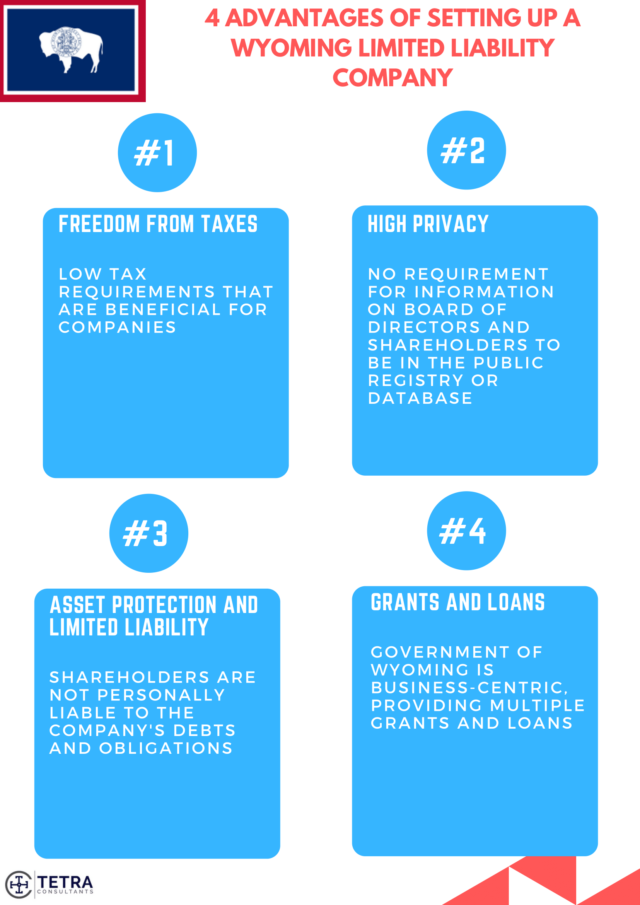

Wyoming is widely recognised as the most business-friendly state to conduct business in the United States (US) given its friendly and low tax requirement. Foreign investors who incorporate their business in the jurisdiction of Wyoming will stand to experience a low tax burden, given that the country has taken a pro-business stance that welcomes investments. This can be seen through the government’s commitment in attracting investments, passing legislation bills that allow for start ups to enter highly regulated industries as well as provide businesses with varying resources and support. Business firms are given access to various resources such as grants, loans and incentive programs which helps propel business growth, attracting various foreign investors for starting a business in Wyoming. Before you proceed to register company in Wyoming, allow Tetra Consultants to share 4 advantages of setting up a Wyoming limited liability company for your reference.

1) Freedom From Taxes

The first advantage of setting up a Wyoming limited liability company is that foreign investors stand to gain freedom from taxes. When incorporated as an LLC in the jurisdiction of Wyoming, the one of the greatest advantages that a foreign investor stands to get is the low tax requirement from operating in the country. High corporate taxes as well as other other accompanying excise tax can chip away at the profit margins of business, leading to lower growth potential throughout the years but foreign investors do not have to worry about this when doing business in Wyoming. The tax obligation in Wyoming will benefit LLCs and other businesses incorporate in the country in the following ways:

1) Personal Income Tax: No requirement to pay personal income tax if you are operating within the state of Wyoming.

2) Corporate Tax: Corporate taxes are not imposed on LLCs or Corporations in the state of Wyoming, helping to reduce the burden of any double taxation.

3) Excise Tax: There is no excise tax imposed on businesses to pay for specific items like gas or food.

4) Estate or Inheritance Tax: There is no estate or inheritance tax imposed in the state of Wyoming.

5) Intangible Tax: Intangible assets such as stocks or bonds are not taxed in the state of Wyoming.

Furthermore, tax exemptions can be granted for manufacturing startup companies in Wyoming, leveraging upon the sales tax exemption applicable on sales or lease of manufacturing machineries.

2) High Privacy

The second advantage of setting up a Wyoming limited liability company is that foreign investors can stand to enjoy high privacy when operating in the country. If you register an LLC in Wyoming, there is no requirement for the board of directors and shareholders’ identification date to be recorded in the public registry or database.

3) Asset Protection and Limited Liability

The third advantage of setting up a Wyoming limited liability company is that it gives shareholders and directors limited liability. It does not matter whether you are a company officer, manager, diretor or even a shareholder; you will not be personally liable for the company’s debts and obligations incurred, if any. However, it is important to note that this protection will not be considered applicable if there is grounds or basis for litigation with regards to suspected fraudulent activities.

4) Grants and Loans

The fourth advantage of setting up a Wyoming limited liability company is that the operating environment in Wyoming is business-friendly and there are multiple resources the businesses can opt to apply for and leverage them to propel their own business growth. The government of Wyoming has set aside numerous grants, loans and incentive programs to provide access to key financial resources to help startup companies navigate their early stage of growth.

Furthermore, the state government has developed a covid-19 business relief program to help alleviate the financial burden and stress that business owners are currently facing during the tough times of the pandemic.

Conclusion:

Engage Tetra Consultants as we guide you on how to register a company in Wyoming through a smooth and hassle-free process. The team provides a comprehensive service package that includes planning and strategizing with our clients to select a suitable business entity, completing the registration and documentation processes, obtaining required licenses, opening a corporate bank account, and ensuring your compliance with the government regulations.

Contact us to find out more about company registration in Wyoming and our dedicated and experienced team will revert within the next 24 hours.