Register Company in USA

The process to register company in USA has attracted many investors for centuries and is a hassle-free process if you are equipped with the proper knowledge to navigate the system. With Tetra Consultants at the wheel, you will be able to dedicate your time and resources to other more important aspects of your business.

With ourThe reputation of the United States of America precedes itself: it is a melting pot of a vast array of cultures and businesses as a consequence attracting a huge amount of foreign direct investment.

With our lean-and-mean mentality, you can rely on our team of experts to provide you with a seamless experience throughout the whole process of the company set up in USA. Our ultimate goal is for your USA company to be operationally ready within the stipulated time frame.

Our service package includes everything you will require to do business in the USA:

- Company registration with respective State Governments

- Local company secretary and registered address

- Provision of nominee director services

- Corporate bank account opening

- Annual filing and tax services

How long does it take to register a company in USA?

- While different states around the USA have their own regulations that dictate the duration of the company registration process, our team of global experts at Tetra Consultants anticipate completing the registration process in 2 weeks. After receiving the required due diligence documents of the directors and shareholders, Tetra Consultants will search for the availability of your preferred company name.

- Throughout the whole company registration process, you will not be required to travel to the state in which you intend to start your business in. However, during the process of opening the corporate bank account for the newly registered entity, if the chosen bank requires that you have a meeting with them in person, we will try to negotiate in order for you to have a virtual meeting with them instead. Rest assured, throughout this process, we will have a representative with you at all times.

- After Tetra Consultants has registered your company, you can expect to receive the documents of your new company including the certificate of incorporation, memorandum and articles of association as well as the register of directors and shareholders.

- Upon 4 weeks of company registration, Tetra Consultants will open a corporate bank account at either a local or internationally reputable bank. Consequently, you can expect to start operations and issue invoices with your USA company within 5 weeks upon engaging Tetra Consultants.

- An important caveat to note is that the duration of the company registration process is contingent on your intended state of incorporation. The abovementioned timeline is a generalization of our extensive experience with assisting clients to start their companies in different states of the USA. For a more precise overview of a specific state, engage with our global team of experts for a free consultation.

Can a foreigner register company in USA?

- Anyone–from local to foreign investors can begin a venture in any and all states in the USA. However, they must meet the minimum regulatory requirements. Since the USA is vast, the minimum requirements vary for each state. That being said, the conventional baseline requirements one needs are a director and shareholder of any nationality and a registered address for your business. In some states such as Delaware and Wyoming, you are required to have a registered agent who must reside in the state of intended incorporation, and the agent must have a physical address.

- As established earlier, with the myriads of states in the USA, engage with Tetra Consultants so that we may be able to provide you with specific and comprehensive information on the registration process and requirements specific to the proposed state of incorporation. We will fully understand your business before recommending the most optimum business entity.

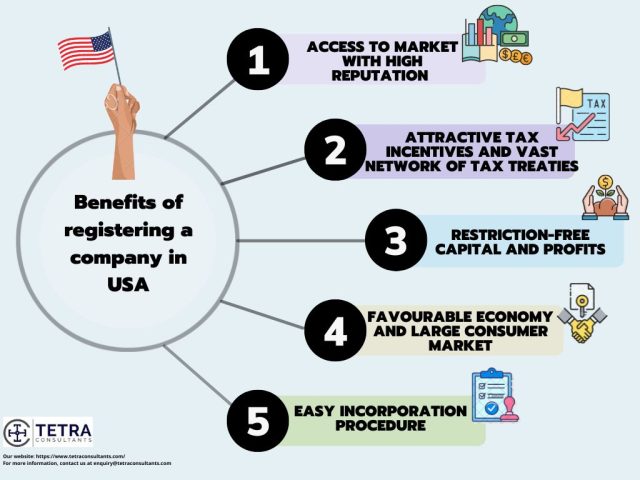

What are the benefits of registering a company in USA?

High Reputation:

- Company formation in the United States can assist you in establishing an international reputation. Because the United States is one of the most well-known countries, registering your company will give you more acknowledgment and people will be inclined to engage with you.

Favorable economy:

- America is providing opportunities for foreign investors to purchase assets in the United States, including real estate, at lower prices than in their home country. Furthermore, the United States has a very wealthy consumer base, with over 300 million people who have a high level of purchasing power. Because of the wide range of income and interest levels, goods of all kinds and price ranges are in high demand.

Ease of doing business:

- The process of company formation along with regulations concerning low taxes adds to the advantage of the ease of doing business in USA. Further, all businesses, whether foreign or domestically owned, are treated equally in the United States. Hence you can take advantage of all the deficient laws when forming a company and transferring your funds with less stringency. It additionally puts you on an equal footing with your opponent in the event of a commercial conflict.

Taxes:

- Several states in the United States provide financial incentives to investors who intend to open a company there. Some of these incentives include tax incentives, and the country has recently reduced commercial real estate taxes for foreign investors. Further, one of the significant advantages of registering your company in the United States is that corporate taxes are lower.

Strong technical infrastructure:

- The United States has access to cutting-edge technology. It makes conducting business there more appealing to entrepreneurs. Many investors are forming companies in the United States solely to gain access to these cutting-edge technologies that will boost their business efficiency and increase connectivity.

Types of business entities available to register company in USA

Before you proceed to register company in USA, it is essential to understand the different types of entities available. The USA is home to a myriad of states and business entities that include sole proprietorship, corporation, general partnership, and more.

Before the start of the engagement, Tetra Consultants will fully understand your business before recommending the most optimum USA business entity. Some considerations we take into account include the type of business activity, tax obligations, and nationalities of shareholders and directors.

Sole Proprietorship

- A sole proprietorship is the simplest form of a business enterprise and it is conducted by an individual. Unlike other business entities, the sole proprietorship structure does not lead to the formation of a separate legal entity. As such, the proprietor can be personally liable for all debts and obligations incurred by the business. Any transfer of business is not allowed and hence, there is no continuity.

- If you are looking to set up a small business (minimart, art studio, bakery, etc.) yourself that includes the advantages of an easy startup and complete control, Sole Proprietorship may be the right business form for you.

- To operate a sole proprietorship, registration with the state is not necessary. However, if a name that is different from your own is adopted, you will have to formally register with the state.

- Aside from the sole proprietorship structure, all other business entities are required to be filed with state governments.

Corporation

- A commonly adopted form of business entity, corporations are entities formed under state or federal law. As a separate legal entity, owners will not be personally liable for any debts and obligations incurred by the business. Corporations can also sue or be sued in their own name. Managed by its board of directors, these directors hold various fiduciary duties to the corporation.

- In general, states in the USA do not mandate a minimum capital requirement on corporations or a principal place of business. Directors, officers, or stakeholders of the corporations do not have to reside in the state of incorporation either. However, specific corporate structures such as the C and S corporations may have different requirements.

- A C-corporation refers to any corporation that is taxed separately from its owners. Typically, for-profit corporations are classified as C-corporation. This default classification is not limited by the number of shareholders. Meanwhile, S-corporations are taxed specially and may benefit from certain tax advantages. As pass-through taxation entities, no income tax is required to be paid at the corporate level. Instead, profits or losses are reported as part of the owner’s personal tax returns. Any tax is thus paid at the individual level by the owners. This way, S-corporation owners are not doubly taxed.

- There is a multitude of requirements when setting up a C-corporation vis-à-vis an S-corporation. To qualify as an S-corporation, there is a restriction on the number of shareholders. S-corporations can have no more than a hundred shareholders. Shareholders are also required to be citizens or residents of the United States. However, such restrictions do not apply to C-corporations. S-corporations are also not allowed to be owned by other C-corporations or S-corporations. Unlike C corporations, S corporations cannot benefit from creating multiple classes and are limited to only one class of stock.

- Tetra Consultants will recommend you set up an S-corp if you are a USA citizen or resident looking to start your own private business. With an S-corp, you will be able to benefit from the single layer of taxation scheme. On the other hand, Tetra Consultants will recommend you set up a C-corp if you are a foreigner looking to do business in the USA.

Public Benefit Corporations

- Public benefit corporations are legally mandated to act morally, ethically, and responsibly. Besides the usual procedures mandated by every USA corporation, the Certificate of Incorporation has to further include the company’s altruistic goal.

- You should consider incorporating your business as a public benefit corporation if you are planning to run a socially conscious business that comes with an altruistic vision of serving the public good. Unlike non-profit corporations, public benefit corporations can still benefit from engaging in profit-generating activities.

Limited Liability Company

- A limited liability company is one the most common business entities for foreign investors who are planning to register company in USA. Under the limited liability entity, directors will not be personally liable for any debts or obligations incurred by the business. They will only be liable up to a specified amount of liability insurance declared. These companies provide different classes of members that come with specific rights, powers, and duties.

- LLC requirements include having at least one or more members and managers. There are no restrictions as to the residency of the corporation’s members or managers. When setting up an LLC, every corporation must maintain a registered office and a registered agent.

- Incorporating a limited liability company in the USA comes with many inherent benefits. Depending on the state, this includes low startup costs, minimal requirements to set up, and enhanced privacy protection.

- You may consider this an easy and inexpensive option to structure your small business. By opting for a limited liability company structure, you can protect your personal assets while escaping the cost and complexity that corporations may bring. While the structural differences between a limited liability company and a corporation may be minimal, you should still look out for several factors. Profits and losses of a limited liability company are passed through to individual owners and are taxed independently of the corporation. This scheme is distinctive from the way a corporation is taxed.

- When filing for income taxes, LLC can be taxed as a C corp, S corp, partnership, or proprietorship. If the LLC chooses to be taxed as a C corp, then the LLC will be taxed based on corporate taxes but the dividends the shareholders received will be taxed based on the individual’s personal income tax.

- Ownership is another important aspect to consider. Unlike a limited liability company, a corporation is allowed to issue or transfer shares of stocks.

Partnership

- A partnership is a business structure in which two or more people share ownership. For a company with two or more proprietors, this is the most basic business structure. A partnership and a sole proprietorship have a lot in common. Because the business does not exist as a separate legal entity from its owners, the owners and the entity are considered as if they were one person.

- The profits and losses of the business are passed on to the partners when filing taxes, and each partner must submit the information on income from such partnership with their tax returns. In addition, depending on their portion of the company’s profits, partners must pay self-employment tax.

- A partnership business arrangement has a number of benefits. There is less paperwork necessary in forming a partnership, and the partners are not required to meet the same level of criteria as limited liability firms. In addition, partnerships have a unique tax structure that requires participants to report their share of the business’s profit or loss on their tax returns.

- On the downside, the partners are personally liable for the company’s debts and liabilities, and their personal assets may be liquidated to cover the company’s commitments. Disagreements between partners are also possible, which can slow down corporate operations.

- Partnerships are relatively inexpensive to set up. The three types of partnerships include

General Partnership

- General partners share equal partnership and equal ownership. They share all liability and business operations unless expressed otherwise.

Joint Venture

- A time-based partnership where two or more individuals collaborate on a specific project for a certain period of time. The JV is terminated when the project is completed. If they wish, the partners can continue to collaborate after the dissolution of the JV by forming a general partnership.

Limited Partnerships

- A separate legal entity, this special form includes general partners as well as limited partners. General partners are distinguished from limited partners based on their liability to the debts and obligations of the company.

- A general partner remains fully liable while a limited partner is only liable up to a specified amount of liability insurance declared as well as their own wrongful acts. A limited partner traditionally holds no management participation benefit in the company.

- Limited Partnership is a great option to consider if you would like to maintain complete control over the company while allowing investors to contribute in monetary forms.

Statutory Trusts

- Known to be one of the USA’s most flexible business structures, the statutory trust is an unincorporated association formed by filing a certificate of trust with the state.

- This trust instrument serves as a governing body to provide for the conduct of the business. With a perpetual existence, the statutory trust holds similar properties to limited liability companies. Trustees are not liable for any obligations incurred by the statutory trusts.

- Do note, however, that this business entity is not as prevalent as the other corporate structures, as it is limited to only certain states such as Delaware. A private trust agreement is required for its formation. Upon the completion of the agreement, a Certificate of Trust can then be obtained. The statutory trust also mandates that at least one trustee has to be either a Delaware resident or have a principal place of business in Delaware. Delaware’s flexible laws allowed for trusts to be set up without any filing.

- Its primary function of protecting assets from creditors makes it a popular option for mortgages, real estate investment trusts, automobile leases, and finance commercial airplanes.

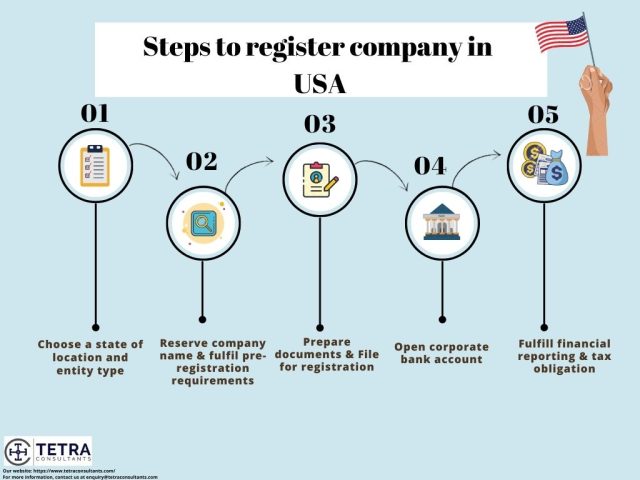

How to register a company in USA?

- Similar to the previously discussed processes, the steps to register company in USA are contingent on the state of incorporation. Nonetheless, Tetra Consultants has generalized the processes to be enumerated as follows:

Step 1: Choosing a state of location and optimum business structure

- Determining a business location is likely the most important decision, and once made, it is costly to modify. Each of the 50 states has its unique set of company rules and tax rates.

- The location you select should meet corporate objectives in the most cost-effective way possible. A corporation must first determine which elements are primary factors in location selection. Tetra Consultants’ team of experts will recommend the most suitable location and state depending on the type of business activity and your long terms needs and goals.

- From the perspective of saving taxes and effective cost of incorporation we usually recommend our clients register a company in Delaware or Wyoming.

- Further, prior to company formation, it is also essential to choose the correct type of company. Tetra Consultants will advise you on the most optimum business entity that suits your needs.

Step 2: Reservation of company name

- Tetra Consultants will search and reserve your company name through the respective Secretary of State. Our team will reserve your company name for up to 120 days.

- Tetra Consultants along with providing company secretarial services and local registered addresses will additionally assist with the provision of nominee director services in case any of the states and business activity of the clients requires having a residential director. Our legal team will draft the nominee director agreement wherein the director will be obligated to only be passively involved with the business of such entity.

Step 3: Preparation and submission of relevant documents

- Once your company name has been reserved, Tetra Consultants will proceed to prepare the relevant corporate documents such as the appropriate forms and the Articles of Organization. If you are registering a Corporation, the document required will be called the Articles of Corporation, while for LLCs it is called the Articles of Organization.

- After the relevant documents have been prepared, Tetra Consultants will register your company with the respective department of the state.

- Upon successful registration of your company, you will receive the Certificate of Incorporation and a certified copy of the company’s Articles of Organization.

Step 4: Application for a business license

- For most states, businesses are required to obtain a business license as long as they conduct business activities in the USA or are incorporated in the USA. Tetra Consultants will completely assist your company in applying for a business license.

Step 5: Tax registration

- Tetra Consultants will complete tax registration with the designated authority of the state of incorporation. We will assist your company to secure an Employer Identification Number (EIN), which is needed for tax filing and payment. The EIN can be registered once the articles of incorporation have been successfully approved. To apply for the EIN, you will have to submit Form SS-4 to the Internal Revenue Service (IRS).

- Once your company has been registered for tax, Tetra Consultants will continue to assist your company in meeting its annual accounting and tax obligations.

Step 6: Corporate bank account opening

- Once the entity is duly registered, you can proceed with the corporate bank account opening.

- Tetra Consultants will assist in consolidating the documents and opening a corporate bank account with a reputable bank of your choice.

- For many banks in the United States, traveling to the United States to open a bank account in person is often preferred by local banks. However, not all local banks have such a requirement. If travel is required, we will have a representative accompany you to the bank meeting. Alternatively, our team will negotiate with the banks to conduct a conference call instead or request a waiver.

- Once the bank account has been successfully opened, Tetra Consultants will courier the internet banking token and access codes to your preferred address.

Accounting and tax obligations for companies in the USA

- Accounting and tax considerations are important factors when incorporating your business. By outsourcing your accounting and tax obligations to Tetra Consultants, you can be confident that you will be in the best hands. Our team will ensure that your firm’s financial statements, corporate tax returns, and audits are timely completed without the need for you to travel.

- Additionally, outsourcing your accounting and tax needs to Tetra Consultants will allow you to reduce overhead costs while being ensured of timely reporting and filings. Before the start of the engagement, our accounting team will also keep you updated of all the mandated deadlines and expectations. Thereafter, we will prepare all necessary filings in advance to ensure that the stipulated deadlines are met. Do note, however, that the below-mentioned requirements are an educated generalization of the requirements of the states in the USA.

Annual reporting requirements

- In most states, state-incorporated companies need to file an annual audit to the designated authority of the incorporated state.

- Based on most state laws, the due date is kept one year from the date your business was founded. All reports can either be submitted online or by mail for more states.

- The report will require you to include or update your principal and mailing address, and directors’ personal information as well as the assets you have located in the city-state.

Income tax

- The income tax your American-registered business will have to address is contingent on the state of incorporation. However, for most states, foreign investors will only be charged for income sourced from the United States.

License tax

- Most states require you to pay licensing tax. This is also otherwise known as a filing fee and will be determined by the number of local assets you have. Minimally, the fee will conventionally be charged at US$50.

- Intangible assets are not charged. As such, if you are looking to set up a business formed purely for the purpose of holding assets. Tetra Consultants can assist you to start a holding company in the USA.

Sales tax

- Typically, this is applicable if you are looking to sell products, tangible property, or services.

- Businesses that are looking to transact goods or services within the State must file for a sales tax application, with the Department of Revenue, in which the duties will then be paid to the state.

What are the documents required to register company in USA?

The documents and information to be provided to respective State Companies Registery Authority in order to have the new entity incorporated include but are not limited to:

- The original copy of the articles of association

- The minute of the meeting where the decision of establishment was taken

- The name and the registered address of the entity,

- The company’s objectives

- The amount of share capital

- Details regarding the shares and the payment made by the shareholders,

- Details regarding the members of the board and the representatives.

- Identification documents including copies of notarized passports, utility bills of the last 3 months, and proof of income of all the directors, shareholders, and beneficial owners of the entity to be incorporated.

Why register company in USA?

- There is a myriad of reasons why you should register company in USA. With its vast array of states, you are bound to find the most suitable environment to begin your business.

- Thereafter if you need further assistance, Tetra Consultants has a global team of experts that will work closely with you to meet your particular business needs.

Political

- The United States has a stable political atmosphere, making it the ‘most captivating market for adventure capital and private equity funding’, according to Ernst & Young. Further, the nation holds the fifth place for ‘ease of doing business’ among all countries active in transnational trade, according to the World Bank Report of Doing Business 2019.

Legal

- The United States is already well-known for its vast market size, however, incorporating a company in the US would give you a distinct market position and visibility, as well as tempt new partners.

- The United States is particularly well-known for its pro-business legislation and policies. Running a business in the US market is simpler than in other nations, and many new entrepreneurs are driven to the US market due to advantageous tax rates. All rules and regulations are focused on incorporation, which also makes doing business easier. For example, if we specifically talk about Delaware’s incorporation process, you only require a registered Delaware agent to maintain a record of the corporation’s contact person and address. However, the Delaware Division of Corporations will not request, obtain or store any information regarding the members and managers. This allows companies to enjoy some sort of anonymity.

- Many states in the United States provide financial incentives to investors who desire to incorporate a new company there. Some of these incentives include tax breaks and decreased commercial real estate taxes for international investors. One of the key benefits of creating your company in the United States is that corporate taxes are lower.

Economic

- With a GDP of $20 trillion and 325 million people, the United States is the world’s largest consumer market. Household expenditure in the United States is the greatest in the world, accounting for approximately one-third of total worldwide household consumption. Simultaneously, free trade agreements with 20 other countries allow expanded access to hundreds of millions of new consumers, and the US continues to engage with corporations to expand prospects for US exporters.

- The United States is a global leader in consumer products market research, product innovation, manufacturing, branding, and marketing, with a highly qualified workforce. This profitable open market is a potent growth engine for businesses of all sizes. Accordingly, the nation is known for its innovative goods and services, high-quality standards, customer service, and strong business methods, providing US exports with a distinct competitive advantage. Through free trade agreements, businesses in the United States have access to nearly 790 million consumers in 20 more nations. And the US does not erect barriers: according to the World Bank, no other country has faster export procedures.

- Global corporations realize the significance of the United States as an export platform. Foreign company affiliates in the United States alone export US$370 billion in products, accounting for more than a quarter of total U.S. goods exports.

Social

- The American workforce is varied, inventive, and mobile. The US institutions and organizations collaborate with both public and private sector organizations and place a high value on this problem in order to preserve competitiveness and educate individuals to fulfill the demands of the modern economy.

- One of the most well-known truths is the strength of the American educational system. The United States is home to a number of prestigious educational institutions. According to research published by US News and World Report, the United States is home to eight of the world’s top ten colleges. In fact, the United States is home to four of the world’s best colleges, Harvard University, Massachusetts Institute of Technology, Stanford University, and the University of California, Berkeley are among them.

Technology

- The United States is an acknowledged leader in R&D, with more international patents registered than any other country. Today’s inventors are protected by a strong intellectual property framework, while tomorrow’s innovators are educated at renowned institutions and incubators around the country. Companies of all sizes contribute to the globalization of innovation in the United States, benefitting from – and contributing to – a thriving environment for invention and inspiration.

- Americans have a long history of obsession with technology, and firms like Apple, Microsoft, Google, Facebook, and many more have addressed the technical demands of Americans and people all over the world. As a result, they have risen to the position of world leaders in their respective fields. Further, the United States has been at the forefront of technology development and application in a wide range of disciplines. Many things have altered and developed as a result of such technological advancements.

Environment

- As the world’s third-largest country by landmass, the United States has vast and diverse landscapes with enormous natural resources. These varied locations are linked by a vast infrastructure network and services that assist businesses in producing and transporting their products effectively.

- The United States provides autonomous, dependable, and low-cost energy sources, as well as some of the world’s biggest reserves of petroleum, natural gas, and coal. A wide range of climates and geographies provide excellent chances to utilize renewable energy sources ranging from wind to biodiesel. When combined with increased energy efficiency, this varied energy source not only helps to US GDP but also leads to decreased greenhouse gas emissions.

Looking to register company in USA?

- Tetra Consultants will be your one-stop solution to register company in USA. Our comprehensive service package will enable you to incorporate a company and include services with respect to opening a corporate bank account, provision of nominee director services, resident agent, local registered office address, and much more.

- Contact us to know more about the process to register company in USA and our team will revert within the next 24 hours.

FAQs

How to register a company in USA?

- The company registration procedure in the USA begins with a preliminary assessment and professional consultation of the company formation by our professionals, who ensure that the incorporation is completed as per the rules of forming a US corporation in the selected state. Following that, our professionals will gather and prepare the required documents before submitting the application for company registration. The registration certificate would be given to you by courier service at the completion of the registration procedure.

How much time does it take to register a USA company?

- The duration for completion of the company registration process in the USA depends on many factors such as the availability of resources and fulfillment of requirements. Tetra Consultants will ensure to complete of the registration of the USA entity within 2 weeks provided we have all the things necessary are in place.

What is the most preferred form of entity structure in the USA?

- Many times the entity structure depends on the business activity of the clients, however, for foreigners opting to register company in USA, the most preferred company structure is LLC especially due to the tax benefits that it offers.

How much does it cost to set up a company in USA?

- Depending on the services you need from Tetra Consultants, the total engagement fee will differ. Our services include planning and strategizing with your company, assisting you in the incorporation process, ensuring that you are compliant, and more.

- This total fee includes the registration fee charged by the USA government. We will discuss with you the total engagement fee you would need to pay before we start the registration process for your company.