Liechtenstein Investment Fund License

- Tetra Consultants assists international clients with the process of applying for a Liechtenstein Investment fund license. The idealistic investment fund hub of Liechtenstein provides a variety of options for fund formation. It stands out well from a global perspective thanks to its quick licensing processes and affordable start-up, administration, and supervision costs.

- In accordance with Liechtenstein legislation, the first investment fund was established in 1996. The fund center has continued to develop ever since. Investors gain from the adaptability of a cutting-edge fund center with investment fund structures that adhere to EU regulations. Access to the European market is made easy and without discrimination thanks to EU passporting. Private label funds make up a sizable share of the funds domiciled in Liechtenstein. These investment funds are tailored specifically to the promotor’s requirements. Independent asset managers, alternative investment fund managers (AIFM), family offices, and high-net-worth individuals are the major types of fund promoters.

- For financial service providers, obtaining financial market licenses frequently proves to be an expensive and time-consuming procedure. A great deal of time and money may be saved with the correct assistance. We give financial service firms in Liechtenstein specialized assistance in acquiring licenses and permits. We have a vast network of partners and many years of expertise in this industry. Our team of licensing experts is suited to help you with licensing requests for a Liechtenstein Investment Fund License. In the subsequent sections, our team has elaborated on the important aspects of obtaining an investment fund license in Liechtenstein, from covering the advantages to the process of applying for such a license, Tetra Consultants is here to help.

What are the advantages of obtaining a Liechtenstein Investment Fund License?

- Liechtenstein is an established destination for businesses interested in establishing a suitable investment fund comparable with other EU equivalent funds. As a result, the Liechtenstein-based investment fund’s founders will have access to the European market while also benefiting from the investor protection and confidentiality afforded by banking secrecy.

- In the subsequent lines, our licensing experts have summarized the additional benefits of setting up an investment fund company in Liechtenstein and it may include economic and political stability, a sophisticated banking system, and economic policies and taxation that are beneficial to international investors, among other things.

Access to two economic areas:

- Liechtenstein has the unique and highly advantageous attribute of belonging to two economic zones. Its customs and currency union with Switzerland is an ideal component, and it is also a member of the EEA, which includes the EU and the three EEA/EFTA nations. This implies Liechtenstein has preferential market access to both the EU and Switzerland. As a result, the benefits of both economic zones may be utilized, and the interests of investors in both Switzerland and the EEA can be competently met.

Passporting rights:

- Liechtenstein is allowed to passport its financial services in the EEA due to the national implementation of EU regulations and the inclusion of EU legislation in the EEA Treaty. This passporting method consists of two parts: the product passport and the management company passport. The product passport allows Liechtenstein UCITS and AIFs to be offered across the EEA. The management company passport also allows Liechtenstein management firms and alternative investment fund managers (AIFM) to manage funds from the European Economic Area (EEA) in addition to Liechtenstein funds, and to actively advertise these funds in the European domestic market.

Adroit financial market capabilities:

- Under the framework of European regulations, the Liechtenstein investment fund center provides several options and significant freedoms in terms of organizing investment programs and selecting investment instruments. Liechtenstein’s excellent track record in financial services, as well as the specialized competence of its market specialists, demonstrate their value, especially when it comes to arranging complicated investment forms in a fund.

Short decision-making channels:

- The Principality of Liechtenstein makes use of its small size to its advantage. Short decision-making pathways to and between public agencies provide for more efficient and speedy functioning. This increases speed, not merely when it comes to establishing an investment fund.

High investor protection:

- To safeguard investors in the investment fund industry, Liechtenstein has enacted a rigorous code of conduct regulations. The Financial Market Authority and certified auditors supervise the fund businesses’ commercial operations.

Low-operating cost:

- From a worldwide perspective, the costs of establishment, overheads, and supervisory fees for setting up a fund management company and Liechtenstein fund investment license are quite low. This is especially true for normal minimum fees, which are frequently significantly higher in other countries. The all-in fees that are often given in Liechtenstein provide fund promoters/initiators with significant planning assurance.

Strong banking infrastructure:

- Domestic Liechtenstein banks hold the assets of domestic investment funds for safekeeping in compliance with European directives. Banks in Liechtenstein face relatively minimal risks and are distinguished by their financial soundness and stability.

Beneficial tax system:

- Liechtenstein investment funds are fully liable for tax. However, earnings are tax-exempt and are therefore effectively not taxed. In addition, Liechtenstein does not impose withholding tax on distributions.

Growing figures of Liechtenstein investment funds formation:

- By the conclusion of the year 2021, 556 Liechtenstein investment funds were licensed at 16 asset management companies or alternative investment fund managers (AIFM). A single investment fund may have one or more sub-funds. 289 single funds and 523 sub-funds were licensed by the end of 2021. By the end of 2021, net assets under management were CHF 70.3 billion. There were 574 non-domestic investment funds approved for sale in Liechtenstein, as well as 1982 sub-funds having a sales license.

What are the laws governing the issuance of a Liechtenstein Investment Fund License?

- Previously, the various forms of Liechtenstein Funds were governed under the Investment Companies Act. The various types of Funds in Liechtenstein were classified under the Investment Companies Act as follows: investment companies specializing in securities, investment companies specializing in other assets, investment companies specializing in real estate, and special investment companies for qualified investors.

- The former Liechtenstein legislation on funds has been superseded by the stipulated statutes called Undertakings for the Collective Investment of Transferable Securities Act (UCITSG) and the Alternative Investment Fund Managers Act (AIFMG). The regulation listed above implements European Directive UCITS-IV. As a result, the two types of funds in Liechtenstein are currently split as follows: funds that engage in the collective investment of transferable securities and funds that do not. Notwithstanding this, the regulations of the Investment Companies Act continued to apply to existing funds until the Alternative Investment Fund Managers Act took effect on July 22nd, 2013.

The new legislations for Liechtenstein fund management companies contain the following provisions:

- The law stipulated as Undertakings for the Collective Investment of Transferable Securities Act (UCITSG) governs the licensing, supervision, investment activity, and management companies of Liechtenstein-based Funds that conduct collective investment of transferable securities.

- The Alternative Investment Funds Managers Act (AIFMG) governs alternative investment Fund managers (AIFM) who manage the portfolios and risks of alternative investment Funds that are not already governed by the Undertakings for the Collective Investment of Transferable Securities Act (UCITSG). In conjunction with the EU passport for these funds and alternative investment fund managers, the Act establishes additional responsibilities. They include the requirement for alternative investment Fund managers to register and seek a license from Liechtenstein’s Financial Market Authority (FMA).

- Furthermore to the Fund structures already governed by the Certain Undertakings for Collective Investment in Transferable Securities Act (UCITSG), the Alternative Investment Funds Managers Act (AIFMG) allows for investment limited liability partnerships in Liechtenstein, with one partner referring to unlimited liability.

- The Alternative Investment Funds Managers Act (AIFMG) mandates a minimum initial capital of €300,000 for a self-managed alternative investment Fund in Liechtenstein (or the equivalent sum in Swiss Francs). The Act also requires an alternative investment Fund managed by an alternative investment Fund manager in Liechtenstein to have a minimum initial capital of €125,000 (or the equivalent sum in Swiss Francs).

Who is the regulatory and issuing authority of a Liechtenstein Investment Fund License?

- According to its legislative mandate, the Liechtenstein Financial Market Authority (FMA) is in charge of ensuring the stability of the country’s financial market, consumer safeguarding, exploitation mitigation, as well as the execution and observance of regulations. In accordance with acknowledged worldwide norms, the Liechtenstein FMA finds the ideal balance between its protective and supervisory duties as well as the demands of the market. The FMA regulates players in the financial market in the Liechtenstein financial center as an integrated and independent supervisory institution. The FMA is represented in all significant supervisory organizations on both a European and international level.

- The Liechtenstein Financial Market Authority (FMA) is a full member of the European Securities and Markets Authority (ESMA), the European Insurance and Occupational Pension Authority (EIOPA), and the European Banking Authority (EBA) (ESMA). The FMA’s standing as an equal and recognized supervisory body is strengthened by its full integration with these European supervisory agencies. The FMA has the same powers and responsibilities as the national supervisory authorities of the EU and a seat on each supervisory council. The FMA does not have the ability to vote on these international financial supervisory authority organizations, nevertheless, as Liechtenstein is not a member of the EU.

- In addition to playing an essential oversight function, the FMA also makes sure it is aware of the market and its requirements. Companies might use it for inquiries, especially when using abrasive commercial concepts. As a result, it significantly enhances Liechtenstein’s appeal as a hub for foreign investment funds.

What are the types of funds available in Liechtenstein?

Collective Investment of Transferable Securities (UCITS)

- Liechtenstein Collective Investment of Transferable Securities funds deals with derivatives as well as securities like shares and bonds, as well as other financial instruments. Liechtenstein’s Collective Investment of Transferable Securities funds is able to offer and sell their services across the whole European Union. To provide and supply their services across the whole European Economic Area (EEA), these funds must first get a license from the Financial Market Authority of Liechtenstein (FMA).

- The products of a Collective Investment of Transferable Securities (UCITS) Fund in Liechtenstein must be transferred to a bank, securities firm, or other person under the Financial Market Authority’s (FMA) supervision who is permanently resident in Liechtenstein or is a Liechtenstein resident company in order to ensure their safety.

Non-Collective Investment of Transferable Securities

Investment companies for other assets

- These investment companies that do not focus on stocks or real estate are represented by this form of fund. Furthermore, this form of Fund specializes in investments that are only partially marketable, prone to significant price changes, exhibit a limited risk spreading, or have complicated valuations. With this type of Fund, investments are specifically permitted in mass-market items, earth metals, and financial derivatives.

Investment companies for other assets with increased risk

- In comparison to Funds for other assets, this form of Fund has a risk profile that is noticeably higher. This kind of fund allows, among other things, increased borrowing as well as speculating and short-selling in derivatives.

Investment companies for qualified investors

- When it comes to the guidelines of the investor, this form of Fund is subject to unique restrictions. Banks, insurers, asset managers, funds, other businesses, and family offices are a few examples of those who fall under stringent conditions in relation to the investor’s qualifications. The Financial Market Authority (FMA) of Liechtenstein does not need this form of Fund to submit an application for a license, but it does provide its investors just a minimal level of protection. Due to the qualified investor’s experience, legal status, assets, and the amount of his prior investments, it is assumed that with this type of Fund, the risks are obvious to him or her.

Investment companies for real estate

- This kind of Fund permits direct or indirect investment in real estate that is utilized for either private or commercial purposes, in accordance with the idea of risk distribution. The minimum fund volume for this kind of fund, a non-collective investment of transferable securities fund, is CHF 2,000,000 (or the equivalent sum in a different currency). After achieving this minimum Fund volume within six months of the initial subscription, the Fund volume may not decline below the specified CHF 2,000,000 (or the equivalent sum in a different currency).

What are the types of legal forms a Liechtenstein fund is permitted to adopt?

- The Structure of Funds in Liechtenstein in Accordance with The Certain Undertakings for the Collective Investment of Transferable Securities Act (UCITSG). A Fund in Liechtenstein is permitted to adopt the following legal forms:

Investment Fund (contractual investment fund)

- In Liechtenstein, an investment fund lacks legal identity. Instead, it is created through a Fund Agreement between a number of investors, which provides for the creation of a management company and a secure location to house its assets and allow investment, management, and safeguarding. This is done in the investors’ names and takes the form of a legally distinct asset pool (fund) that the investors are a part of. Each investor’s contract has the same information. After receiving authorization from Liechtenstein’s Financial Market Authority to operate, an investment fund is required to be registered in the Commercial Register, a public record (FMA).

Collective Trust

- Similar to an investment fund, a Collective Trust in Liechtenstein lacks legal identity. In Liechtenstein, a collective trust is a trust established by a trust deed with an arbitrary number of participants for the purpose of managing and investing its assets on behalf of the investors. Each investor’s contract has the same information. The personal liability of each individual investor is limited to the amount of their unique individual investment, but not more. After receiving permission to operate from Liechtenstein’s Financial Market Authority, a Collective Trust is required to be registered in the Commercial Register, a public record (FMA).

Investment Company

- A Liechtenstein investment company may be established as a Public Limited Corporation (PLC., Corp.), a European company (SE), or a Liechtenstein Establishment, with the sole intent to invest and manage its assets in the name of its investors. Its capital may be fixed or variable (SICAV) (SICAF). In Liechtenstein, a third-party administrative body may handle an investment company domestically or externally. A Liechtenstein investment company becomes legally formed upon registration into the Commercial Registry, unlike a Liechtenstein investment Fund or Collective Trust.

- Liechtenstein’s Financial Market Authority requires all fund structures that take the form of management companies to submit an application and get a license (FMA). Investment companies in Liechtenstein that are self-managed are exempt from this restriction.

What are the regulatory requirements for obtaining a Liechtenstein Investment Fund License?

- The Liechtenstein regulatory body, Financial Market Authority under the relevant legislative mandate authorizes domestic undertakings for collective investments in transferable securities (UCITS) and their management companies as well as the establishment and licensing of alternative investment fund managers (AIFM). Accordingly, in order to establish and form such types of investment funds in Liechtenstein, an investor needs to comply with the regulatory requirements before they proceed to apply for a Liechtenstein Investment Fund License.

- Tetra Consultants’ team of financial licensing experts has years of experience and updated knowledge of the regulatory requirements to adhere to when applying for a Liechtenstein Investment Fund License. In the subsequent section, our team has highlighted such requirements so that you can make a more informed decision on the availability of such resources before you form a fund management company in the nation.

Initial and minimum capital

- In accordance with Article 17 of the UCITS Act and Article 32 of the AIFM Act, management companies and AIFMs applying for a Liechtenstein Investment Fund License are required to have initial capital of at least €125,000 or the equivalent in Swiss franc.

- While self-managed investment companies and AIFs must have initial capital of at least €300,000 or the equivalent in Swiss francs.

- In addition, the company’s own funds must be equal to or greater than 0.02% of the amount by which the value of the portfolios under management exceeds €250,000,000 or the equivalent in Swiss francs.

- Notwithstanding the aforementioned capital requirement, the capital held must be equivalent to one-quarter of the preceding year’s fixed overheads. The capital must be fully paid up prior to commencing business operations.

Organizational structure

- Management companies and AFIMs must have a suitable permanent establishment in Liechtenstein, both in terms of staffing and premises, and the organizational structure required for the performance of their functions. Management companies and AIFMs must have

- A Board of Directors or Supervisory Board is responsible for overall management, supervision, and control;

- An Executive Board responsible for operations must be composed of not less than two members with joint responsibility for performing the relevant functions; the members may not concurrently serve on the Board of Directors.

- The company shall establish the following positions and functions, depending on the nature, volume, and complexity of its operations and the type and range of services supplied:

- A compliance function;

- An internal audit function;

- A risk management function;

- An authority responsible for dealing with investor complaints.

- In addition, appropriate procedures must be established for dealing with breaches of the UCITS Act, AIFM Act, and market abuse legislation by employees.

- To ensure the appropriate conduct of business at all times, the individuals responsible for managing the management company must satisfy the necessary professional and personal standards. Particularly, whoever is appointed to manage the company must meet the requirements for the intended role based on their education and previous employment. Also, they must have a minimum of three years of full-time relevant experience. Regarding their other commitments, their location of residence, the infrastructure, and the structure of the company, the individuals in question must be able to carry out their duties at the management company correctly. The FMA may examine the appropriate individuals’ curriculum vitae (CV), educational credentials, job verification, and employer references while evaluating them.

Shareholder

- There is no minimum number of shareholders required for a Liechtenstein investment fund license. The Liechtenstein legal framework for investment funds allows for both single-investor and multiple-investor funds, so the number of shareholders can vary depending on the specific structure of the fund.

- However, it is worth noting that the number of shareholders may have an impact on the regulatory requirements that apply to the fund. For example, if the fund has more than 20 investors, it may be subject to additional reporting and disclosure requirements.

- In addition, the number of shareholders may also impact the practical considerations related to the operation of the fund, such as the ability to hold meetings and make decisions. It is important to carefully consider the number and characteristics of potential investors when designing the fund structure and preparing the application for the investment fund license.

- Overall, while there is no minimum number of shareholders required for a Liechtenstein investment fund license, the number of investors may have implications for both regulatory compliance and practical operation of the fund. It is important to work with experienced legal and financial advisors to design a fund structure that is appropriate for the investment strategy and investor base.

Business plan

- Management companies and AIFMs applying for the relevant fund management license must submit a viable business plan. Accordingly, the business plan must include information on the organization, staff, premises, and office equipment as well as a projected balance sheet and projected profit and loss account, as verified by the auditors, for at least the first three financial years. The time frames for attaining the projected targets are to be indicated.

Company name

- According to Article 12(4) of the UCITS Act, UCIT management companies applying for investment fund license in Liechtenstein may only use terms or expressions that denote management company operations in the company name, in any descriptions of the business’s goals, or in business advertising if they have been granted permission to do so. The FMA will confirm that the business name complies with all applicable regulations.

- While for AIFMs under article 27(4) of the AIFM Act, entities may only use words or expressions indicating AIFM activities in the business name, in any descriptions of the purposes of the business, and in business advertising if they have been authorized to operate as an AIFM. The FMA will verify that the name of the entity is acceptable from a regulatory perspective.

Head office and legal form

- The registered office and the head office of the fund management company must be situated in Liechtenstein. Further, the management company must be a legal entity or limited partnership.

What are the documents required to apply for a Liechtenstein Investment Fund License?

- As a general principle, applications for the Liechtenstein investment fund license and the accompanying documents must be submitted in German or English. The FMA may require applications to be submitted in German but will accept applications in other languages for legitimate reasons on a case-by-case basis. Tetra Consultants’ team of licensing experts and legal team will cooperate with you in order to draft the license application as per the required criterion as well as mention all the credentials necessary for the application to proceed. The application, including all the requisite documents, must be sent to the FMA. The documents to be provided in support of an application for management company authorisation include, in particular:

- Completed application form (the additional supporting documents to be provided are also specified in the application form);

- Business plan;

- Draft articles of association or deed of partnership;

- Declaration of acceptance by a firm of auditors recognised by the FMA (lead auditor);

- Evidence of the capital specified (deposit confirmation or bank guarantee);

- Calculation of the available and required equity capital;

- Confirmation from the Commercial Registry that the company is registrable;

- Documents evidencing that the proper conduct of business is ensured by reason of the persons charged with the administration and management of the company:

- Descriptions of functions

- Original copies of CVs which must be signed and dated

- Copies of degree certificates, educational certificates, evidence of employment and employer’s references demonstrating professional competence and qualifications

- Colour copy of a passport or some other identification document

- Criminal records excerpts (original documents less than three months old)

- Statements pertaining to any pending criminal and administrative proceedings that would affect the performance of duties and an undertaking to notify any relevant changes; these statements must be signed and the originals submitted

- Personal statement as to whether bankruptcy or composition proceedings have been instituted or concluded without the possibility of appeal.

- Diagram showing the ownership structure down to the last owner;

- Guidelines on making investment decisions;

- Risk management guidelines including risk map;

- Guidelines on conflicts of interest;

- Compliance guidelines;

- Internal audit guidelines;

- Rules on employee transactions;

- Description of measures in place to prevent money laundering and terrorist financing.

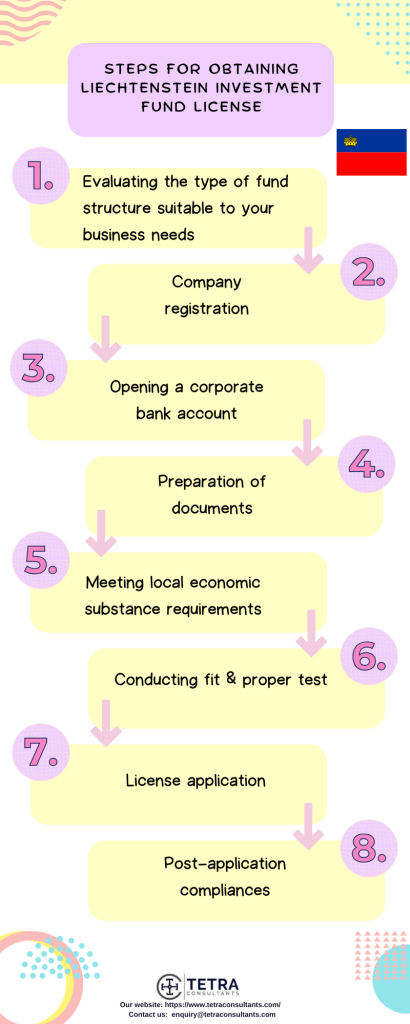

What is the process for applying for a Liechtenstein Investment Fund License?

The process of applying for a Liechtenstein investment fund license typically involves several steps. Here’s a general overview of the process:

Step 1: Evaluating the type of fund structure suitable to your business needs

- The first step is to determine the structure of the investment fund, such as whether it will be a mutual fund, alternative investment fund, or other types of investment vehicle. This will help determine the specific requirements for the license application. Tetra Consultants will advise you on the most appropriate fund structure and license requirement for your business based on your projected business operation and your client base.

- Prior to the commencement of the engagement in Liechtenstein, our team of specialists will present you with the licensing requirements, including eligibility criteria, paid-up capital requirements, local economic substance requirements, timelines, and procedures.

Step 2: Company registration

- To officially begin the process of obtaining an investment fund license in Liechtenstein, you need to have a legal entity duly registered with the Liechtenstein Chamber of Industry and Commerce (LIHK).

- To obtain an investment fund license in Liechtenstein, there are several legal forms that an entity can take, including:

- Limited Partnership (Kommanditgesellschaft): This is a partnership consisting of one or more general partners and one or more limited partners. The general partners are responsible for managing the business, while the limited partners are only liable up to the amount of their investment.

- Public Limited Company (Aktiengesellschaft): This is a company whose capital is divided into shares and whose liability is limited to the company’s assets. The company is managed by a board of directors, which is elected by the shareholders.

- Limited Liability Company (Gesellschaft mit beschränkter Haftung): This is a company whose liability is limited to the company’s assets. The company is managed by one or more directors, who are appointed by the shareholders.

- Foundation (Stiftung): This is a legal entity that is set up to manage assets for a specific purpose. The foundation is managed by a board of trustees, which is appointed by the founder.

- Tetra Consultants will perform due diligence on the company’s directors and shareholders. We will move with Liechtenstein company registration with the local Companies Registry after we have all KYC credentials, incorporation forms, and power of attorney.

- We will send the corporate documents, including the Certificate of Incorporation, Memorandum and Articles of Association, and other administrative documents after the business has been properly registered.

Step 3: Opening a corporate bank account

- Tetra Consultants will proceed to the process of corporate bank account opening with a reputable bank. This bank account will be used to deposit the minimum paid-up capital required to secure the license. You can enjoy leveraging our extensive banking network and receive your bank account numbers within four weeks.

- Tetra Consultants will contact multiple reputable international or Liechtenstein banks and present your business to each relationship manager and compliance team.

- In most cases, Liechtenstein banks will not require you to travel to Liechtenstein for the bank meeting. In the event this is required, We will send a representative to the bank meeting with you. Conversely, our staff will negotiate with the banks to hold a conference call or obtain a waiver.

- On average, the corporate bank account will be opened within 4 weeks. Tetra Consultants will courier the internet banking token and access codes to your preferred address.

Step 4: Preparation of documents

- The legal experts at Tetra Consultants will draft the necessary documentation for the licensing application. Depending on the local laws, these papers will contain the company strategy, AML/CFT policy, and other necessary documents.

- Tetra Consultants will deliver you the draft of such documents after they have been prepared. Following that, we will email them to you for e-signature and start working on your license application.

Step 5: Meeting local economic substance requirements

- Since Liechtenstein FMA requires you to maintain a local presence in the country, Tetra Consultants will assist you to fulfil the same. Our team will assist with the recruitment of local qualified employees to join the team as well as with the appointment of a local resident director by providing our nominee director services.

- Tetra Consultant’s HR team will conduct the shortlisting and initial interview with the candidates. Thereafter, you can shortlist the final list of candidates to determine who is most suitable to join the team. Once the candidate is chosen, Tetra Consultants will assist to prepare an employment contract with the terms and conditions that are agreed upon.

- With respect to having a local registered office as a place of business, our team will also shortlist a list of physical offices and send them to you. We will include important considerations such as monthly rental, location, size, etc so you can better decide which is most suitable for you. Once the office is chosen, Tetra Consultants will prepare the lease agreement to be signed between you and the landlord.

Step 6: Conducting fit & proper test

- Tetra Consultants’ team of experts will make sure that every key managerial personnel engaged has the requisite qualifications and is competent enough to take the position, by verifying the informational data and supporting documents for the same.

Step 7: License application

- Once the above is completed, Tetra Consultants will submit the application to the FMA. During the authorization procedure, the FMA will undertake a thorough legal and financial assessment of the applicant’s circumstances. It is important to comment on each issue with reference to any relevant documents appended. A separate list of any appended documents must be provided, arranged in numerical order. The documents submitted will be checked carefully to ensure that the formal requirements are met. Tetra Consultants’ legal team will ensure the collating of documents is properly done to smoothly conclude the application at every stage of the licensing process.

- Depending on the circumstances, you may be required to attend an interview with the regulator prior to license approval. In this case, Tetra Consultants will prepare you for the interview and assist with the follow-up actions required by regulatory authorities.

- All going well, your firm will receive the Liechtenstein investment fund license and will be required to start business operations within the stipulated time frame in order to maintain the license.

Step 8: Post-application compliances

- Tetra Consultants will assist you in ensuring you are compliant with the local laws after you have received the necessary approval to conduct your fund management business.

- We will assist you in adhering to the yearly compliances of submitting the annual audited financial statements to the local regulatory authorities along with taking care of tax and accounting obligations.

What is the tax implication of obtaining a Liechtenstein Investment Fund License?

- An investor must first decide on an entity that will act as the structure for the fund’s administration before they may start a fund in Liechtenstein. These fund vehicles may be corporate or non-corporate entities, and they will be taxed in accordance with the Liechtenstein taxation system. Funds formed using a non-corporate vehicle, such as a contractual fund, will be subject to the income tax in Liechtenstein, whereas funds created using a corporate vehicle, such as investment firms with variable or fixed capital, would be subject to the corporation tax rate as relevant.

- In general, funds formed in Liechtenstein (UCITS and AIF) must comply with the same disclosure requirements as any other business subject to taxes since they are subject to unlimited tax liability in Liechtenstein. However, the revenue from the managed assets is not subject to taxes. As a result, funds with a Liechtenstein base are effectively tax-free. Furthermore, no taxes are deducted from distributions made by the fund to its investors. Tetra Consultants’ team of chartered accountants and tax associates can explain in detail the important provisions and applicability of the tax laws of Liechtenstein.

- The fact that capital gains made upon the liquidation of assets in legal companies are tax-free, as are dividends earned from such investments, is a significant advantage. For public limited businesses and public EU corporations, the responsibility of managing the investment fund in Liechtenstein, a tax of 1% is levied upon the issue or increase of the nominal value of the shares. When it comes to investment businesses with fixed capital, the same rate is used. When it comes to shares of investment companies with fluctuating capital, there is no tax.

- Further, getting a refund of foreign withholding taxes is the main problem for investors in Liechtenstein. According to the European non-discrimination principle, there are reimbursement options in reference to several EU nations (e.g. in relation to France, Sweden, and Ireland). Refunds for investment funds headquartered in Liechtenstein are only feasible in connection with non-EU nations if the two nations have signed a double-taxation agreement. Otherwise, an investor-level review of a refund request is required. For more information on the tax advantages when obtaining a Liechtenstein Investment fund license you may contact our licensing experts in Liechtenstein who will help you with every aspect of attaining offshore financial licenses in a country like Liechtenstein.

How long does it take to obtain a Liechtenstein Investment Fund License?

- The length of time it takes to obtain a Liechtenstein investment fund license can vary depending on a number of factors, such as the complexity of the proposed fund structure and the completeness of the application. However, in general, the process can take 6 months to a year or more.

- The first step in obtaining an investment fund license in Liechtenstein is to submit an application to the Financial Market Authority (FMA). The application should include detailed information about the proposed fund structure, investment strategy, and management team. The FMA will review the application and may request additional information or clarification.

- Once the FMA has all the necessary information, it will evaluate the application and make a decision on whether to grant the license. If the application is approved, the FMA will issue the license and the fund can begin operations. If the application is not approved, the fund may need to make changes to its structure or strategy and reapply.

- Overall, the process of obtaining a Liechtenstein investment fund license can be time-consuming and require a significant amount of effort and resources. It is important to work with experienced legal and financial advisors who can guide you through the process and ensure that your application is complete and meets all the necessary requirements.

How much does it cost to obtain a Liechtenstein Investment Fund License?

- In general, the cost of obtaining a Liechtenstein investment fund license can be significant, especially compared to some other jurisdictions. The fees charged by the FMA for processing the license application and ongoing supervision of the fund can be substantial, and there may also be additional costs associated with legal and financial advisory services.

- According to the FMA’s fee schedule, the fee for processing an application for an investment fund license is typically between 5,000 CHF and 10,000 CHF, depending on the complexity of the fund structure. In addition, there are ongoing fees for the supervision of the fund, which are based on the assets under management and can range from 10,000 CHF to 200,000 CHF per year.

- Other costs associated with obtaining a Liechtenstein investment fund license may include legal and financial advisory fees, as well as expenses related to setting up and operating the fund, such as accounting and auditing costs, regulatory compliance costs, and marketing and distribution expenses.

- Overall, the total cost of obtaining a Liechtenstein investment fund license can vary widely depending on the specific circumstances of the fund and the services required, but it is generally expected to be a significant investment.

- The total engagement fee depends on the services you need from Tetra Consultants. We provide you with multiple services ranging from assisting you through the incorporation process to obtaining the investment fund license. This total fee that will be charged will be inclusive of the company registration fee, license fee, and any additional cost that may arise. We will discuss with you the total engagement fee charged in detail before we begin the registration process so that you have a better understanding of what you are paying for.

Looking to apply for a Liechtenstein Investment Fund License?

- Tetra Consultants is proficient in advising our global clients on securing a fund management license in jurisdictions like Liechtenstein. Our team of experts will manage your license application from the start to the end, including the incorporation of a new offshore company, the opening of a corporate bank account, drafting the legal documents required, consultation on the client’s eligibility and application procedures, write-up of such a suitability study based on the client’s profile.

- Additionally, Tetra Consultants will also take care of due diligence checks, profiling, and guidance on document drafting and preparation, construction of a specific business plan to meet the client’s objectives, and preparation of financial forecast, KYC, and AML manuals. Moreover, Tetra Consultants also act as a liaison and key contact person for both, the client and regulating authorities on all correspondences, meetings, and /or interviews if required in the furtherance of the application process.

- In addition, Tetra Consultants can also assist with attaining other offshore financial licenses depending on your long-term business goals.

Find out more!

- Contact us to find out more about how to get a fund management license. Our team of experts will revert within the next 24 hours.

FAQ

What is a Liechtenstein investment fund license?

What types of investment funds are covered by a Liechtenstein investment fund license?

Who is eligible to apply for a Liechtenstein investment fund license?

What are the requirements for obtaining a Liechtenstein investment fund license?

How long does it take to obtain a Liechtenstein investment fund license?

What are the fees associated with obtaining a Liechtenstein investment fund license?

What are the ongoing requirements for companies holding a Liechtenstein investment fund license?