Cayman Islands Banking License

- Obtaining a Cayman Islands Banking License is a smooth and hassle-free process with Tetra Consultants. Our service package includes everything you need to operate your banking business in the nation from the formation of the entity to the ultimate acquirement of an offshore banking license. Our team ensures you witness a smooth application procedure with our assistance and channel your energy on other important aspects of your business.

- The Cayman Islands is arguably one of the first nations that come to mind when you think about the offshore banking business. Since Cayman Islands’ banking business has got such a good reputation as it is regarded as the fifth-largest financial hub and is a global financial leader. Three-quarters of the world’s hedge funds are held by the nation, together with deposits worth about $7 billion.

- However, the compliance rules are getting stricter resulting in complex and time-consuming licensing procedures for a layman who is unaware of banking norms and policies in the country. But one thing is ensured that the Cayman Islands is no longer a location for dishonest people to conceal money in the name of it being accorded as tax heaven.

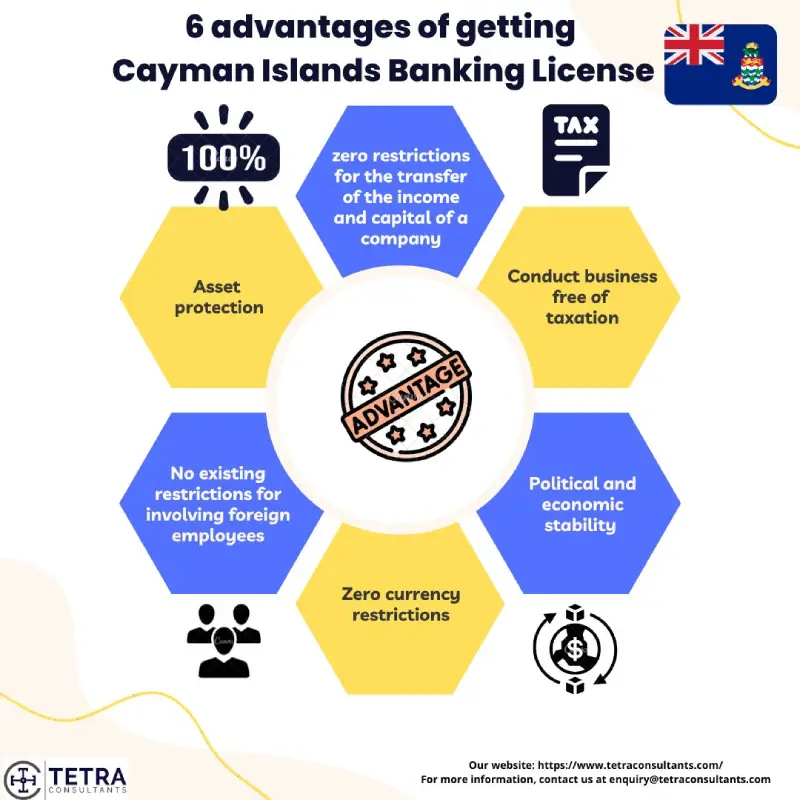

What are the advantages of getting a Cayman Islands Banking License?

The advantages of starting an offshore bank and obtaining a Cayman Islands banking license are as follow:

- Asset protection

- Political and economic stability

- Conduct business free of taxation

- Freely transact exchange, trade, or deal in any currency

- Engage in business transactions free from excessive regulatory interference

- A high degree of privacy in operating a bank account and other banking business

- Conduct offshore banking with a reasonable but effective and balanced regulatory regime based on international standards concerning lending limits and investment restrictions.

- The Cayman Islands’ banking regulations provide banks with the finest chance to maximize the potential of their assets and offer them a competitive edge to participate in the global financial markets.

Regulations governing the banking sector of the Cayman Islands and issuance of Cayman Islands Banking License

- The Cayman Islands’ Banks and Trust Companies Law (the “Banking Law”) is the main legal framework for the supervision and licensing of banks and controls all “banking business” conducted within the Cayman Islands. The Act makes it an offense to conduct banking business or trust business without the appropriate license. Additionally, the Banks and Trust Companies (Licence Applications and Fees) Regulations (the “Regulations”), a subsidiary rule, also specifies the format for license applications as well as the fees that must be paid.

- In addition to the above, all the banks conducting banking business in the Cayman Islands must abide by the guidelines set out in the Anti-Money Laundering Regulations, Proceeds of Crime Law, and accompanying Guidance Notes as and when published. To execute the obligations of the Common Reporting Standards (CRS) and the United States Foreign Account Tax Compliance Act (FATCA), the Cayman Islands have also passed respective legislation.

- The Cayman Islands do not have a central bank, but instead, the government of the Cayman Islands established The Cayman Islands Monetary Authority as a statutory body (“the Authority”). The Authority was established to control and oversee the financial services sector, including an island-wide evaluation and monitoring of all banks and trust companies. Additionally, the Authority advises the Government on banking and monetary issues while promoting and upholding monetary stability. Hence for the banking business in the nation, the Cayman Islands Monetary Authority (CIMA) is responsible for the licensing and regulation of financial service providers in the Cayman Islands. CIMA is responsible for both the processing of bank and trust license applications and the continuing supervision of licensees.

- The Banking Supervision Division of CIMA is in charge of ensuring that the laws and regulations regulating banks are followed. Under Cayman Islands legislation, CIMA is given wide authority over the granting and revoking of Cayman Islands banking license, the imposing of restrictions thereto, as well as the management of a licensee’s directors, managers, and officials. Banking operations must adhere to supervision rules published by CIMA. CIMA ensures to grant Cayman Islands banking license and supervises banks also in accordance with the Core Principles for Effective Banking Supervision (the “BCPs“) issued by the Basel Committee on Banking Supervision.

What is regarded as a banking business?

- According to Cayman Islands’ banking law “no banking business may be transacted from Island, whether or not such business is carried in Island, except by a person who is in possession of a valid license granted by CIMA, enabling him to carry on such business.”

- Wherein the term “banking business” refers to the act of accepting (except from a bank or trust firm) and holding on to current, savings, deposit, or other similar account money that are repayable by cheque or order and may be invested through advances to customers or otherwise.

What are the categories of Cayman Islands banking licenses?

There are three main categories of banking licenses provided in the Cayman Islands to conduct banking business in the country. The type of license granted may differ primarily with regard to their permissible activities. The categories of Cayman Islands banking license can be outlined below:

Category “A” Banking Licence

- This category of Cayman Islands banking license is unrestricted and allows the conduct of banking operations within and outside of the Cayman Islands, although it is subject to any restrictions that CIMA may apply. A big multinational bank’s branch or subsidiary is often given a Class A Licence. Class A licensed banks are expected to have a Cayman office open with qualified employees and suffice other requirements as may be specified.

The Regulations further subdivide Category “A” licenses based on permissible activities. The types of Category “A” licenses are as follows:

- An “A” license granted without restrictions on the carrying on of banking business within Cayman;

- An “A” license granted with restrictions as to the carrying on of banking business within Cayman and with permission to provide principal office services to five or more other licensees; and

- An “A” license granted with restrictions as to the carrying on of banking business within Cayman.

Category “B” Banking Licence – Unrestricted

- This category of Cayman Islands banking license enables the holder to conduct unrestricted banking business anywhere in the world from the Cayman, except that it may not service clients within the Cayman Islands itself, subject to limited exceptions. Thus, the licensee is not permitted to –

- Accept deposits from Cayman residents other than other licensees or exempted or ordinary non-resident companies that are not operating in Cayman;

- Invest in any asset that represents a claim against any Caymanian resident, excluding claims arising from any of the following:

a. Loans to exempted or regular non-resident companies that are not conducting business in Cayman;

b. Mortgage loans to one of the licensee’s employees for the purchase or construction of an owner-occupied residence in Cayman;

c. Transactions with other licensees; or

d. The acquisition of bonds or securities issued by the Cayman government; or - Carry on any business which is outside the express scope of the Category “B” license without written approval from CIMA.

- Invest in any asset that represents a claim against any Caymanian resident, excluding claims arising from any of the following:

- Accept deposits from Cayman residents other than other licensees or exempted or ordinary non-resident companies that are not operating in Cayman;

- The Banking Law also states that the holder of a Category “B” license who is neither a subsidiary nor a branch of a bank licensed in a nation or territory outside of Cayman may not conduct business in Cayman unless it has the resources (including personnel and facilities) and the books and records that CIMA deems appropriate in light of the nature and scale of its operations.

- For Class B licensed banks, a minimum of two (2) individuals with the necessary expertise must be based in Cayman; one of these individuals must be the managing director and the other the assistant managing director. A licensee may also have its major office at a Class A Bank or Trust Business, and the authorized agents must work for that bank or trust company if it does not have its own office and personnel in Cayman.

Category “B” Banking Licence – Restricted

- This category is similar to the unrestricted Category “B” license, provided that it imposes an additional restriction that the licensee shall not receive or solicit funds by way of trade or business from persons other than those listed in any undertaking accompanying the application for the Cayman Island banking license.

- This license is thereby limited to the licensee’s identified or the named clients under the license application. For instance, when the licensee is a reputable business group from outside of Cayman that is establishing a bank there to offer a treasury function to other group members exclusively (i.e. there is no intention to take third-party deposits).

The banking regulation further subdivides each of the Category “B” licenses and restricted Category “B” licenses based on nationality and ultimate ownership of the bank. The sub-types of Category “B” and Restricted Category “B” licenses are as follows:

- Where the license holder is a branch of a bank licensed in a country or territory outside Cayman;

- Where the license holder is a subsidiary of a bank licensed in a country or territory outside Cayman;

- Where the license holder is not a subsidiary or branch of a bank licensed in a country or territory outside Cayman.

Accordingly, Category “B” and Restricted Category “B” licensees construed under (i) and (ii) above are considered by CIMA to be “host regulated banks”, in that they are subject to consolidated supervision in accordance with the BCPs by another banking supervisory authority (for example, the FDIC or Federal Reserve Board in the USA). In general, upon application by a host-regulated bank for a license under the Banking Law, CIMA will seek assurance from the banking supervisory authority of the fact of such consolidated supervision and the good standing of the applicant and will require such authority to give its approval for the authorization of the applicant.

While the licensee’s falling within section (iii) above are considered by CIMA to be “home-regulated banks” and CIMA will supervise these applicants on a consolidated basis in accordance with the BCPs.

What are the minimum regulatory requirements for obtaining a Cayman Islands banking license?

Type of company structure

The type of business structure to be used depends on the extent of your business goal and activities. Tetra Consultants’ team of licensing experts will recommend the most suitable form of business structure based on your licensing needs and the ultimate vision of your banking business. Accordingly, you may consider the following option:

- In case you plan to conduct banking business locally and acquire a Class A license, you can consider forming a Cayman ordinary company or locally registered entity.

- Whereas, if branch operations are contemplated, your existing foreign banking entity will be required to register as a branch of a foreign bank having a place of business in Cayman.

- For companies that do not plan to operate as branches, a Cayman Islands ordinary or exempted company may be utilized. The advantages of using an exempted company for a Category “B” bank license include the tax exemption certificate (effectively a guarantee from the Cayman Government from incorporation that the licensee will not be required to pay taxes for a period of twenty (20) years.

Name of Company

- Before proceeding to the official registration of the entity in Cayman, an applicant is required to submit the business name to CIMA as the name of the bank that will provide financial services must be approved by CIMA. The name cannot be similar to any other Cayman Islands companies or international banks. The use of a name that is deceptive or implies affiliation with a non-existent entity or organization is not permitted by CIMA.

Directors and Officers

- CIMA must approve all the directors and officers of all the authorized or licensed banks of the Island. The Cayman banking law provides that an applicant shall not have less than two (2) directors. CIMA requires that directors of licensed banks have a minimum of five (5) years of relevant experience in a senior position. In addition, directors and officers must meet fitness and propriety criteria which include: honesty, integrity and reputation, competence and capability, and financial soundness.

- A fit and proper persons assessment is mandated by CIMA for all directors and senior officers, and a similar requirement is present in connection with the subsequent appointment of any additional directors or other senior officers (with respect to a Cayman Islands branch, if there are a significant number of directors and senior officers, CIMA will consider accepting full due diligence on only those who will be directly involved in the operations of the branch). All director and senior officer appointments must be submitted to CIMA for its prior written approval; however, licensees may request CIMA for an exception from this requirement.

Capital requirements

- For new unrestricted banking and/or trust licenses the initial paid-up capital must be at least CI$400,000 (approximately US$500,000) or it is equivalent in another currency. The minimum capital requirement for restricted licenses is CI$20,000 (approximately US$25,000). However, higher figures may be required by CIMA depending on the nature and scope of the proposed operation.

- There are applicable minimum net worth requirements as well, which depend on the type of license you are planning to apply for. However, this can be varied by CIMA if it is of the view that a higher net worth figure is required to demonstrate that the applicant will have, and will continue to have, financial resources that are adequate for the nature and scale of the business and for the amount of risks underwritten.

- CIMA must also be satisfied that the applicant’s owner has sufficient financial strength to support the applicant and, in doing so, will also assess the financial strength of the applicant’s owner.

Authorized representative agent and registered office

- A licensee is either required to:

a. Maintain a place of business in the Cayman Islands and have two individuals resident in the Cayman Islands to be its agents or

b. If a licensee does not maintain its own local staffed office, it must have its registered office situated at a class A bank or trust company and the authorized agents should be employees of such bank or trust company.

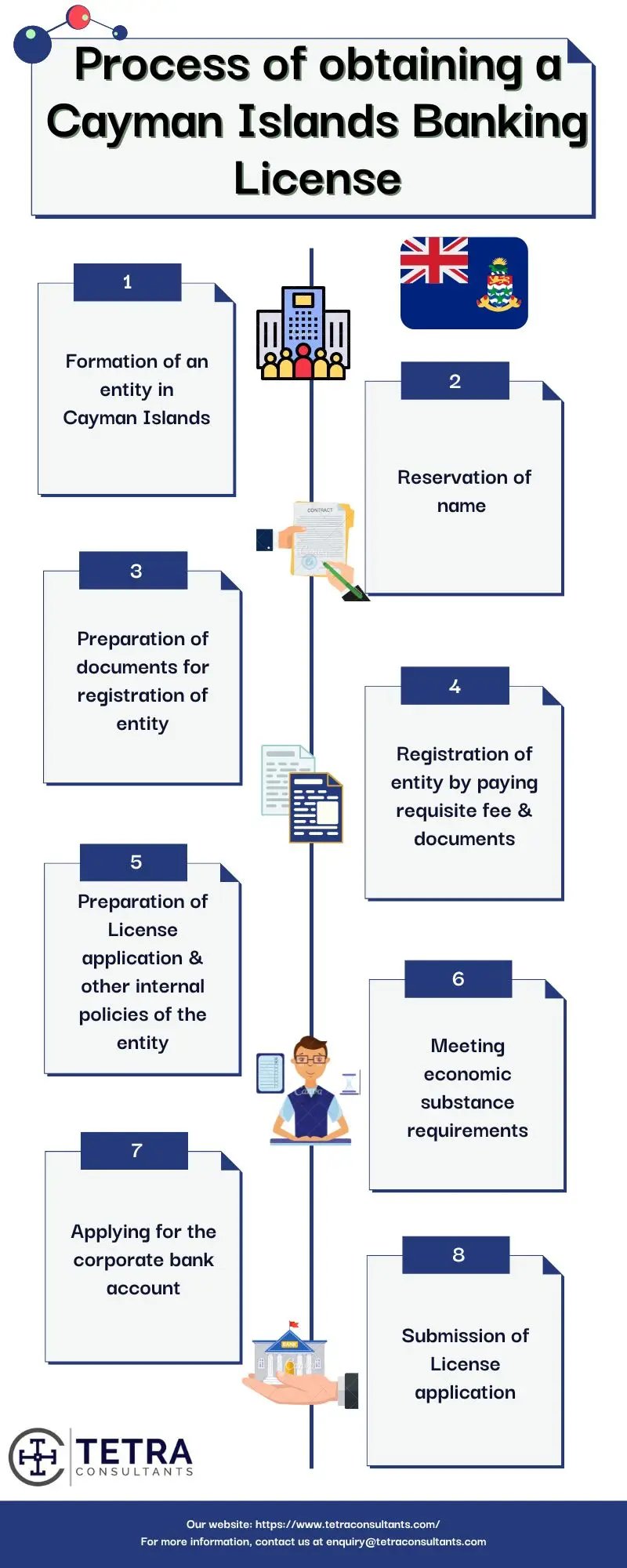

What is the procedure to obtain a Cayman Islands banking license?

- Tetra Consultants has assisted multiple clients with acquiring a Cayman Islands banking license. Our formation and licensing package will get you all the answers to how to set up a banking entity in the Cayman Islands and obtain a Cayman Islands banking license.

- Before we proceed with the official preparation of your banking license, it is important that you get the initial permit from CIMA and give an intimation of the intention to set up a bank in the country. Tetra Consultants’ team of specialists will assist with the preparation of acquiring a pre-license or permit to begin the procedure of organizing a bank in the Cayman Islands.

- Tetra Consultants advises you to read through this guide to fully understand the steps prevalent during a normal course of engagement when applying for a Cayman Islands banking license.

Step 1: Formation of entity

- Depending on your intended business activity and the extent of your customer base, Tetra Consultants will advise on the most suitable form of entity structure and category of license for your banking business in the country.

- Our team of experts will provide you with the requirements of the concerned Cayman Islands banking license including paid-up capital requirements, local economic substance requirements, timelines, and other obligations prior to the start of the engagement.

- In order to incorporate a company in the Cayman Islands and subsequently apply for a banking license, you need to have a registered agent and registered office. As such Tetra Consultants will ensure that you meet such requirements.

- Tetra Consultants’ team of dedicated professionals expects to complete the process to register company in Cayman Islands within 2 weeks. Once the company is successfully registered, we will send over the corporate documents including the Certificate of Incorporation, Memorandum, and Articles of Association as well as the other internal documents.

Step 2: Fulfiling the regulatory requirements for the license application

- Based on the banking laws and licensing regulations of the Cayman Islands, the local regulator, CIMA requires you to have economic substance, Tetra Consultants will assist you to meet them. Our team will assist with the recruitment of local qualified employees.

- Accordingly, Tetra Consultants will provide you with the nominee director services in order to fulfill the requirements of resident directors of the banking entity. Wherein the nominee director will be made to sign a nominee agreement under which he will only act as the representative of the entity and ensure there is no interference in the important decisions of your business.

- Tetra Consultants’ HR team will conduct the shortlisting and initial interviews with the candidates. Thereafter, you can shortlist the final list of candidates to determine who is most suitable to join the team. Once the candidate is chosen, Tetra Consultants will assist to prepare an employment contract with the terms and conditions that are agreed upon.

- Our team will also shortlist a list of physical offices and send them to you. We will include important considerations such as monthly rental, location, size, etc so you can better decide which is most suitable for you. Once the office is chosen, Tetra Consultants will prepare the lease agreement to be signed between you and the landlord.

Step 3: Preparation of documents and license application

- Tetra Consultants’ legal team will prepare the required documents for the license application. These documents will include the business plan, AML/CFT policy, and insurance policy depending on the local requirements.

- Once the documents are prepared, Tetra Consultants will send over the drafts for your review. Thereafter upon confirmation, we will send them to you for e-signature and prepare for license application.

Step 4: Opening a corporate bank account

- Prior to opening a correspondent bank account, Tetra Consultants’ banking team will proceed to the standard process of corporate bank account opening for your newly registered entity. This standard bank account will be used to deposit the minimum capital required for the license application approval.

- You can rely on our banking experts who maintained years of relationships with international and locally reputed banks. We will present the proposal for a corporate bank account opening for your entity. We expect the respective process to take roughly 4 weeks.

- Additionally, a correspondent account at a multinational bank may allow you to hold some cash in US dollars and some in your primary country of operation. This way, you can batch-process transfers and reduce your transfer costs. Tetra Consultants will assist you in opening the correspondent bank account in order to ensure the smooth operation of the banking business.

Step 5: Submission of license application

- Once the above requirements are successfully adhered to and complied with, Tetra Consultants will apply for the Cayman Islands banking license appended with other supplementary documents to the CIMA.

- In case the regulatory authority requires additional documents and evidences to support the application process, Tetra Consultants’ team of licensing experts will thoroughly respond to the queries posed on the application and negotiate with the regulatory authorities.

- If everything goes well and your entity gets through the audit of the above banking system and other internal procedures successfully, you will be issued the Cayman Islands banking license which will enumerate the type of services you are permitted to conduct under the name of your entity.

What are the documents required to obtain a Cayman Islands banking license?

The information and documents which need to be filed with the application differ depending on the type of license being applied for however it may include, but are not limited to the following documents:

- Evidence for approval of corporate name;

- In respect of the shareholders, directors, and officers of the company, the following documents are required:

- Identification documents like copy of notarized passport, utility bills of not less than 3 months, and documents evidencing the source of income;

- Two (2) character references;

- Financial reference from a bank/trust company;

- Police clearance certificate;

- Evidence of two (2) effective directors; and

- Evidence of relevant banking experience of at least one (1) director;

- Letter of recommendation from bank/trust company;

- Written assurance from the parent’s banking supervisory authority of the consolidated supervision and good standing of the applicant;

- A descriptive business plan enlisting the following:

- Objectives of company

- Reasons for establishment;

- Customer base (including names for Restricted Category “B” license);

- Asset structure;

- Management structure; and

- Two-year projection;

- Evidence showing the deposit of minimum required capital;

- Undertaking not to solicit funds in the Cayman Islands;

- Details of principal office, authorized agents, local auditors;

- Date of financial year-end;

- Memorandum and Articles of Association;

- Certificate of Incorporation; and

- Opening balance sheet

What are the continuing operational obligations to maintain a Cayman Islands banking license?

- Licensed banks must have their accounts audited annually by an approved auditor and a copy of the audited accounts must be forwarded to CIMA within 90 days of the licensee’s financial year-end. These audited accounts are not required to be made public.

- Licensed banks must submit Quarterly Prudential Returns in the form prescribed by CIMA providing information required to ensure that the bank is complying with the Banking Law and is in a sound financial position.

- The minimum capital adequacy ratio for locally incorporated banks is 10%. For subsidiary banks subject to consolidated supervision in another jurisdiction CIMA requires a minimum ratio of 12% and for banks that are not subject to such supervision, the minimum ratio is 15%. There is no minimum ration requirement for branches regulated in another jurisdiction.

- A director or senior manager is usually required to meet with CIMA annually to discuss matters pertaining to the licensee. Additionally, CIMA may arrange periodic on-site inspections of the licensee.

- No issue of shares or transfer of shares of a licensed bank is permitted.

- CIMA must be made aware of any significant change in the licensee’s operations or activity. It is recommended that significant changes be discussed with CIMA prior to any implementation.

- The Dormant Accounts Law of the Cayman Islands requires licensed banks to transfer funds held in any dormant accounts to the Cayman Government after 7 years of account inactivity. Licensed Banks must submit a report to the Minister of Finance and to CIMA at the time that it makes such transfers (no later than 31 March each year) and must submit a certificate of compliance, attesting that it has complied with these dormant account requirements by 31 December annually.

How much time does it take to obtain a Cayman Islands banking license?

- Prior to the start of the engagement, Tetra Consultants will send you a project plan with the timelines stipulated for company registration, preparation of documents as well as license application. This is to ensure that all parties are clear on the upcoming project.

How much does it cost to obtain a Cayman Islands banking license?

- The total engagement fee depends on the services you need from Tetra Consultants. We provide you with multiple services ranging from assisting you through the incorporation process to obtaining the banking license. The total fee that will be charged is inclusive of the company registration fee, license fee, and any additional cost that may arise.

- We will discuss with you the total engagement fee in detail before we begin the registration process so that you have a better understanding of what you are paying for. Tetra Consultants strives to be transparent with the engagement fees prior to the start of any engagements. All these terms and conditions will be stated clearly in our appointment letter.

Our Services

- Tetra Consultants regularly provides assistance to financial service providers who are seeking licenses from CIMA and can provide assistance in preparing applications for obtaining banking licenses including setting up the pre-meeting with CIMA and providing advisory services with respect to the consultation on different types of banking licenses in the Cayman Islands.

- Tetra Consultants will provide you with a comprehensive set of services to obtain a Cayman Islands banking license, including the formation of a Caymanian entity, the preparation, and drafting of a descriptive business plan, the preparation of the requisite bank constitution and prospectus as well as license application, the development of responses to license application inquiries and the assistance with the management and organization of required physical presence and resident director.

- Tetra Consultants is proficient in assisting financial service providers with attaining other offshore financial licenses depending on business activity and long-term business goals.

Find out more!

Contact us to find out more about how to obtain a Cayman Islands banking license. Our team of experts will revert within the next 24 hours.

FAQ’s

Who regulates banks in the Cayman Islands?

- The Cayman Islands Monetary Authority: The Monetary Authority Act and the Banks and Trust Companies Act give the Cayman Islands Monetary Authority (“CIMA”) the responsibility for licensing and regulating banking and trust business in the Cayman Islands.

How do I open a bank in the Cayman Islands?

- The process for a bank license in Cayman begins with a request for a permit to organize. This preliminary license gives you the right to incorporate your bank, use the word “bank” in your name, and generally take the steps necessary to launch the business.