UK EMI license

The development of innovative paying instruments has led to the creation of a new medium called E-money. if you wish to be authorized to issue electronic money and provide e-money accounts to your clients in Great Britain. You will need an Electronic Money Institution license in the UK (also called UK EMI license or E-money license in the UK) to provide such services.

Tetra Consultants can help you to become an E-money licensed firm in the UK by offering a full end-to-end service, from company formation to complete UK EMI license preparation and management.

What is e-money?

Regulation 2 of the electronic money regulation defines e-money as the monetary value represented by a claim on the issuer that is:

- Stored electronically, including magnetically

- Issued on receipt of funds for the purpose of making payment transactions

- Accepted as a means of payment by persons other than the issuer

Examples of e-money include prepaid cards that can be used to pay for goods at a range of retailers, or virtual purses that can be used to pay for goods or services online.

What is an electronic money institution?

- An e-money institution is a financial entity that is authorized for developing services related to electronic money (credit cards and similar) and payments related to it.

- Only after obtaining a special financial license (e-money license) does a legal person have the right to engage in the issuance of electronic money and provide services associated with it. Therefore, an EMI which receives authorization under the EMRs is termed an ‘authorized EMI’

- Electronic Money Institution (EMI) in the UK is allowed to issue and redeem electronic money. Additionally, EMIs can be authorized to provide all of the services of a Payment Institution.

Who is exempted from getting a UK EMI license?

The following entities can issue e-money and do not need to apply for a UK EMI license under the electronic money regulations, but they must give FCA a notice if they issue or propose to issue e-money:

- Post Office Limited;

- The Bank of England, when not acting in its capacity as a monetary authority or other public authority;

- Government departments and local authorities when acting in their capacity as public authorities; and

- The National Savings Bank.

Additionally, credit institutions, credit unions, and municipal banks do not require authorization or registration under the Electronic money regulations but if they propose to issue e-money they must have a Part 4A permission under Financial Services and Market Act, 2000.

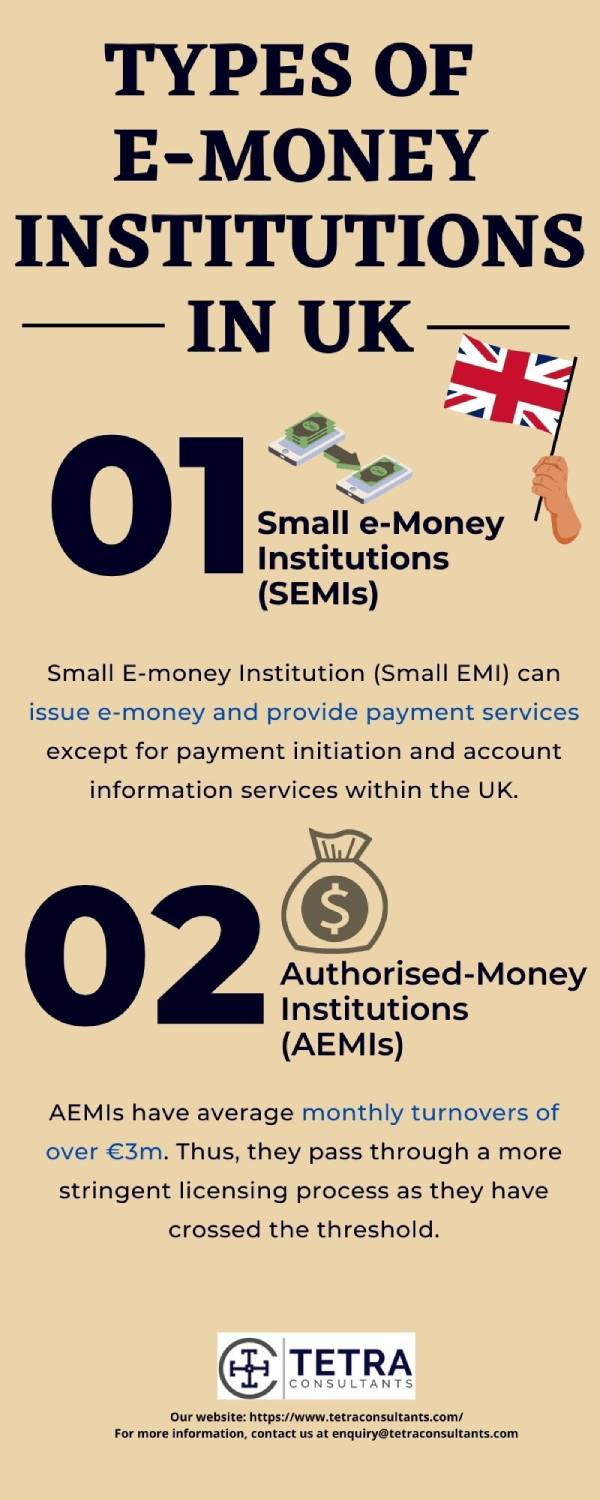

What are the types of EMI?

There are two main types of e-Money institutions in the UK:

Small e-Money Institutions (SEMIs)

- Small E-money Institution (Small EMI) can issue e-money and provide payment services except for payment initiation and account information services within the UK.

However, there are certain limitations related to the operation of a company with a Small UK EMI license:

- The total business activities of the applying Small Electronic Money Institution immediately before the time of registration must not generate average outstanding electronic money that exceeds EUR 5,000,000 and

- The monthly average over the period of 12 months preceding the application to be registered as a Small EMI of the total amount of relevant payment transactions must not exceed 3,000,000 euros.

Additionally, to be considered a small EMI, the maximum storage amount on the payment instrument of the customer where the electronic money is stored cannot exceed €250,000. A small EMI is required to hold initial capital at the time of authorization. When the business activities of the EMI generate average outstanding electronic money less than €1,000,000, it shall hold initial capital equal to €50,000. When the business activities of the EMI generate average outstanding electronic money between €1,000,000 and €2,000,000, it shall hold initial capital of €100,000. Small EMIs must maintain at all times own funds, equal to or in excess of the applicable initial capital requirement.

Authorised-Money Institutions (AEMIs)

- AEMIs have average monthly turnovers of over €3m. Thus, they pass through a more stringent licensing process as they have crossed the threshold.

What is a UK EMI license?

- An Electronic Money License acts as authorization provided by the FCA (which acts as the sole regulator) for an Electronic Money Institution to conduct its business.

- A licensed e-money institution is a financial entity that is authorized for developing services related to electronic money (credit cards and similar) and payments related to it.

Why do you need a UK EMI license?

There is a total of nine core services that a fully authorized e-money institution can provide under its UK EMI license. They comprise all of the services which can be provided by the Payment Institution including ancillary services together with the possibility to issue e-money. Hence an e-money (electronic money institution) license in the UK enables the license holder to offer a number of services:

- Issuing of electronic money e.g. prepaid cards and electronic wallets.

- Services enabling cash to be placed on a payment account and all of the operations required for operating a payment account;

- Services enabling cash withdrawals from a payment account and all of the operations required for operating a payment account;

- The execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider, including, execution of direct debits, including one-off direct debits; execution of payment transactions through a payment card or a similar device; execution of credit transfers, including standing orders;

- The execution of payment transactions where the funds are covered by a credit line for a payment service user, including, execution of direct debits, including one-off direct debits; execution of payment transactions through a payment card or a similar device, execution of credit transfers, including standing orders;

- Issuing payment instruments or acquiring payment transactions;

- Money remittance;

- Payment initiation services;

- Account information services.

What are the benefits of having a UK EMI license?

As an authorized EMI you will have the following benefits:

- You will acquire an English SWIFT code for transactions

- You will be able to issue English IBAN accounts for your clients

- You will be able to register accounts remotely for individuals and companies

- You will be able to issue credit and debit card payments linked to your customer accounts

- Your company will be able to perform bank payments in more than 45 currencies worldwide

- You can accept payments from all international accounts that use the SWIFT system

- Create correspondent accounts in different countries

- Acquire your AML department

- Your financial services are VAT-exempt in the UK

- No restrictions regarding the turnover of the company

Who is the issuing authority of the UK EMI license?

The UK regulator – Financial Conduct Authority

- The Financial Conduct Authority in the UK regulates electronic money institutions in the UK.

- If you wish to become an electronic money institution in the UK and provide electronic money, such as prepaid cards or electronic wallets, you will be required to prepare and submit an application to the Financial Conduct Authority for the Electronic Money Institution license.

Why UK for an EMI license?

Highly Respected Financial Jurisdiction

- UK licenses are widely regarded as the best in the world and the top jurisdiction that holds almost three-quarters of the European market.

Reliable Regulatory Authority

- The FCA (Financial Conduct Authority) is the regulatory body that oversees this and it is widely known for its fair rules, clear instructions, and up-to-date information.

Free Economy

- Businesses enjoy top trade and business freedom in the country.

Who Should Apply for a UK EMI License?

Fintech startups

- Tetra Consultants assist fintech companies with developing their thorough strategic business plan, capital adequacy papers, and compliance framework to satisfy FCA requirements and application for a UK EMI license to issue an electronic money and payment services.

Crypto payment platforms (non-custodial)

- UK EMI license allows non-custodial crypto payment platforms to make legal digital payments and not hold customer funds directly. Tetra Consultants will walk through the AML compliance gauntlet and various risk management policies and properly identify the non-custodial crypto payment platforms to obtain regulatory approval.

Multi-currency wallets

- For multi-currency wallet providers, obtaining an EMI license allows the firm to offer multi-currency e-money services. Tetra Consultants helps with legal structure, compliance with IT systems, and customer funds segregation requirements, all of which are crucial for FCA licensing.

Prepaid card issuers

- Prepaid card issuers must have an EMI license to legally operate as an EMI in the UK. Tetra Consultants can help you to prepare the operation policy/framework, liquidity, UK EMI license capital requirements, and application documents that are needed to obtain an EMI license despite the scrutiny of the FCA process.

Neo-banks

- EMI licenses are required for neo-banks to provide electronic money issuance and payment services through digital channels. Tetra Consultants offers a full breadth of support with regulatory submissions, governance setup and on-going compliance to ensure neo-banks can easily enter the UK market.

What are the other laws governing an EMI in the UK?

- The Electronic Money Regulations (EMR), transposing Directive 2009/110/EC is the legislation that sets out the rules for the business practices and supervision of E-money Institutions and must be read along with the Payment Service Regulations 2017 governing the provision of payment services by EMIs.

- To get E-money Institution License and operate as an EMI, more laws, and regulations (including rules of card schemes and standards) should be considered.

- The Financial Services and Markets Act 2000 establishes a regulatory framework for providing financial services in the UK.

- The Electronic Money Regulations 2011;

- Directive on the taking up, pursuit and prudential supervision of the business of electronic money institutions (EU) 2009/110/EC(EMD);

- The Payment Services Regulations 2017;

- The FCA rules, guidelines, and instruments such as the Principles for Businesses – FCA Handbook, Payment Services and Electronic Money – FCA Approach, the FCA’s role under the Electronic Money Regulations 2011

- Money-laundering and terrorist financing regulations such as the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 including amendments;

- The Criminal Finances Act 2017 regulates the obligation of firms regarding the facilitation of money laundering, corruption, and tax evasion.

What are the regulatory requirements for obtaining an EMI license in the UK?

- A minimum capital requirement of €350,000 is to establish an authorized E-money EMI / Electronic Money Institution business.

- The requirement is to safeguard client funds either with a segregated client bank account or with an insurance policy.

- The management body of the E-money EMI / Electronic Money Institution license must be of good repute and possess the relevant qualifications and experience to perform their duties.

- Ongoing capital requirement for the UK E-money license. The ongoing capital required for an E-money (electronic money institution) license is calculated at 2% of the outstanding electronic money a firm has issued.

Other conditions to be fulfilled as set out by FCA-

- You are a corporate body

- Payment services will be carried out in the UK

- You have robust governance arrangements

- You have a business plan

- You have taken adequate measures to safeguard users’ funds (our Banking partners can help you with opening Safeguarding Account to fulfill this condition )

- You hold adequate indemnity cover

- Directors must be of good repute with the required appropriate skills

- No managers must have been convicted of money laundering

- Head office must be in the UK

- You must comply with money laundering regulation

- Anyone with 10% or more shares must be ‘fit and proper

- If the applicant has close links with another person, the link must not be likely to prevent the FCA’s effective supervision of the business.

UK EMI License Application Process

Initial assessment & eligibility check

- Tetra Consultants evaluates eligibility against 3 criteria: fewer than 250 employees, gross assets of less than £30 million, and qualifying trades. We highlight all of the UK EMI license requirements and will suggest how you can structure your business and trade to qualify for EMI.

Scheme design & documentation preparation

- We assist you in designing the rules of your EMI scheme – including types of share options, vesting schedules, option limits, employee eligibility, etc. Our team prepares the agreements and documentation required for your business, specifically designed for your business needs.

HMRC advance assurance application

- Tetra Consultants prepares and submits an advanced assurance application to His Majesty’s Revenue and Customs (HMRC), to confirm your company’s eligibility for EMI. This will involve gathering corporate paperwork, financials, and trading descriptions to support your application.

HMRC valuation and EMI share option pricing

- We will arrange for an HMRC-approved valuation to establish the market value of the shares under the EMI scheme, meaning employees will receive maximum value from their share options.

Granting EMI options to employees

- Once the valuation has been approved, Tetra Consultants will formalize the granting of EMI options to eligible employees. We will keep records and issue written option agreements within any timeframes set out in the regulations.

Registering EMI scheme and notifications

- We register your EMI scheme and report options granted under the EMI scheme to HMRC as required prior to the July 6 deadline following the end of the tax year to retain tax-advantaged status.

Ongoing compliance and reporting support

- Tetra Consultants provides ongoing compliance advice, support with the annual HMRC reporting, employee notifications, and managing scheme variations to continue to benefit from the EMI legislation.

FCA application portal

- To know how to get an EMI License in the UK from the FCA, our experts will let you know the whole procedure. Basically, it is done through their online portal called Connect System, which will lead you through every step of the application.

- Firstly, the applicant must register on the Connect System to make an account and to access the application forms.

- All documents and required materials must be uploaded through the portal. This includes the business plan, compliance policies, governance and oversight, and financial forecasts.

- The portal also requires information about the company’s directors, key management personnel, and any qualifying shareholders (as well as some background checks).

- As part of the submission process, the FCA requires a non-refundable application fee, paid online.

- Once submitted, the FCA has an assessment process which involves potential outreach via the portal for clarifications or documents.

- The typical review timeline through the Connect System is between 6 to 12 months depending on the completeness and complexity of the submissions.

- It is also to be noted that it is the applicant’s responsibility to use the portal to inform FCA of any changes during the authorization process or after authorization is granted to remain in regulatory compliance.

Documentation checklist

- Company registration documents (Certificate of Incorporation)

- Articles of Association and shareholder agreements

- Board resolution approving the EMI scheme

- EMI scheme rules document (share plan rules)

- Employee eligibility and employment contracts

- Notice of option grant (detailing shares granted, strike price, and vesting schedule)

- Notice of option exercise (when employees convert options to shares)

- HMRC advance assurance application and correspondence

- Share valuation report approved by HMRC

- PAYE reference number of the company

- Corporation Tax Unique Taxpayer Reference (UTR)

- Company Reference Number (CRN) from Companies House

- Shareholder resolutions for share allotment or subdivision

- Evidence of employee eligibility for EMI (e.g., working hours, UK tax residency)

- Notifications submitted to HMRC for each option grant

- Annual EMI scheme return to HMRC (including nil returns if applicable)

UK FCA Compliance for EMI Requirements

Anti-money laundering (AML)

- Companies are required to do customer due diligence (CDD), ongoing monitoring, and report suspicious transactions to the FCA EMI license application and other authorities. Enhanced due diligence applies to higher-risk clients and transactions to help prevent money laundering and terrorist financing against the AML/CTF regulations specific to the UK. The companies’ AML programmes must include risk assessments, training for appropriately trained employees, and controls that are compliant with the Proceeds of Crime Act, and lastly, the Sanctions and Anti-Money Laundering Act.

Safeguarding customer funds

- Companies in the crypto space must segregate their clients’ assets from their own, maintain records, and ensure that client funds cannot be lost or misappropriated. Custody arrangements must be transparent and follow regulatory guidelines aimed at protecting investors.

Regular reporting to the FCA

- We will help you submit reports like financial returns, transaction monitoring, risk assessments, and material changes to your business, and any type of governance, regularly. SARs (suspicious activity reports) must be filed promptly. The Financial Conduct Authority (FCA) will conduct regular audits and compliance reviews.

Risk and compliance frameworks

- All companies should implement a risk management system that encompasses operational, financial, and compliance risks. To prevent fraud, market abuse, and systemic risks, strong internal controls, training staff, and embedding FCA safeguarding rules could help. Companies also need to have data protection provisions within GDPR compliance.

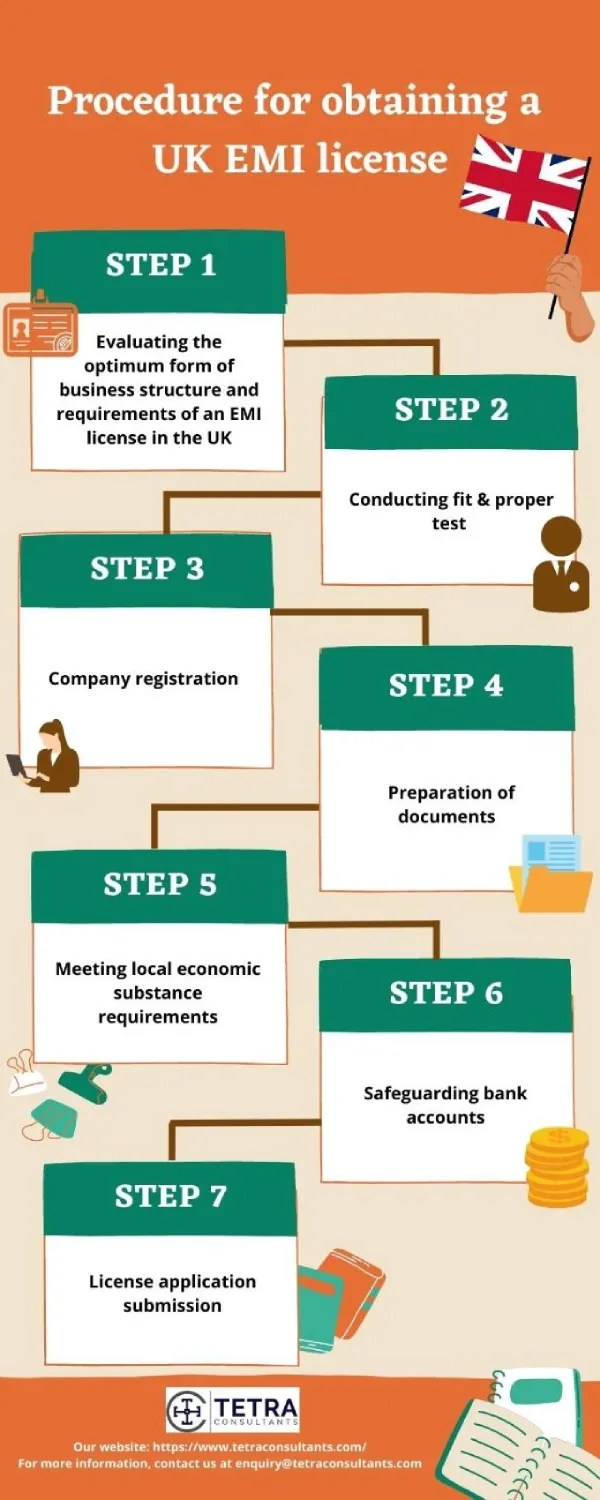

What is the procedure for obtaining a UK EMI license?

The procedure to set up an electronic money institution may vary depending on the amendments taking place in the local laws and regulations. Tetra Consultants has summarized the most prevalent steps that take place during the normal engagement of attaining the EMI license.

Step 1: Evaluating the optimum form of business structure and requirements of an EMI license in the UK

- Tetra Consultants will advise you on the most appropriate form of entity and license for your business based on your projected business operation.

- Prior to the commencement of the engagement in the jurisdiction, our team of specialists will present you with the licensing requirements, including eligibility criteria, paid-up capital requirements, local economic substance requirements, timelines, and procedures.

Step 2: Conducting fit & proper test

- Tetra Consultants’ team of experts will make sure that every key managerial personnel engaged has the requisite qualifications and is competent enough to take the position, by verifying the informational data and supporting documents for the same.

Step 3: Company registration

- Tetra Consultants will perform due diligence on the company’s directors and shareholders. We will move to register the entity with the local Companies Registry after we have all KYC credentials, incorporation forms, and power of attorney.

- We will send the corporate documents, including the Certificate of Incorporation, Memorandum and Articles of Association, and other administrative documents, after the business has been properly registered.

Step 4: Preparation of documents

- The legal experts at Tetra Consultants will draft the necessary documentation for the licensing application. Depending on the other local laws, these papers will contain the business plan, AML/CFT policy, and other necessary documents.

- Tetra Consultants will deliver you the draft of such documents after they have been prepared. Following that, we will email them to you for e-signature and start working on your license application.

Step 5: Meeting local economic substance requirements

- If the local regulator needs you to have economic substance, Tetra Consultants will assist you in meeting those requirements. Our staff will help with the recruitment of skilled local individuals to join the team.

- Tetra Consultants HR team will undertake the applicant shortlisting and initial interview. Following that, you may narrow down the final list of prospects to choose who is most suited to join the team. Tetra Consultants will assist with the preparation of an employment contract with the agreed terms and conditions once the candidate has been approved.

- In addition, our staff will compile a list of physical offices and deliver it to you. We will provide crucial factors such as monthly rental, location, size, and so on so you can better pick which is best for you. Tetra Consultants will draft the lease agreement to be signed between you and the landlord after the office has been selected.

Step 6: License application submission

- Once the above is completed, Tetra Consultants will submit the application to the local regulator. Depending on the jurisdictions, you may be required to attend an interview with the regulator prior to license approval. In this case, Tetra Consultants will prepare you for the interview and assist with the follow-up actions required by regulatory authorities.

- All going well, your firm will receive the UK EMI license and will be required to start business operations within the stipulated timeframe in order to maintain the license.

Step 7: Safeguarding bank accounts

- To obtain an EMI license, you will need specialist banking facilities, such as client safeguarding accounts, and access to payment systems, such as IBAN and SWIFT. Furthermore, you will require systems and software to manage your business.

- Tetra Consultants Banking Team will help you by arranging banking facilities, such as safeguarding accounts, issuing cards, and access to payment infrastructures.

What is the timeline for obtaining a UK EMI license?

Application acceptance

- The FCA, the UK’s regulator, recognizes applications within 7 business days. The application is then allocated to a case officer, who evaluates the information presented and makes a decision.

Decision on an application

- The FCA takes a decision on the application within 3 months of receipt (assuming the FCA has all of the necessary information and documentation), or – 12 months (if the application is incomplete).

How long does it take to obtain a UK EMI license?

- Prior to the start of the engagement, Tetra Consultants will send you a project plan with the timelines stipulated for company registration, preparation of documents as well as UK EMI license application. This is to ensure that all parties are clear on the upcoming project.

EMI License UK Renewal and Ongoing Obligations

Yearly reporting

- Employers with an EMI scheme have to submit a yearly Employment Related Securities (ERS) return to HMRC detailing the share options they granted, exercised, or that lapsed during the tax year to keep HMRC informed and the tax reliefs current.

Audited financials

- Although EMI schemes do not require companies to have audited accounts, they should keep reasonable and up-to-date financial records (to justify valuations and satisfy HMRC), and audited financial records reinforce transparency to HMRC and integrity of compliance.

Compliance review

- Routine internal checks of the EMI scheme’s compliance with qualifying conditions are advisable to mitigate disqualification events, like changes in company status, employee eligibility or alterations in share capital. Professional assistance will help ensure the EMI scheme continues to obey qualifying conditions.

FCA supervision

- While EMI schemes are not regulated by the FCA, companies that provide financial services in conjunction with EMI-based incentives may be regulated by the FCA. As a result, firms need to ensure compliance with applicable regulations, governance standards, and need to inform the FCA of any material changes.

Suspension or Revocation of EMI License

FCA enforcement actions

- If the holder is found to be non-compliant with regulations, has lied on their application, or utilizes the license in furtherance of an illegal activity, the FCA may suspend or revoke an EMI license. Suspension is used while investigations are ongoing and is temporary – revocation is permanent and more profound.

Non-compliance

- The EMI license could be revoked if the firm repeatedly or seriously breaches FCA’s rules, fails to maintain governance or reporting standards, or fails to take remedial action after suspension.

Capital breach

- The EMI license could be revoked if the director of the firm, which is now subject to an FCA investigation or proceedings to revoke the license, continues to breach FCA’s rules, fails to maintain governance or reporting standards, or fails to take remedial action after the suspension.

Customer fund mismanagement

- Excessive handling or improper holding of customer funds, including the failure to segregate client assets or improper records, can result in serious regulatory consequences, including license suspension or revocation.

Can the UK EMI license be revoked and canceled?

Yes, the regulatory authority that is FCA can revoke and cancel a firm’s authorization and registration in the form of a UK EMI license:

- If your entity no longer meets the minimum standards;

- If your entity can no longer fulfill its basic regulatory obligations, such as paying fees or submitting returns;

- If your entity can no longer meet its liabilities as they fall due, or where a firm fails to pay the amount due to a consumer under a final decision of the Financial Ombudsman Service (FOS).

Our services

- Tetra Consultants is an expert in attaining the payment license. we will consult on all aspects of e-money systems licensing and minimize the risks of permission dismissal. We will select an optimal form of the company and help to register a business in the UK, prepare all necessary policies and descriptions, and a business plan, prepare and verify the correctness of the documents package for the company, and shareholders, and provide support for the implementation of management requirements.

- In addition, Tetra Consultants can also assist with attaining other offshore financial licenses depending on your long-term business goals.

Find out more!

Contact us to find out more about how to get a UK EMI license. Our team of experts will revert within the next 24 hours.