Compliance Officer for New Zealand FSP License

- A New Zealand FSP License compliance officer is an important role that monitors that financial service providers are compliant with the restriction and obligations imposed on them by New Zealand authorities. A compliance officer will conduct compliance reviews, maintain up to date with the requirements of legislation which are constantly changing in the industry, and provide ongoing advice and training to financial advisers and companies to ensure they are complying with their obligations. A compliance officer will also have responsibility for the AML (anti-money laundering) audit as well as ensuring that there is a process in place which adheres to Financial Markets Authority (FMA) information and guidelines.

- The last few years have seen significant growth, and with greater enforcement processes in NZ financial services. Recently in 2023, there are over 2,500 financial advice providers licensed to provide advice or registered as bodies with 1360 licensed financial advice providers (FAPs) and 8838 advisers listed on the Financial Services Providers Register (FSPR). Interestingly, as of December 2022 – 86% of financial advice providers had either started or finished their full licensing status. This data reinforces the developing role of compliance officers in overseeing compliance to support the integrity of the sector throughout the transition and to help companies manage legislative change.

- At Tetra Consultants we understand to register company in New Zealand is the first phase for businesses that want to enter the financial services business and obtain an FSP license. Your dedicated team of Tetra Consultants professionals will hold the client’s hand throughout the entire process. They will assist clients with selecting the right business structure and reserving a company name, lodging all administrative documents in the Companies Office. They will also ensure full compliance with New Zealand’s tax and employment regulations, providing a perfect pathway towards the application process for FSP licenses. With Tetra Consultants, clients can relax knowing they will be provided with all the information needed to deal with the regulatory environment and be able to focus on running a financial services business in New Zealand.

Benefits of appointing New Zealand FSP License compliance officer

Assures regulatory compliance

- The compliance officer is the very core player in ensuring a financial service provider complies with all applicable legislation or regulations, including anti-money laundering (AML), countering the financing of terrorism (CFT), and Know Your Client (KYC) requirements. They actively engage with legislative change, regulatory updates, and compliance requirement changes in other ways, to save the company from regulatory consequences and reputational damage caused by non-compliance. They deal with the obligations associated with licensing and operating the company with the least potential interruption or losses in the company’s interests.

Manages licensing obligations on an ongoing basis

- Obtaining a license is just the start: thereafter they have continuing obligations. They continue to comply with various obligations to maintain compliance with licensing. The compliance officer will be able to oversee timely submission for the required report, renewal application, and documentation updates as required. Compliance officers also ensure that client agreements are produced at any remedial or sanction, or they will face long delays and disruption in the company’s operations.

Carrying out risk assessments and AML programs

- The management of risk and implementation of AML programs must be proportionate to the risks faced by financial service providers pursuant New Zealand Regulations. The role of the compliance officer is to develop, implement and review the provisions and protocols to identify, mitigate and respond to issues of fraud, anti-money laundering and terrorist financing. Part of this process involves ongoing monitoring of suspicious activity to allow early identification and mitigation in order to protect the company and its clients from crime exposure and regulatory penalties.

Acting as a liaison with regulators

- The compliance officer is often the first point of contact between the company and key regulators like providing timely and accurate responses to inquiries, audits and investigations are essential to achieving timely and transparent communication. Building a wait time with regulators is important particularly in a compliance review or when regulatory stuff gets complicated; regulators take diligence and credibility seriously.

Reinforces business credibility and client trust

- Clients and investors care about a company’s compliance with regulations and having a compliance officer reinforces the company’s commitment to ethics and the law, which enhances the company’s reputation in the market and better attracts clients, partners, and stakeholders. Strong compliance frameworks lower the risk of scandals or operational failures that can tarnish client trust.

Facilitates consistent internal procedures

- A compliance officer creates and maintains policies, procedures, and manuals on internal compliance that will meet the requirements of the company’s FSP license. They take the burden of making all employees aware of their compliance responsibilities and consistently following the same procedures. These structures will reduce errors, improve operational efficiency, and create a culture of compliance to sustain success long-term.

Mitigates operational risks

- Through ongoing training and monitoring, the compliance officer ensures that staff members performing compliance-related activities are competent and informed. These activities will reduce the likelihood of human error, negligence, or intentional wrongdoings that result in regulatory breaches or financial loss. By recognizing possible deficiencies in controls, the compliance officer can protect the company’s assets and reputation.

Facilitates business growth

- Having a compliance officer ensures that the company is compliant not only with local standards but also with international regulatory standards. This is becoming increasingly important due to the globalized nature of the financial market. Maintaining compliance readiness facilitates entry into overseas markets and partnerships with international financial institutions. It furthers the company’s sustainability plans and supports reputable growth and expansion strategies.

Who should appoint New Zealand FSP License compliance officer?

Licensed Financial Service Providers (FSPs) offering financial advice or services to retail clients:

- An individual or entity which provides financial advice or product to retail clients within New Zealand must have a Compliance Officer to be compliant with the Financial Markets Authority (FMA) licensing requirements as well as ongoing compliance with the Code of Professional Conduct and AML/CFT obligations.

Entities issuing or holding an FSP License:

- Entities that are obtaining an FSP license or have one, require a Compliance Officer to implement and oversee their Financial Compliance Program (FCP), including systems, policies, protocols and controls to ensure compliance with the Fair Conduct Principle and other regulations.

Financial Advice Providers (FAPs) with more than one adviser:

- An organization with more than one financial adviser or non-nominated representative must have a Compliance Officer to monitor competencies, conduct and compliance of all advisers, ensuring they comply with the conditions of their license and ethics.

Companies conducting regulated financial services:

- Businesses engaging in asset management, securities, investment advisory or other regulated financial services must appoint a compliance officer to manage risk assessments, customer due diligence, suspicious transaction reporting, and record-keeping as part of their AML/CFT program.

Large financial institutions and businesses with complex or diverse operations:

- It is necessary to appoint a compliance officer and potentially a compliance department for large, complex or diverse operations to effectively exercise oversight and maintain adequate internal controls and complete regular compliance testing to meet the FMA’s expectations.

Businesses registering as financial service providers:

- Although, businesses registering on the Financial Service Providers Register (FSPR) have not been licensed yet, they should appoint a compliance officer to start preparing and maintaining compliance frameworks in regard to New Zealand’s financial system regulations.

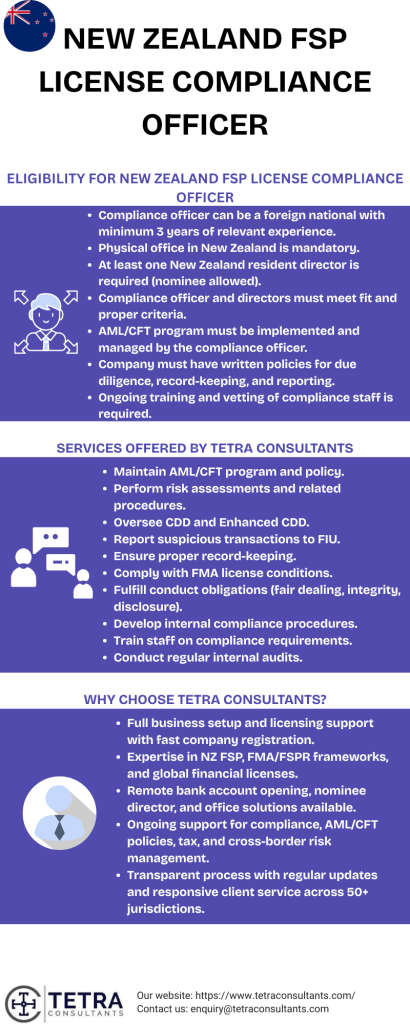

Eligibility for New Zealand FSP License compliance officer

- For a New Zealand FSP License, it is not necessary for a compliance officer to be a local compliance officer in New Zealand; in fact, the compliance officer could be a foreign citizen.

- It is still recommended that the compliance officer have a minimum of three years’ work experience in compliance or the provision of a financial service to understand and execute their regulatory obligations.

- The compliance officer must be appointed and ready to go before any FSP registration application is submitted to demonstrate compliance and oversight prior to commencing the business.

- The company needs to meet one of the most significant requirements, which is to show that the company has a physical office in New Zealand, which can either be a co-working space or a private office, even if the services being provided are completely Online.

- The company is also required to have at least one New Zealand resident director who can manage the business and communicating with regulators and government agencies as required. This requirement can be met by the nominee director and shareholder services.

- The compliance officer and directors will all be subject to a fit and proper person assessment that includes background checks for criminal history, financial probity, and reputation.

- The compliance officer has a duty to plan, implement, and administer an effective Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) program including risk assessments, staff training, and reporting suspicious transactions.

- The company must have written policies and procedures to meet all regulatory obligations, such as client due diligence, record keeping, and reporting obligations.

- Ongoing training and vetting of compliance officers and staff are needed to continue awareness and compliance with New Zealand’s financial regulations.

- The compliance officer is responsible for ensuring all reports are submitted to the Financial Markets Authority (FMA) in a timely manner and ensuring continued compliance with evolving regulations.

New Zealand FSP License compliance officer assistance

- Tetra Consultants offers complete outsourced compliance officer services to licensed and registered New Zealand FSPs, both active and dormant. The compliance officers have an in-depth knowledge of the Financial Service Providers (Registration and Dispute Resolution) Act 2008, AML/CFT Act 2009, and any other applicable regulatory obligations determined by the FMA and DIA. All compliance officers hold professional certifications, many with CAMS (Certified Anti-Money Laundering Specialist) and further relevant regulatory qualifications, and over 5 years of industry experience.

- When you appoint Tetra Consultants to be your outsourced compliance officer you will receive:

- Ongoing maintenance of your AML/CFT program and periodic risk assessments.

- Assisting in the preparation of annual AML/CFT reports and audits as required by the regulator.

- Assisting with compliance filings and reporting to regulators, internal compliance reviews.

- Providing assistance with maintaining registration, governance processes, and dispute resolution schemes.

- Liaison with the supervisory authority (FMA, DIA, or RBNZ) on your behalf.

- Our aim is to ensure your FSP entity is compliant, risk aware and trusted in New Zealand’s regulated environment so you can focus on your business with peace of mind.

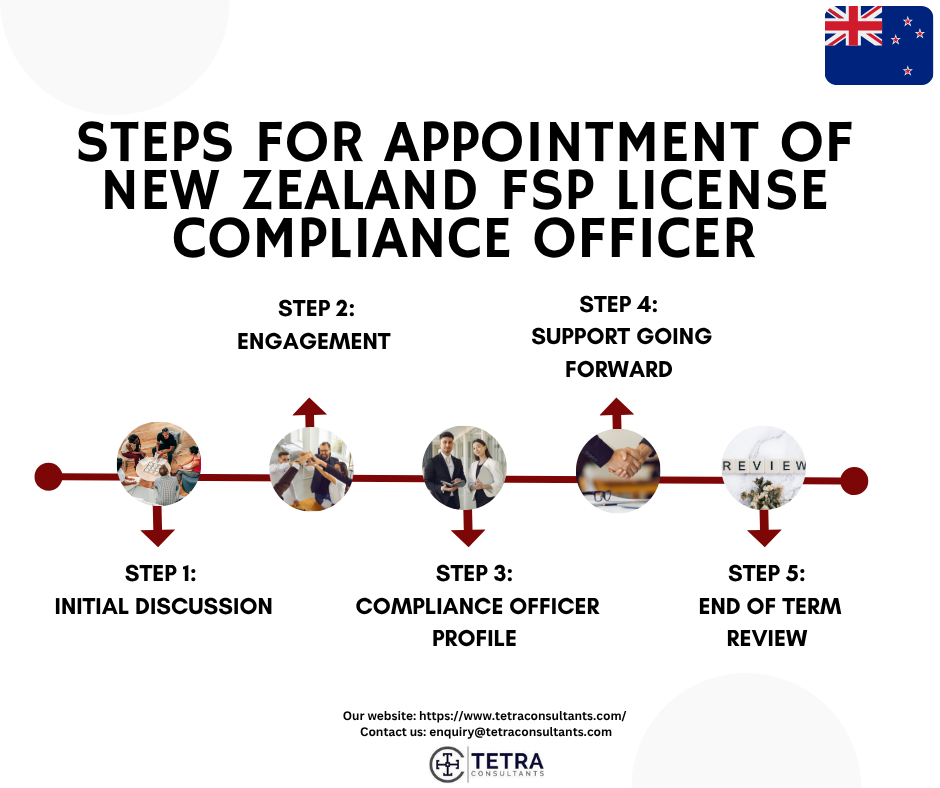

Steps for appointment of New Zealand FSP License compliance officer

Step 1: Initial discussion

- We will talk with you at length to understand your company’s specific compliance requirements and duties you want the compliance officer to perform. This will help us get an understanding of your business model, regulatory compliance, and expansion plans, which allows us to design a compliance solution that suits your operational needs, while ensuring that you are following New Zealand FSP licensing rules.

Step 2: Engagement

- Once you have approved our recommended approach, we will officially commence engagement with you by sending you an appointment letter that sets out the scope of services, responsibilities, and terms of engagement. You will also receive an invoice that provides transparency and ensures that we can start the service as soon as possible. This is the official start of our engagement and allows for expectations and deliverables to be framed.

Step 3: Compliance officer profile

- After we confirm the appointment, we will provide you with the compliance officer’s CV in detail. This profile includes their professional qualifications, industry experience and any understanding they may have of the New Zealand financial regulatory environment. Providing this profile to you up front allows you to decide if this candidate is suitable for your needs and also gives you confidence that the compliance officer will be able to satisfactorily fulfill your regulatory obligations.

Step 4: Support going forward

- While the appointment is underway, the compliance officer remains available as a proactive partner in your compliance work. We will regularly engage with you through our meetings and consultations to monitor your compliance status, respond to any new regulatory requirements, and develop your compliance framework accordingly. Having this ongoing support will help you stay ahead of compliance risks and changes being introduced by the Financial Markets Authority (FMA).

Step 5: End of term review

- At the end of the engagement, we will review our engagement and how we have performed the compliance function. We will then engage with you to ascertain whether you would like to retain the engagement or change the engagement in a way that better suits your future needs. This ensures that your compliance function will be sustainable and fit for purpose as your business continues to develop.

Services offered by Tetra Consultants New Zealand FSP License compliance officer

- Develop and maintain the AML/CFT programme/policy

- Ensure the implementation of the risk assessment and procedures

- Oversee and monitor customer due diligence (CDD) including Enhanced CDD where appropriate

- Monitor and report suspicious activity and transactions to the FIU

- Ensure record-keeping requirements are adhered to

- Ensure ongoing compliance with license conditions set by the Financial Markets Authority (FMA)

- Ensure compliance with conduct obligations, including dealing fairly with clients, integrity, and disclosure

- Develop internal policies, procedures, and training

- Ensure that staff are notified of and trained on compliance obligations

- Conduct regular compliance audits or assessments

- To ensure registration with a DRS (E.g. FSCL, IFSO, FDR) in case financial services are provided to retail clients;

- To manage the internal dispute resolution process and liaise with the external DRS as necessary.

- To submit the below reports,

- Annual AML/CFT reports (this is mandatory for all AML/CFT reporting entities)

- Suspicious Activity Reports (SARs) using goAML to FIU.

Cost for appointment of New Zealand FSP License compliance officer

- At Tetra Consultants, we appreciate how appointing a New Zealand FSP License compliance officer is an important investment towards your company’s long-term regulatory compliance. We have developed our service to be very effective by providing you with a highly skilled compliance officer who will guarantee that your business is compliant from Day 1 with all statutory and regulatory requirements. We will do all of the hard work for you, from initial consultation to candidate selection, to continued consultation and awareness of current regulations. You will be able to focus on growing your financial services business without the need to become an expert in financial services regulators.

- Our compliance officers have years of industry experience, so they are industry professionals, and have an in-depth understanding of New Zealand’s financial services landscape. Consequently, our compliance officers will be able to customize our service to match your particular operational requirements within the operational risk context.

- Your benefits when engaging Tetra Consultants include transparent engagement, active compliance engagements, attention to the regulations and we provide real ongoing support without you feeling like you are trying to figure out the complexities of New Zealand financial services regulations and compliance by yourself. Tetra Consultants are aligned with the changing requirements of the Financial Markets Authority (FMA) and ensure your company is assessed against the latest expectations.

Why choose Tetra Consultants?

- When you choose to work with Tetra Consultants, you are choosing a company that is invested in your business growth and regulatory network in New Zealand and beyond. We are a trusted advisor that has the ability to provide tailored solutions by providing a full suite of services to ensure that your company can operate smoothly and compliantly. We promise to provide you with advice that is clear and actionable, even if that advice isn’t what you expected, which is why we call ourselves your ‘one stop solution’ for all your business needs.

Full-service offering:

- We provide a full package to your business needs and requirements, such as registering your company, registering for taxes, corporate bank account opening, working on visa applications and many various types of offshore financial license applications, like the New Zealand FSP License. We can cover every stage of your set-up and your ongoing compliance for you, in order to simplify the whole process and service for you.

Expertise in financial licensing:

- Our experience speaks for itself, as we secured over 80 financial licenses for our clients across a variety of regulated industries around the world, such as Canada MSB, Mauritius Investment Dealer, Seychelles Securities Dealer Licenses. We will apply to the NZ Financial Markets Authority for the particular license(s) for your company’s financial services.

Efficient and easy processes:

- Our team aims to provide the most seamless and easy process for incorporating your business and obtaining your FSP license in New Zealand – hopefully to enable you to become operational as quickly as possible. We are able to register with your company as quickly as one week and even the corporate bank account opening in four weeks, allowing us to set up a fully operational branch within five weeks.

Worldwide & banking network:

- Internationally based in Singapore, we are going global; we have clients in over 50 jurisdictions. We also leverage our significant network of banks to assist with your corporate bank account opening with reputable banks and even negotiated video calls for account opening so that you do not have to travel to New Zealand.

Ongoing compliance support:

- We go further than just helping you to get registered and licensed, we keep Your business informed of compliance with your government obligations. We assist you in securing the necessary business licenses and preparing tax returns and financial reports on time. We help our clients join approved consumer dispute resolution schemes if they offer financial services to retail clients.

Client-focused:

- We pride ourselves on being responsive, and our team of professionals will typically get back to you within 24 hours of an enquiry. Our clients have provided glowing reports about the ease with which they were able to set up their new business and have mentioned that they appreciated our ongoing assistance even when there were unforeseen delays from banks.

Looking to appoint New Zealand FSP License compliance officer

- Contact us to know more about New Zealand FSP License compliance officer and our team will get back to you in 24 hours.

FAQ

Who is required to appoint a compliance officer of New Zealand FSP License?

Does the compliance officer need to live in New Zealand?

When do I need to appoint a compliance officer?

What are the key responsibilities of compliance officers?

Is it a requirement of FSP licensing, to have a physical office base in New Zealand?

In addition to appointing a compliance officer, what other statutory obligations will need to be satisfied?

How does a compliance officer assist the company moving forward?