utilize cryptocurrency’s anonymity to cheat taxes. This action demonstrates the Czech government’s willingness to punish tax evaders.

- VAT (Value Added Tax): In general, VATs are not applied to cryptocurrency transactions in the Czech Republic. There is one circumstance, nevertheless, when Czech cryptocurrency companies would be forced to pay VATs. The Czech tax authorities are permitted to reclaim taxes on the company that bought the items when suppliers do not pay VATs. Because of this, if the suppliers do not pay VATs, the cost of paying VATs may be passed on to the buyers of cryptocurrencies. For example, suppose the cryptocurrency exchange does not pay VATs. In that case, the cryptocurrency buyer may be required to pay the VATs if the authorities try to recover taxes from the transaction. However, in most situations, buyers in cryptocurrency transactions are exempt from paying VATs for the buyer.

MiCA application deadline for Czech crypto licenses

- The MiCA application deadline for the Czech cryptocurrency license was July 31, 2025. Companies submitting their applications prior to this date will be allowed to continue to operate using that license, no longer than until the decision by the Czech National Bank (CNB) is made, and no longer than July 1, 2026. After that date, no operations could take place without a MiCA license. Overall, this transitional period provides existing crypto service providers time to qualify for a MiCA license, while allowing business continuity.

MiCA impact on Czech Cryptocurrency license

- Aligns Czech crypto regulations with EU-wide MiCA regulations, replacing the VASP framework with CASP licenses.

- Introduces licenses for all crypto asset service providers, promotes regulatory oversight and consumer protection.

- Creates capital requirements based on class of service, ranging from €50,000 to €150,000, to demonstrate financial soundness.

- Implement full compliance with AML/CFT, risk management, internal controls and governance standards.

- Gives the Czech National Bank expanded powers to supervise, license, and take enforcement action against crypto companies.

- Allows a transitional period for existing businesses to continue operations until July 1, 2026, provided they apply for MiCA licenses by July 31, 2025.

- Facilitates European single market passporting to enable licensed businesses to operate across member states without applying for additional licenses.

- Creates standard consumer protections, service disclosures, and operational transparency to mitigate legal uncertainty and fragmentation in market.

- Strengthens the regulatory framework with the aim of mitigating risks of market manipulation, fraud, and operational failures inherent to the crypto sector.

- Encourages innovation and investor confidence by developing a single legal landscape for digital asset services that is clear and uniform.

How long does it take for obtaining a Czech Crypto License?

- At Tetra Consultants, we assist our clients with the registration of their Czech company and the opening of a corporate bank account in as little as 6 weeks. License approval is typically granted if the application meets all the requirements, and the documents were submitted correctly. Inconsistent or incomplete documentation may lead to requests for clarification.

- To limit delays, it is vital to have a good description of the entire business operations, including a strong business plan, as well as supporting evidence of a physical office, employees located locally, and directors qualified in the Czech Republic. Our experts also indicate that, similar to MiCA applications, review times can be around 1 year, depending on the efficiency of regulation. Prior to engagement, we provide a clear project plan, which will outline timelines for registration, documents, and licensing, so you will know exactly what to expect.

How much does it cost for obtaining a Czech Crypto License?

- Tetra Consultants will provide you with multiple services ranging from assisting you through the incorporation process to obtaining the Czech crypto license. The total fee that will be charged is inclusive of the company registration fee, license fee, and any additional cost that may arise.

- We will discuss with you the total engagement fee in detail before we begin the registration process so that you have a better understanding of what you are paying for. Tetra Consultants strives to be transparent with the engagement fees prior to the start of any engagements. All these terms and conditions will be stated clearly in our appointment letter.

Our services

- Tetra Consultants assist cryptocurrency companies with their regulatory and licensing needs and provide continued support and assistance to financial companies with regard to all aspects of entity formation and operation in the Czech Republic.

- Tetra Consultants is an international professional consultancy firm that specializes in the preparation of cryptocurrency license applications. We can assist you in obtaining a relevant cryptocurrency license or authorization from your proposed jurisdiction, in order to lawfully operate the cryptocurrency business in overseas jurisdictions like the Czech. We provide licensing services in all major jurisdictions that have introduced advanced legislation regulating such cryptocurrency businesses.

- Tetra Consultants’ team of licensing experts is proficient in assisting financial service organizations with attaining various offshore financial licenses depending on long-term business needs and goals.

Find out more!

Contact us to find out more about how to get a Czech Crypto License. Our team of experts will revert within the next 24 hours.

FAQs

Is the Czech Republic a good place to start a cryptocurrency business?

How to Start a Crypto Business in the Czech Republic?

Is cryptocurrency legal in the Czech Republic?

Who can start a crypto company in the Czech Republic?

Which body regulated crypto company activities in the Czech Republic?

What is the validity period of a Czech Crypto License?

What is the minimum capital requirement to begin a cryptocurrency company and obtain a Czech crypto license?

What are the taxes for a crypto company in the Czech Republic?/How is a crypto company in the Czech Republic taxed?