Compliance officer for Cayman Island Cryptocurrency license

- Cayman Island Cryptocurrency license compliance officer are vital for the companies in any jurisdiction looking to register company in Cayman Islands and run a cryptocurrency business in a productive manner. As of April 2025, the Cayman Islands have passed and implemented reactively stringent regulation, requiring any cryptocurrency trading and custody firm to obtain a Virtual Asset Service Provider (VASP) license and have compliance officers. There are more than 62% of regulatory authorities worldwide who are moving towards aligned crypto regulatory frameworks as stated in both the World Bank’s and World Economic Forum Reports respectively.

- As of July 2025, the regulatory environment related to cryptocurrency business in the Cayman Islands has changed significantly. In November 2022, the Cayman Islands had 17 registered crypto service providers, and they were operating under a registration regime. After the Cayman Islands Monetary Authority (CIMA) stepped-up enforcement with new rules effective April 1, 2025, all virtual asset service providers (VASPs) will be required to obtain full licenses to continue their services. Local compliance officers are responsible for ensuring that our client companies adhere to the anti-money laundering (AML) requirements and cybersecurity requirements.

- The regularity of anti-money laundering (AML) and cybersecurity practices and compliance will help build investor confidence and regulatory assurance. Utilizing the services of trusted experts such as Tetra Consultants, will provide the easiest way to get the Cayman Islands Crypto license, for your company, and the complete regulatory compliance process will be taken care of, allowing the company to focus on continued innovation and growth in a regulated environment.

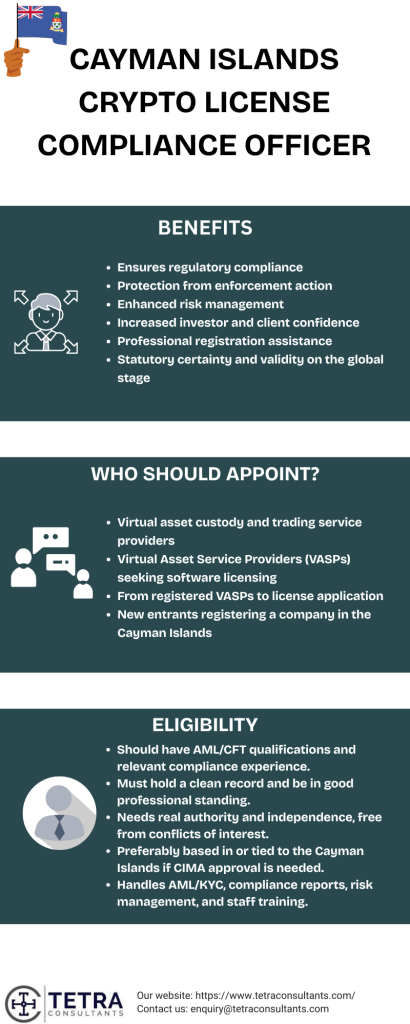

Benefits of appointing Cayman Island Cryptocurrency license compliance officer

Ensures regulatory compliance

- It is a regulatory requirement of the new Cayman Islands jurisdiction VASP regulations to have a full-time compliance officer, who will be motivated to ensure strict compliance with anti-money laundering (AML), know-your customer (KYC), and terrorism financing requirements, thus, minimizing legal and operational risk.

Protection from enforcement action

- When used properly, the compliance officer may be critical in avoiding violations that potentially lead to serious enforcement actions against the company, including suspension or revocation of the license, cancellation of registration, a monetary penalty, or formal or public reprimand from the Cayman Islands Monetary Authority (CIMA).

Enhanced risk management

- The appointment of a professional compliance officer provides the organization with a better understanding of its risks associated with financial crime, cyber security threats, and operational resilience.

Increased investor and client confidence

- Increases transparency and trustworthiness of the organization, because they have a compliance function with the appointment and oversight of compliance officer which makes the company more attractive to investors and institutional counterparties.

Professional registration assistance

- The role of the compliance officer is central to register company in the Cayman Islands. Compliance officer’s knowledge of current market trends helps prepare the documentation, meet regulatory filings, and follow on with the ongoing statutory reporting.

Statutory certainty and validity on the global stage

- Compliance professionals’ strength local and international compliance by ensuring the company follows the legally compliant route to global expansion based on nationally accepted jurisdictions where the compliance assessed positively addresses concerns by local and international standards.

Who should appoint Cayman Island Cryptocurrency license compliance officer?

Virtual asset custody and trading service providers

- Any business engaged in virtual asset custody, or operating a trading platform within the Cayman Islands or operating a trading platform from the Cayman Islands must have a compliance officer to satisfy the licensing requirements of the Virtual Asset (Service Providers) Act.

Virtual Asset Service Providers (VASPs) seeking software licensing

- Businesses applying for registration or licensing as VASPs, including wallet providers, exchanges, and custodial crypto service businesses are required to appoint qualified compliance personnel including an anti-money laundering compliance officer and money laundering reporting officer.

From registered VASPs to license application

- Businesses registered with the Cayman Islands Monetary Authority (CIMA) to provide virtual asset services will be required to maintain their compliance officer and officer of compliance positions as they transition from registered to licensed businesses under the new regulations effective in April 2025.

New entrants registering a company in the Cayman Islands

- Businesses looking for company incorporation in the Cayman Islands (and act as a VASP) will also be required to appoint compliance officers with relevant experience in AML/CFT and compliance as part of their license application process.

Eligibility for Cayman Island Cryptocurrency license compliance officer

- In order to serve as a compliance officer is to be an individual with relevant professional experience and qualifications in anti-money laundering (AML) and counter-terrorism financing (CFT).

- The officer should ideally have a good level of management experience and a practical understanding of the regulation and compliance landscape in the Cayman Islands.

- The individual should also present with a clean criminal record (supported by confirmation from their country of residence) and should have a record of good standing (usually as confirmed by letters or confirmation from banks or other institutions).

- A detailed CV outlining the compliance officer’s experience, qualifications and other relevant previous roles will be needed to demonstrate that they are suitable for the position.

- The compliance officer must be truly accessible and have the authority to fulfill the role (not just symbolic identity or passive authority) and maintain independence, which would require avoiding involvement with day-to-day operations that may present conflicts of interest.

- The compliance officer must be able to act independently and should be free of conflict, for the purposes of the role throughout the business.

- The compliance officer would generally live in the Cayman Islands or be effectively permanent from the jurisdiction (if the role and structure require a compliance officer to be approved by the Cayman Islands Monetary Authority (CIMA).

- The candidate would be expected to manage and oversee AML/KYC policies, regular compliance reporting, risk management, and training staff, consistent with local legislative requirements or global best practice.

Cayman Island Cryptocurrency license compliance officer assistance

- Hiring compliance officers who are Certified Anti-Money Laundering Specialists (CAMS) and Certified Crypto Asset AFC Specialists (CCAS), who have over 5 years’ experience in the industry, will greatly improve the quality of compliance officer support for Cayman Islands crypto licenses. CAMS and CCAS certifications are recognized globally as the standards for AML and crypto asset professionals, so you can be assured of Tetra Consultants’ personnel possessing robust, current understanding of the rapidly developing regulatory landscape in the Cayman Islands.

- With this type of specialized background, your compliance department will not only be equipped to design, implement and maintain a full AML/CFT framework, but will also have the technical expertise to undertake, regulatory reporting, prepare for audits, carry out the ongoing risk assessments to CIMA’s standards, as well as adaptively manage the compliance function in response to evolving CIMA requirements. With this service and regulatory compliance, clients can be assured that they will be operating within the most current and relevant local and international compliance expectations, supporting operational consistency, and establishing greater credibility in the eyes of regulators and partners within a fast-evolving Cayman Islands crypto market.

Services offered by Tetra Consultants for Cayman Island Cryptocurrency license compliance officer

- Ensure the entity continues to meet the requirements of the VASP Act, 2020, AML Regulations, and the CIMA rules and guidance notes.

- Liaison with CIMA in respect of regulatory filings, audits and inspections.

- Manage the status of the entity’s license/registration applications, renewals or amendments (e.g., if there is a change in directors, services and/or ownership).

- Ensure senior management and the board are aware of compliance related risks and relevant legal/ legislative developments.

- Maintain and refresh the company’s AML/CFT program in accordance with:

- Anti-Money Laundering Regulations (2020 Revision)

- Proceeds of Crime Act (2020 Revision)

- FATF recommendations

- Ensure your company’s Customer Due Diligence (CDD/KYC) and Enhanced Due Diligence (EDD) processes are effective.

- Ongoing monitoring of all client transactions, wallet activities, and risk profiles.

- Coordinate and/or act as Money Laundering Reporting Officer (MLRO) and make Suspicious Activity Reports (SARs) to the Financial Reporting Authority (FRA).

- Conduct Enterprise-Wide Risk Assessments (EWRA).

- Establish internal controls to reduce compliance and operational risk.

- Implement a Compliance Monitoring Program (CMP) that is used to test or validate adherence within the company.

- Manage tools and processes for monitoring blockchain transactions, identification of suspicious wallets, and the detection of:

- Structuring

- Sanctions breaches

- High frequency or unusual trading activity

- Maintain correspondence of all AML and business-related records for at least five years, including:

- KYC records

- Transactional history

- Risk assessments

- Compliance reviews

- File and ensure timely response to requested statutory reports to CIMA and information requests.

- Schedule and take minutes of AML/CFT training for all staff on an annual basis, including:

- Frontline personnel (onboarding, client ops)

- Senior managers and directors

- Determine awareness of obligations under the regulations, and the internal policies and procedures.

- Review and approve documentation and processes for new client onboarding.

- Provide clear policies for cross border crypto, custody services, and issuance of tokens.

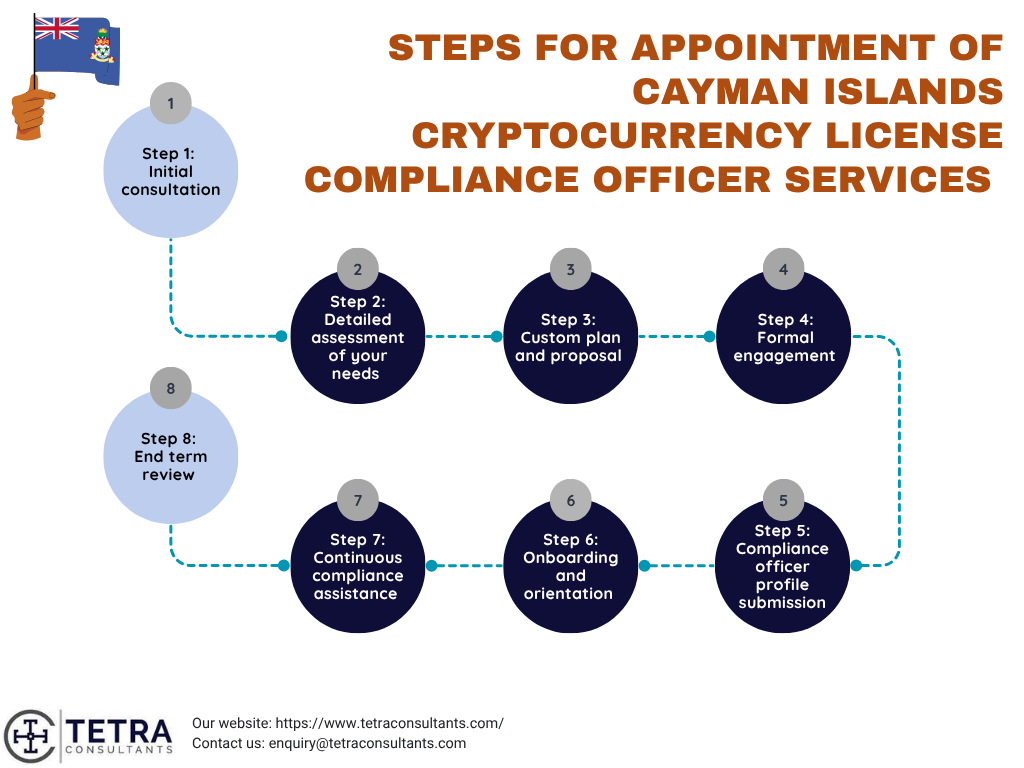

Steps for appointment of Cayman Island Cryptocurrency license compliance officer

Step 1: Initial consultation

- Get in touch with us to talk about your business needs and outline the main tasks for the compliance officer role. The initial consultation allows Tetra Consultants a full understanding of your business, regulatory needs, and any concerns or challenges you anticipate, tailoring our approach to fit your needs.

Step 2: Detailed assessment of your needs

- Following the initial consultation, we perform a comprehensive assessment of your business operations and risk profile. This may involve assessing your internal controls, existing policies, projected business activity, and allowing us to identify a compliance officer appropriate to your situation.

Step 3: Custom plan and proposal

- Based on our consultation and assessment, we will provide a detailed proposal outlining the services, deliverables and our fee proposal. The proposal is particularly tailored for your company structure, business model, and licensing in the Cayman Islands.

Step 4: Formal engagement

- When you have accepted our offer, we send an official letter of appointment along with an invoice. This formalizes our engagement which clarifies deliverables and where we are reporting, as well as how often and in which format you’ll be in contact with our practice.

Step 5: Compliance officer profile submission

- Once our engagement assumes effect, we will submit the curriculum vitae of the recommended compliance officer, or officers, (all with advanced AML and crypto-asset compliance qualifications) for your due diligence, and approval

Step 6: Onboarding and orientation

- When you accept a compliance officer, we will arrange an onboarding. This will include introduction to your business, policies, procedures and systems, and as required, training staff on new compliance protocols and Cayman Islands regulatory requirements.

Step 7: Continuous compliance assistance

- During the term of appointment, your compliance officer remains involved, providing support in meetings, actively maintaining the company’s AML/CFT framework, filing regulatory documents, and advising on any new compliance issues as your business changes.

Step 8: End term review

- At the end of our engagement term, we will have a review meeting to assess your satisfaction with our services and discuss your wishes to renew, or amend the engagement, to continue to receive assistance.

Cost for appointment of Cayman Island Cryptocurrency license compliance officer

- At Tetra Consultants we have a clear commitment to transparency with our Cayman Island Cryptocurrency license compliance officer services, with no hidden costs at any stage of the process. We provide an unequivocal summary of fees that are involved, including any required Government licensing fees, professional services fees and ongoing compliance monitoring fees, all quoted in US$.

- This level of transparency allows you to plan your budget with confidence when starting your new licensing process, without any hidden costs. Our detailed cost partnerships cover everything from the initial appointment of a compliance officer to ongoing regulatory support for your business, giving you full clarity on the cost structure of your compliance. We also provide services such as offshore company incorporation to corporate bank account opening as per your needs. When you work with Tetra Consultants, you receive professional expertise on compliance, and the trusted and honest approach to pricing will give you comfort in assuming your compliance obligations.

Why choose Tetra Consultants?

- When you select Tetra Consultants as your Cayman Islands Cryptocurrency license compliance officer, you can take comfort in knowing you are working with a multidisciplinary firm that has experience in regulatory compliance and corporate services; this means you will receive expertise, personal service, and transparent pricing. Tetra Consultants has a strong historical experience with businesses that have regulatory compliance obligations, and we can facilitate your business meeting your obligations regarding AML/CFT and crypto-related licensing, all while doing it in an efficient manner.

- Our team at Tetra Consultants have certified professionals providing a professional service from the first meeting to ongoing compliance management support who monitor and oversee advocacy for your business and give you the peace of mind throughout the fast-paced and evolving regulatory climate as it relates to the crypto sector. Tetra Consultants leverage open communication at all levels to ensure our solutions meet your specific needs. By selecting Tetra Consultants, you will receive a reliable compliance officer business partner who will protect your company’s reputation and allow your company to operate effectively in the competitive Cayman Islands cryptocurrencies sector.

- Key reasons to choose Tetra Consultants:

- Certified AML and crypto compliance specialists with extensive industry experience.

- Customized compliance solutions tailored to specific business needs.

- Transparent pricing with clear, upfront fees in US dollars and no hidden costs.

- Comprehensive support from licensing applications through ongoing regulatory compliance.

- Deep expertise in Cayman Islands AML/CFT regulations and virtual asset risk management.

- Proven track record of helping companies maintain compliance and avoid regulatory penalties.

Looking to appoint Cayman Island Cryptocurrency license compliance officer services

- By entrusting your Cayman Islands cryptocurrency license compliance officer services to Tetra Consultants, your business can feel confident navigating one of the strongest crypto regulatory frameworks in the world. In the Cayman Islands, where potential international fintech leaders are now establishing operations, a comprehensive way to maintain continuity and trust from investors includes compliance.

- With Tetra Consultants, we provide unique insight and commercial advice every step of the way in the licensing process, including readiness assessment, document submission, policy execution & audit preparation. We make it our mission to keep up with evolving requirements from CIMA and support your company emerging from the operational efficiency of the Cayman Islands, with its taxation appeal and fintech ecosystem.

- This will position you aligned with your cryptocurrency license aspirations, at the same time establishing responsible governance and consistent compliance in this premium international jurisdiction.

- Contact us to know more about Cayman Island Cryptocurrency license compliance officer services and our team will revert in 24 hours.

FAQs

Who needs a compliance officer for a Cayman Islands crypto license?

What are the compliance officer's primary responsibilities?

Does the compliance officer have to be based in the Cayman Islands?

What are the qualifications of a compliance officer?

Can I use the services of an external compliance officer service provider?

What are the ramifications of my company acting without a licensed compliance officer?

Is there a minimum capital requirement to obtain a crypto license?

Are ongoing meetings and regulatory updates required?

Why choose Tetra Consultants for compliance officer services?